Marathon Digital Holdings’ most current fiscal report exhibits third-quarter 2023 income of $97.eight million, far exceeding the identical-time period 2022 income of $twelve.seven million.

Bitcoin mining giant Marathon Digital’s income surged 670% as BTC hit new peak in 2023

Bitcoin mining giant Marathon Digital’s income surged 670% as BTC hit new peak in 2023

On the morning of November 9, 2023, Marathon Digital Holdings, the market’s top Bitcoin mining enterprise, announced Latest financial reports and represents a 670% maximize in income in the third quarter of 2023 in contrast to the identical time period final yr.

The Bitcoin mining giant’s income was $97.eight million in the quarter, seven occasions larger than the $twelve.seven million figure recorded in the third quarter of 2022. The enterprise also reported net earnings of $64.one million in contrast to a net reduction of $72.five million in the identical time period final yr.

Marathon’s third quarter earnings release is right here:

– Revenues of $97.eight million, thanks to an maximize of 467%. #Bitcoin manufacturing and larger BTC rates.

– Adjusted EBITDA enhanced to $43.seven million.

– eight% maximize in hash charge expanding with hydroelectric ventures in Paraguay.

– Long-phrase debt diminished by 56%,…— Marathon Digital Holdings (NASDAQ: MARA) (@MarathonDH) November 8, 2023

The enterprise explained the enhanced fiscal benefits have been due to a 467% maximize in Bitcoin (BTC) mining manufacturing from six.seven BTC mined per day to 37.9 BTC/day. At the identical time, a further cause is that the typical value of BTC in the third quarter of 2023 is also 32% larger than the identical time period final yr. At the time of creating, BTC has skyrocketed to over USD 36,000, setting a new substantial in 2023.

Similar, Marathon Digital Holdings also took note hash charge (denoted by EH/s – the amount of Exahash per 2nd refers to the volume of vitality a miner contributes to defending the Bitcoin network) enhanced by 403% in contrast to the identical time period final yr from three.eight EH/s to 19.one EH/s. The hashrate maximize is partly due to the new 27-megawatt hydroelectric joint venture in Paraguay announced by the enterprise on November seven, 2023.

Empower on your own in Paraguay! We carry on our worldwide growth with 27 MW #Bitcoin mining undertaking powered by a hundred% hydrogen vitality. Read the complete press release: https://t.co/mMQIuc6S7Z pic.twitter.com/KXa5kqfqlI

— Marathon Digital Holdings (NASDAQ: MARA) (@MarathonDH) November 7, 2023

Marathon CEO and President Fred Thiel explained:

“Significant progress in our enterprise tactic for the third quarter of 2023 has aided strengthen our company’s stability sheet ahead of the Bitcoin Halving occasion scheduled for April 2024…Not only that, the $417 million bond swap finished in September 2023 also aided lessen Marathon’s extended-phrase debt by 56%, though attaining a complete financial savings of $101 million for winter shareholders.” .

Reported by Marathon Digital it also exhibits that the company’s hashrate is at 23.one EH/s and in the close to long term the enterprise ideas to move to 26 EH/s with the aim of rising the hashrate by thirty% by 2024.

This is certainly a beneficial indicator for the Bitcoin mining sector in basic. Because in 2022, when the market place is in “downtrend”, a lot of Bitcoin mining providers are dealing with a major liquidity crisis following working for a lot of months with lower revenue margins and Mining revenues have hit rock bottom.

Even Marathon Digital itself had to “drag” Bitcoin by the “cryptocurrency winter”, and the Hardin mining facility in Montana – which accounts for 75% of Marathon’s mining capability – was forced to shut following a serious storm in mid-2022.

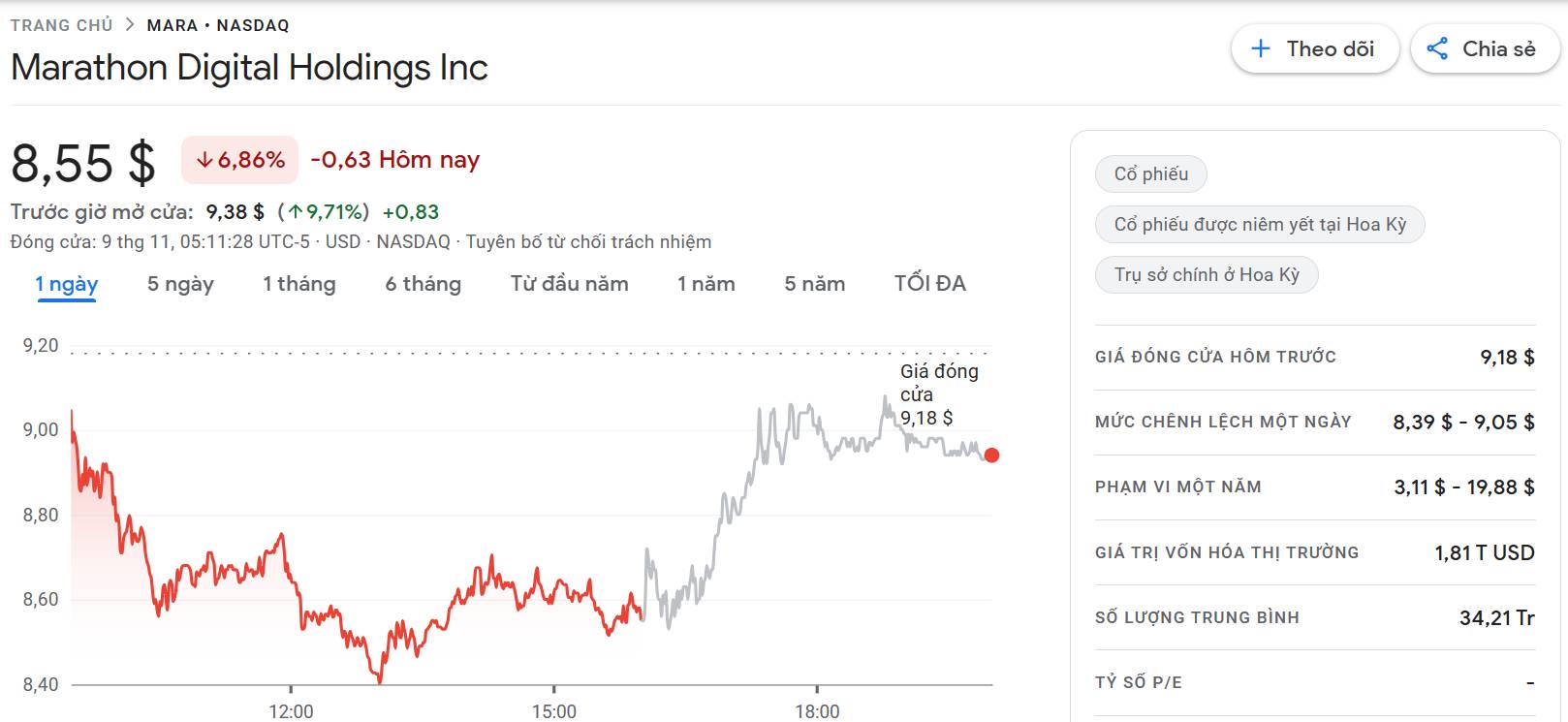

Marathon Digital Holdings’ MARA share value fell six.9% to $eight.fifty five on Nov. eight, 2023, but rose four.three% in following-hrs trading following the enterprise launched its fiscal report.

Bitcoin mining giant Marathon Digital Holdings’ MARA share value traded over $9, up far more than four% following the most current fiscal report. Photo: Google Finance

Bitcoin mining giant Marathon Digital Holdings’ MARA share value traded over $9, up far more than four% following the most current fiscal report. Photo: Google Finance

Coinlive compiled

Join the discussion on the hottest problems in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!