Bitcoin (BTC) dipped under the $31,000 help on Monday evening (July 19 ET) soon after growing offering strain following days of sideways trading.

Sorrow new discomfort for Bitcoin

Data from Cointelegraph Markets Pro and TradingView demonstrates that the BTC/USD pair hit a lower of $thirty,630 on Bitstamp on Monday.

The move comes a day soon after Bitcoin closed its weekly candle at its lowest degree considering the fact that December 2020, the selling price action underlines how delicate a lower-volume marketplace is and how network fundamentals stay. is in the recovery phase.

Cryptocurrency traders have been anticipating a pullback soon after Bitcoin failed to hold larger help, with the upcoming probable target at $thirty,000.

“Volatility, finally for Bitcoin,” well known trader Michaël van de Poppe wrote on Twitter.

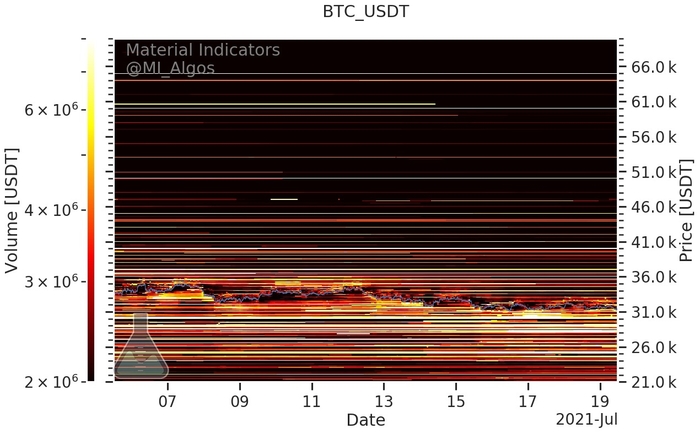

At the time of creating, BTC/USD selling price hovers all-around $thirty,700, down about three% on the day. A search at get and promote orders on significant exchange Binance demonstrates that sizeable shopping for stays at $27,000 or extra, which minimizes the probability of a deeper drop under this degree.

Some marketplace participants are wanting for affordable entry factors to “bottom fishing”.

Not saying this is the bottom.

I’m just saying the PA often seems to be horrible at the bottom, and that the bottom is only also apparent when it truly is also late to catch it.

3k & 30k

– Similar sentiment, most calling for 28k n decrease.

– Similar construction, fakeout and slow bleed.#Bitcoin pic.twitter.com/9NyEC6o6HD— Inmortal (@inmortalcrypto) July 14, 2021

Previously, van de Poppe had also recommended that the ultimate BTC bottom selling price may well not be the end result of a sudden drop or have nicely-defined traits.

A every day near under $31,000, even so, has not occurred considering the fact that January.

Altcoins hit difficult

Meanwhile, Bitcoin’s decline has induced discomfort for altcoin traders, which typically doubles the greatest cryptocurrency’s hourly losses.

Ether (ETH) has dropped just about eight% on the day to hit the $one,800 help degree, which demonstrates that the altcoin marketplace is even now reliant on Bitcoin sentiment.

The only attainable motive ideal now behind the marketplace drop is the Grayscale Bitcoin Trust fund “unlocking” sixteen,000 BTC on Sunday, just a day later on possibly impacting the marketplace.

Today, Grayscale CEO Michael Sonnenshein advised CNBC that the regulatory discussion of Bitcoin exchange-traded money (ETFs) is coming into its “final phase” and that the corporation is committed to building GBTC a this kind of merchandise.

Readers can stick to Bitcoin prices and extra than two,000+ other tokens right here.

Maybe you are interested:

Join our channel to update the most valuable information and understanding at:

According to CoinTelegraph

Compiled by ToiYeuBitcoin

.