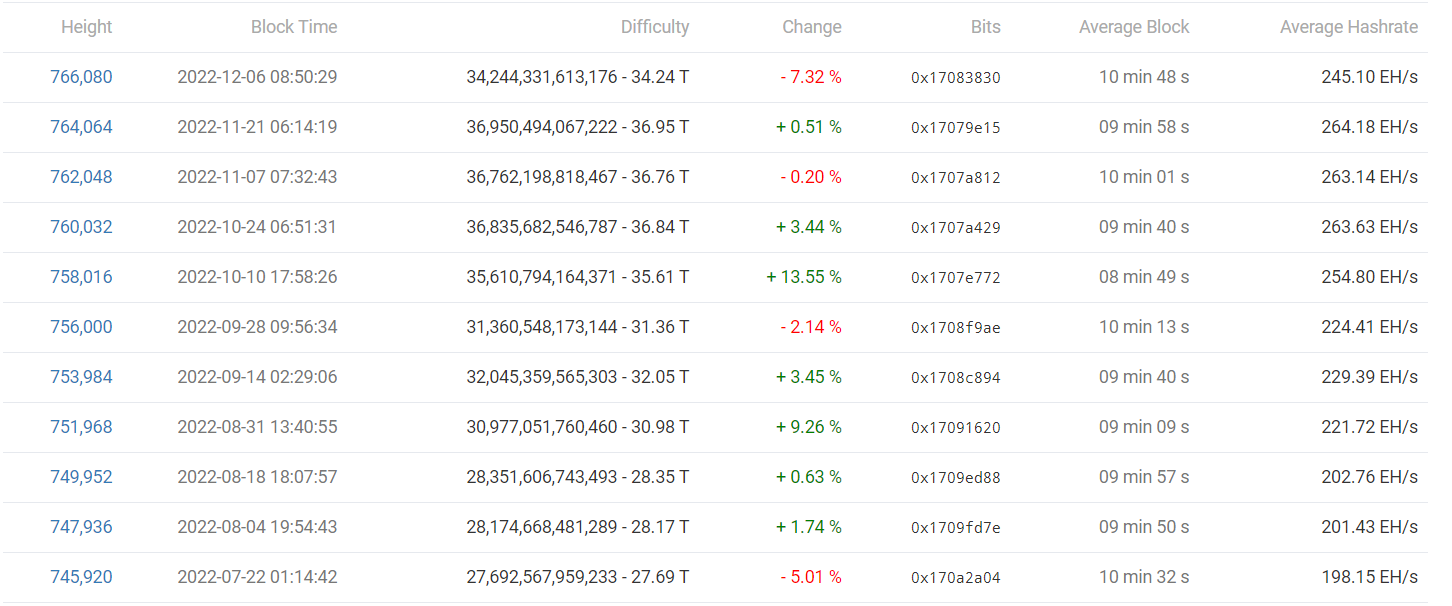

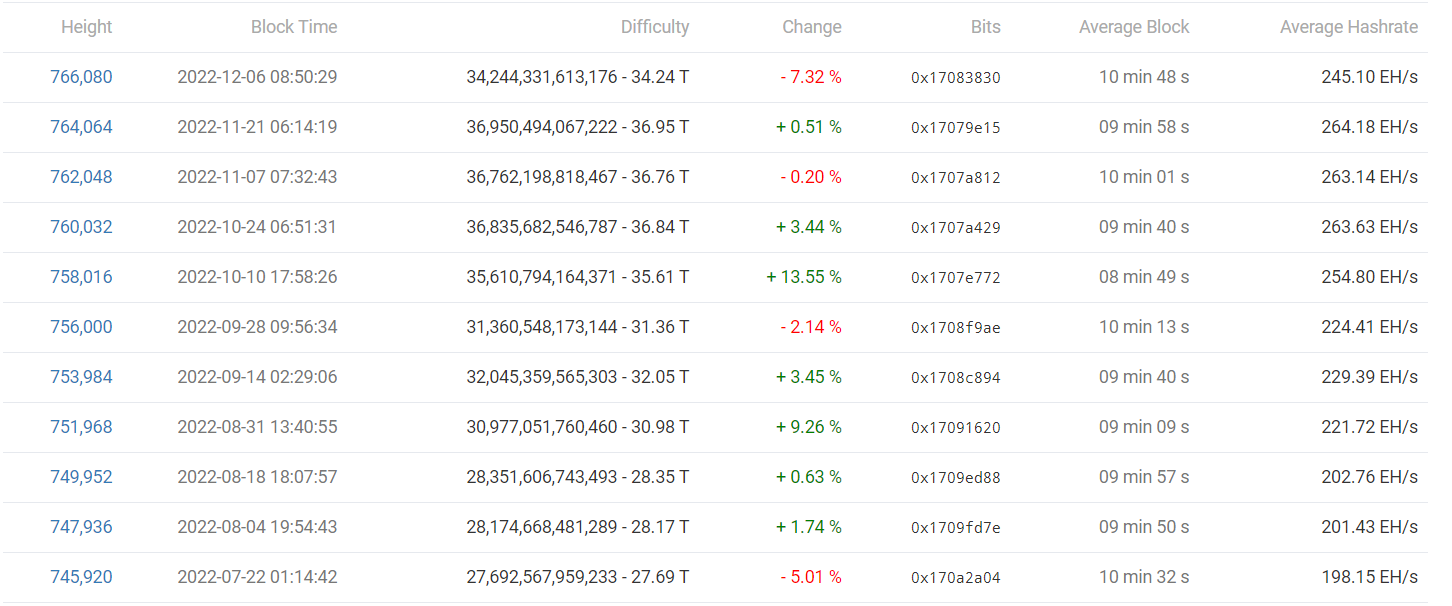

Bitcoin mining problems decreased by seven.32% on Dec. six, with BTC miners shut down as the brutal bear market place displays no indications of stopping.

According to information from BTC.com, Bitcoin’s mining problems adjustment at block 766,080 fell seven.32%, marking the greatest downward modify considering the fact that July 2021. This was the second when a series of miners they have been forced to suspend operations and depart the network following China’s widespread ban on the field, so China was the biggest Bitcoin mining center in the planet.

Bitcoin mining problems is immediately adjusted primarily based on the volume of computing electrical power on the network, or hashrate, to continue to keep the time it will take to mine a block approximately secure at ten minutes. The increased the hashrate, the increased the problems and vice versa. This signifies that the a lot more energetic miners, the increased the problems.

The motive the mining problems rating has dropped so radically is simply because Bitcoin miners have been caught among a minimal selling price of Bitcoin that cuts into their revenue and a large selling price of electrical energy that drives up prices in current months. Data recorded at the finish of November 2022 displays that Bitcoin mining income has bottomed out more than the previous two many years.

Market-top BTC producers this kind of as Core Scientific, Argo Blockchain or Iris Energy are dealing with liquidity shortages, though Compute North has officially filed for Chapter eleven bankruptcy.

The actuality of the cryptocurrency winter looks to have caught up with the Bitcoin mining field and miners in a hurry are shutting down their miners. The proof is that not only did the mining problems reduce, but the BTC hashrate also began to decline all around mid-November 2022, when earnings took a hit. Even so, the hashrate is even now a lot increased than what has been noticed considering the fact that China’s crackdown on the field.

The truth is that due to the soaring selling price of Bitcoin in 2021, numerous miners are previously super worthwhile, so they try out to boost their on the net mining capability as swiftly as probable by investing a lot more capital in the products. .

Typically, giant Marathon Digital has “bought” 78,000 Bitcoin miners for 2022, well worth practically $900 million. The pull of the mining field is even a lot more exaggerated by the move from “big” Intel to launching Bitcoin mining chips.

However, when anyone was on the lookout forward and setting expectations for a prosperous 2022, a series of sudden big-scale disruptions came from the collapse of LUNA/UST, stETH – Alameda – Celsius “ripple effect” prospects to crisis Liquidity Crisis of Celsius – Three Arrows Capital (3AC) and FTX go bankrupt. This left the mining businesses unable to battle back and they had to discover a way to divest their capital to offset their losses.

Synthetic currency68

Maybe you are interested:

Bitcoin mining problems decreased by seven.32% on Dec. six, with BTC miners shut down as the brutal bear market place displays no indications of stopping.

According to information from BTC.com, Bitcoin’s mining problems adjustment at block 766,080 fell seven.32%, marking the greatest downward modify considering the fact that July 2021. This was the second when a series of miners they have been forced to suspend operations and depart the network following China’s widespread ban on the field, so China was the biggest Bitcoin mining center in the planet.

Bitcoin mining problems is immediately adjusted primarily based on the volume of computing electrical power on the network, or hashrate, to continue to keep the time it will take to mine a block approximately secure at ten minutes. The increased the hashrate, the increased the problems and vice versa. This signifies that the a lot more energetic miners, the increased the problems.

The motive the mining problems rating has dropped so radically is simply because Bitcoin miners have been caught among a minimal selling price of Bitcoin that cuts into their revenue and a large selling price of electrical energy that drives up prices in current months. Data recorded at the finish of November 2022 displays that Bitcoin mining income has bottomed out more than the previous two many years.

Market-top BTC producers this kind of as Core Scientific, Argo Blockchain or Iris Energy are dealing with liquidity shortages, though Compute North has officially filed for Chapter eleven bankruptcy.

The actuality of the cryptocurrency winter looks to have caught up with the Bitcoin mining field and miners in a hurry are shutting down their miners. The proof is that not only did the mining problems reduce, but the BTC hashrate also began to decline all around mid-November 2022, when earnings took a hit. Even so, the hashrate is even now a lot increased than what has been noticed considering the fact that China’s crackdown on the field.

The truth is that due to the soaring selling price of Bitcoin in 2021, numerous miners are previously super worthwhile, so they try out to boost their on the net mining capability as swiftly as probable by investing a lot more capital in the products. .

Typically, giant Marathon Digital has “bought” 78,000 Bitcoin miners for 2022, well worth practically $900 million. The pull of the mining field is even a lot more exaggerated by the move from “big” Intel to launching Bitcoin mining chips.

However, when anyone was on the lookout forward and setting expectations for a prosperous 2022, a series of sudden big-scale disruptions came from the collapse of LUNA/UST, stETH – Alameda – Celsius “ripple effect” prospects to crisis Liquidity Crisis of Celsius – Three Arrows Capital (3AC) and FTX go bankrupt. This left the mining businesses unable to battle back and they had to discover a way to divest their capital to offset their losses.

Synthetic currency68

Maybe you are interested: