Bitcoin’s latest heavy downturn has pushed the efficiency of the world’s primary cryptocurrency to a standstill. Bitcoin is on observe to file its worst quarterly efficiency for the reason that begin of a downtrend in 2018.

The present quarter can also be set to change into the second “nightmare” quarter on file for Bitcoin in almost eight years for the reason that begin of 2014. According to information from Skew, Bitcoin is at the moment down almost 46 % on the quarter, its low quarter. for the reason that first quarter of 2018.

#bitcoin up 10% year-to-date however on observe for worst quarter since Q1 2018 pic.twitter.com/z3PpsAlIJK

— skew (@skewdotcom) June 22, 2021

.

Bitcoin’s pedestal has at all times been in institutional funds. But in line with CoinShares weekly report, institutional buyers have continued to scale back their publicity to Bitcoin for the sixth straight week, with BTC funding merchandise solely transferring round $89 million in seven days. .

Overall, crypto funding merchandise mixed noticed a 3rd straight week of no flows, with buyers eradicating $79 million from the sector final week. The pullback from the “big guys” behind will increase the hazard to Bitcoin and your complete market. For instance, we will see that even when MicroStrategy simply purchased one other $489 million in Bitcoin, skepticism can’t be improved in comparison with the final state of affairs.

See extra: Too many whales are pushing Bitcoin to the ground, is crypto winter already?

However, establishments usually are not alone in decreasing their publicity to Bitcoin. According to Glassnode, OTC exchanges and miners are additionally step by step offloading this circulation. BTC holdings on OTC exchanges have fallen to their lowest degree since March 2020, whereas miners have additionally offered off in latest weeks amid China’s crackdown on Bitcoin mining.

#Bitcoin miners have elevated their distribution all through June, because the mining business experiences the most important migration in historical past.

nonetheless, $BTC holdings on OTC desks has reached a brand new native low, final seen in March 2020.

Read our evaluation right herehttps://t.co/dRbQgKkwfh pic.twitter.com/9MDXQfVB4l

— glassnode (@glassnode) June 23, 2021

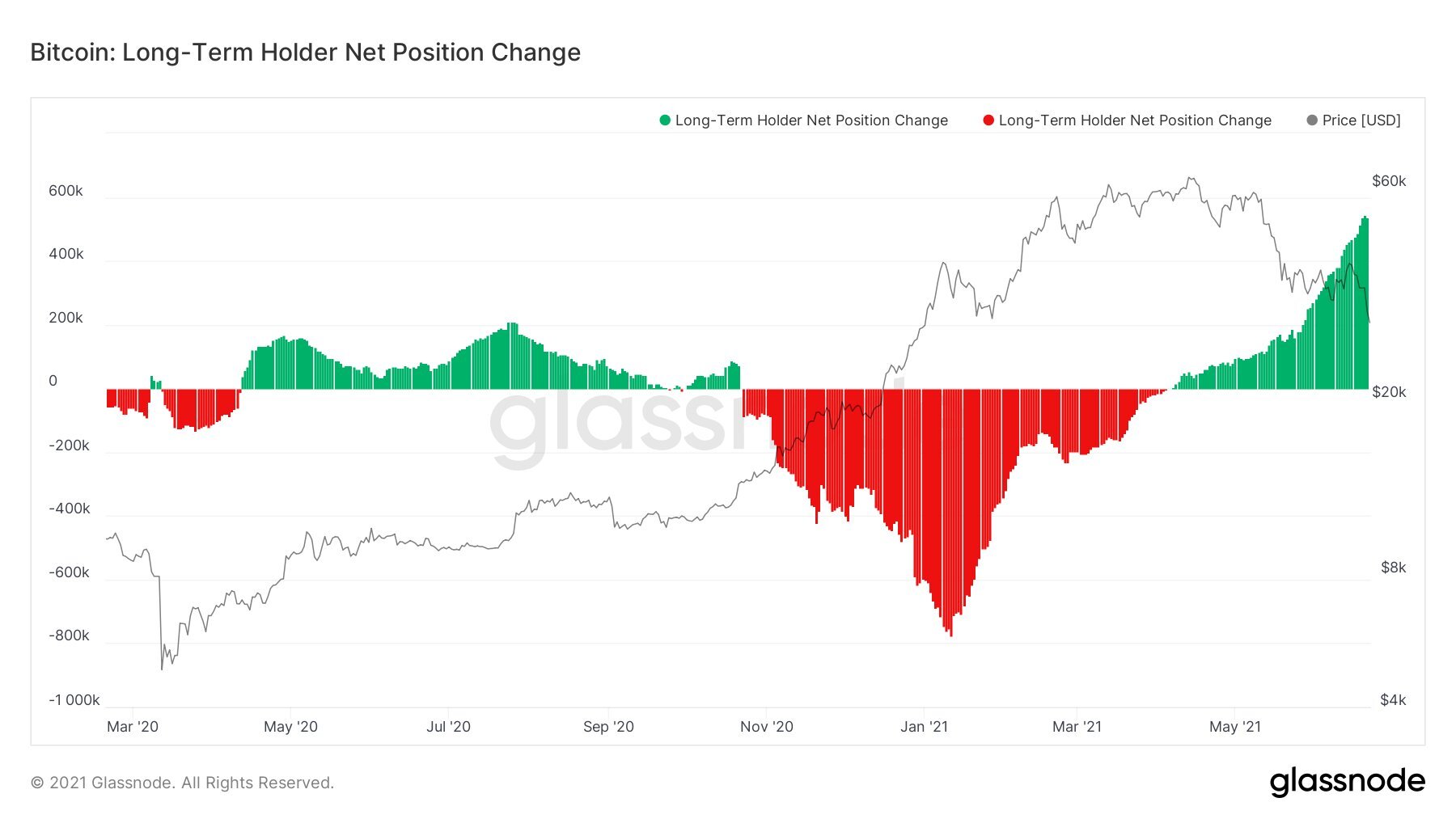

Besides, primarily based on one other Glassnode chart, the previous long-term Bitcoin holders didn’t promote the BTC they collected. They have even considerably elevated their holdings since Bitcoin began to bounce again from its all-time excessive in April.

In the brief time period, Bitcoin’s downtrend is probably not over but. However, CryptoQuant CEO Ki Young Ju has raised hopes that this won’t final too lengthy as a result of when it comes to long-term provide and demand primarily based on the ratio of stablecoins and SSR, every part is optimistic.

To be clear, I count on my $BTC bearish bias will not final lengthy (possibly just some weeks) as a result of the market seems good when it comes to provide/demand in the long run (eg, Stablecoins ratio(USD) and SSR)

So do not get me mistaken, I’m not saying it is over. pic.twitter.com/lfjgzUFyjO

— Ki Young Ju (@ki_young_ju) June 21, 2021

Synthetic

Maybe you have an interest:

.