Institutional traders are continuing to flock to Bitcoin regardless of BTC’s value hitting a five-month large, setting the stage for a enormous Bitcoin boom above the program of the 12 months.

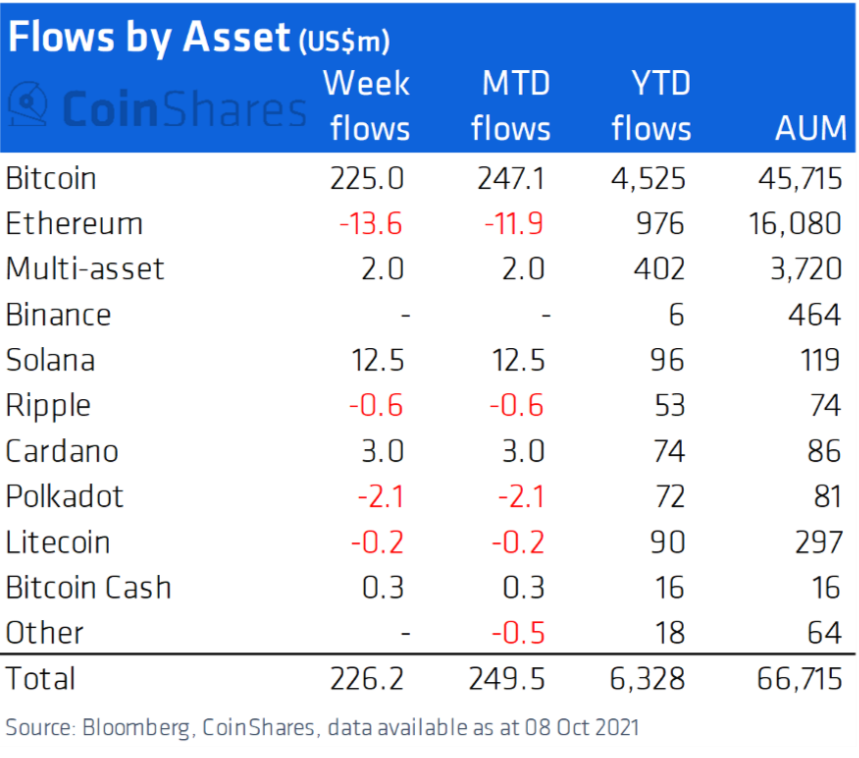

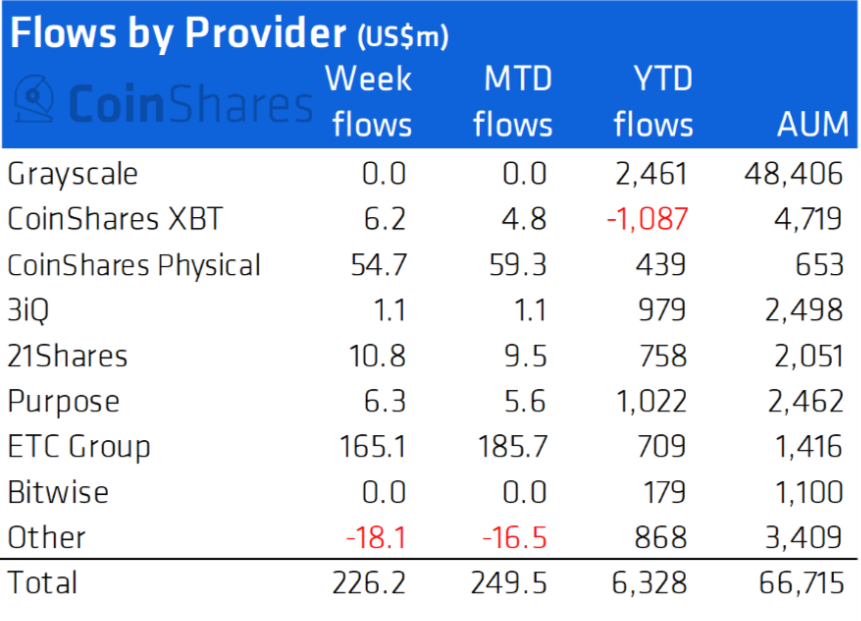

According to CoinShares’ weekly report on October twelve, a lot more than $ 226 million of institutional capital has flowed into Bitcoin (BTC) merchandise above the previous week. At the exact same time, it marks the third consecutive week that Bitcoin has dominated institutional inflows, up 227% from the former week.

Altcoin monitoring merchandise with an ongoing lead with Solana (SOL) and Cardano (ADA) created inflows of $ twelve.five million and $ three million, respectively. However, money delivering publicity to Ethereum (ETH), Polkadot (DOT) and Ripple (XRP) have been not “lucky”, owning suffered outflows of $ 13.six million, $ two, $ one million and $ 600,000 respectively.

The substantial inflow of income coincided with BTC value development of twelve.five% during the week. The good shift in Bitcoin value sentiment has largely stemmed from latest statements by US Securities and Exchange Commission (SEC) Chairman Gary Gensler suggesting the extended-awaited approval of cryptocurrency, the very first US Bitcoin ETF.

At the exact same time, the over information confirmed that, regardless of the rise in Bitcoin (BTC) charges, retail traders are not prepared to intervene, BTC’s robust recovery is largely due to “big players” on the industry. However, the latest image is particularly “optimistic” for Bitcoin, particularly as the “wave” of merchants returns to the industry.

– See a lot more: All indicators are favorable, is Bitcoin (BTC) about to return to the previous top rated?

The surge in exercise all around Bitcoin has witnessed the mixed assets below management (AUM) of institutional crypto merchandise increase to $ 66.seven billion, which is estimated to be just five% reduce than the industry’s AUM record. May.

Although the SEC previously denied each and every request acquired for Bitcoin ETF, the SEC is at present evaluating 4 requests for Bitcoin ETF based mostly on the regulated futures contracts of the Chicago Mercantile Exchange (CME).

With the CME futures industry providing a product or service presently insured and regulated by US regulators, authorities like Bloomberg’s senior ETF analyst feel the US will approve the Bitcoin ETF in October, the value of BTC has reached USD a hundred,000.

Synthetic currency 68

Maybe you are interested: