The cryptocurrency market place seems to have commenced to “reborn” immediately after far more than a yr in the red as all indicators concerning Bitcoin network action have grown impressively.

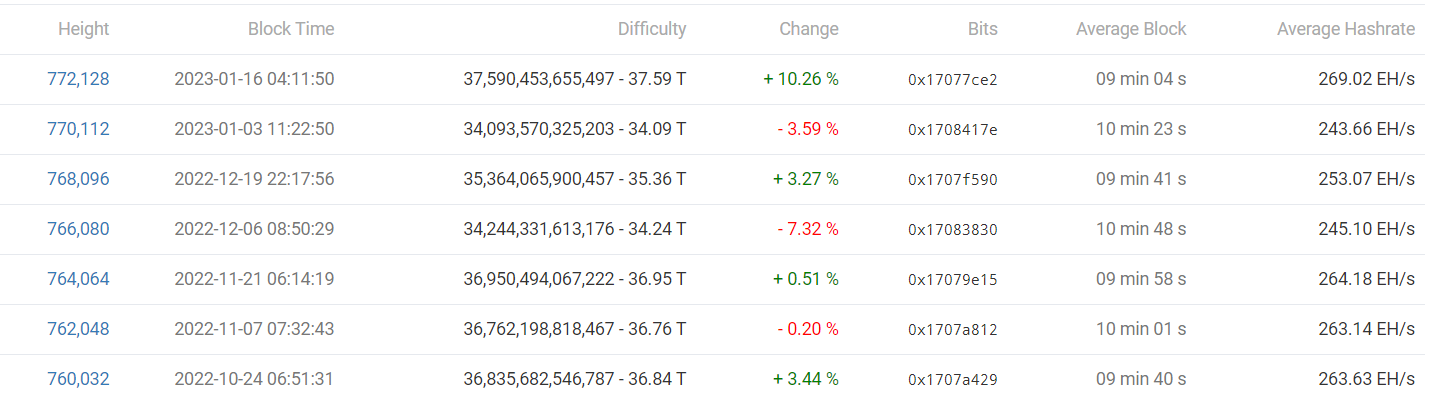

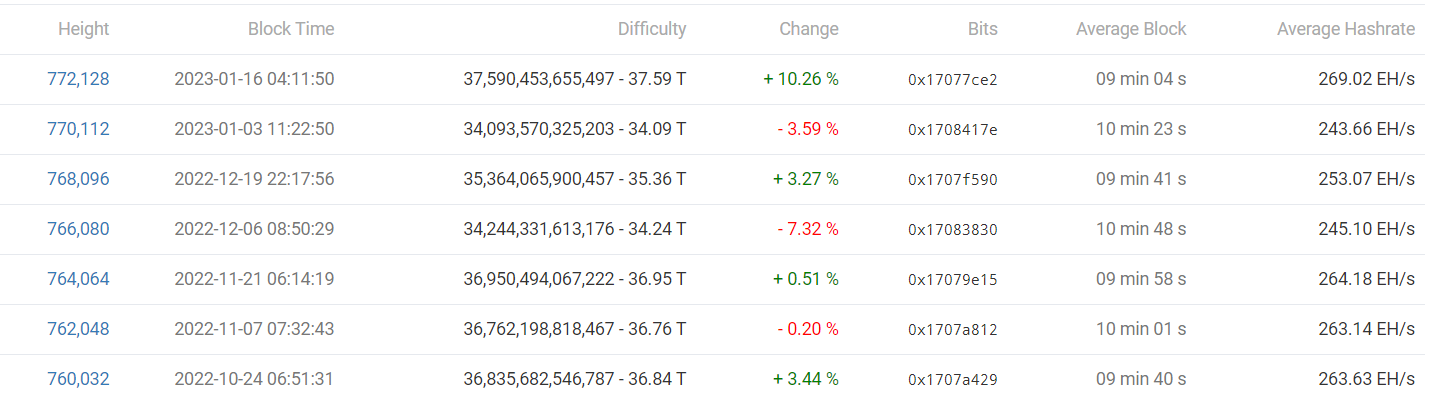

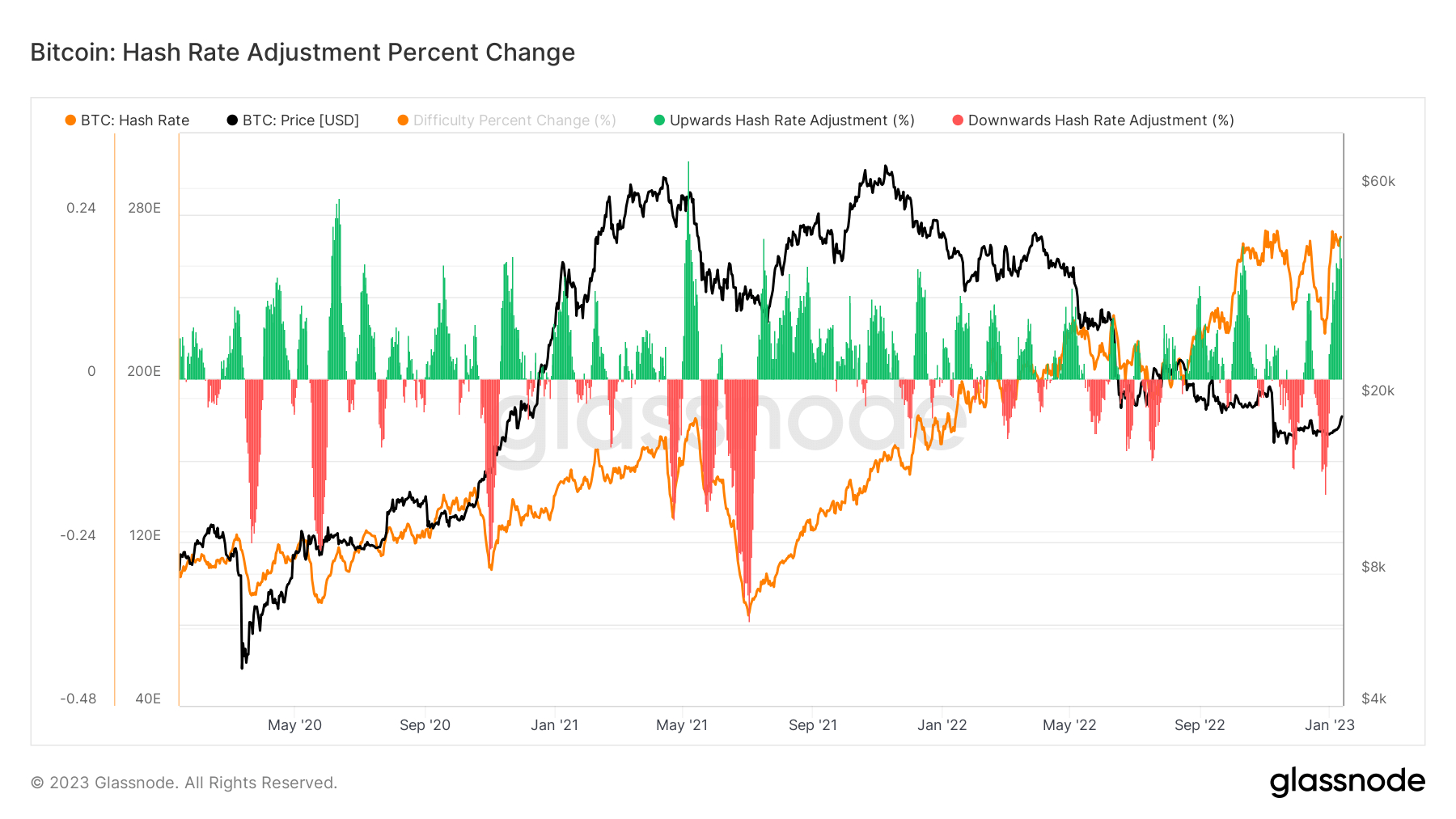

Bitcoin Mining Difficulty From Biggest Drop Since China’s 2021 BTC Mining Ban to Early December 2022 (About seven.32%), Then After Jumping To $21,200 By Week The Second Of 2023, The index rapidly recorded an spectacular ten.26% improve, covering all earlier damaging movements in Bitcoin network assets.

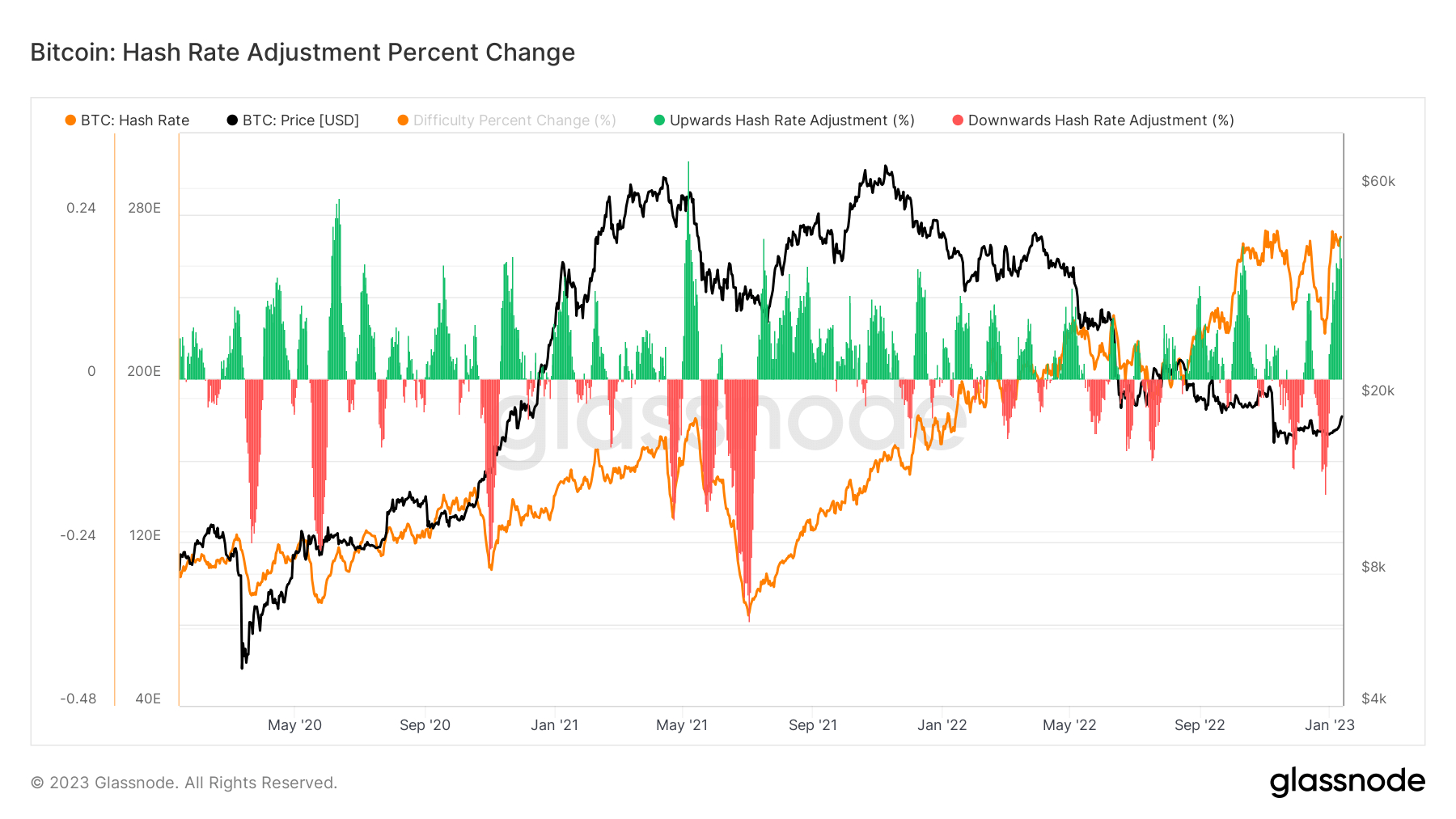

Not only that, Bitcoin’s hashrate also surged twenty% to hit a new all-time substantial on Jan. twelve, 2023, which is the 2nd time the hashrate surged to a new ATH in the previous week.

The spectacular acceleration in mining problems and hashrate – two “backbone” indicators for measuring efficiency close to the Bitcoin network – probably stems from the reality that investor self confidence was drastically restored afterward, when shares of mining businesses Bitcoin mining recovered strongly just then as the US stock market place (SP500 and Nasdaq) recorded a historic extended rally with five consecutive green sessions.

A comparable response follows for Bitcoin, which also noticed a joy-filled week, with no sizeable downside correction, which seems to have hardly ever occurred through the 2022 “crypto winter”.

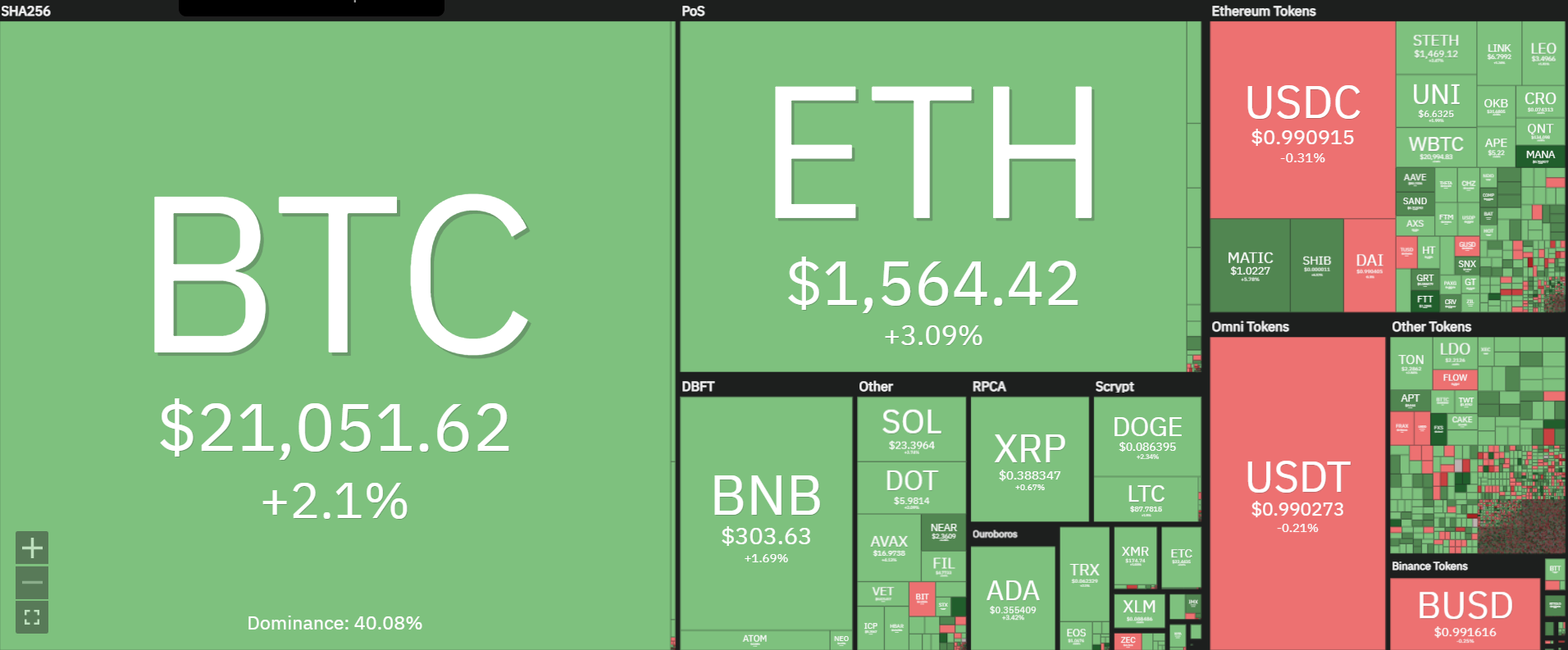

At the time of creating, BTC continues to sustain robust upside momentum, hitting a 24-hour substantial at $21,439 and trading close to $21,216.

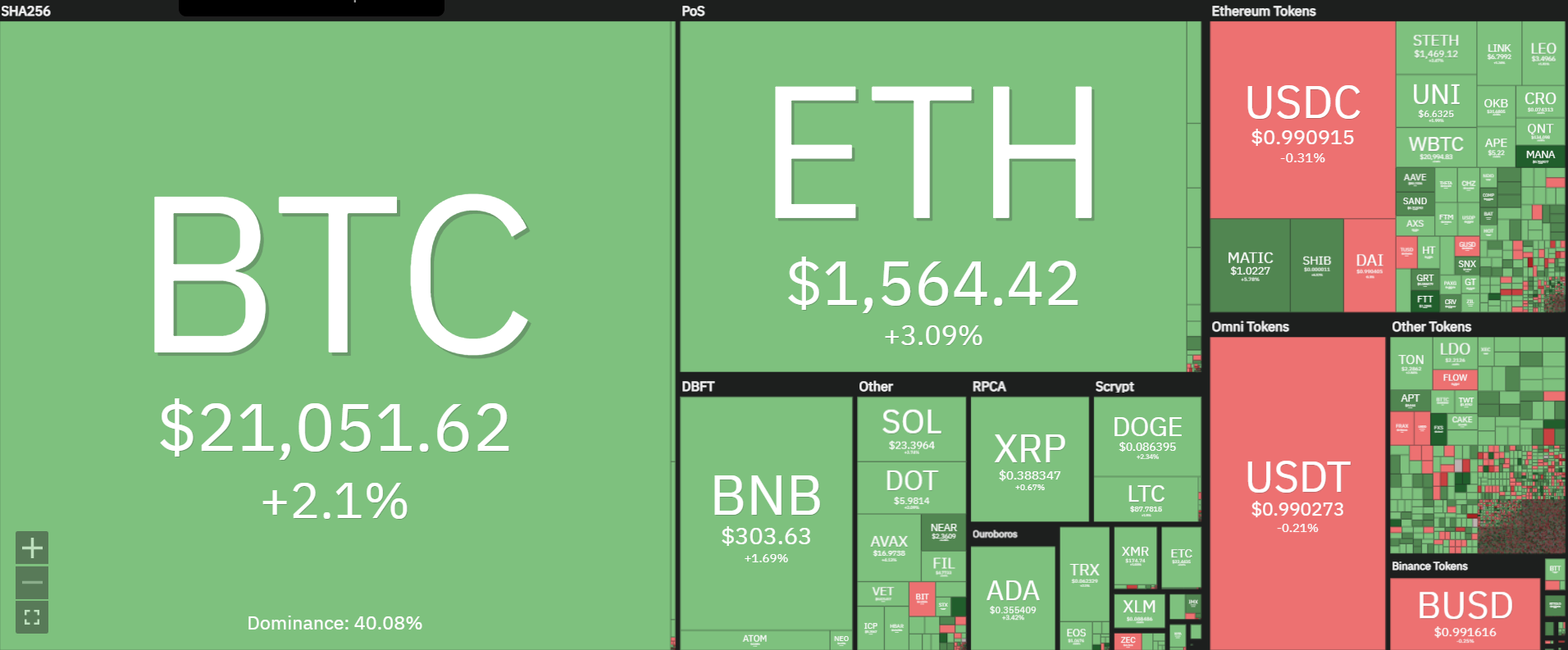

Furthermore, the traction of the “leader” Bitcoin has assisted the total market place cap attain the $one trillion mark immediately after a three-month hiatus due to the fact the FTX crisis of November 2022.

All other altcoins have posted spectacular gains more than the previous week, bouncing off the lows set in June 2022, the time when BTC initial plunged to $17,500 amid the LUNA/UST crash, as Ethereum traded over 1550 USD or BNB over 300 USD .

Synthetic currency68

Maybe you are interested:

The cryptocurrency market place seems to have commenced to “reborn” immediately after far more than a yr in the red as all indicators concerning Bitcoin network action have grown impressively.

Bitcoin Mining Difficulty From Biggest Drop Since China’s 2021 BTC Mining Ban to Early December 2022 (About seven.32%), Then After Jumping To $21,200 By Week The Second Of 2023, The index rapidly recorded an spectacular ten.26% improve, covering all earlier damaging movements in Bitcoin network assets.

Not only that, Bitcoin’s hashrate also surged twenty% to hit a new all-time substantial on Jan. twelve, 2023, which is the 2nd time the hashrate surged to a new ATH in the previous week.

The spectacular acceleration in mining problems and hashrate – two “backbone” indicators for measuring efficiency close to the Bitcoin network – probably stems from the reality that investor self confidence was drastically restored afterward, when shares of mining businesses Bitcoin mining recovered strongly just then as the US stock market place (SP500 and Nasdaq) recorded a historic extended rally with five consecutive green sessions.

A comparable response follows for Bitcoin, which also noticed a joy-filled week, with no sizeable downside correction, which seems to have hardly ever occurred through the 2022 “crypto winter”.

At the time of creating, BTC continues to sustain robust upside momentum, hitting a 24-hour substantial at $21,439 and trading close to $21,216.

Furthermore, the traction of the “leader” Bitcoin has assisted the total market place cap attain the $one trillion mark immediately after a three-month hiatus due to the fact the FTX crisis of November 2022.

All other altcoins have posted spectacular gains more than the previous week, bouncing off the lows set in June 2022, the time when BTC initial plunged to $17,500 amid the LUNA/UST crash, as Ethereum traded over 1550 USD or BNB over 300 USD .

Synthetic currency68

Maybe you are interested: