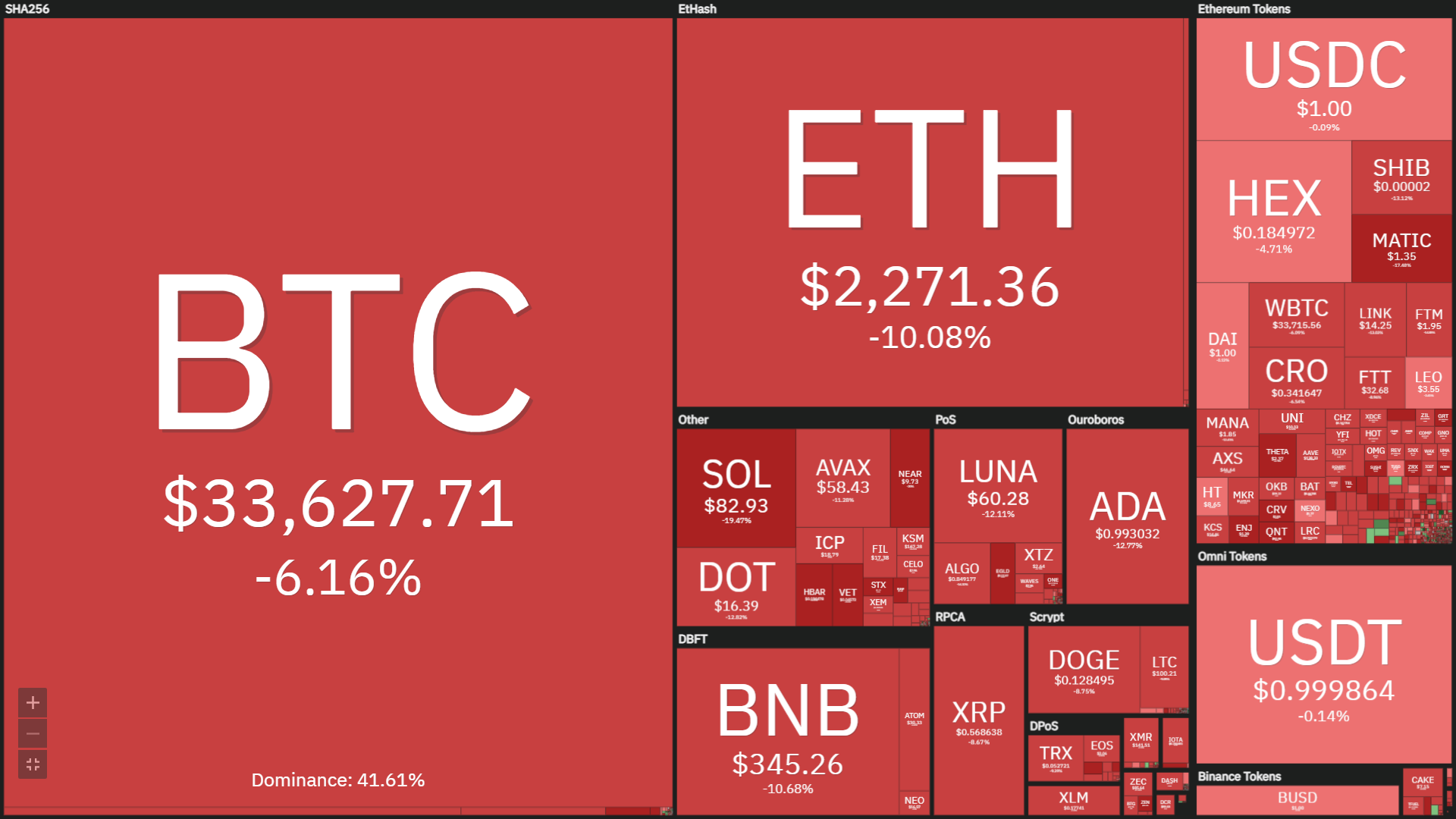

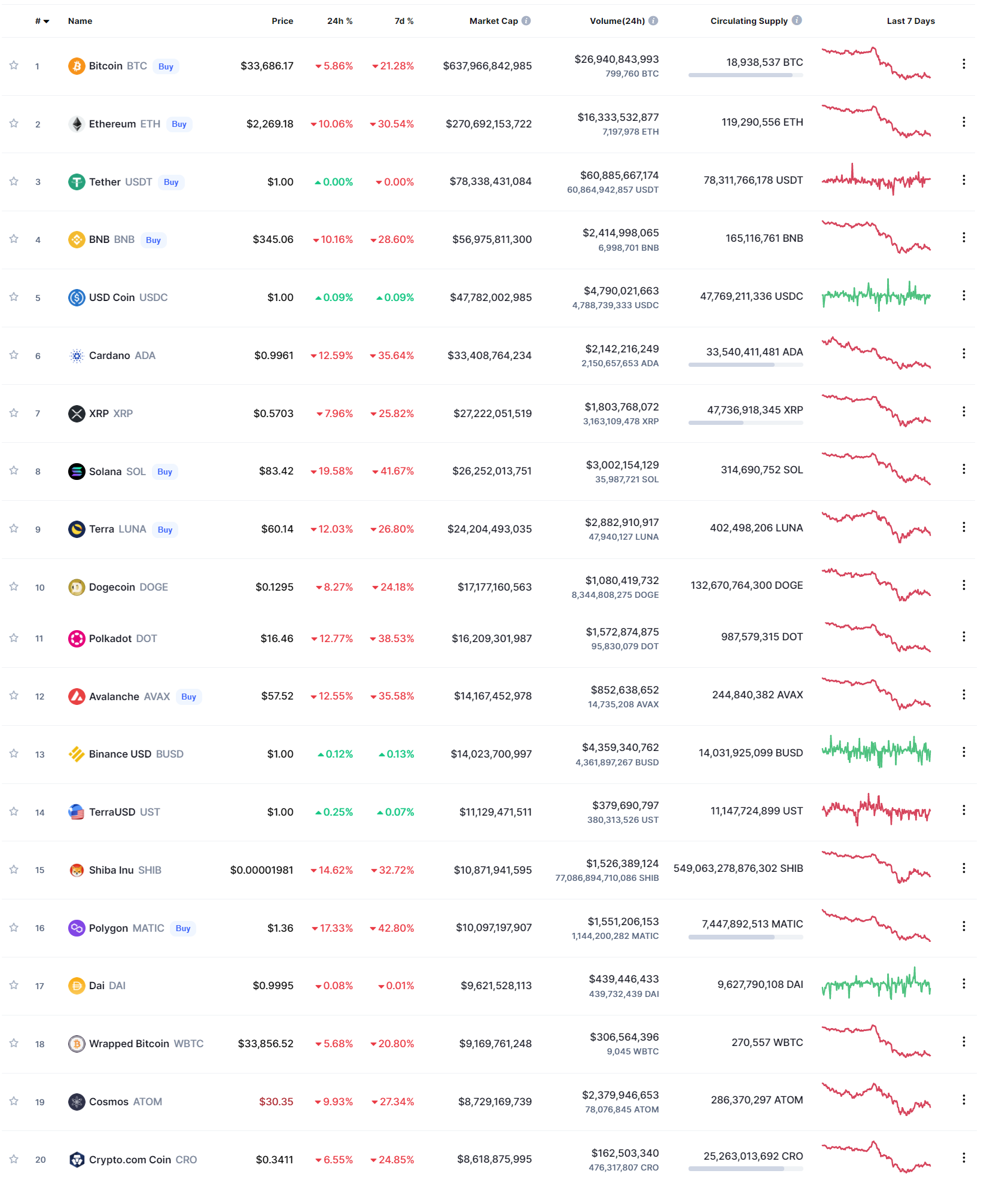

The cryptocurrency marketplace extends its “red day” to Monday (January 24), with lots of key currencies continuing to discover new lows.

As reported by Coinlive, the cryptocurrency marketplace has been concerned in a new wave of income considering that January 21, pushing Bitcoin from $ 41,110 to just $ 35,440 in a matter of hrs. On January 22, BTC set a new reduced at USD 34,008, the lowest degree in the final half yr.

Negative info top to cryptocurrency marketplace regulation incorporates the Russian Central Bank proposing to ban cryptocurrencies, the Crypto.com exchange becoming hacked, the US Securities and Exchange Commission wanting to exert regulatory stress on cryptocurrency exchanges.

Some argue that the sudden drop in the cryptocurrency marketplace could stem from the reality that the US stock marketplace is also falling, when information that the Fed is about to increase curiosity prices to cope with inflation has created worldwide traders not additional optimistic about the development prospective customers of big businesses in 2022.

The believed that two quiet weekends will be the basis for the recovery of Bitcoin and altcoins in standard, but on the afternoon of January 24th, cryptocurrency no. one in the planet was pushed back to USD 33,434, the lowest degree considering that July 2021.

The result in of the most current drop is nevertheless unknown, but in accordance to Whale Alert, an account that tracks the volatility of the “whale’s” wallet, just about $ a hundred million well worth of Bitcoin was transferred to Coinbase just just before the selling price of BTC plummeted. .

one,250 #BTC (43,109,069 USD) transferred from unknown wallet to #Coinbasehttps://t.co/JdaQCept4e

– Whale alert (@whale_alert) January 24, 2022

one,500 #BTC (51,730,882 USD) transferred from unknown portfolio to #Coinbasehttps://t.co/5Xbtbc8UAZ

– Whale alert (@whale_alert) January 24, 2022

Other altcoins are also posting hefty losses, with ETH down eleven% to $ two,240, BNB down eleven% to $ 342, SOL down twenty% to $ 82, AVAX down 13% to $ 56.88, DOT down 13% to USD sixteen.27, LUNA down 13% to USD 59.forty, …

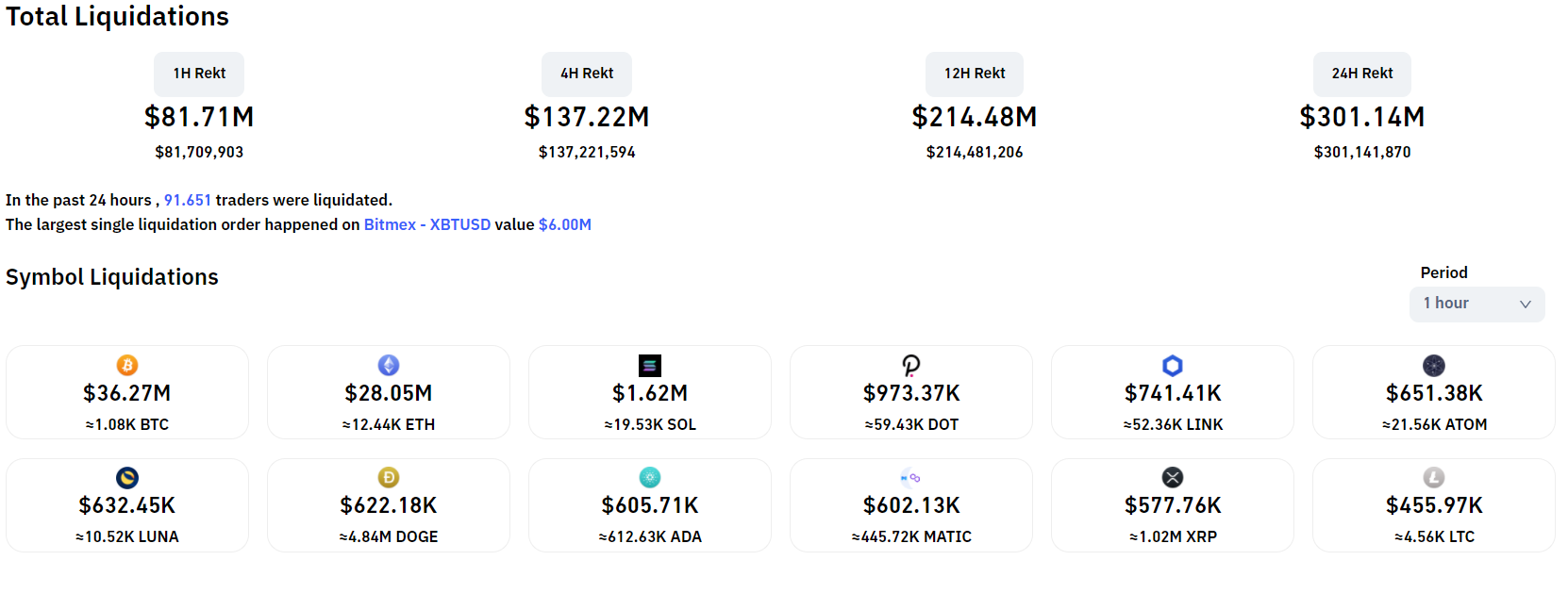

According to Coinglass statistics, $ 81 million well worth of derivative orders have been cleared in the previous hour, with 87% of lengthy orders.

Synthetic currency 68

Maybe you are interested: