The cryptocurrency market place on the afternoon of June 18 expert a new sudden crash, pushing BTC and ETH charges to their 18-month lows.

The price tag of bitcoin in the previous hour has offered at $ 19,066, the lowest worth degree considering that December 2020.

Similarly, Ethereum also dropped to a round of $ 988, the lowest considering that January 2021.

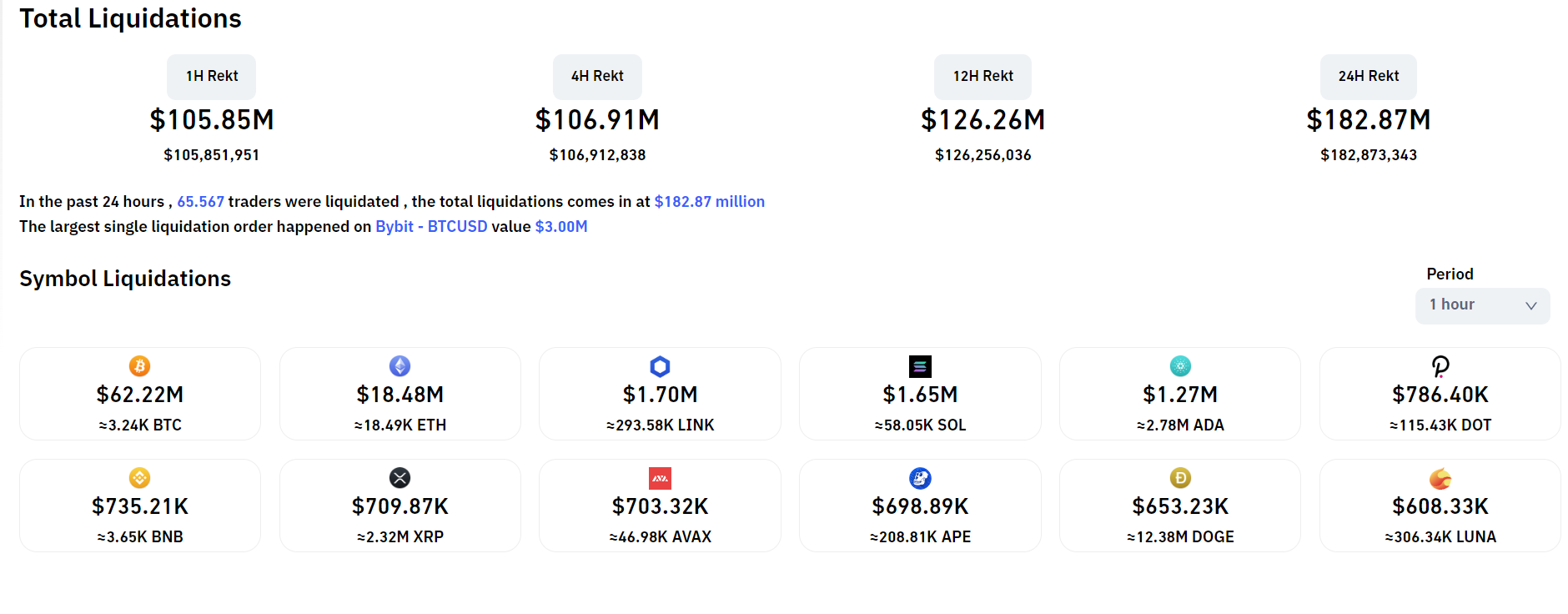

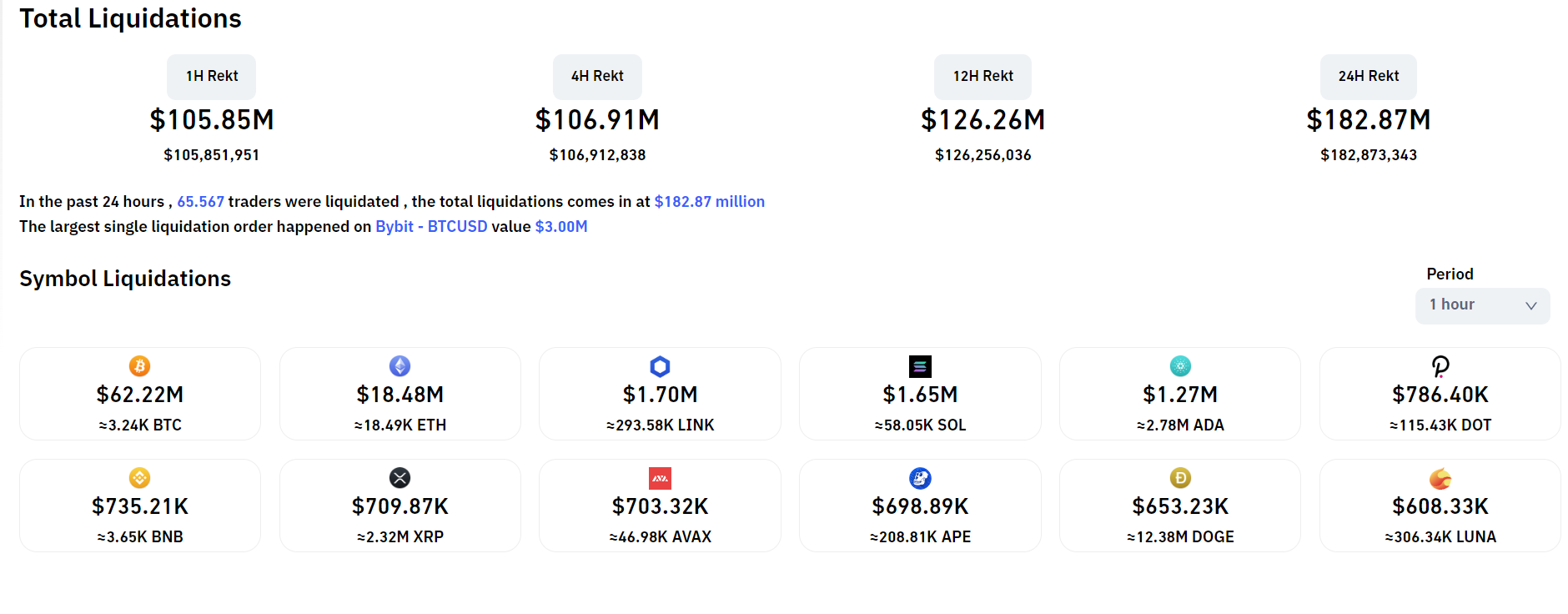

The volume of liquidations in the final hour has reached 95 million bucks, primarily concentrated in Bitcoin, with a charge of lengthy orders burned up to 74%.

Total cryptocurrency market place capitalization is now just $ 855 billion, down virtually $ 500 billion from one.three trillion in early June and “evaporated” by two.one trillion from record market place capitalization of two.9 billion. billions of bucks by November 2021.

The cryptocurrency market place has proven indicators of declining considering that final Friday (June ten), at which time the US announced inflation information May has risen beyond expectations, building stocks “red on fire” and foremost to main cryptocurrencies. The Fed then announced it raise interest rates by 0.75% to one.75% and is anticipated to proceed to increase curiosity charges to three.four% in the remaining four changes in 2022.

Update information and facts The merger of Ethereum the chance of getting delayed for the reason that the “difficulty bomb” is reprogrammed, leading to much more repressed negativity.

The solid dumping price tag of BTC also helps make the Bitcoin investments well worth of big providers like MicroStrategy, Tesla or the nation of El Salvador collapsed. MicroStrategy is shedding up to $ one billion from its BTC investment.

Then, quite a few “big hands” fell into a tricky problem due to liquidity complications. Lending platform Centigrade This is in which it all began, when the price tag of stETH was out of phase with ETH, leading to them to drop the capability to meet customers’ withdrawal desires and was forced to block deposits / withdrawals on June 13th.

Three capital arrows From the starting of the week till now, there have been consistent rumors of “default”, reduction of the capability to cope with liquidity for mortgages, foremost to a mass liquidation. The fund is also accused of misusing investor dollars to “salvage” borrowed positions, only to be silent when questioned by traders. In the most recent update, 3AC admitted that it was thinking of marketing assets or inviting other organizations to purchase back to resolve the problem.

Many of the main organizations in the cryptocurrency marketplace that are believed to be linked to 3AC this kind of as Avalanche, Trader Joe, dYdX, and so on. they denied getting impacted by the fund’s problem. Exchanges together with FTX, Deribit, BitMEX and the BlockFi lending platform have confirmed that they have liquidated the Three Arrows Capital assure.

The crisis has also extended to Finblox and Babel Finance, loan units and the DeFiance Capital investment fund for the reason that it is believed to be linked to 3AC.

Synthetic currency 68

Maybe you are interested:

The cryptocurrency market place on the afternoon of June 18 expert a new sudden crash, pushing BTC and ETH charges to their 18-month lows.

The price tag of bitcoin in the previous hour has offered at $ 19,066, the lowest worth degree considering that December 2020.

Similarly, Ethereum also dropped to a round of $ 988, the lowest considering that January 2021.

The volume of liquidations in the final hour has reached 95 million bucks, primarily concentrated in Bitcoin, with a charge of lengthy orders burned up to 74%.

Total cryptocurrency market place capitalization is now just $ 855 billion, down virtually $ 500 billion from one.three trillion in early June and “evaporated” by two.one trillion from record market place capitalization of two.9 billion. billions of bucks by November 2021.

The cryptocurrency market place has proven indicators of declining considering that final Friday (June ten), at which time the US announced inflation information May has risen beyond expectations, building stocks “red on fire” and foremost to main cryptocurrencies. The Fed then announced it raise interest rates by 0.75% to one.75% and is anticipated to proceed to increase curiosity charges to three.four% in the remaining four changes in 2022.

Update information and facts The merger of Ethereum the chance of getting delayed for the reason that the “difficulty bomb” is reprogrammed, leading to much more repressed negativity.

The solid dumping price tag of BTC also helps make the Bitcoin investments well worth of big providers like MicroStrategy, Tesla or the nation of El Salvador collapsed. MicroStrategy is shedding up to $ one billion from its BTC investment.

Then, quite a few “big hands” fell into a tricky problem due to liquidity complications. Lending platform Centigrade This is in which it all began, when the price tag of stETH was out of phase with ETH, leading to them to drop the capability to meet customers’ withdrawal desires and was forced to block deposits / withdrawals on June 13th.

Three capital arrows From the starting of the week till now, there have been consistent rumors of “default”, reduction of the capability to cope with liquidity for mortgages, foremost to a mass liquidation. The fund is also accused of misusing investor dollars to “salvage” borrowed positions, only to be silent when questioned by traders. In the most recent update, 3AC admitted that it was thinking of marketing assets or inviting other organizations to purchase back to resolve the problem.

Many of the main organizations in the cryptocurrency marketplace that are believed to be linked to 3AC this kind of as Avalanche, Trader Joe, dYdX, and so on. they denied getting impacted by the fund’s problem. Exchanges together with FTX, Deribit, BitMEX and the BlockFi lending platform have confirmed that they have liquidated the Three Arrows Capital assure.

The crisis has also extended to Finblox and Babel Finance, loan units and the DeFiance Capital investment fund for the reason that it is believed to be linked to 3AC.

Synthetic currency 68

Maybe you are interested: