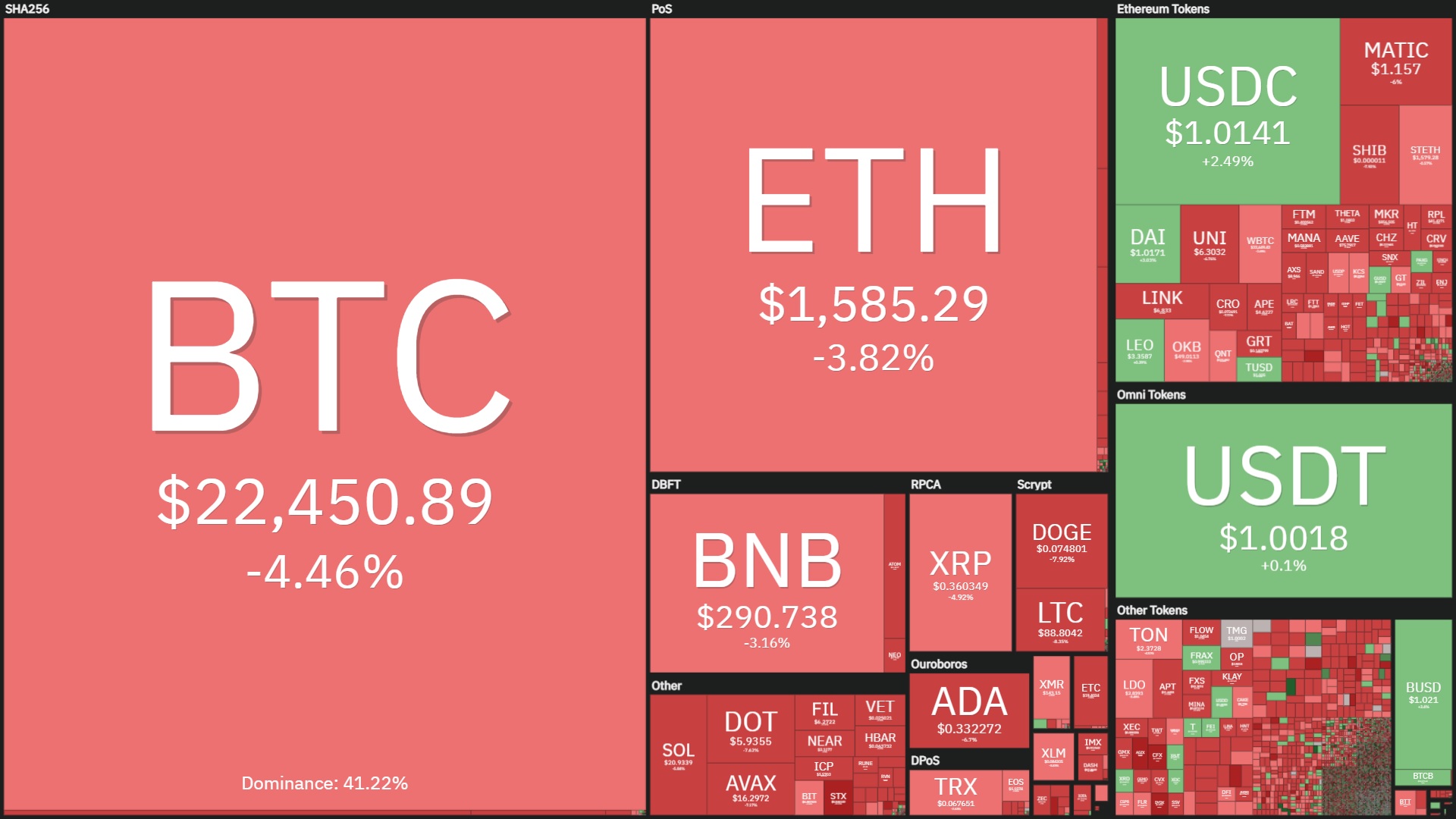

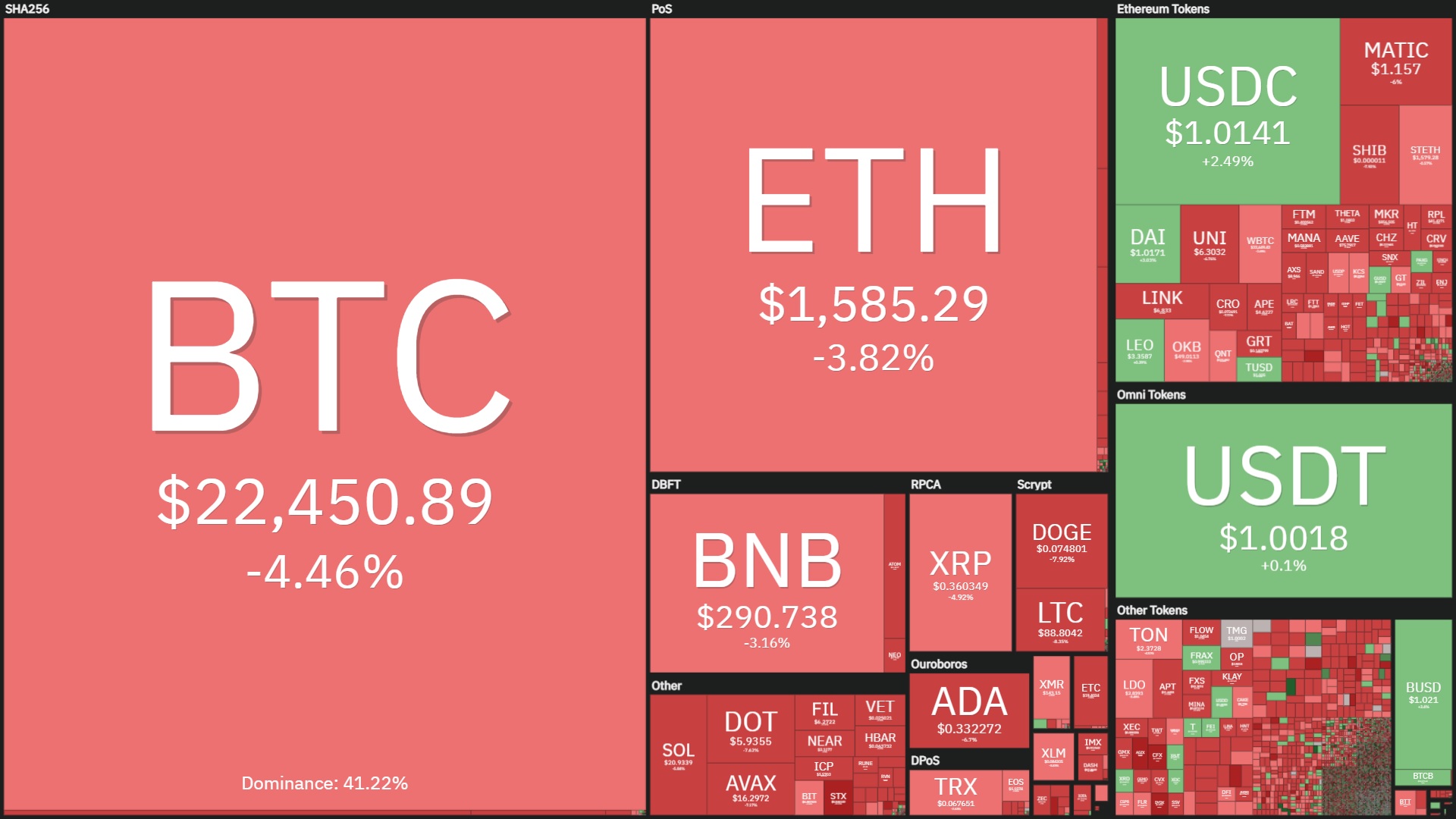

The biggest cryptocurrency in the planet, Bitcoin, fell sharply on the morning of March three due to the most current detrimental information and facts from the cryptocurrency industry relating to Silvergate Bank.

On the morning of March three, the cost of Bitcoin out of the blue swung from $23,400 to $22,a hundred in a sharp decline, prior to rebounding to $22,400.

While the motive for the most current industry correction is unknown, it is probably stemming from fears more than the plight of Silvergate Bank, the US financial institution that serves as a gateway for USD deposits for lots of of the country’s top rated cryptocurrency companies. Silvergate missed its SEC filing deadline this week, raising worries about the bank’s outlook as it is recognized to have been hit tough by the FTX and Genesis crashes.

From final evening until eventually now, lots of cryptocurrency giants in the United States have announced that they are terminating their romance or claiming to have no romance with Silvergate Bank, together with Coinbase, investment fund Galaxy, stablecoin company Circle and Paxos, the investment company.From MicroStrategy…

Similar to BTC, big-cap coins are also down four-eight% suitable now in contrast to 24 hrs in the past.

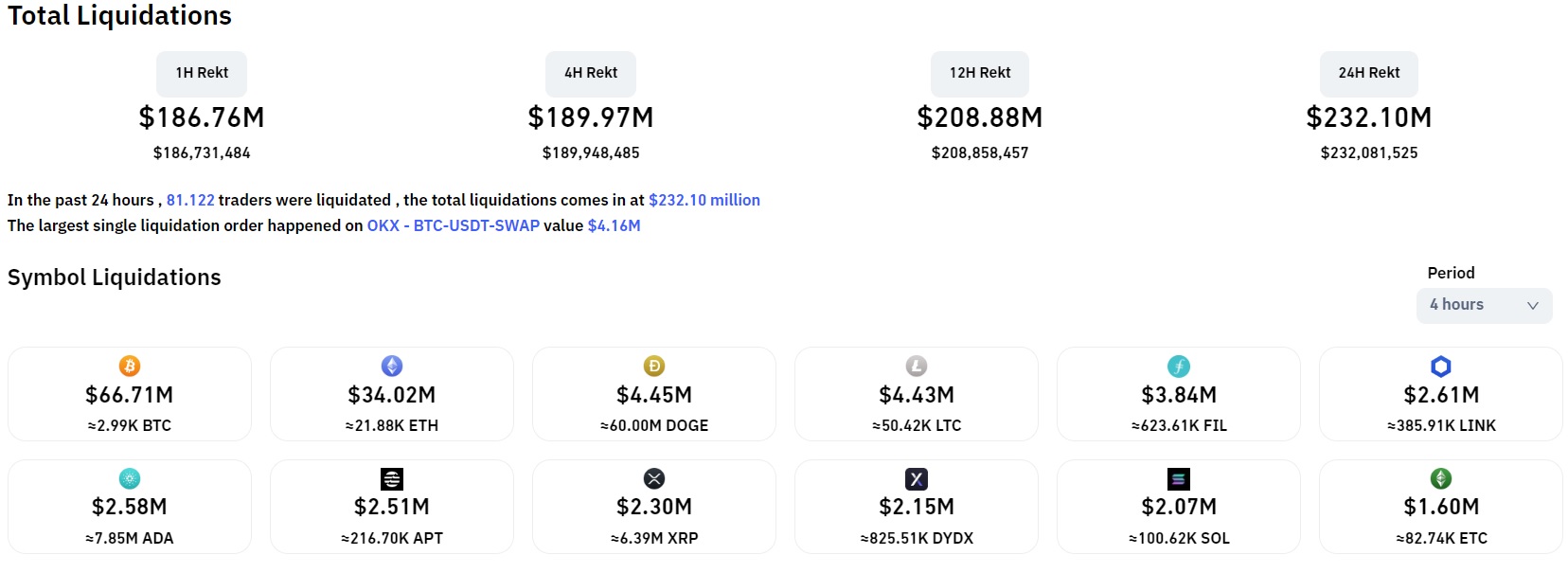

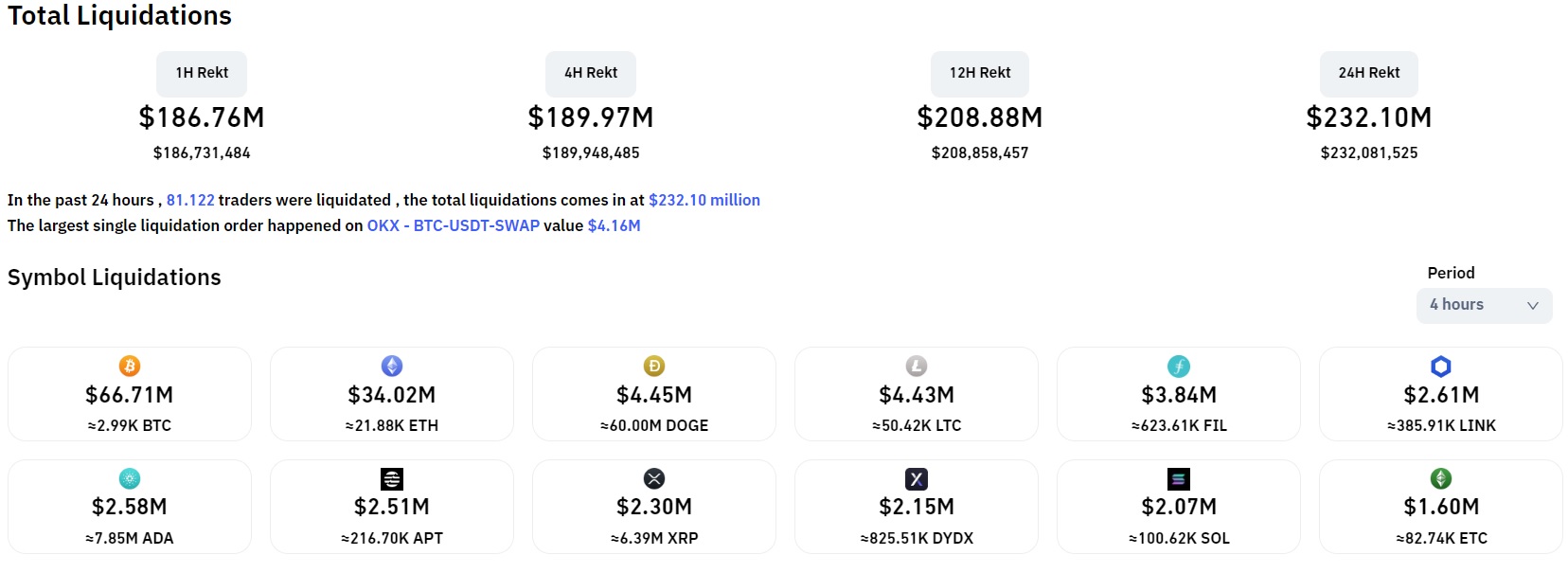

The variety of derivative orders cleared in the final one hour reached USD 170 million, representing the vast majority of the liquidation worth in the four-hour, twelve-hour and 24-hour frames, exhibiting that there was a significant impact of liquidation accumulated in the dump and manufactured lots of traders reduce their hands more than time. Among the cleared orders, quick orders account for much more than 98%.

Synthetic currency68

Maybe you are interested:

The biggest cryptocurrency in the planet, Bitcoin, fell sharply on the morning of March three due to the most current detrimental information and facts from the cryptocurrency industry relating to Silvergate Bank.

On the morning of March three, the cost of Bitcoin out of the blue swung from $23,400 to $22,a hundred in a sharp decline, prior to rebounding to $22,400.

While the motive for the most current industry correction is unknown, it is probably stemming from fears more than the plight of Silvergate Bank, the US financial institution that serves as a gateway for USD deposits for lots of of the country’s top rated cryptocurrency companies. Silvergate missed its SEC filing deadline this week, raising worries about the bank’s outlook as it is recognized to have been hit tough by the FTX and Genesis crashes.

From final evening until eventually now, lots of cryptocurrency giants in the United States have announced that they are terminating their romance or claiming to have no romance with Silvergate Bank, together with Coinbase, investment fund Galaxy, stablecoin company Circle and Paxos, the investment company.From MicroStrategy…

Similar to BTC, big-cap coins are also down four-eight% suitable now in contrast to 24 hrs in the past.

The variety of derivative orders cleared in the final one hour reached USD 170 million, representing the vast majority of the liquidation worth in the four-hour, twelve-hour and 24-hour frames, exhibiting that there was a significant impact of liquidation accumulated in the dump and manufactured lots of traders reduce their hands more than time. Among the cleared orders, quick orders account for much more than 98%.

Synthetic currency68

Maybe you are interested: