The cost of bitcoin in the early morning of May eight corrected to new lows, triggering the threat of collapse for the LUNA – UST model.

Bitcoin can make a new reduced in the 2nd quarter of 2022

The biggest cryptocurrency in the planet Bitcoin (BTC) did not make it possible for us to have a quiet Sunday as it continued to drop to new lows, followed by a series of altcoins in the market place.

Specifically, all around five am, the cost of Bitcoin was offered off somewhat at $ 34,785 – the lowest degree because February 24 – at which time the conflict in between Russia and Ukraine broke out.

From “fake pump” for $ 40,000 Since May 5th, BTC has misplaced additional than USD five,000 in worth. The trigger of this decline, as reported by Coinlive, came from the US Federal Reserve (Fed) which announced a move to increase curiosity costs by .five% and mentioned it would hold this rise in the long term. of curiosity is in June and July.

Not only did cryptocurrencies and the US stock market place also record the “red” Friday trading session when most of the shares fell.

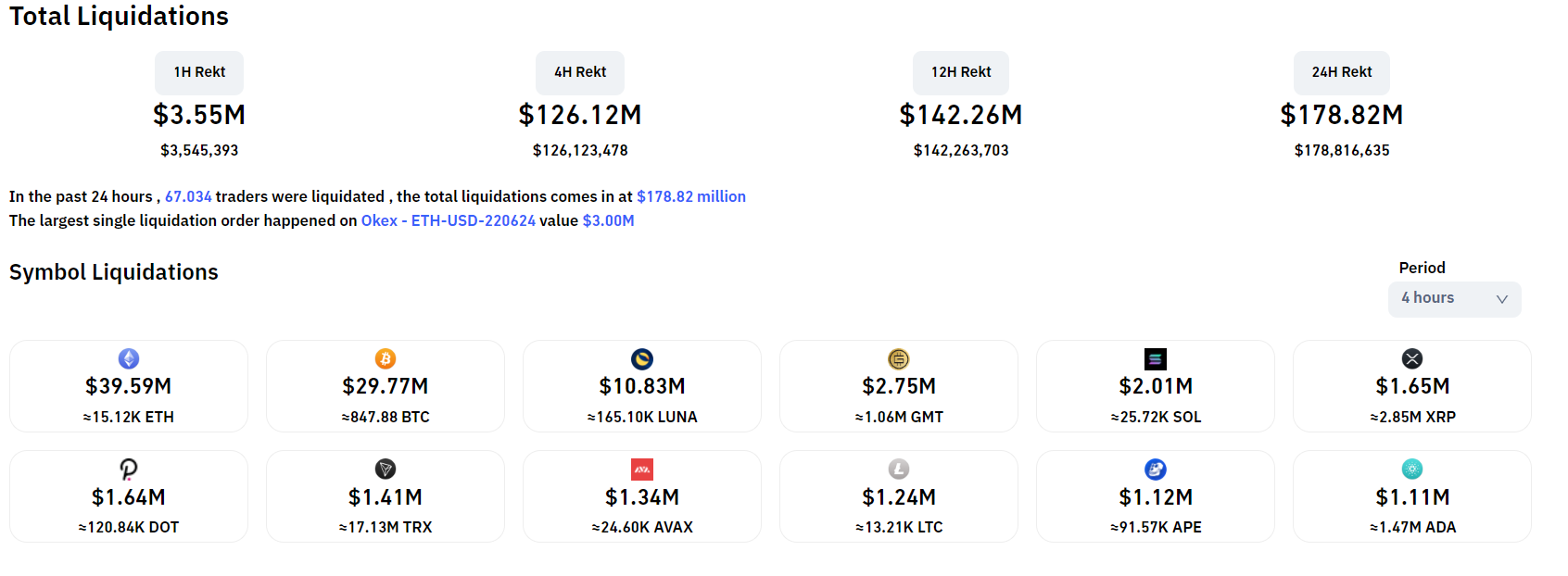

Over $ 125 million well worth of crypto derivatives orders have been cleared in the previous couple of hrs, of which 85% had been extended orders. However, in contrast to typical when the coins in liquidation will be primarily BTC and ETH, this time the market place is seeing the emergence of a new title, LUNA, with a liquidation degree of just about $ eleven million.

MOON – The UST model “trembles” violently

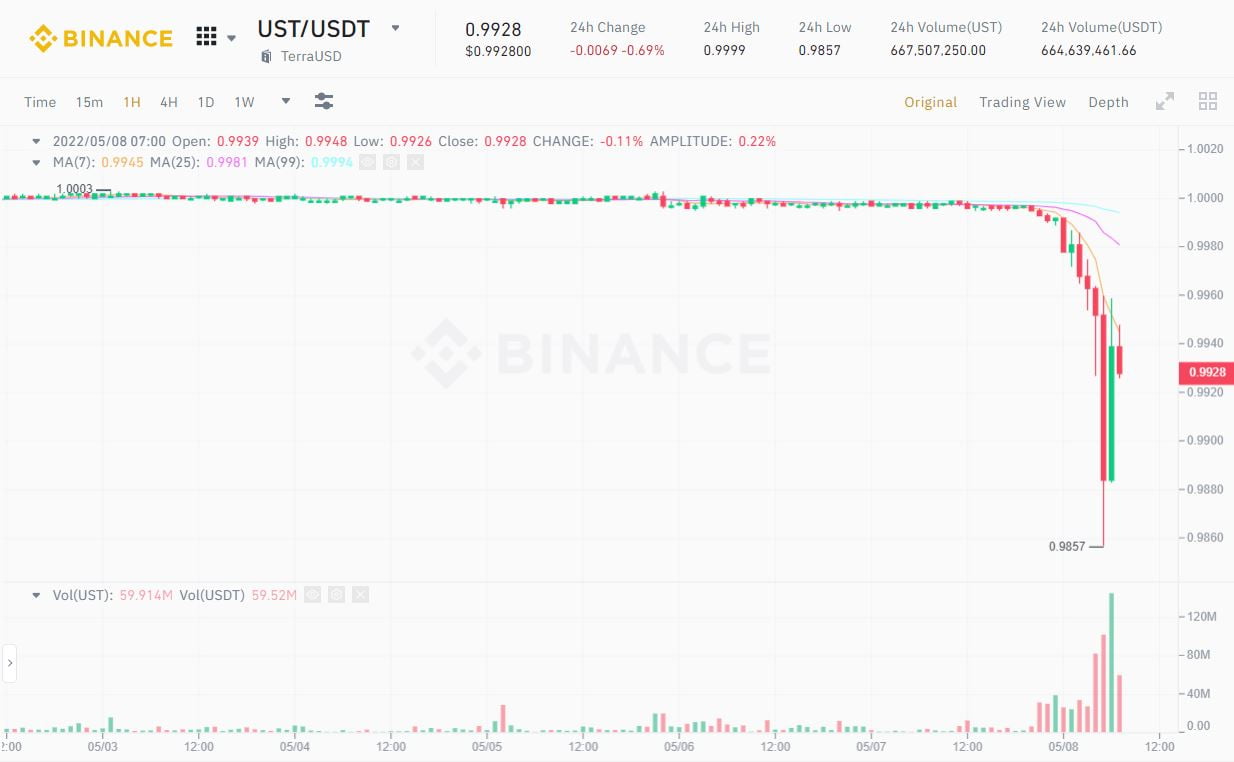

The Earth (LUNA) cost when plummeted in the USD 63 spot this morning, dropping additional than 28% of its worth because its peak of USD 88 on May 5th. The collapse of LUNA has greater the threat of the UST algorithmic stablecoin dropping its $ one mark (aka de-peg).

As explained by Coinlive, there is a “strange” romantic relationship in between LUNA and UST which aids to sustain the cost of the two coins. Specifically, UST is an algorithmic stablecoin issued based mostly on the volume of LUNA blocked. When transporting the LUNA vital, the consumer will obtain back a corresponding volume of UST and can exchange it once again at will. The FSO can then be deposited on the Land Anchor Protocol lending protocol to obtain APY curiosity up to 18% (previously twenty%).

This has been the principal driving force behind the development of Terra, LUNA, UST and Anchor in latest months, as traders have a incredibly protected deposit alternative (in the type of a stablecoin) and substantial returns, building it even additional rewarding. liquidity has entered right here. UST grew to become the third biggest stablecoin in the cryptocurrency sector in April (soon after USDT and USDC), although Terra’s TVL climbed to 2nd spot only soon after Ethereum.

However, this model is accused by several of “ponzi” when it are not able to be maintained for extended. The 18% bonus at the heart of this ecosystem is truly Terraform Labs (Earth Development Unit) cash pumped to Anchor to pay out consumers, not a secure supply of revenue due to the fact most of the consumers of this protocol are all deposits. , not loans, for Anchor to have income. Anchor is estimated to have only about 34 days left to run out of money.

Yet a further threat is the UST de-peg. This is due to the lessen in the volume of LUNA blocked to help UST, building the real worth of UST in the market place larger than LUNA and triggering the stablecoin to get rid of the $ one mark. When that comes about, traders will promote even additional of the two UST and LUNA. , producing a ripple impact that collapses the model.

This is specifically what took place to the two LUNA and UST this morning, evident in the volatility of costs and unusually substantial revenue volume.

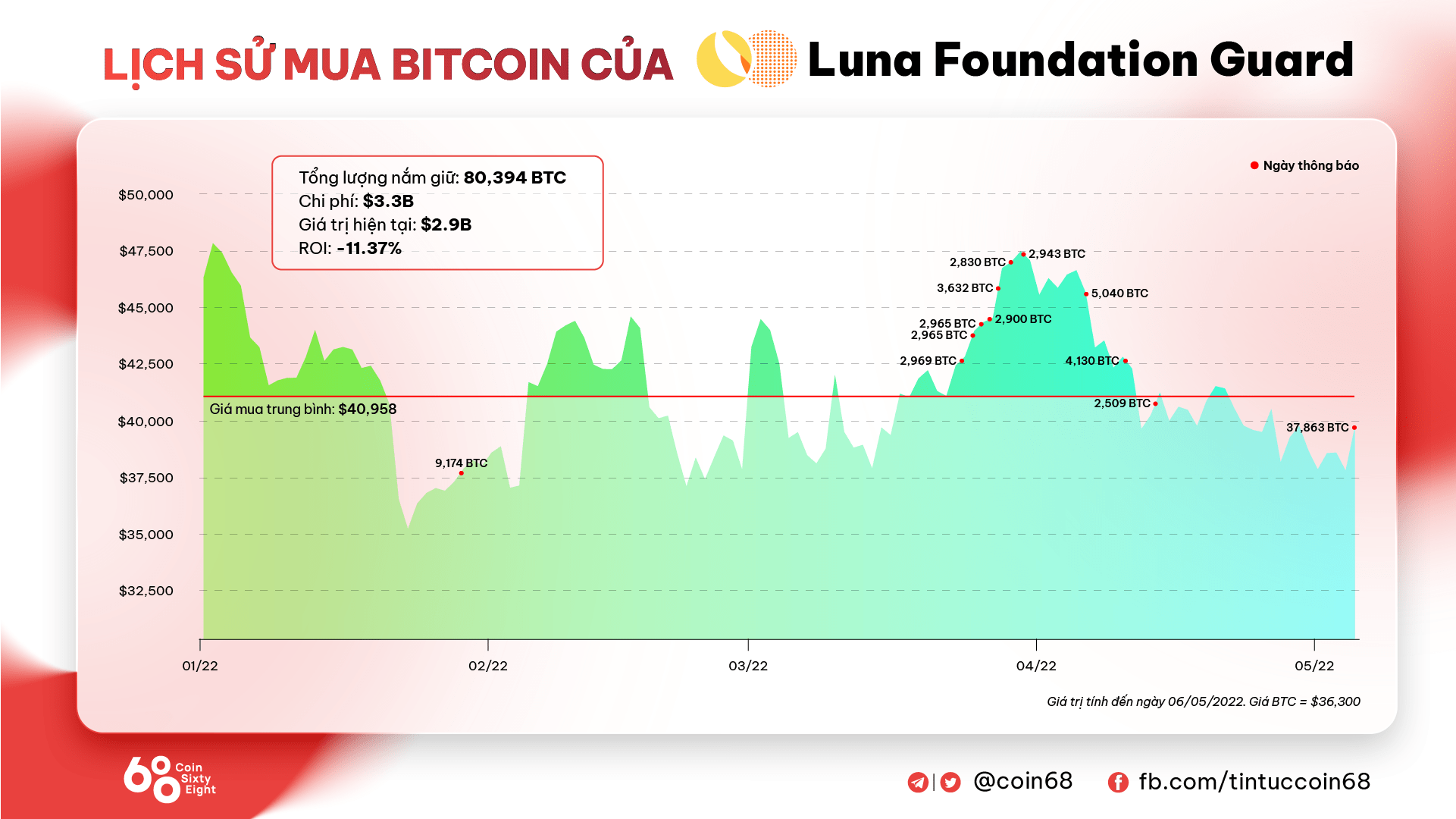

Terra has extended observed UST’s threat of de-peging and has determined to build a reserve fund in the type of other cryptocurrencies, termed the Luna Foundation Guard (LFG). Just on May 5th LFG invested a further one.five billion bucks to invest in Bitcoin, bringing the fund’s assets to nearly three.five billion bucks, of which BTC represented 90%, the rest had been other coins this kind of as LUNA, AVAX, USDT and USDC.

However, what LFG may possibly not have taken into account is that in a downtrend, any coin will fall, which includes Bitcoin.

The LUNA – UST landfill this morning was so undesirable that Terraform Labs CEO Do Kwon had to “wake up early” on Twitter to reassure the local community.

I’m awake – enjoyable morning

Anon, you may possibly be hearing CT influensooors on UST depegging for the 69th time

Or you may possibly don’t forget that everybody is bad now and go for a run as an alternative

WYD

– Do Kwon (@stablekwon) May 7, 2022

Mr. Do Kwon is betting on $ eleven million with two critics of the LUNA – UST model in the cryptocurrency local community that the cost of LUNA on March 14, 2023 will be more than $ 88.

The cryptocurrency market place this May also witnessed a further algorithmic stablecoin “clone” of the LUNA – UST model, which is USDD on TRON with thirty% of APY.

Synthetic currency 68

Maybe you are interested: