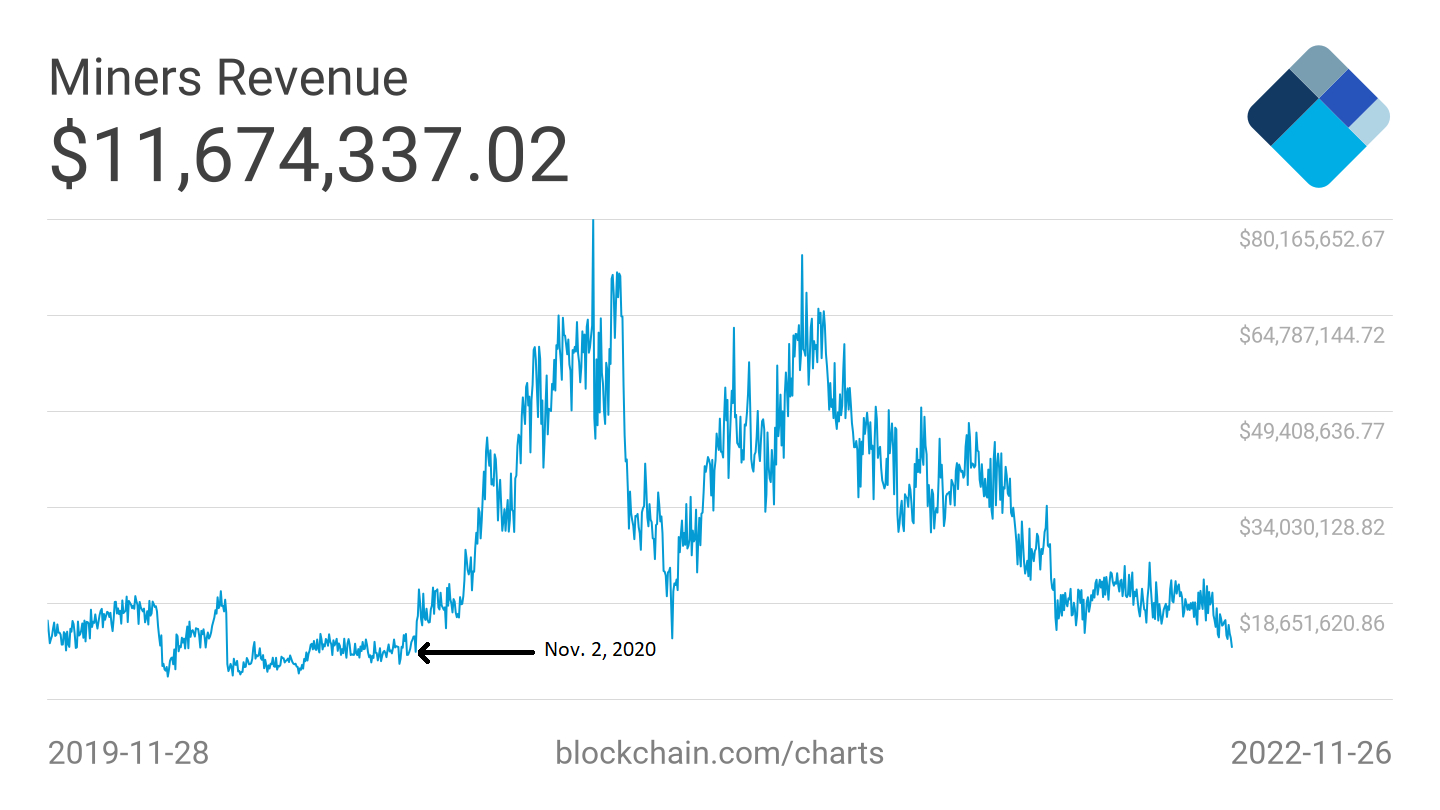

Total Bitcoin mining income, which include block rewards and transaction charges, has plummeted for the duration of the “cryptocurrency winter” which is nevertheless creating a whole lot of hardship for traders.

Revenue earned in Bitcoin (BTC) fell to a two-yr very low due to bad industry efficiency and larger computational demand as the mining trouble of the BTC network enhanced. However, the continued decline in Bitcoin hashrate more than the previous month has permitted miners to recover relatively from this reduction.

Total Bitcoin mining income dropped to $eleven.67 million as of November 28, 2022. This variety was final recorded on November two, 2020, when the transaction cost of Bitcoin was only all over USD 13,500.

However, the present industry cost of BTC is fluctuating somewhat additional at the second, at all over $sixteen,200, indicating that mining revenues are in dire straits, aspects which include enhanced mining trouble and growing power rates contribute to a significant reduction in cash flow.

The trouble of mining a block of Bitcoin has skyrocketed to an all-time large of virtually 37 trillion, forcing Bitcoin miners to expend additional power and computing energy to remain aggressive with the competitors.

However, more than the previous 3 months, the hashrate of the Bitcoin network has been on a regular decline. The hashrate is 225.9 exahash per 2nd (EH/s), down 28.six% from the all-time large of 316.seven EH/s on October 31, 2022. The hashrate is a safety figure that assists defend the Bitcoin network from double-commit attacks.

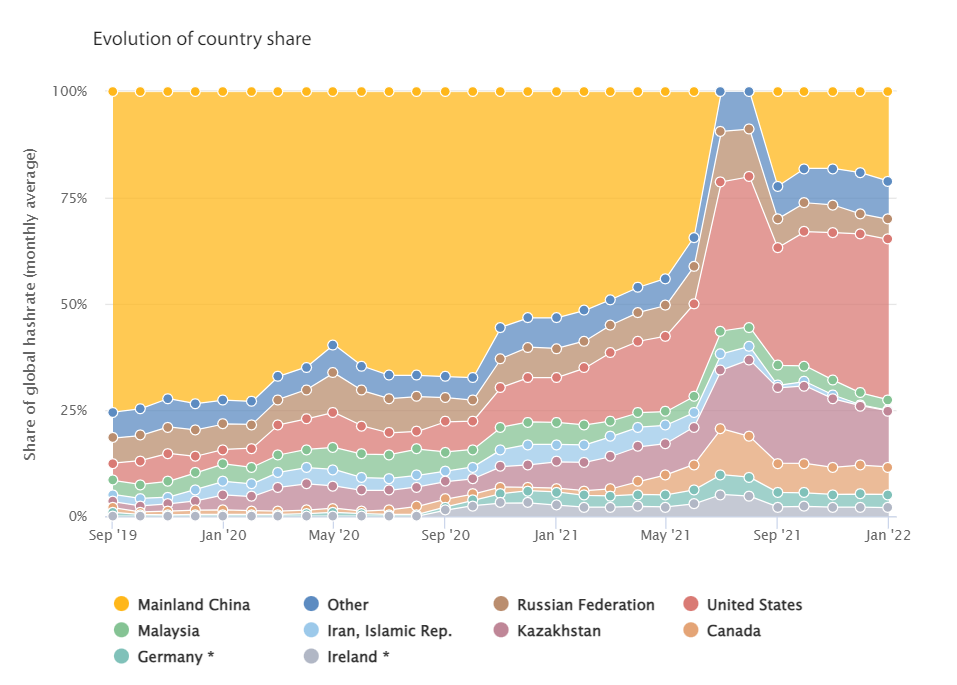

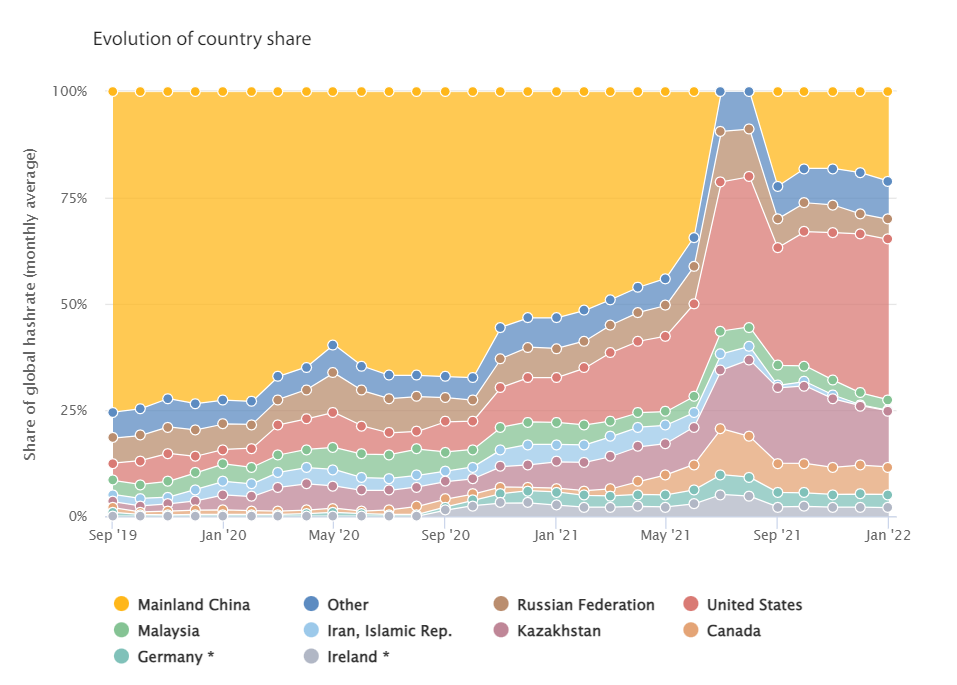

Indeed, given that China banned all cryptocurrency trading and mining in September 2021, the United States has turn into the greatest contributor to the worldwide Bitcoin hashrate. However, Chinese miners seem to have tacitly returned to this track. The United States at this time accounts for 37.84% of the worldwide hashrate, followed by China with 21.eleven% and Kazakhstan with 13.22%.

Overall, the large grid trouble and growing electrical power prices all over the planet, coupled with the declining cost of BTC, are placing a whole lot of stress on Bitcoin miners. Most miners have gone into “hibernation” as revenue margins are at this time bottoming out. Not stopping there, there have been numerous miners who have offered their assets massively to partially compensate for the reduction.

Synthetic currency68

Maybe you are interested:

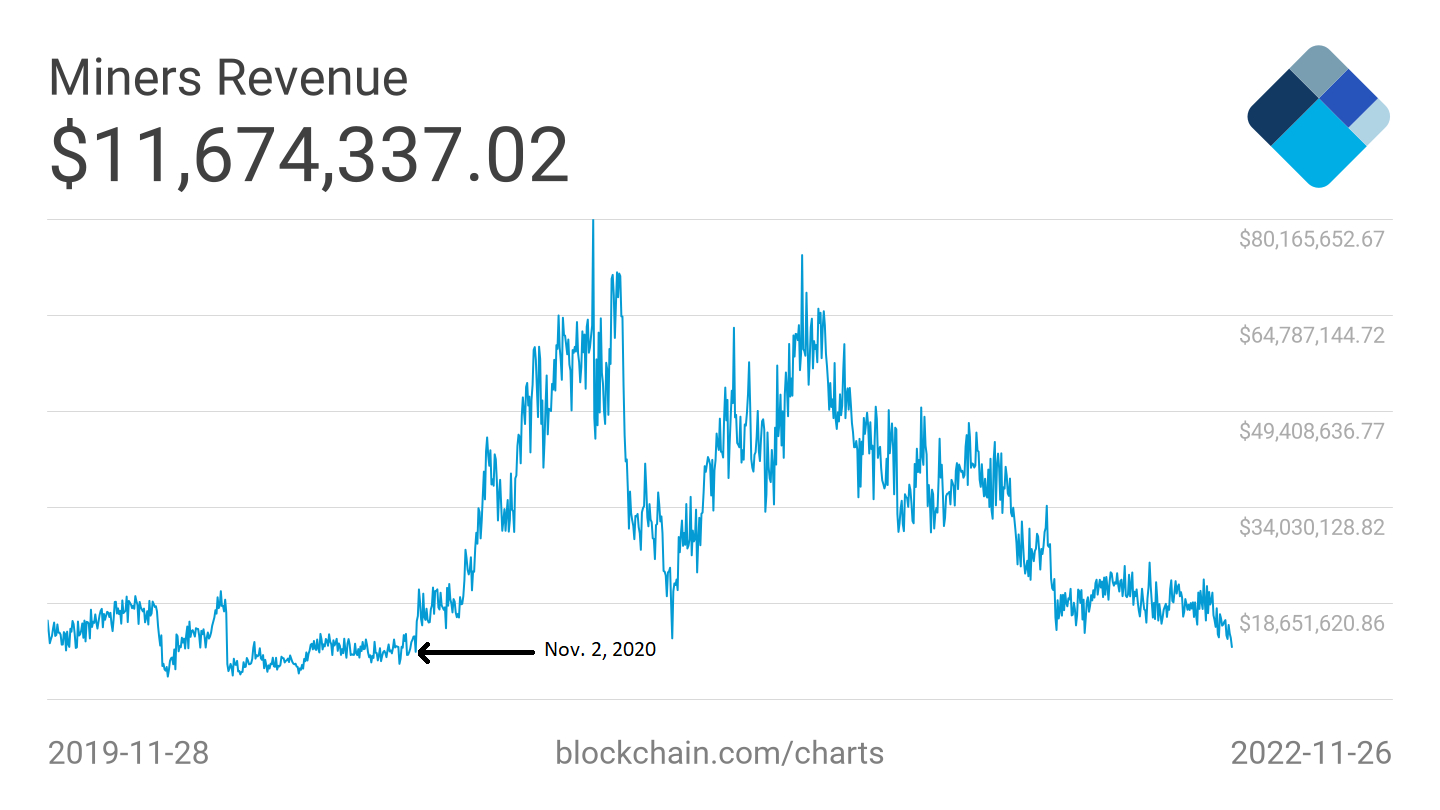

Total Bitcoin mining income, which include block rewards and transaction charges, has plummeted for the duration of the “cryptocurrency winter” which is nevertheless creating a whole lot of hardship for traders.

Revenue earned in Bitcoin (BTC) fell to a two-yr very low due to bad industry efficiency and larger computational demand as the mining trouble of the BTC network enhanced. However, the continued decline in Bitcoin hashrate more than the previous month has permitted miners to recover relatively from this reduction.

Total Bitcoin mining income dropped to $eleven.67 million as of November 28, 2022. This variety was final recorded on November two, 2020, when the transaction cost of Bitcoin was only all over USD 13,500.

However, the present industry cost of BTC is fluctuating somewhat additional at the second, at all over $sixteen,200, indicating that mining revenues are in dire straits, aspects which include enhanced mining trouble and growing power rates contribute to a significant reduction in cash flow.

The trouble of mining a block of Bitcoin has skyrocketed to an all-time large of virtually 37 trillion, forcing Bitcoin miners to expend additional power and computing energy to remain aggressive with the competitors.

However, more than the previous 3 months, the hashrate of the Bitcoin network has been on a regular decline. The hashrate is 225.9 exahash per 2nd (EH/s), down 28.six% from the all-time large of 316.seven EH/s on October 31, 2022. The hashrate is a safety figure that assists defend the Bitcoin network from double-commit attacks.

Indeed, given that China banned all cryptocurrency trading and mining in September 2021, the United States has turn into the greatest contributor to the worldwide Bitcoin hashrate. However, Chinese miners seem to have tacitly returned to this track. The United States at this time accounts for 37.84% of the worldwide hashrate, followed by China with 21.eleven% and Kazakhstan with 13.22%.

Overall, the large grid trouble and growing electrical power prices all over the planet, coupled with the declining cost of BTC, are placing a whole lot of stress on Bitcoin miners. Most miners have gone into “hibernation” as revenue margins are at this time bottoming out. Not stopping there, there have been numerous miners who have offered their assets massively to partially compensate for the reduction.

Synthetic currency68

Maybe you are interested: