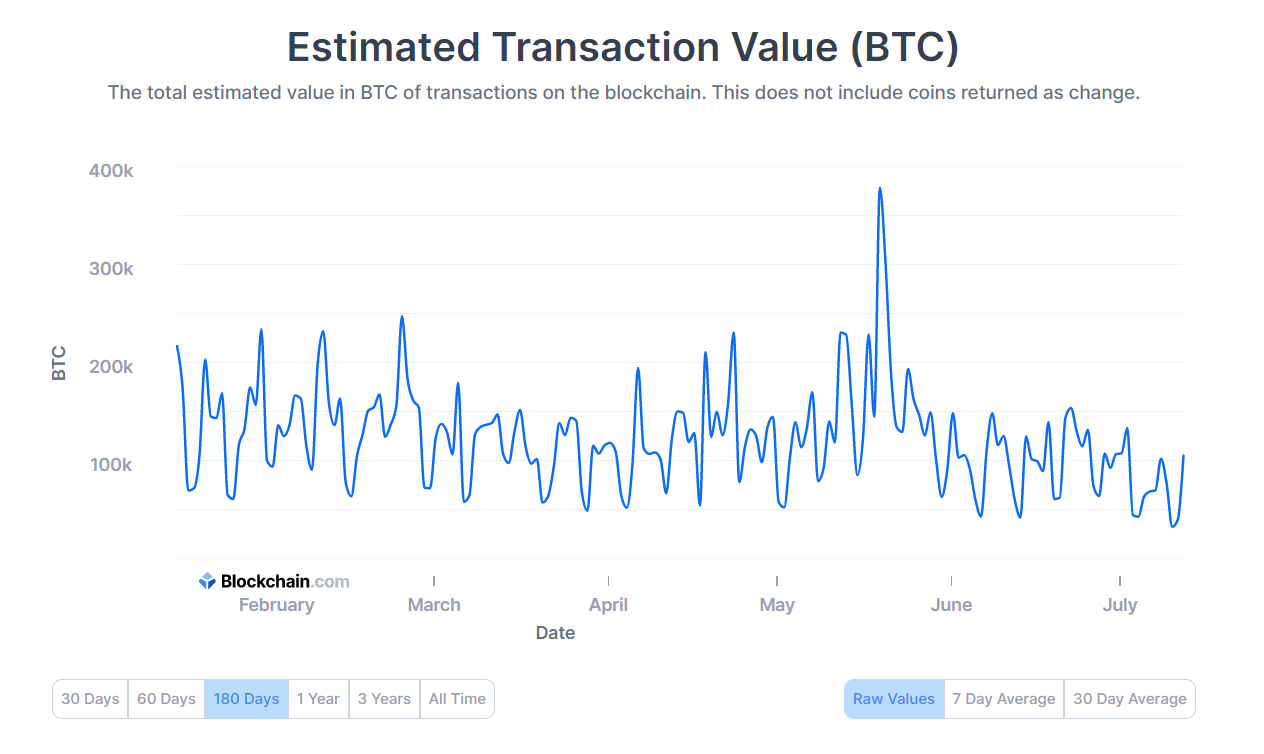

With Bitcoin’s price tag correction in current months, network utilization has also dropped appreciably. The estimated worth of day-to-day USD transactions on the blockchain, the amount of transactions, on-chain action, and miner’s income all declined from their respective peaks earlier this 12 months.

According to information from Blockchain.com, confirmed day-to-day transactions on the world’s greatest blockchain have viewed a substantial drop considering that the starting of the 12 months. After peaking in January at in excess of 400,000 and yet another boom in mid-April at in excess of 350,000, transactions dipped beneath 200,000 at the finish of June.

This grew to become the lowest level on the index in additional than 3 many years. The amount of transactions has elevated somewhat considering that then, but is even now far from the peak.

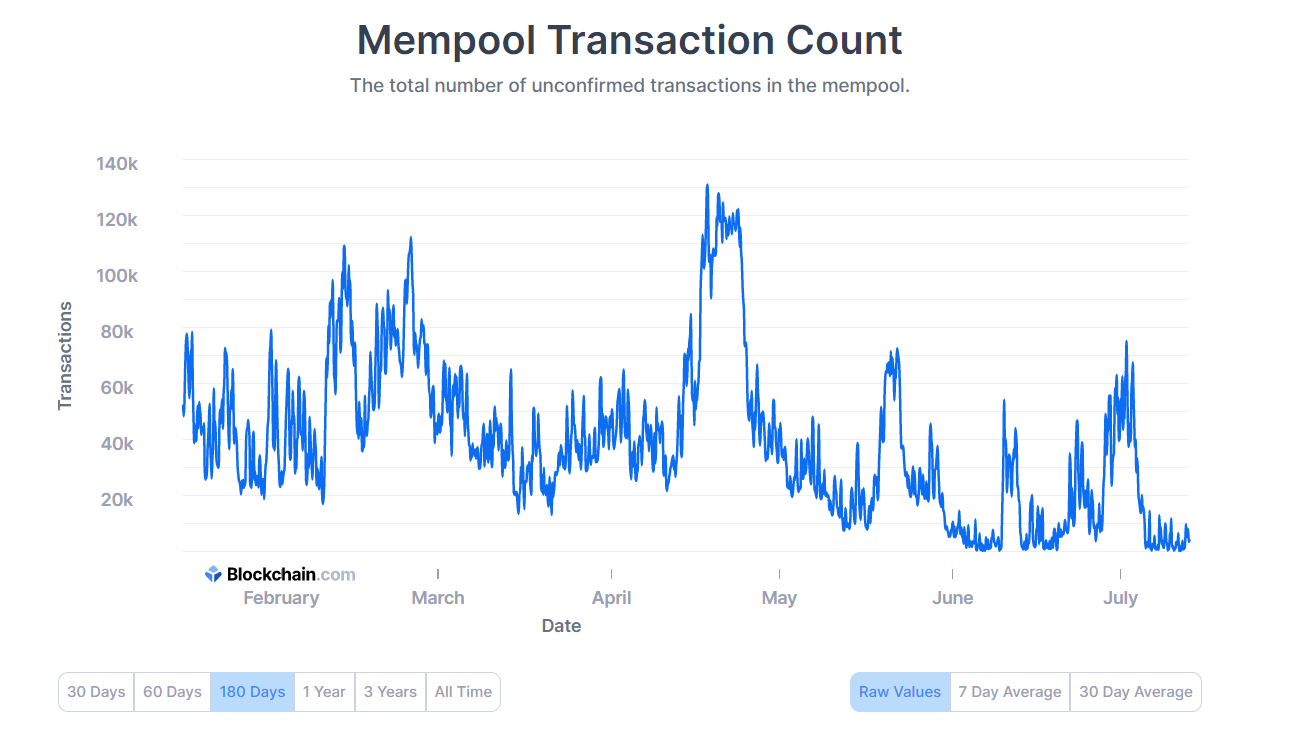

Likewise, mempool’s transaction count – the complete amount of unconfirmed transactions on the network – was shut to zero immediately after exploding to about 140,000 in April.

The estimated trading worth in USD hit a six-month minimal at about $ one billion. This information totaled practically $ 15 billion in mid-April, when the price tag of Bitcoin peaked at $ 65,000.

Probably the purpose behind the BTC price tag correction is the current Chinese attacks aimed immediately at miners. This appreciably impacted the Bitcoin blockchain as the hashrate plummeted by 50% in quite a few weeks. This index has started out to recover, but the influence is even now pretty substantial.

Impact of China’s mining ban on Bitcoin Hashrate

Miners’ income dropped from a substantial of $ 80 million in April to just in excess of $ 13 million at the finish of June, the lowest level considering that November, when the price tag of BTC was just in excess of $ ten,000. However, immediately after the adjustment, the income skyrocketed to in excess of $ thirty million.

Synthetic currency 68

Maybe you are interested:

.