Bitcoin (BTC) mining action is larger than ever, suggesting that mass offering stress from miners is very unlikely.

Despite Bitcoin falling to $ 27,000 from its ATH set at $ 69,000 in November, BTC is getting to be much more beautiful than ever to miners. The estimated hashrate of the complete processing energy committed to mining is exhibiting important development.

As the renowned analyst mentioned @Adventure founder from CryptoQuant on January 14, even at $ 42,000, Bitcoin is even now all around twenty% over the miners’ value.

The worst landfills #Bitcoin had by no means been due to the miners’ capitulation (December 2018, March 2020), when #BTC has fallen under manufacturing charges, is at possibility of capitulation by the miners

BTC was at possibility of miners capitulating at $ thirty,000 in May. The recent manufacturing value is $ 34k, which is twenty% much less than the recent value pic.twitter.com/t0UBrgVpZi

– venturefoundΞr (@venturefounder) January 14, 2022

Concern that Bitcoin’s decline in excess of the previous couple of months may well prompt miners to promote has been relatively allayed. Referring to the BTC manufacturing value index of Charles Edwards, CEO of asset manager Capriole, it was identified that the miners’ breakeven stage is at the moment at $ 34,000.

He also shared that the worst drops Bitcoin has ever had was due to the capitulation of the miners. Typically the 3 timelines of December 2018, March 2020 and May 2021, when BTC fell under the value of manufacturing, the principal trigger of the promote-off of miners.

“Bitcoin will be at possibility of a significant retracement if it loses the $ thirty,000 assistance degree. The recent manufacturing value is $ 34,000, which is twenty% much less than recent costs. “

Therefore, there is at the moment no motive for miners to promote, provided the revenue and beneficial potential prospective customers from their operations. In a 2019 report, Edwards also mentioned that transaction charges are rewarded to miners, offering them with an extra cushion towards spot value penetration under the value of manufacturing.

“Historically, the cost of electricity to produce Bitcoin has represented a low level in the market price of BTC.”

As Coinlive reported that consolidating BTC under $ 50,000 is a good affliction to open the door for miners to include to their holdings. The illiquid giving of Bitcoin meant that ATH, as a substitute of offering, constantly accumulated much more BTC this month and longer than the peak.

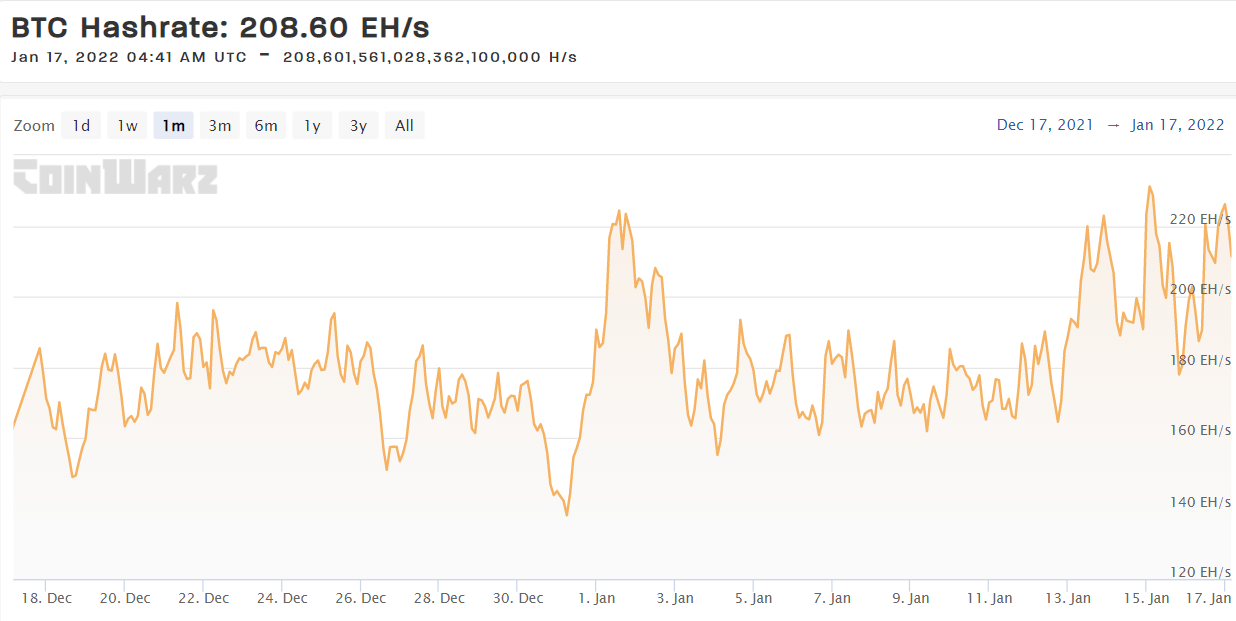

This speaks to a balanced stability sheet and could be much more explosive in the potential, worries about impending financial hardships are at the moment not weighing on the mining sector. It can be obviously viewed that even although Kazakhstan misplaced the web due to the protests, which severely impacted Bitcoin’s worldwide hashrate, the index only necessary a week to recover strongly, breaking the ATH degree this week.

Market top Bitcoin miners are also producing fantastic preparations, Marathon Digital “buys” an additional 78,000 Bitcoin miners, really worth $ 900 million, or Bitfarms taking benefit of the possibility to acquire an additional one,000 Bitcoins (BTC) is the most evident illustration. .

However, the optimistic signal that is compiled based mostly on lots of worse market place estimates by top analysts predicting the brief-phrase trend of Bitcoin is that the “low” value of BTC will not be very low, over $ thirty,000.

Synthetic currency 68

Maybe you are interested: