Many Bitcoin miners are promoting off BTC from their accumulators and stocks soon after the income of the cryptocurrency mining market have plummeted considering that November.

With Bitcoin now hovering all-around $ 43,500, 33% beneath the all-time large of $ 69,000 BTC reached in November, miners have small curiosity in taking income for revenue and their income are approaching twenty%. However, electrical power and mining gear have to be paid for.

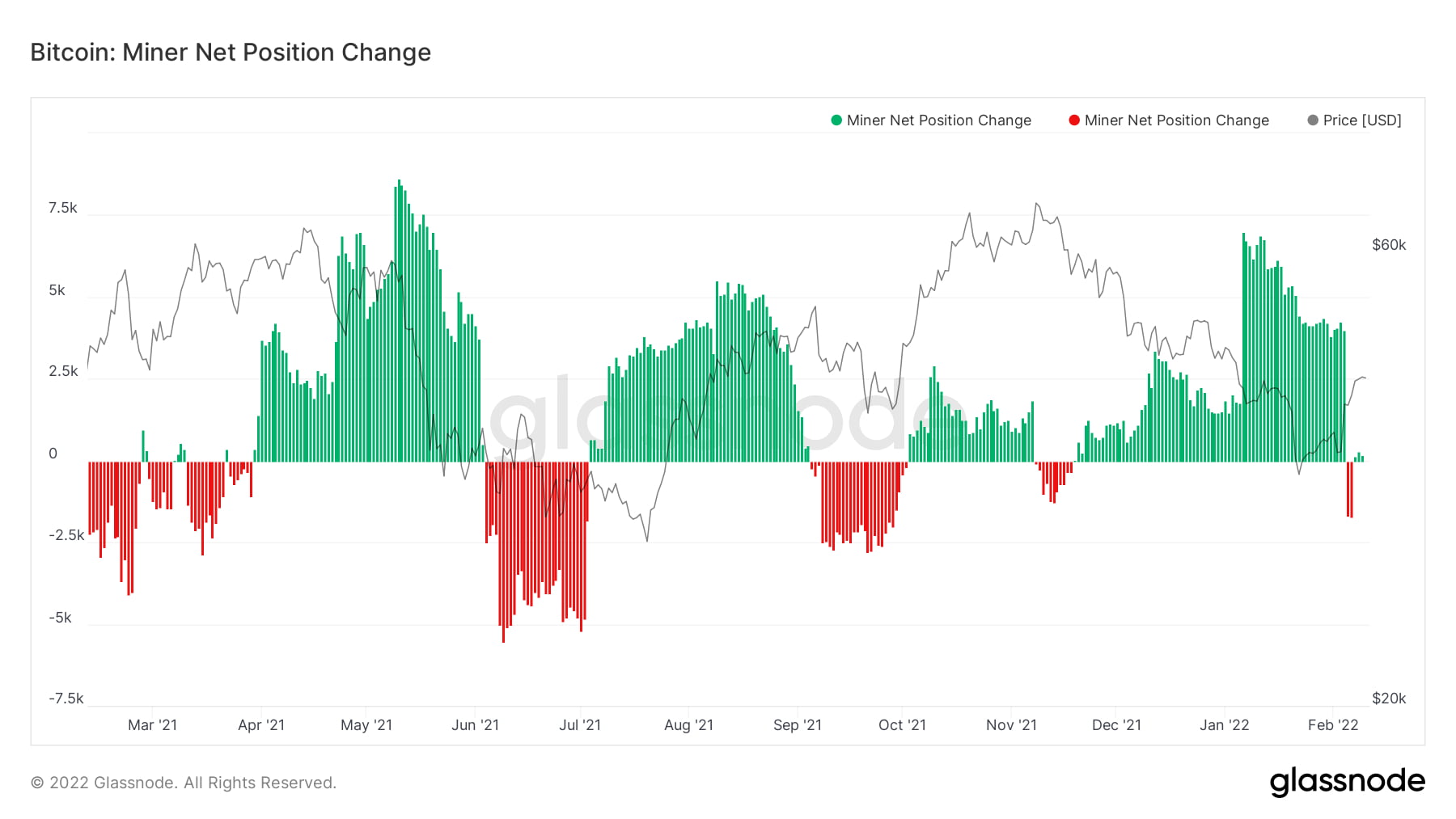

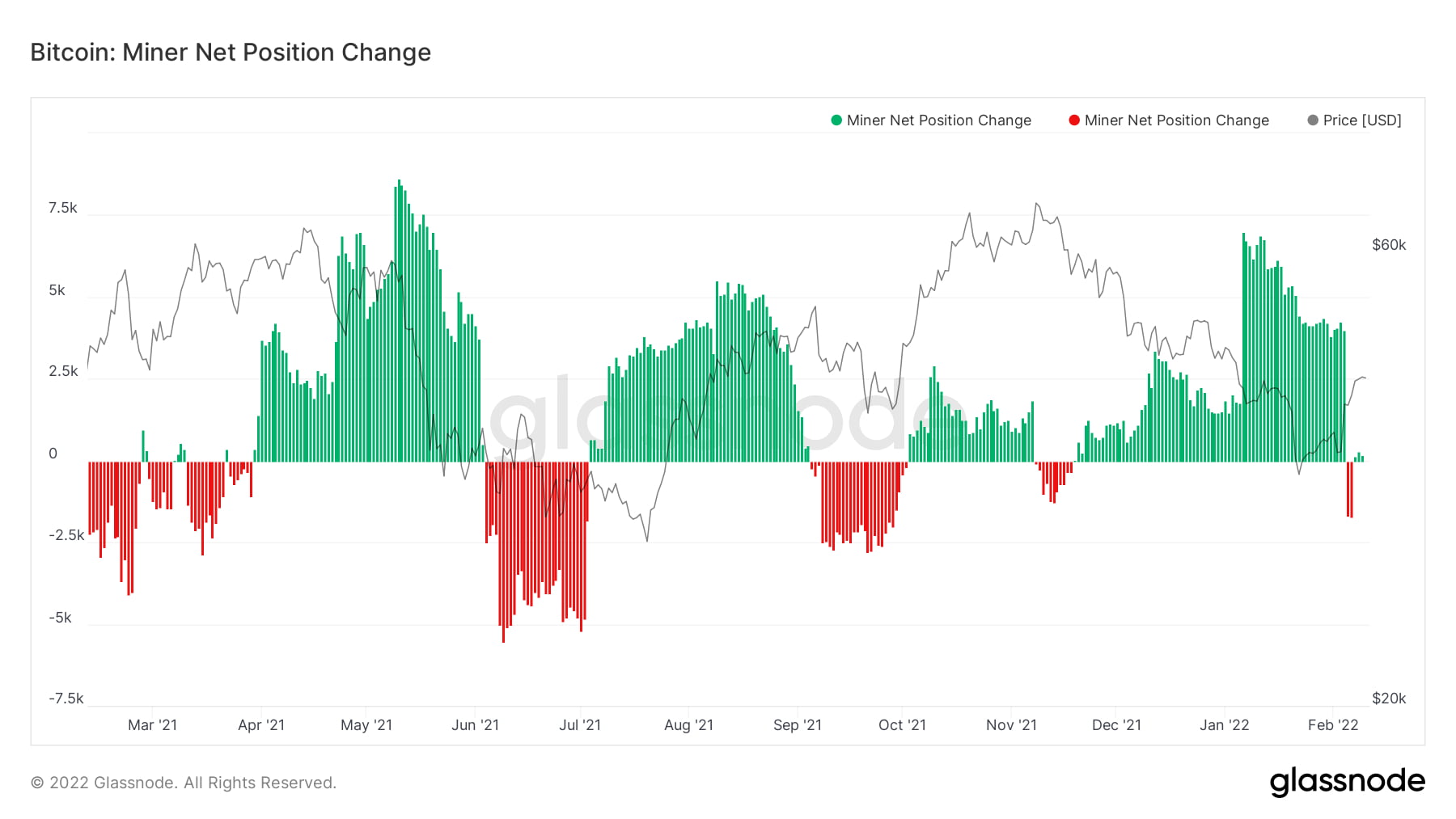

According to the newest information from Glassnode, Bitcoin miners switched to sellers soon after months of supporting bulls in their efforts to include a whole lot of BTC to their positions.

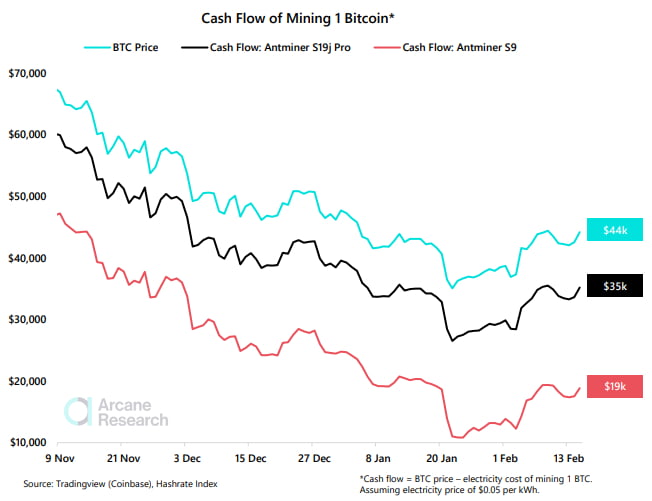

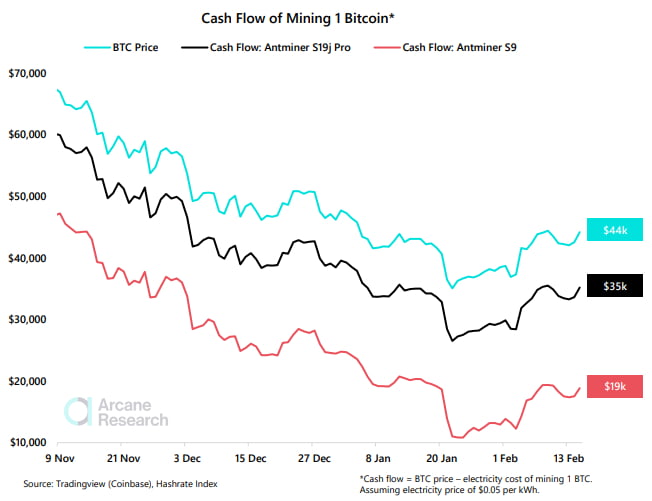

Additionally, mining income per one BTC have fallen by an common of 50.five% for the two common miners considering that November 9, in accordance to a report from blockchain study company Arcane Research, the most prevalent becoming S9 and S19. This usually means that the return on investment has declined at a a lot quicker price than BTC’s rate movements.

Much of the bring about can be attributed to the substantial improve in hashrate which contributed to the lessen in profitability throughout mining. As the stiff competitors amid miners increases in proportion to the hashrate, much more gadgets have to be activated to run in search of the up coming block. As Coinlive reported that Bitcoin’s hashrate continued to explode to all-time highs this week.

On the other hand, other substantial mining giants progressively appeared and chose to improve their liquidity by promoting stocks alternatively of BTC. On February eleven, a spokesperson for Marathon Digital Holdings Inc. (MARA), 1 of the industry’s primary organizations, confirmed with Bloomberg who commenced promoting a handful of their BTC in October 2020 and considering that then no satoshi have been “wasted” by Marathon in the market place.

Instead, Marathon filed with the Securities and Exchange Commission (SEC) to promote $ 750 million in stock in the organization, intending to use the income to buy hardware and common functions. However, an analyst at wealth management company DA Davidson commented that miners are incredibly reluctant to promote Bitcoin throughout this time period:

“Most big miners would prefer to sell stocks, because their shareholders want them to hold Bitcoin and don’t even think about selling it.”

Synthetic currency 68

Maybe you are interested:

Many Bitcoin miners are promoting off BTC from their accumulators and stocks soon after the income of the cryptocurrency mining market have plummeted considering that November.

With Bitcoin now hovering all-around $ 43,500, 33% beneath the all-time large of $ 69,000 BTC reached in November, miners have small curiosity in taking income for revenue and their income are approaching twenty%. However, electrical power and mining gear have to be paid for.

According to the newest information from Glassnode, Bitcoin miners switched to sellers soon after months of supporting bulls in their efforts to include a whole lot of BTC to their positions.

Additionally, mining income per one BTC have fallen by an common of 50.five% for the two common miners considering that November 9, in accordance to a report from blockchain study company Arcane Research, the most prevalent becoming S9 and S19. This usually means that the return on investment has declined at a a lot quicker price than BTC’s rate movements.

Much of the bring about can be attributed to the substantial improve in hashrate which contributed to the lessen in profitability throughout mining. As the stiff competitors amid miners increases in proportion to the hashrate, much more gadgets have to be activated to run in search of the up coming block. As Coinlive reported that Bitcoin’s hashrate continued to explode to all-time highs this week.

On the other hand, other substantial mining giants progressively appeared and chose to improve their liquidity by promoting stocks alternatively of BTC. On February eleven, a spokesperson for Marathon Digital Holdings Inc. (MARA), 1 of the industry’s primary organizations, confirmed with Bloomberg who commenced promoting a handful of their BTC in October 2020 and considering that then no satoshi have been “wasted” by Marathon in the market place.

Instead, Marathon filed with the Securities and Exchange Commission (SEC) to promote $ 750 million in stock in the organization, intending to use the income to buy hardware and common functions. However, an analyst at wealth management company DA Davidson commented that miners are incredibly reluctant to promote Bitcoin throughout this time period:

“Most big miners would prefer to sell stocks, because their shareholders want them to hold Bitcoin and don’t even think about selling it.”

Synthetic currency 68

Maybe you are interested: