After a four-day time period of sharp correction, Bitcoin’s selling price rose somewhat to $ 37,550 on the morning of January 25th.

The greatest cryptocurrency in the globe earlier on January 24 had a minute the place it dropped to USD 32,917, the lowest worth degree due to the fact late July 2021. The drop also took BTC’s industry cap off a record higher of. $ one.29 trillion to just $ 638 billion.

At this selling price, BTC is believed to have “split in half” from its $ 69,000 peak in November final yr.

However, on the morning of January 25th, Bitcoin created a notable recovery to the USD 37,550 degree. This is the important upward correction in the industry right after a time period of continued devaluation.

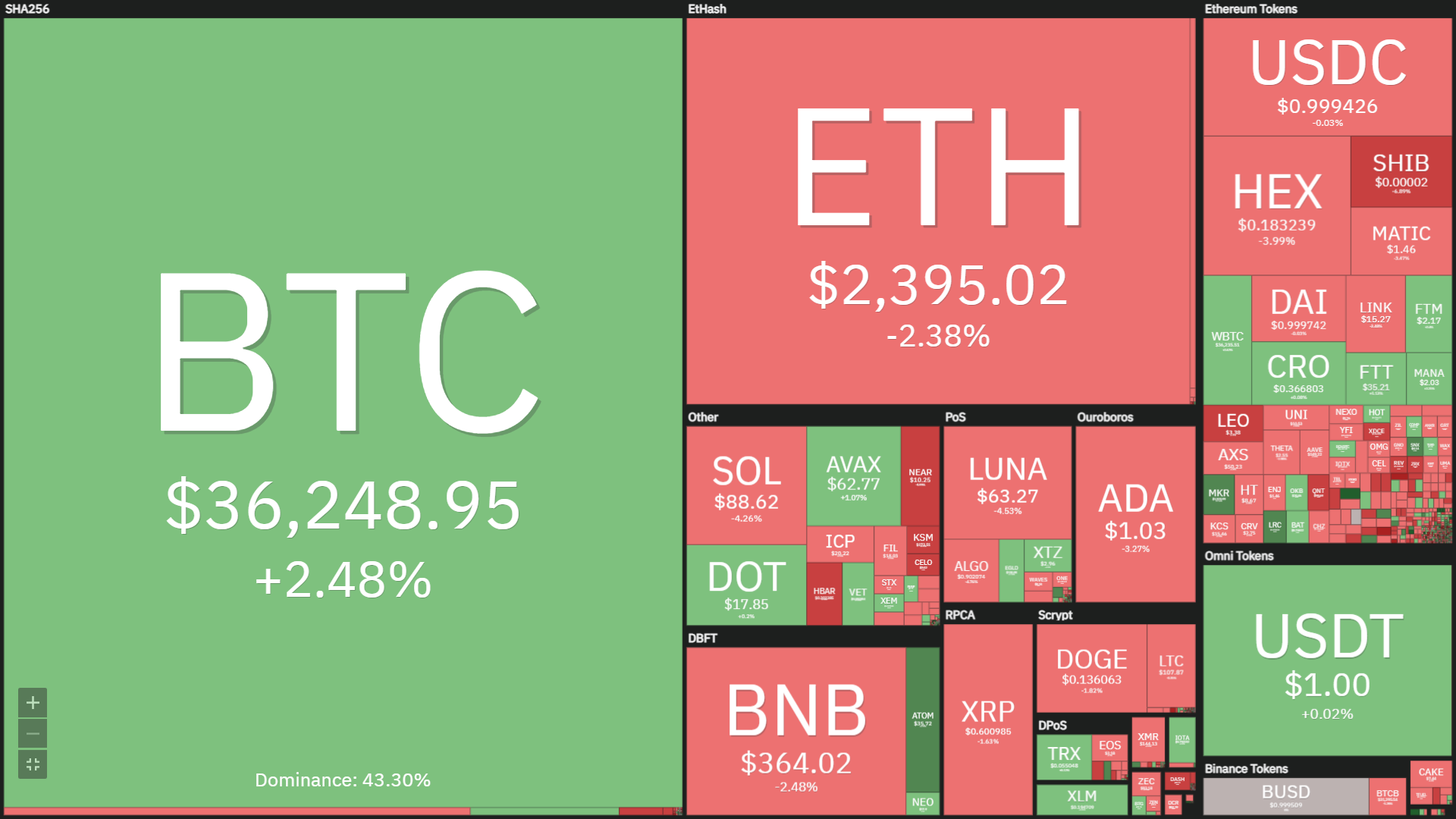

Similar to BTC, also other key altcoins like ETH, BNB, SOL, AVAX, ADA, DOT, and so on. they had a slight maximize, recovering some of what was misplaced right after the latest four-day chain of lessen and lessen.

Even so, numerous analysts are even now not extremely optimistic about Bitcoin’s selling price outlook in distinct and the cryptocurrency industry in standard in the close to long term. The motive is that the motive for the decline stems from macro aspects, mostly the reality that the US Federal Reserve (Fed) will put together to make choices to increase curiosity costs in 2022 to cope with the predicament. Inflation is gradually going out. management in the United States, as reported by Coinlive.

The Fed’s Federal Open Market Committee (FOMC) – the unit that right conducts US dollar money movement operations in the US funds industry – is anticipated to have a standard meeting on Thursday this week. closing the plan to lower the funds provide to increase curiosity costs.

The Fed’s hike in curiosity costs also has a profound result on the US monetary industry, as numerous stock indices and shares of huge companies have also been “connecting” in latest instances.

Zhu Su, head of cryptocurrency hedge fund Three Arrows Capital, commented:

I was undeniably incorrect about how a lot cryptocurrency could fall from the macro contagion.

I stay bullish on area as a entire and believe it is the most crucial mega-trend of our instances.

I joined CT in 2018 and will be right here with you guys for the following number of many years, bull or bear.

– Zhu Su (@zhusu) January 24, 2022

“I was totally incorrect about how macro information can negatively effect the cryptocurrency industry. I stay very bullish on the cryptocurrency sector and contemplate it the greatest trend of our generation. I joined the sector in 2018 and will proceed to accompany you in excess of the following number of many years, irrespective of whether or not the industry goes up or down. “

However, not every person is pessimistic about the latest predicament. As found by the Twitter Trading Room account, Bitcoin is encountering alternating 96-day cycles of up and down, with the latest bearish cycle ending in the middle of this week at the time of the FOMC meeting.

Model, selling price and time

Let’s move away from the TA Price Action chart to realize time cycles and how it will work in cryptocurrencies and influences Bitcoin

I’m creating a thread and will be releasing it quickly

Like and share

Discussion quickly pic.twitter.com/GMAF8F7lxZ

– Trading Room (@tradingroomapp) January 24, 2022

Synthetic currency 68

Maybe you are interested: