Bitcoin has been really volatile in the previous handful of days, leading to really unpleasant selling price movements. In this post, 68Trading will give a private view on Bitcoin’s efficiency in September.

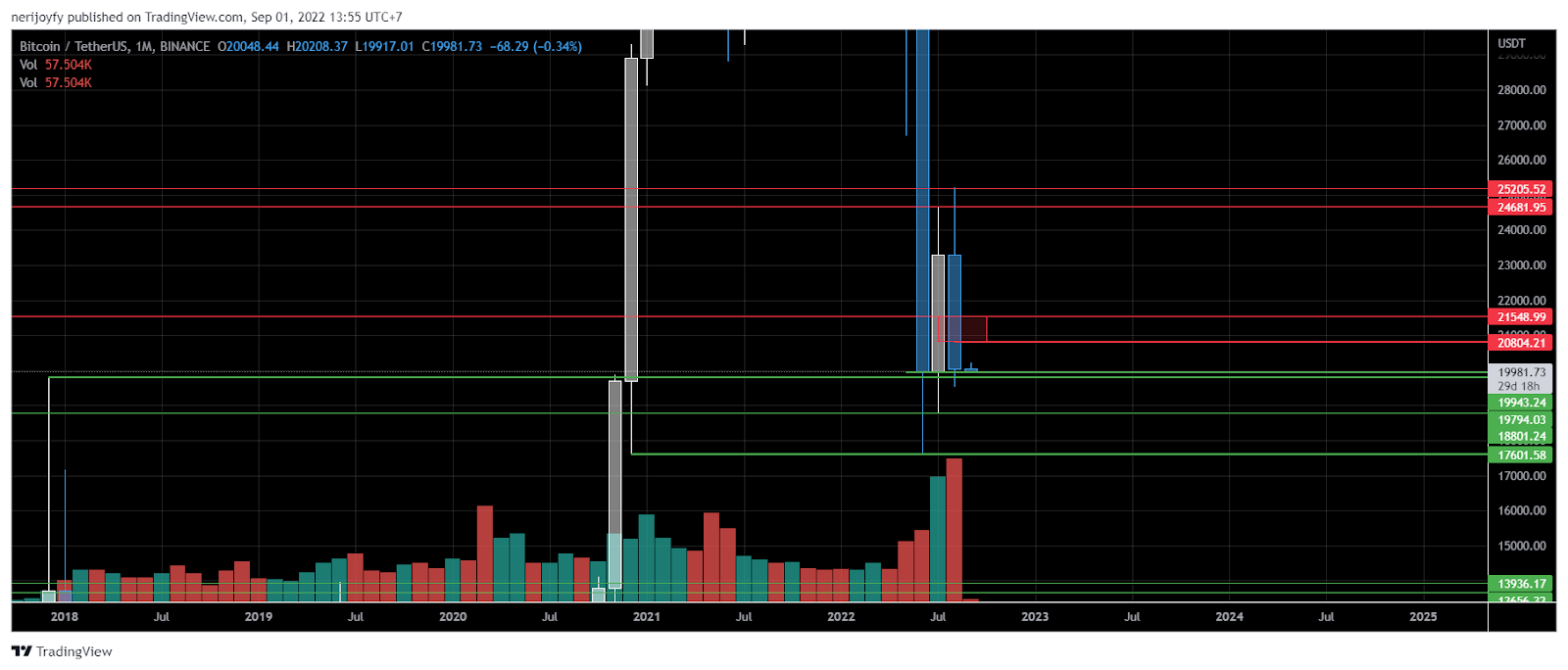

1M chart (one month)

The August candle has closed, it is a robust bearish candle with volumes that have exceeded all of July, demonstrating that sellers are nevertheless dominant, the common trend is nevertheless down.

The August candle selling price closed over the $ 19.943 assistance degree, even so, the September candle tends to check the $ 19.943 assistance yet again, if this assistance is broken, $ 19.794 and $ 18.800 will be the two ranges assistance upcoming assist.

The resistance on the 1M chart will be the $ 24.681 – $ 25.205 zone.

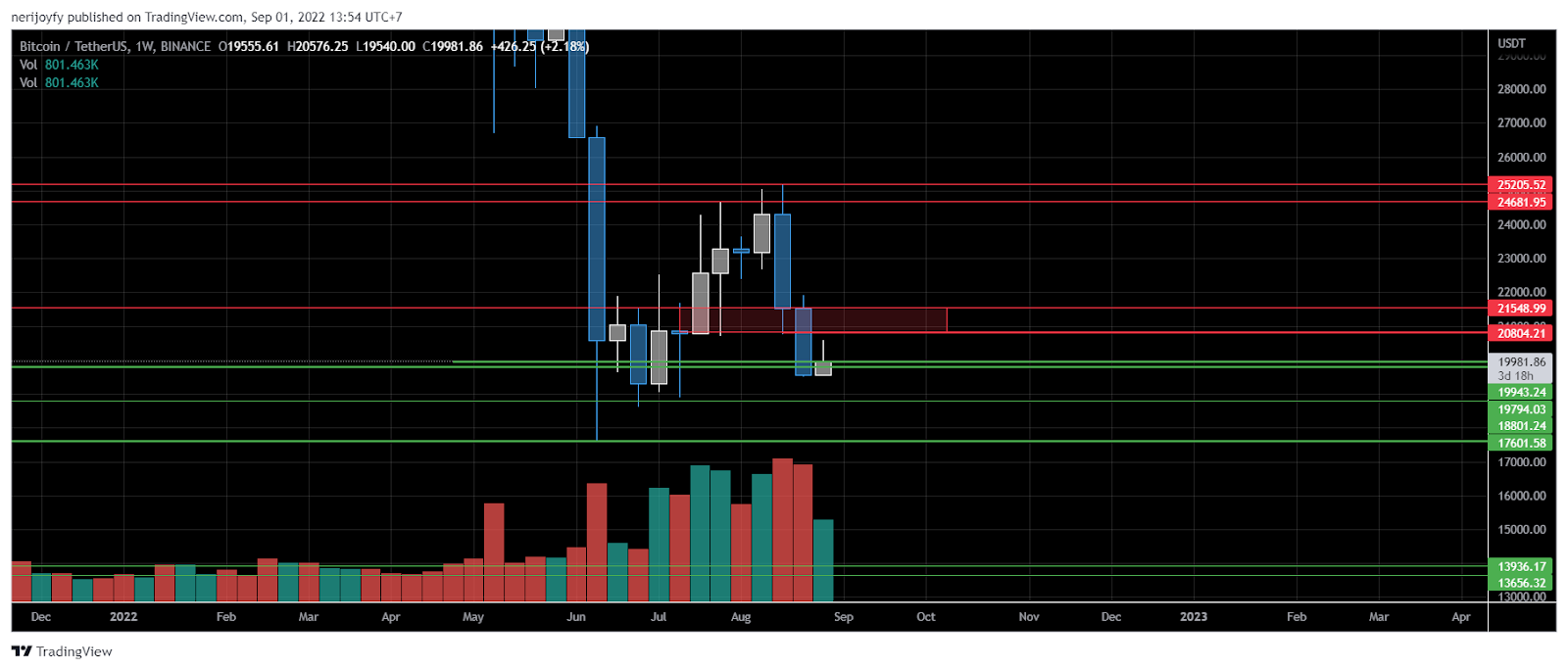

1W chart (one week)

The weekly candle is all around $ twenty,000 and the form of the candle is also rather bad due to its lengthy beard which suggests that all attempts to increase the selling price have failed and this candle could kind a bearish pin bar, a signal signal. really respectable low cost in selling price action.

If this week’s candle (Aug 29 – Sep four) closes over the $ 19.943 assistance, we may perhaps proceed to see bulls try out to push the selling price additional. The resistance to observe out for on the 1W chart is $ twenty,800 – $ 21,548.

If the weekly candle closes under $ 19,943 or worse, $ 19,794, a bearish pin bar will kind and this is a negative signal for the bulls, the upcoming assistance degree will nevertheless be at $ 18,800.

Try to wait patiently for the weekly near to make a trading choice.

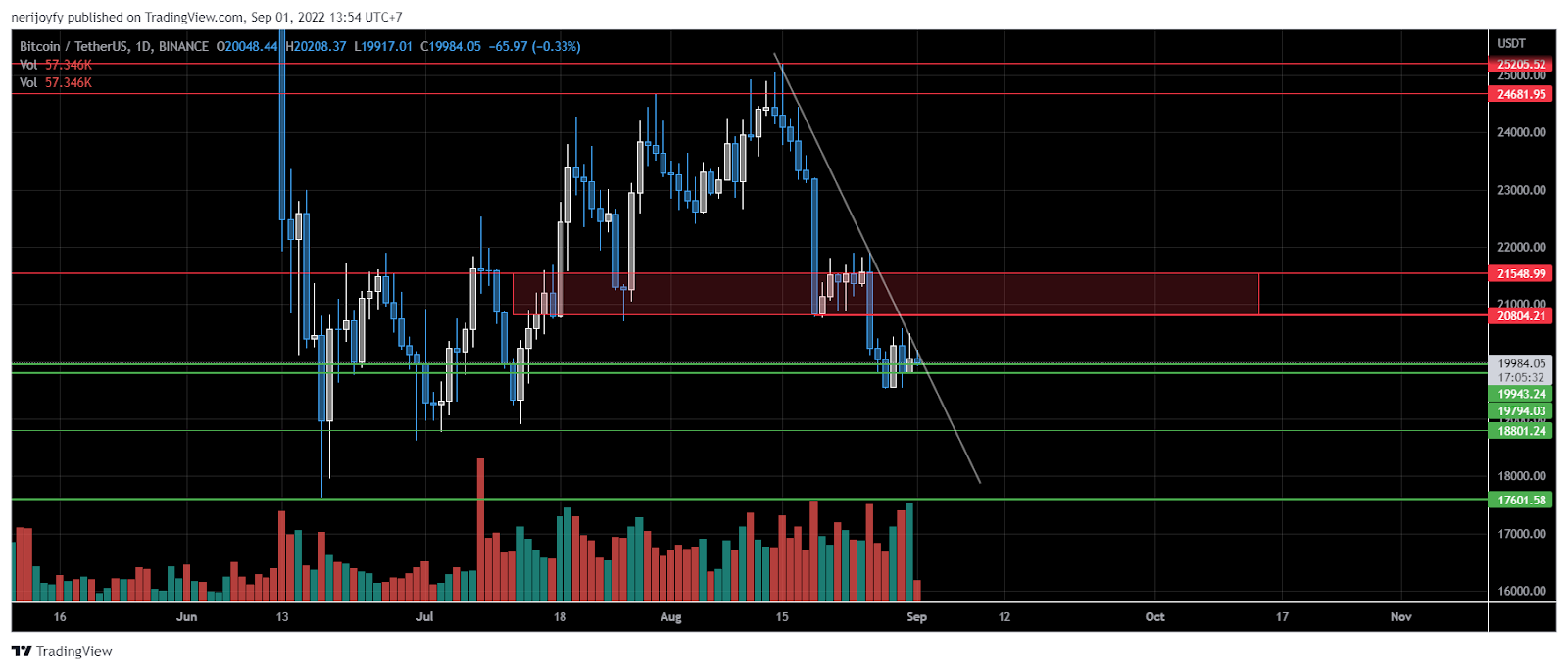

1D chart (one day)

The selling price is at the confluence of the $ 19,943 assistance and the downtrend line. I count on a breakout to the upside to method the $ twenty,800 – $ 21,548 resistance. However, the likelihood of the selling price going sideways is feasible since the trading volume on the weekend is frequently really reduced.

summary

The all round trend is nevertheless down, all efforts to increase the selling price will only be deemed as a retracement, so discovering brief setups will be a lot more acceptable at this stage.

I will seem for settings to brief in the $ twenty,800 – $ 21,548 resistance zone or when the selling price breaks under the $ 19,943 – $ 19,794 assistance as proven under.

Synthetic currency 68

Maybe you are interested: