This is a Bitcoin story in which lively miners reap the anticipated earnings although other folks stay wholly offline.

Data displays Bitcoin (BTC) miners’ income skyrocketed just after the network noticed its steepest decline in issues ever.

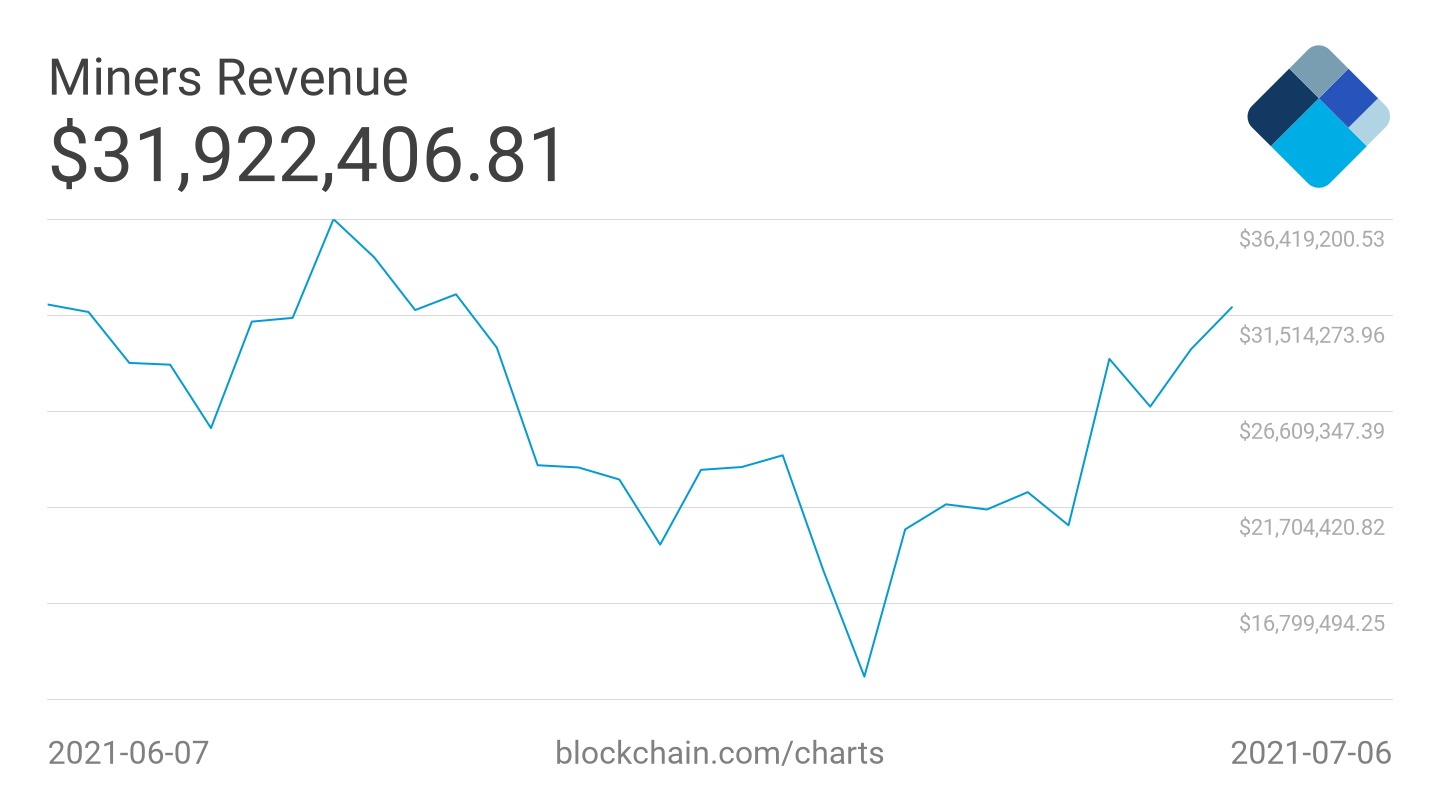

According to information from Blockchain Asset Tracking, every day income enhanced by extra than 50%.

“Interesting Momentum” had an influence on Bitcoin mining

Bitcoin mining is at present in a exclusive state of alter: about half of the hash energy is offline as miners depart China, and it is not however acknowledged how speedily they will be in a position to get back on the net.

At the similar time, miners unaffected by the Chinese system noticed half of their rivals disappear overnight and earnings enhanced as a consequence.

With information now out there for the previous couple of weeks, the extent of the adjustments is clear. Daily mining income was around $ twenty.seven million as of July two, the day just before the issues adjustment. The upcoming day, it hit $ 29.three million, and on Tuesday this week it was $ 31.9 million.

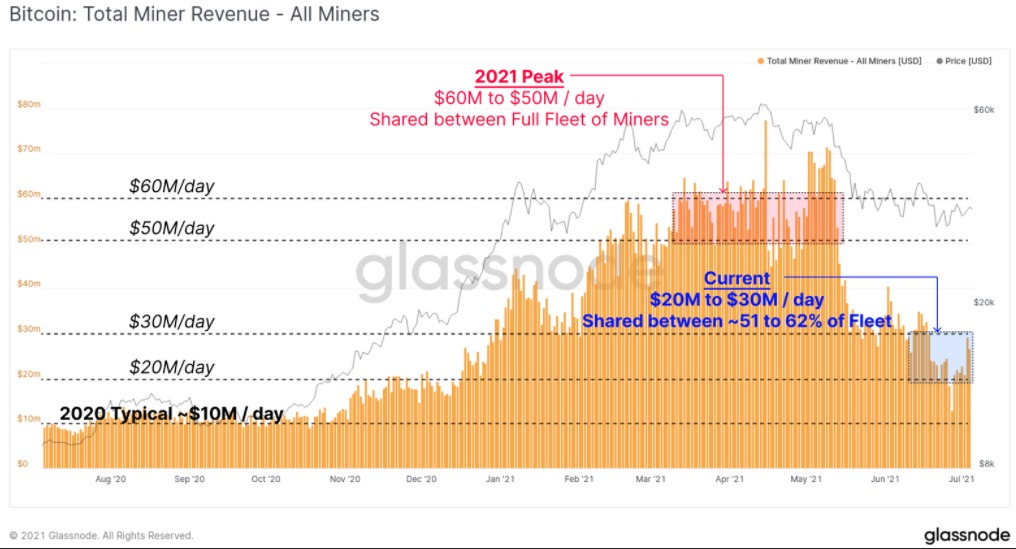

All of this is the consequence of a “very interesting” analytics firm, Glassnode summarized in a video tutorial for this week’s edition of the newsletter, “The Week On-chain”.

“We have a quite exciting dynamic in which about 50% of the hashing energy is at present offline and it consists of a enormous sum of overhead due to logistics and just not hashing, at present acquiring idle hardware and 50 The other% virtually have it. observed half explaining their competitors outdoors the network ”.

“Although the protocol is currently issuing the same amount of coins as usual, having difficulty solving the problem, we are currently in a situation where half of the network doubles its earnings and the other half of the network essentially produces nothing.”

For lively miners, profitability has returned to ranges close to the ranges observed when BTC / USD was trading at $ fifty five,000 – $ 60,000.

Block Times sets a record

The success had been felt not only by miners. Average block occasions reached all-time highs in the final week, Glassnode was only beaten all through Bitcoin’s “launch” phase in 2009-2010, even just before the cryptocurrency had a secure selling price in USD.

Other metrics on the chain also record the dichotomy concerning diverse mining pools.

These present, between other issues, how some are investing the crates due to the transfer expenses although not becoming in a position to mine new coins and get a reward and a blocking charge.

At the similar time, other folks have held extra BTC per block than they are investing, element of the uptrend that continues in spite of the drop in costs also reaching more than 50%.

“This is definitely one of those things to see.”

Synthetic currency 68

Maybe you are interested:

.