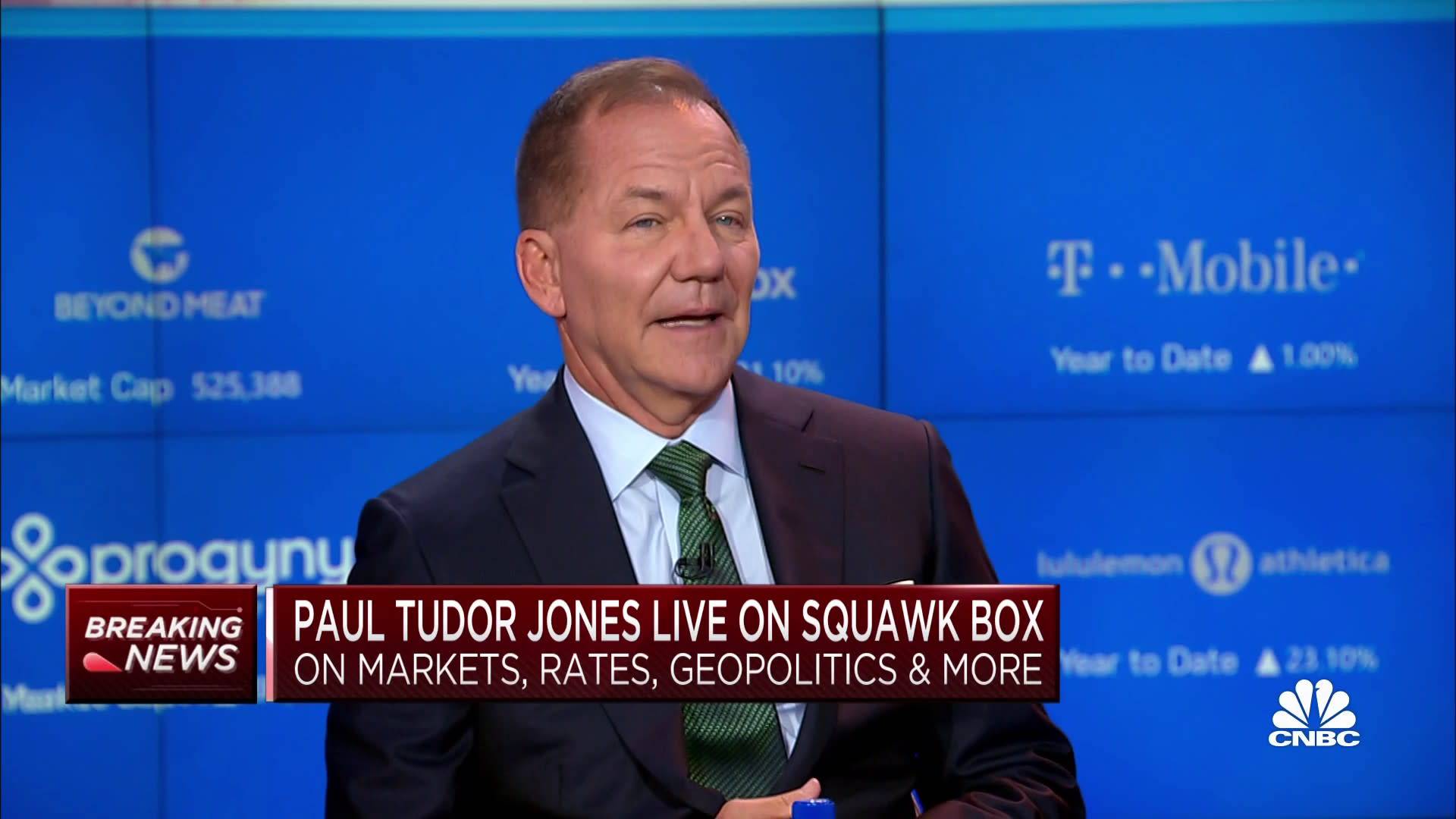

Billionaire Paul Tudor Jones stated that this is an very tricky time period for risky assets, amid a increasing geopolitical surroundings and a weakening US economic predicament.

Paul Tudor Jonesthe billionaire nicknamed the “talented trading wizard”, has just explained his stage of see on the existing investment predicament CNBC. He is convinced that the geopolitical framework and the economic wellness of America make it extra tricky than ever to invest in stocks and securities. Bitcoin (BTC) and gold will as soon as once again be interesting choices.

“The United States is probably in the weakest fiscal position since World War II,” he says @ptj_official ON @SquawkCNBC. pic.twitter.com/VfAN689OmH

—CNBC (@CNBC) October 10, 2023

Appeared on the station’s Squawk Box plan CNBCJones painted the bleak economic surroundings in the United States, which he stated was the weakest time period considering that World War II:

“This may be the most dangerous geopolitical scenario I have ever seen.”

The popular investor stressed that the war in between Israel and Hamas has produced the geopolitical predicament extremely risky. Combined with stress from increasing curiosity costs, this is weighing heavily on America’s economic wellness as this flagship continues to borrow extra. Mr. Jones warns:

“As interest rates rise in the United States, we will find ourselves in a vicious cycle. In particular, high interest rates increase the costs of capital mobilization, leading to more debt issuance, which in turn causes more bond liquidation, ultimately pushing interest rates higher, leading us into a bind blind. ”

Despite his cautious perspective in direction of stock investments, the hedge fund manager has a solid preference for gold and Bitcoin:

“I may not love stocks, but I love Bitcoin and gold.”

Ultimately, Jones is awaiting a resolution and evaluating the probable effect of the Israel-Hamas conflict prior to looking at returning to risky assets. Furthermore, he did not rule out the probability of nuclear war.

Paul Tudor Jonesfounder and chief investment officer of Tudor Investment, he rose to fame soon after predicting and profiting from the 1987 stock marketplace crash. Jones is also president of Just Capital, a non-revenue public rating company, a US-primarily based public corporation on social and environmental parameters.

The billionaire initial publicly announced his stance on Bitcoin in May 2020. At that time, he confirmed that he had invested one% – two% of his personalized wealth in the cryptocurrency. A 12 months later on, he exposed his intentions raise the percentage allotted to Bitcoin to five%.

Going into 2023, Jones looks significantly less optimistic, arguing that the hostile regulatory surroundings and the US Federal Reserve’s determination to tame inflation will pose key difficulties for Bitcoin.

Unlike Paul Tudor Jones, two other billionaires, Charlie Munger and Ray Dalio, “still don’t like Bitcoin” and even feel cryptocurrencies need to be banned.

Coinlive compiled

Join the discussion on the hottest concerns in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!