Bitcoin (BTC) on the morning of November sixteen registered a correction in the $ 60,000 spot as the latest bullish momentum disappeared.

The world’s # one cryptocurrency fell from $ 66,400 to just $ 60,400 in the previous 24 hrs, shedding virtually eight% of its worth. This is Bitcoin’s third correction in the previous two weeks, following declines on October 21-27 and November ten.

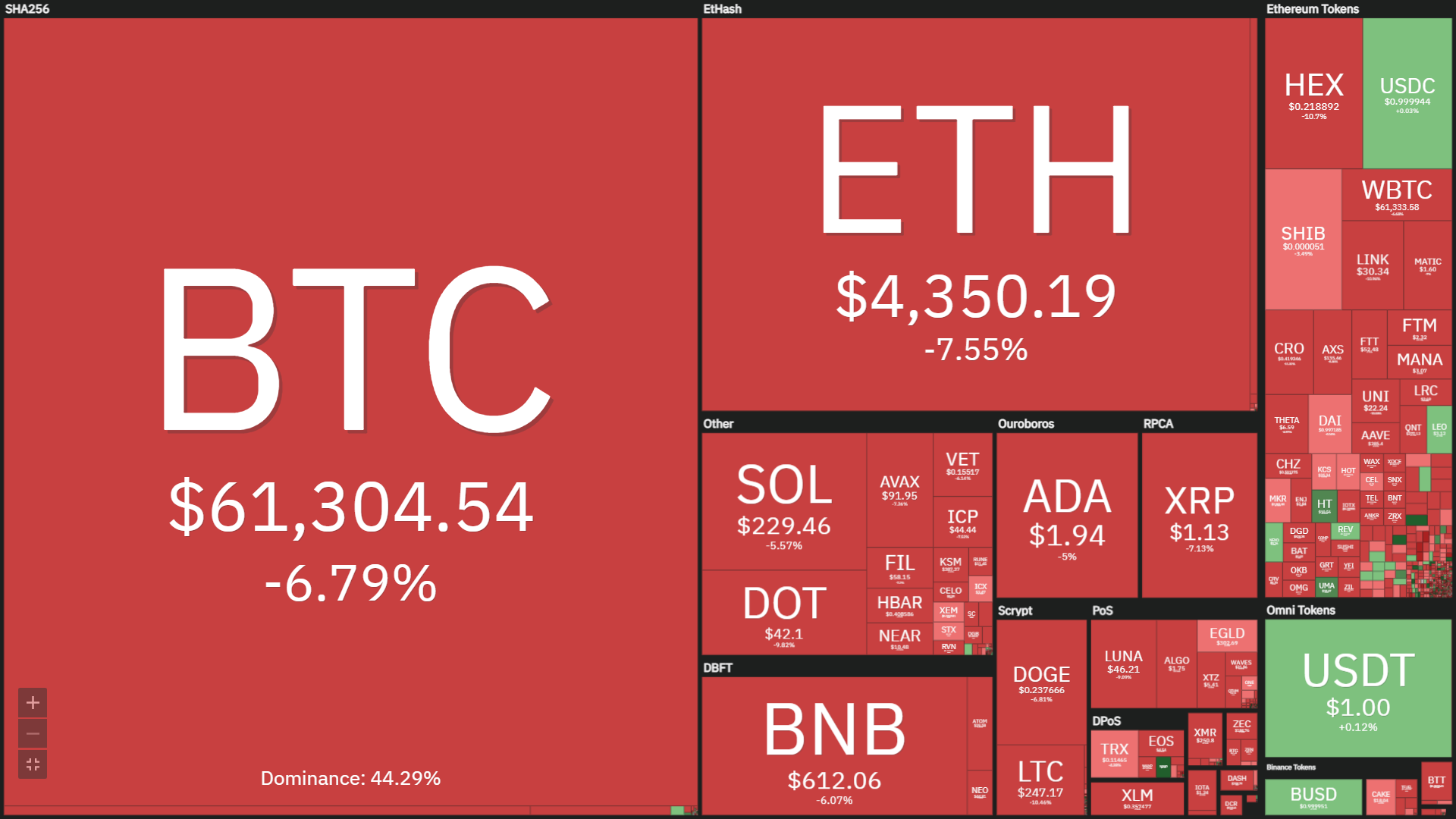

The cryptocurrency industry on the morning of November sixteen was also filled with a red colour in the course of the BTC retracement, with most of the downside involving five-twenty%.

Unlike the two dips just before the price tag was pushed back following setting a new record large, the price tag of BTC in the morning of November 15th has maintained a steady recovery momentum and has only reversed due to the fact yesterday afternoon.

As mentioned by Coinlive, there is no clear information behind Bitcoin’s present decline. Therefore, it is hugely possible that BTC has exhausted its upward momentum following the acceleration time period due to the fact the starting of October right up until now.

Since September 24, when the Chinese authorities announced a ban on cryptocurrencies, the price tag of Bitcoin has acquired momentum and returned to the $ 50,000 mark thanks to a wave of fantastic information.

Subsequently, the cryptocurrency No. one in the globe “exploded” with information that the US had last but not least authorized a Bitcoin ETF, pushing the price tag of this coin to a peak of $ 67,000 on 21 October. However, on the evening of that day, the industry took a hit when numerous significant exchanges concurrently logged mistakes, with the price tag of BTC on Binance.US occasionally dropping as reduced as $ eight,200. BTC on October 27 continued to decline due to strain on the derivatives industry.

In the following days, as the Bitcoin ETF craze cooled, Bitcoin was trading largely in the $ 58,000 – $ 63,000 array, just before macro information hit the industry. Notably, on November ten, the United States announced that inflation information reached a thirty-12 months large. This facts signifies that the USD is severely weakened, driving up the price tag of choice assets this kind of as gold or cryptocurrencies. Thanks to this, Bitcoin reached a new all-time large at $ 69,000, specifically as predicted by Elon Musk. However, due to the fact the price tag enhance did not stem from inner forces, BTC then offered once more for $ 62,800.

With Taproot, the only significant Bitcoin update in the final four many years, successfully implemented on 11/14, BTC has officially run out of fantastic information to assistance brief-phrase bullish momentum. Furthermore, Taproot is not an update that brings as well numerous new capabilities to end users, but largely improves the safety of transactions.

This is possibly why this coin was reported at $ 60,000. Additionally, undesirable information like the SEC’s rejection of a bodily Bitcoin ETF proposal or the US President’s signing of a law with provisions to tax cryptocurrencies also contribute to a damaging image for BTC these days.

Despite this, numerous analysts feel that Bitcoin nevertheless has area to develop in 2021. Based on the stock-to-movement model evaluation, PlanB stays in the place that Bitcoin’s target rates for November and December are $ 98,000 and $ 135,000, respectively. PlanB even predicts that BTC’s bullish cycle will lengthen into 2022, peaking at $ 288,000.

Prediction of $ 98K for November and $ 135K for December nevertheless in perform pic.twitter.com/Df9CsxTdEj

– PlanB (@ $ one hundred trillion) November 14, 2021

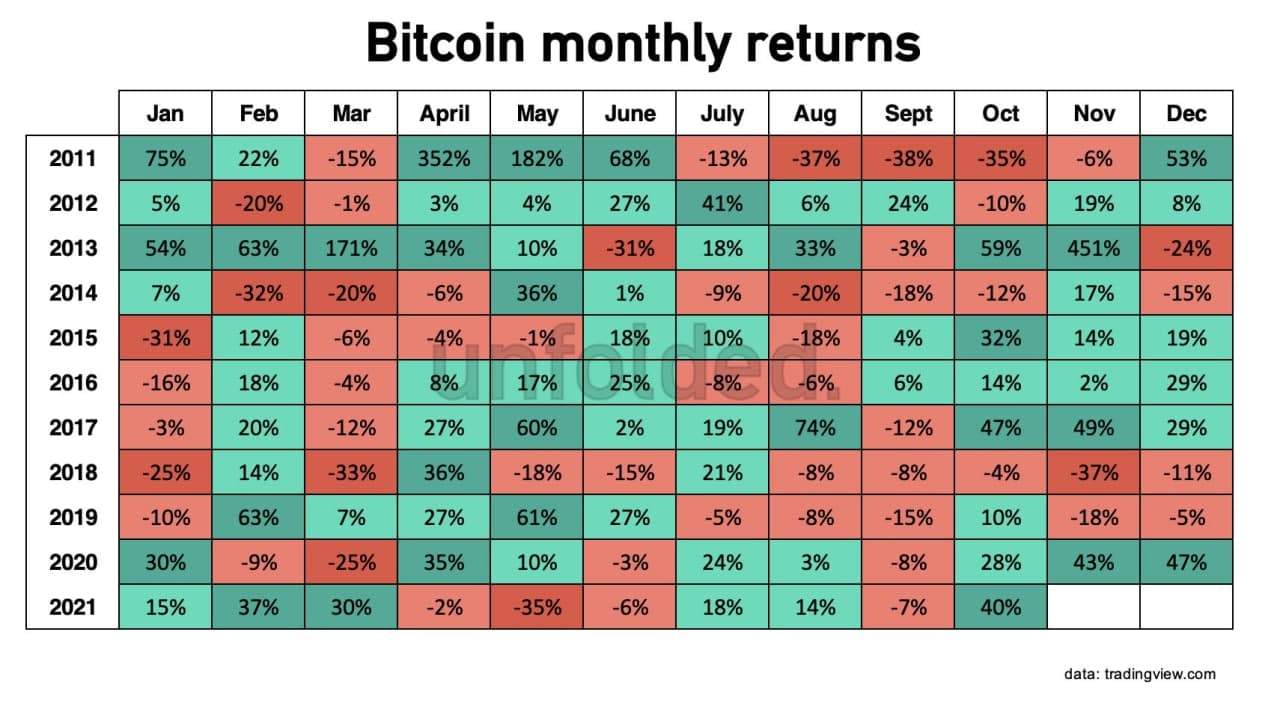

Historical information also demonstrates that the final two months of the 12 months are frequently the “wanest” instances for Bitcoin, primary numerous to hope for a situation the place BTC will carry on to hit new highs for the remainder of 2021..

Synthetic Currency 68

Maybe you are interested: