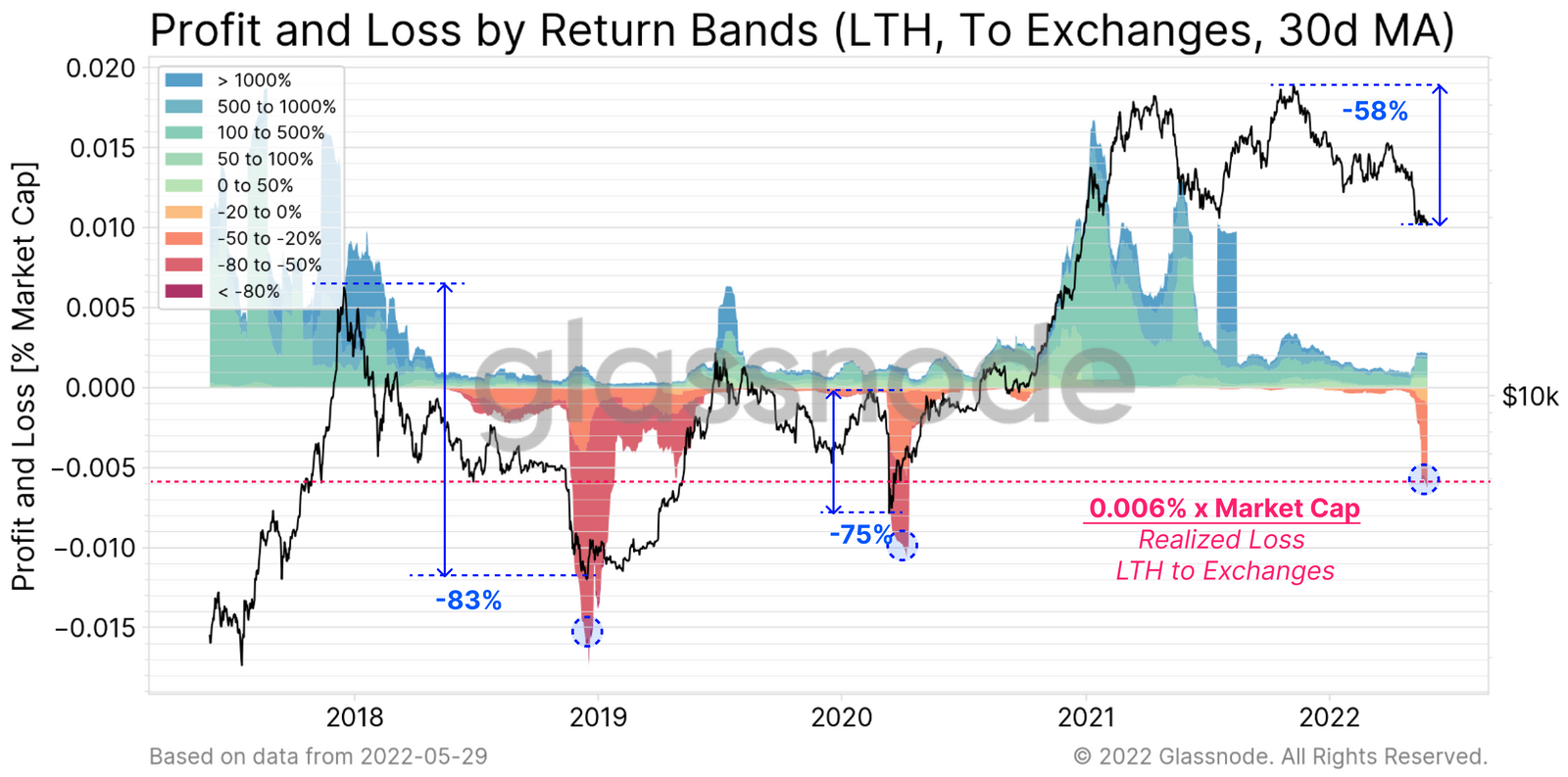

Long-phrase Bitcoin holders are starting up to endure losses proportional to people seasoned by past bear markets.

According to the most current report from blockchain evaluation company Glassnode, calculated by measuring the worth of Bitcoin deposited on a stock exchange, the complete amount of losses created by prolonged-phrase traders (LTH) of Bitcoin (BTC) exceeded .006% of the market place capitalization on May 29th.

However, additional significant losses could carry on in the close to phrase if the historical reduction patterns of past dormant markets are repeated. From 2018 to 2019, LTH losses peaked at .015% on market place capitalization, and people losses lasted for about a 12 months. While, the existing index has only been observed for about a month.

This suggests that in terms of value correlation, Bitcoin could flip out to be worse than trading all around $ 29,500 at press time.

In comparison, the over information coincides with Bitcoin’s lucrative cycle-based mostly construction of CryptoQuant, which has now dropped to fifty five%.

About fifty five% of the $ BTC the give is nonetheless lucrative

“2-three months of dull value action. So the final attainable capitulation with an more value drop of thirty% – 50% “.

from @KriptoMevsimiRead more👇https://t.co/BTolS8aBET pic.twitter.com/GQcPojIzXC

– CryptoQuant.com (@cryptoquant_com) May 27, 2022

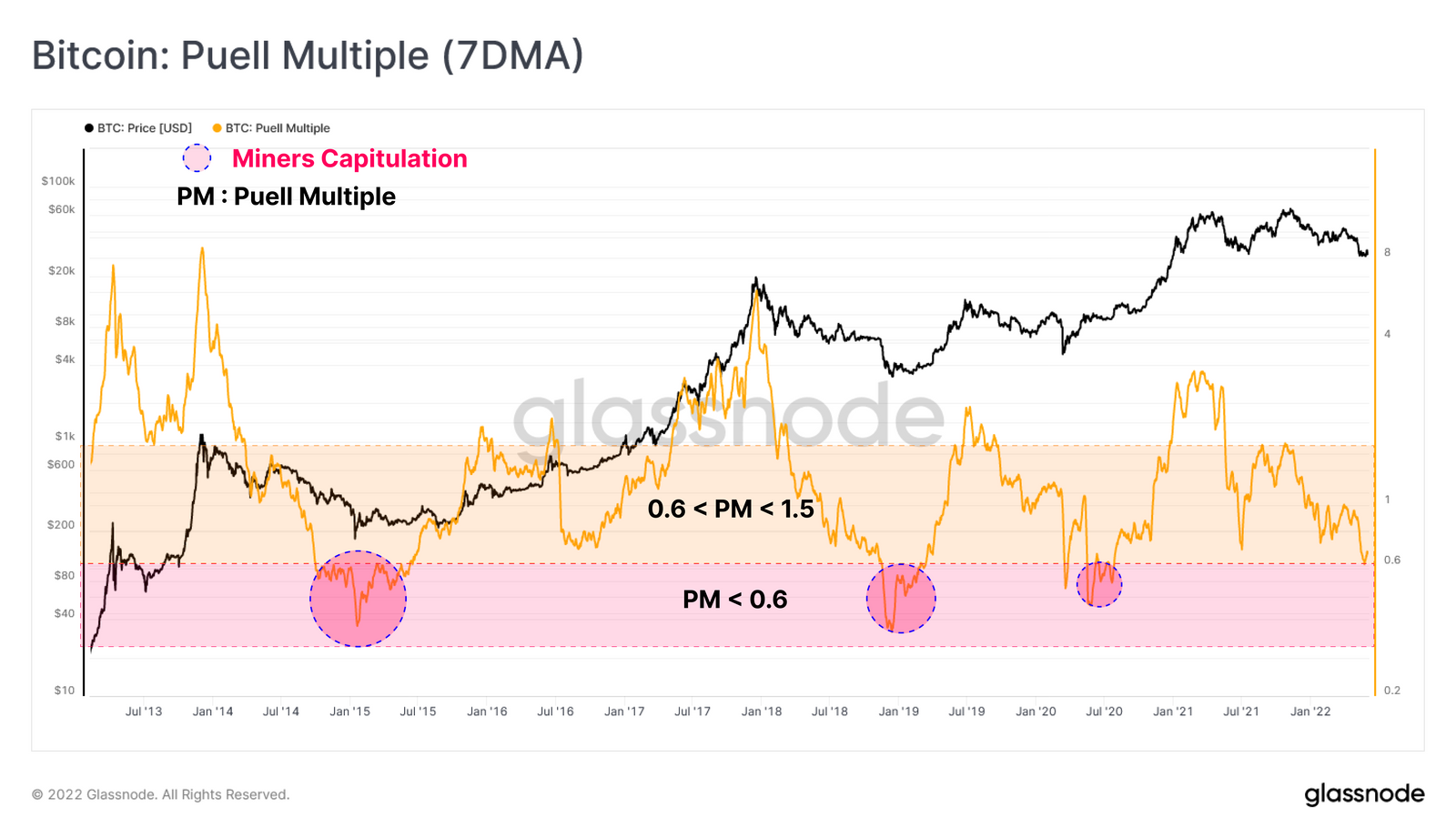

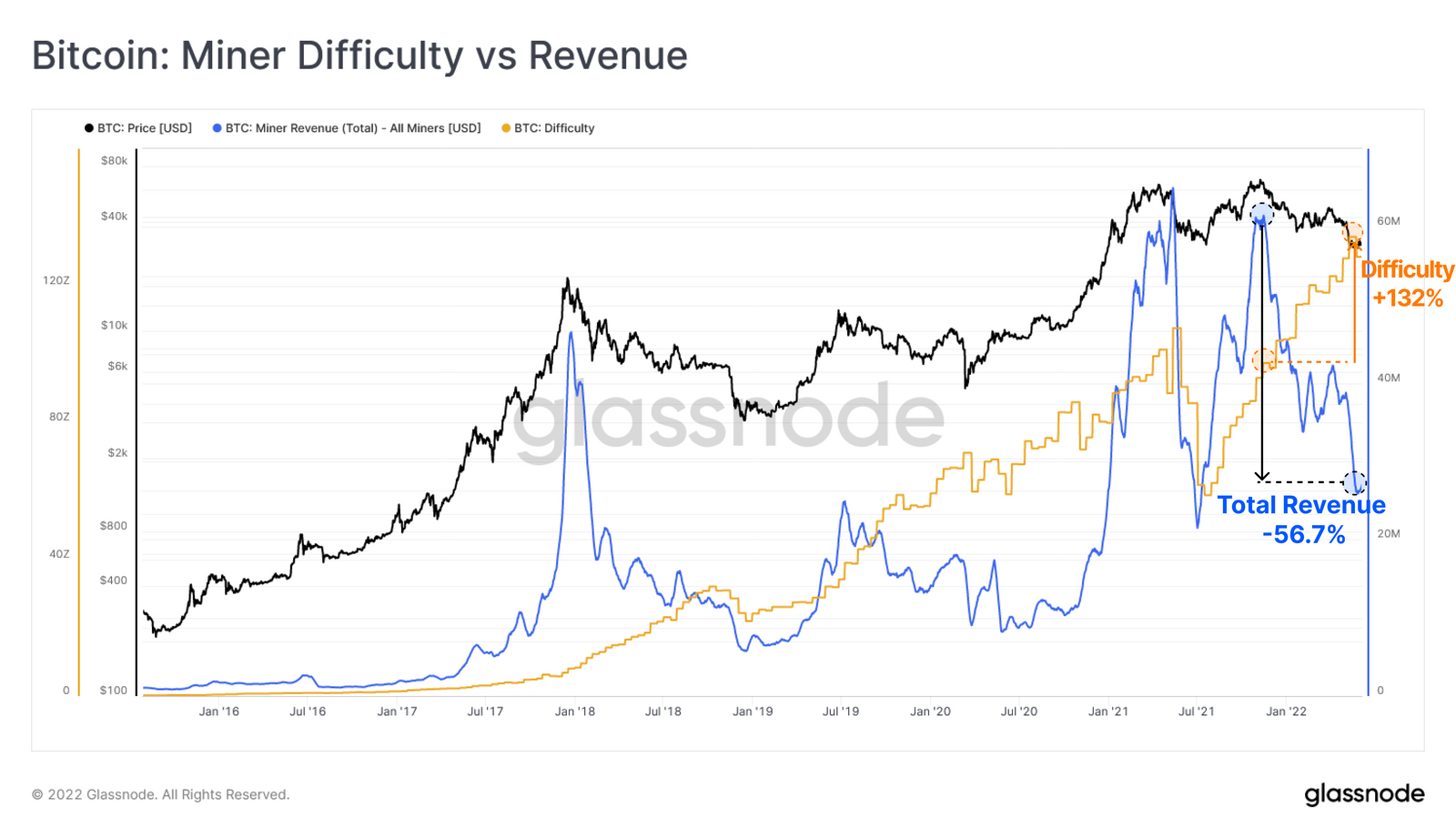

After figuring out how “dangerous” the existing market place is and exploring prolonged-phrase investor conduct, miners’ response to falling earnings also signals a lot of adverse situations. To fully grasp this evaluation, we need to initial quantify the profitability of the market place from a miner’s stage of see. And the Puell Multiple is the typical instrument supplied by Glassnode, illustrating the partnership involving Bitcoin’s every day manufacturing worth (in USD) and its 365-day moving regular.

Judging from the total historical past of the Puell various, throughout the early phases of the bear market place that commenced in 2013-2014, the Puell various ordinarily fell in the variety of .six to one., indicating the reduced regular existing gains of the forty% in contrast to the past 12 months. Then, throughout the later on phases of the upcoming hibernation cycle, the Puell Multiple drops into the area beneath .five.

The index is at this time at .66, in the system of coming into a variety-bound. Taking into account the higher correlation involving this index and value, a drop in the value of -ten% or additional for Bitcoin would indicate widespread strain on miners’ revenue streams.

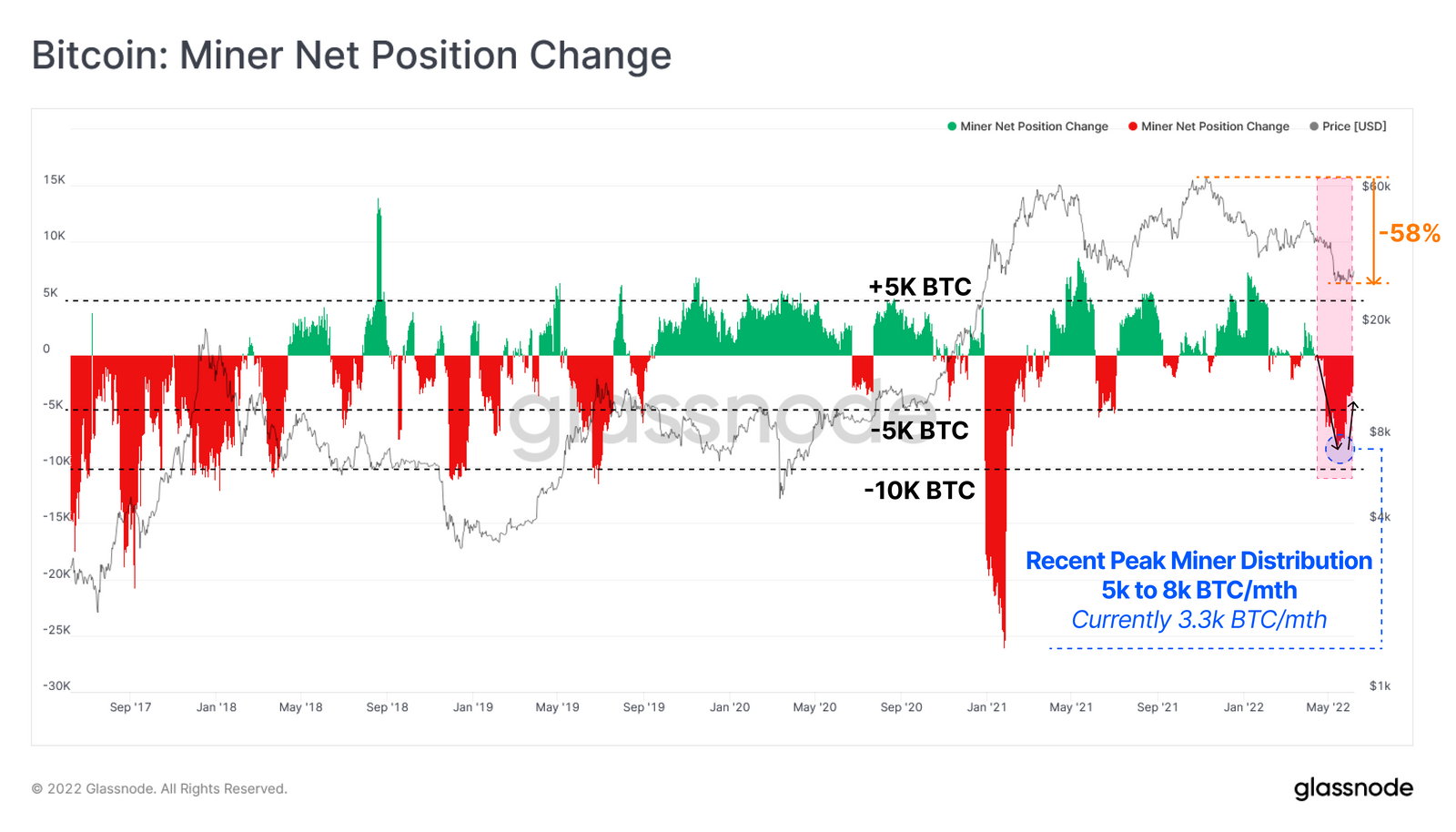

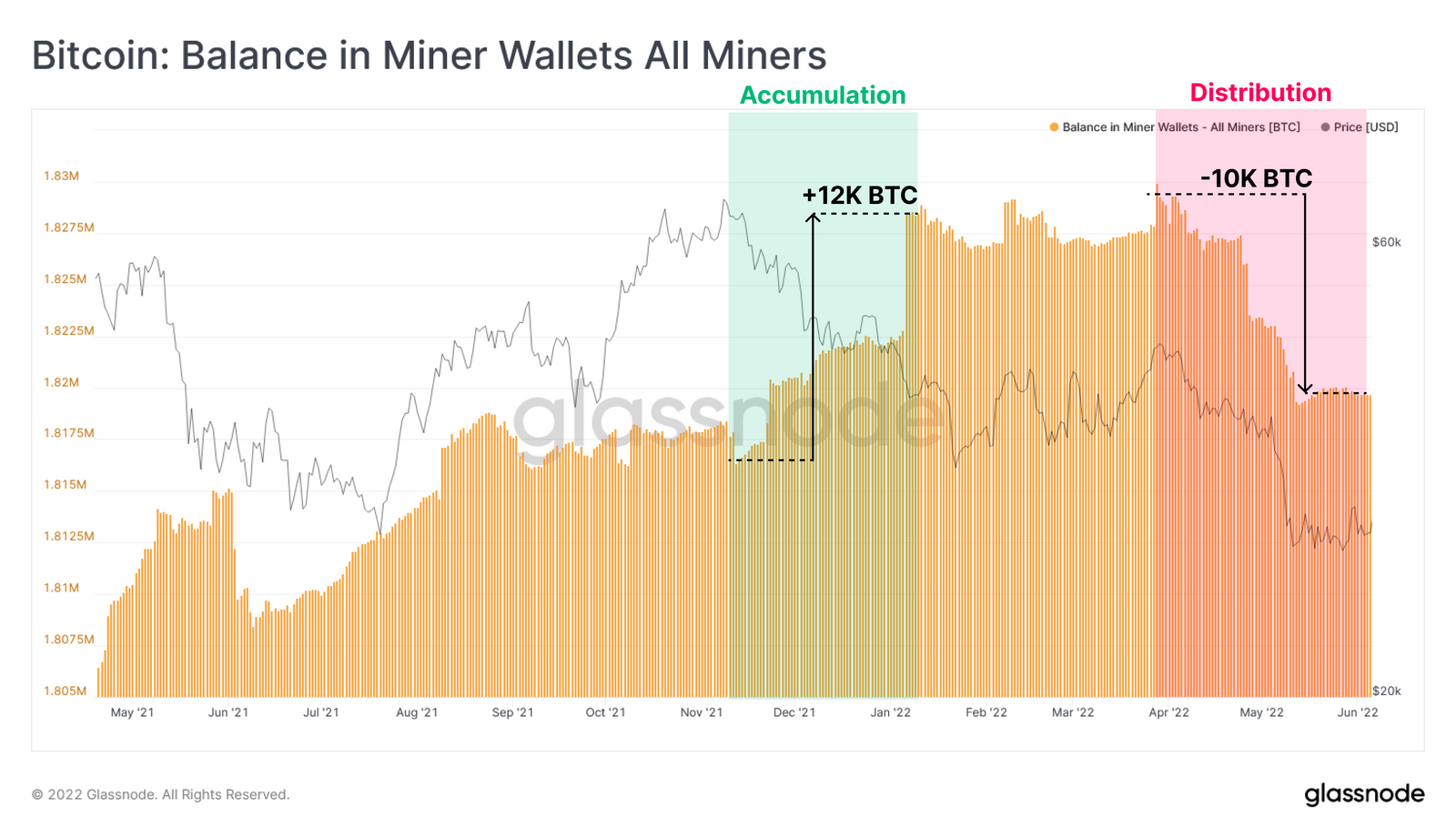

In light of the widespread decline in USD earnings due to the fact November 2021, miners’ balances are also gradually declining. Their net place adjust index at this time signifies an all round decline of involving five,000 and eight,000 Bitcoins per month.

This signals a marked adjust in miners’ conduct, as their balances amassed all around twelve,000 BTC throughout the initial $ 69,000 ATH BTC sale. In response to the market place crash brought about by the LUNA Foundation promoting $ three billion in BTC in an work to preserve the UST price, miners have due to the fact distributed up to ten,000 BTC, growing the promoting stress on the market place.

– See additional: Shares of Bitcoin Mining Companies Fall Simultaneously: Are Miners “Entering”?

A fascinating big difference to go over later on is that the network trouble continues to develop, obtaining greater 132% from ATH, regardless of the monetary momentum as the miners’ complete income has just seasoned its worst decline of all time. 2022. This major spike in trouble demonstrates that a lot of miners have expanded their operations and new ones have joined the grid regardless of falling earnings. Therefore, latest divestment charges from hardware and mining services are probably to place additional stress on miners’ stability sheets.

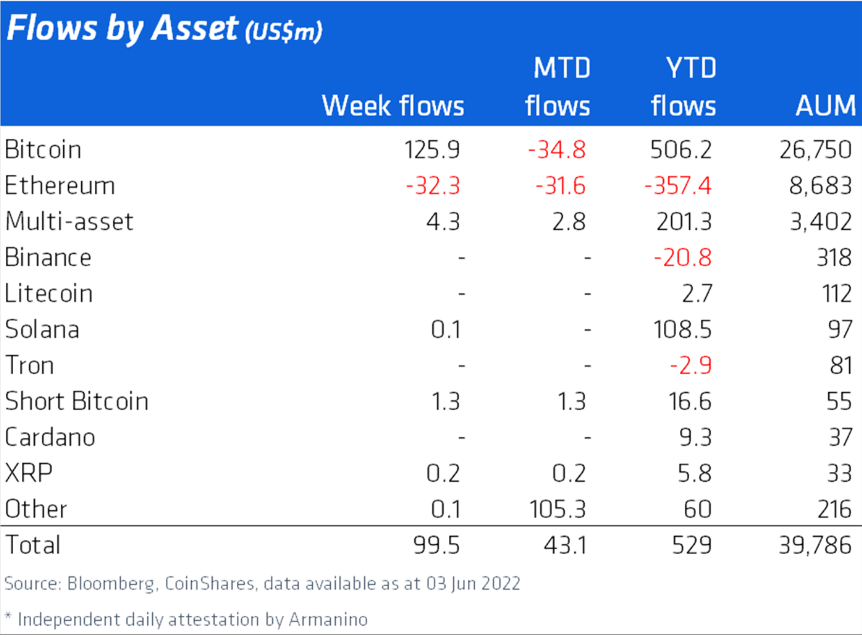

Overall, regardless of the not-so-optimistic outlook for Bitcoin costs, the quantity of Bitcoin held by institutions nonetheless hit a record higher final week. Interestingly, BTC inflows have reached all around $ 506 million in 2022 so far, when ETH has witnessed a $ 357 million retracement. This demonstrates that the market place sentiment for ETH has been substantially reduced than for BTC for the previous two quarters.

Summary of Coinlive

Maybe you are interested: