The biggest cryptocurrency in the planet, Bitcoin (BTC), professional an uncommon trading day the place it rose sharply and then returned to its outdated degree.

After climbing back to $ forty,797 on the afternoon of April 26, the price tag of Bitcoin abruptly reversed in the late afternoon and early morning of April 27, correcting itself to $ 37,702. This is the lowest BTC price tag given that March 14.

Bitcoin also dropped to $ 38,200 earlier on April 25. The BTC price tag chart is at the moment an arc, increasing pretty swiftly but falling just as violently.

The trigger of the most up-to-date drop in the world’s biggest cryptocurrency is attributed to external variables. The initial is the new advancement of stress in between the West and Russia when the Russian enterprise Gazprom announced that it will do so gas cutting leads to Poland and Bulgaria from April 27. This is thought of to be Russia’s response to the new sanctions utilized by the West. With the war circumstance in Ukraine tending to escalate as a lot of Western nations talk send heavy weapons to the Kiev governmentobservers worry the Kremlin will reply with more powerful cards like cutting pipelines to the EU, the place major economies like Germany are heavily dependent on Russian fuel.

The aforementioned information led to a promote-off in the US stock market place, as a lot of key indices this kind of as Dow Jones and Nasdaq each fell from two.four% to four% at near of trading. This morning, two significant providers, Microsoft and Alphabet (Google) announced their initial quarter 2022 monetary statements with unsatisfactory final results. In addition to the truth that the US Federal Reserve (Fed) is about to get even further techniques to curb inflation, monetary analysts predict that US equities are about to enter a new phase of economic downturn. Bitcoin is very correlated with US equities, so any drop could have a ripple impact on the cryptocurrency market place.

Not stopping there, the re-emergence of the COVID-19 epidemic in China and the country’s rigid lockdown measures are major to the possibility of disrupting worldwide provide chains, worsening the circumstance of the manufacturing patterns of US and EU makers.

The very good information of the previous number of days this kind of as the truth that Fidelity Financial Group supports customers to invest in Bitcoin by way of their corporate pension fund is not ample to sustain the price tag of BTC. MicroStrategy, an investment company with more than 129,000 BTC, will be the initial consumer to indicator up for Fidelity’s support.

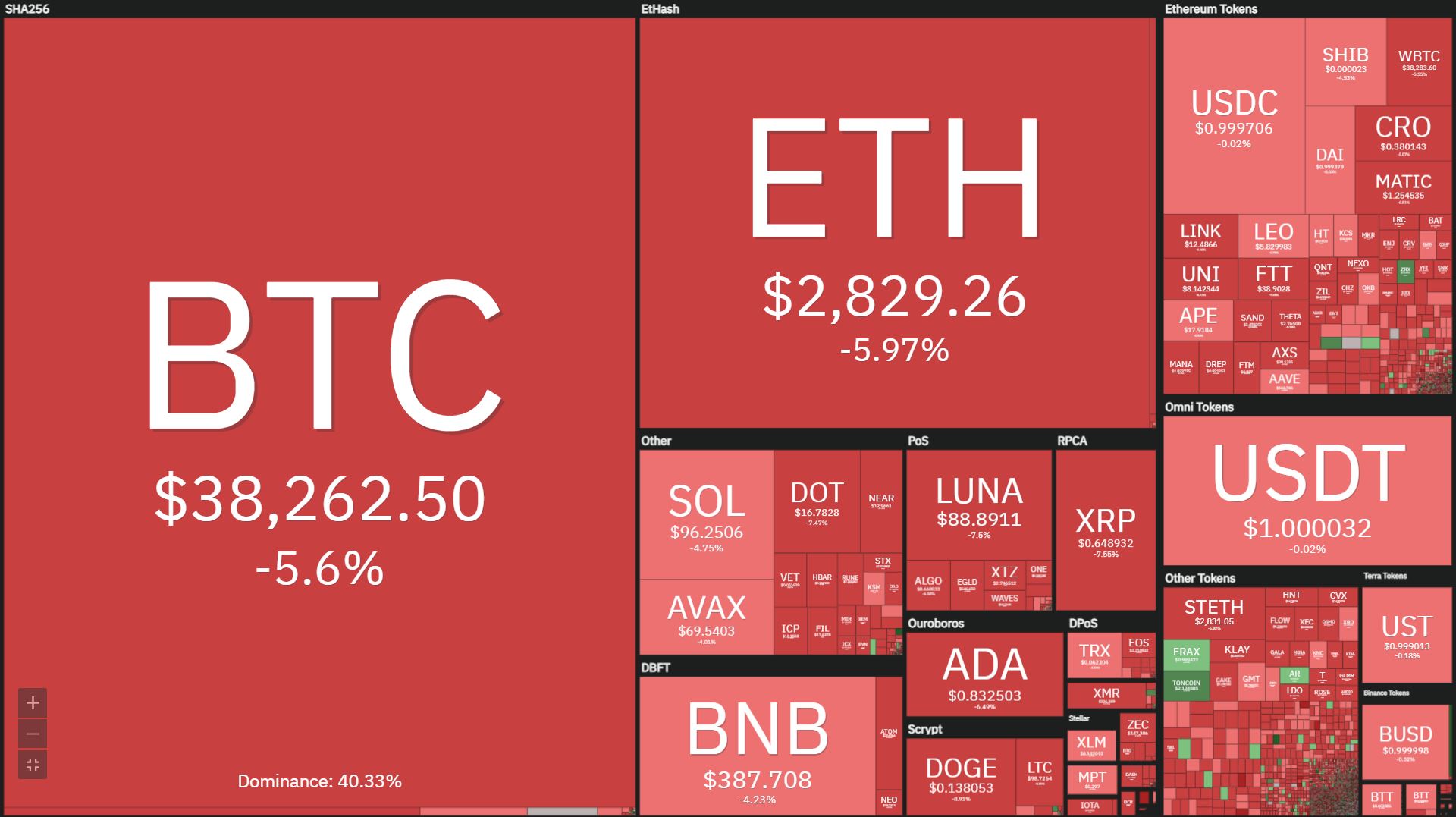

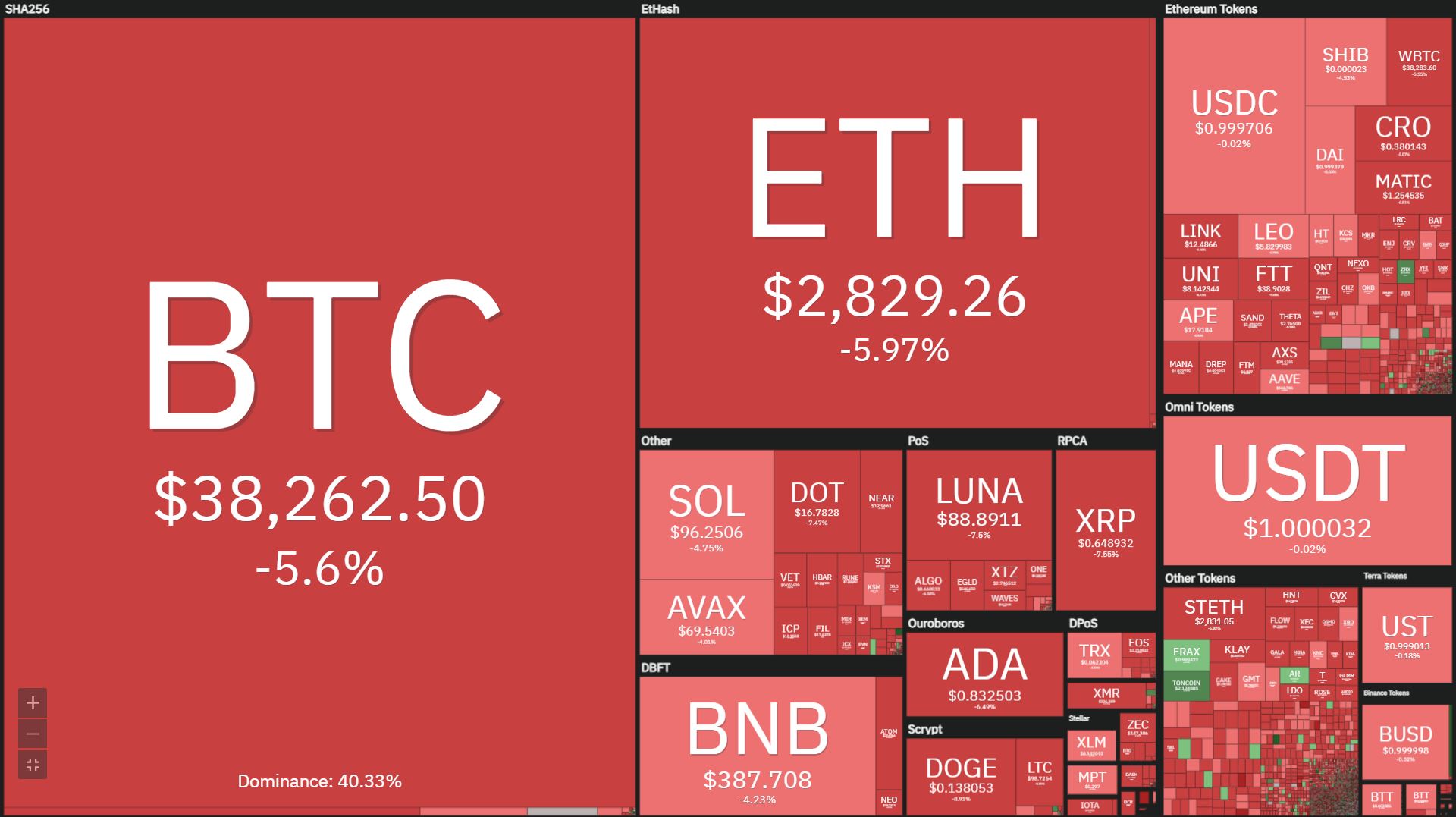

Similar to BTC, a lot of of the key cryptocurrencies in the market place have also been brought down by the marketing strain in the market place. Ethereum (ETH) is down a lot more than six% to $ two,767, Solana (SOL) is down five% to $ 94, Terra (LUNA) is down seven.five% to $ 86, Dogecoin (DOGE) is down eight% to $ .13, BNB down four.five% to USD 380, Practically down 13.five% to USD twelve.three, …

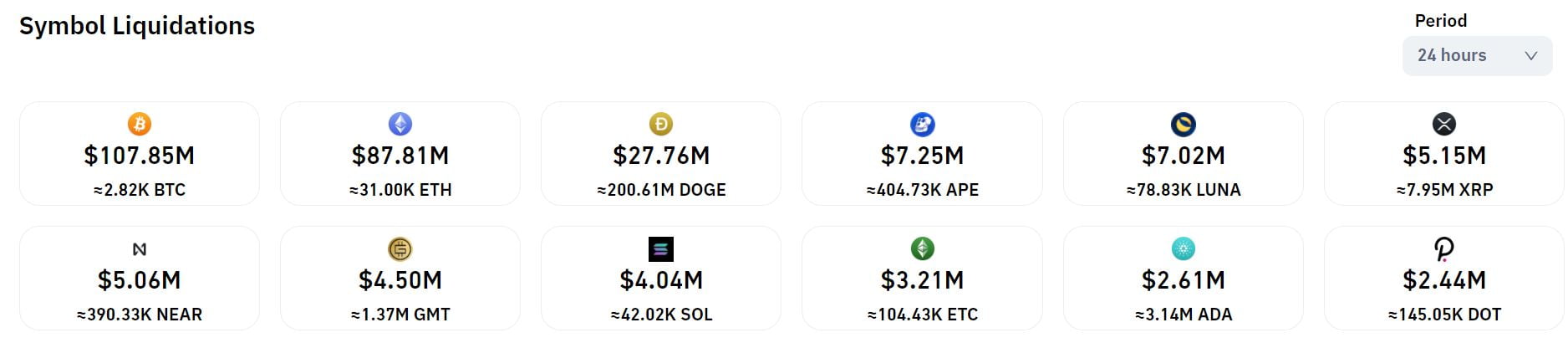

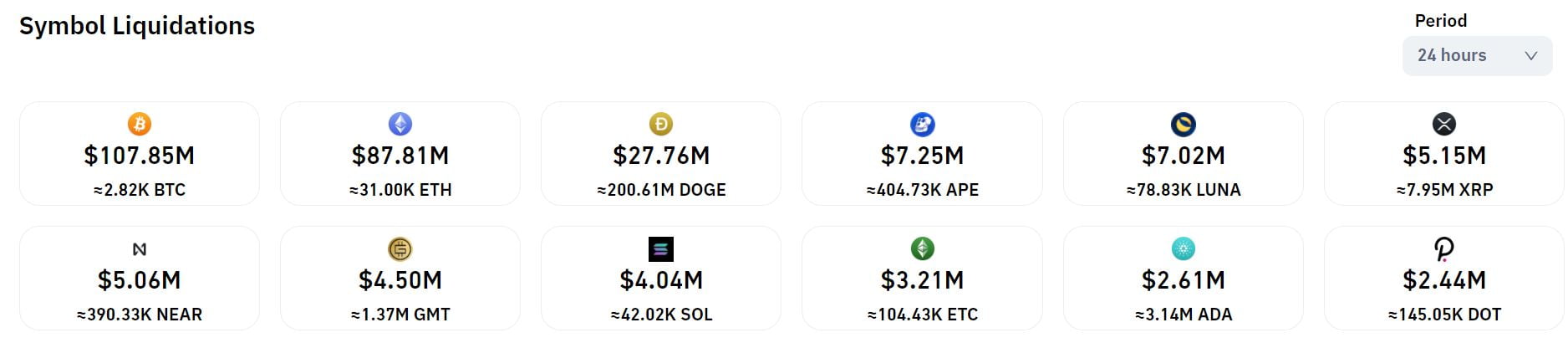

According to Coinglass information, the worth of crypto derivative orders cleared in the previous 24 hrs is almost $ 336 million, primarily concentrated in BTC and ETH. The cleared buy fee is up to 86% of prolonged orders.

Synthetic currency 68

Maybe you are interested:

The biggest cryptocurrency in the planet, Bitcoin (BTC), professional an uncommon trading day the place it rose sharply and then returned to its outdated degree.

After climbing back to $ forty,797 on the afternoon of April 26, the price tag of Bitcoin abruptly reversed in the late afternoon and early morning of April 27, correcting itself to $ 37,702. This is the lowest BTC price tag given that March 14.

Bitcoin also dropped to $ 38,200 earlier on April 25. The BTC price tag chart is at the moment an arc, increasing pretty swiftly but falling just as violently.

The trigger of the most up-to-date drop in the world’s biggest cryptocurrency is attributed to external variables. The initial is the new advancement of stress in between the West and Russia when the Russian enterprise Gazprom announced that it will do so gas cutting leads to Poland and Bulgaria from April 27. This is thought of to be Russia’s response to the new sanctions utilized by the West. With the war circumstance in Ukraine tending to escalate as a lot of Western nations talk send heavy weapons to the Kiev governmentobservers worry the Kremlin will reply with more powerful cards like cutting pipelines to the EU, the place major economies like Germany are heavily dependent on Russian fuel.

The aforementioned information led to a promote-off in the US stock market place, as a lot of key indices this kind of as Dow Jones and Nasdaq each fell from two.four% to four% at near of trading. This morning, two significant providers, Microsoft and Alphabet (Google) announced their initial quarter 2022 monetary statements with unsatisfactory final results. In addition to the truth that the US Federal Reserve (Fed) is about to get even further techniques to curb inflation, monetary analysts predict that US equities are about to enter a new phase of economic downturn. Bitcoin is very correlated with US equities, so any drop could have a ripple impact on the cryptocurrency market place.

Not stopping there, the re-emergence of the COVID-19 epidemic in China and the country’s rigid lockdown measures are major to the possibility of disrupting worldwide provide chains, worsening the circumstance of the manufacturing patterns of US and EU makers.

The very good information of the previous number of days this kind of as the truth that Fidelity Financial Group supports customers to invest in Bitcoin by way of their corporate pension fund is not ample to sustain the price tag of BTC. MicroStrategy, an investment company with more than 129,000 BTC, will be the initial consumer to indicator up for Fidelity’s support.

Similar to BTC, a lot of of the key cryptocurrencies in the market place have also been brought down by the marketing strain in the market place. Ethereum (ETH) is down a lot more than six% to $ two,767, Solana (SOL) is down five% to $ 94, Terra (LUNA) is down seven.five% to $ 86, Dogecoin (DOGE) is down eight% to $ .13, BNB down four.five% to USD 380, Practically down 13.five% to USD twelve.three, …

According to Coinglass information, the worth of crypto derivative orders cleared in the previous 24 hrs is almost $ 336 million, primarily concentrated in BTC and ETH. The cleared buy fee is up to 86% of prolonged orders.

Synthetic currency 68

Maybe you are interested: