On the evening of December 13, the United States launched CPI information for November, a measure of inflation in the world’s greatest economic climate, and brought about a optimistic recovery in the cryptocurrency industry.

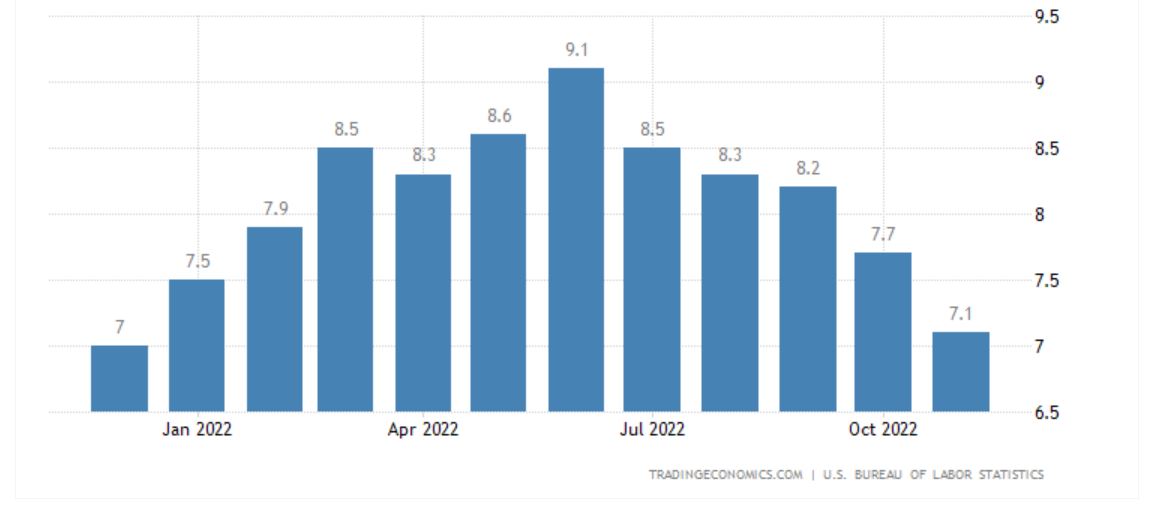

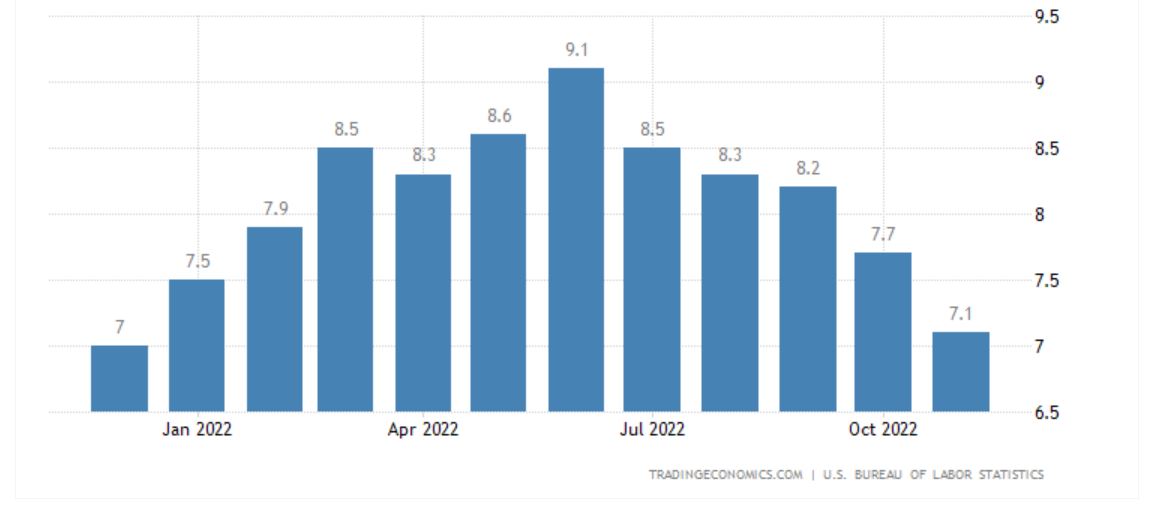

As has been repeatedly reported by Coinlive, 1 of the information that has had a standard influence on the cryptocurrency industry during 2022 is the month to month releases of the customer selling price index (CPI) in the United States. The CPI is thought of a measure of US inflation, which has reached its highest degree in three-four decades considering that the middle of this 12 months.

As a outcome, the US CPI in November 2022 was only seven.one% larger than the similar time period final 12 months, down from seven.seven% in October and beneath economic observers’ expectations of seven.three% .

This is the fifth consecutive month that the US 12 months-on-12 months inflation price has declined.

At the similar time, the Core CPI distinction (minus volatile goods this kind of as foods and power) involving November 2021 and November 2022 also fell to six% from six.three% the preceding month.ten, yet another signal that inflation it acquired cold.

The selling price of Bitcoin (BTC) reacted positively to the aforementioned info, growing by five.five% from 24 hrs in the past to $18,000 – the highest worth threshold considering that November 9, when the exchange FTX started to reveal challenges of liquid assets.

Ethereum (ETH) jumped seven.two% to $one,349 on the side of BTC.

The main altcoins in the industry all rallied four-six%.

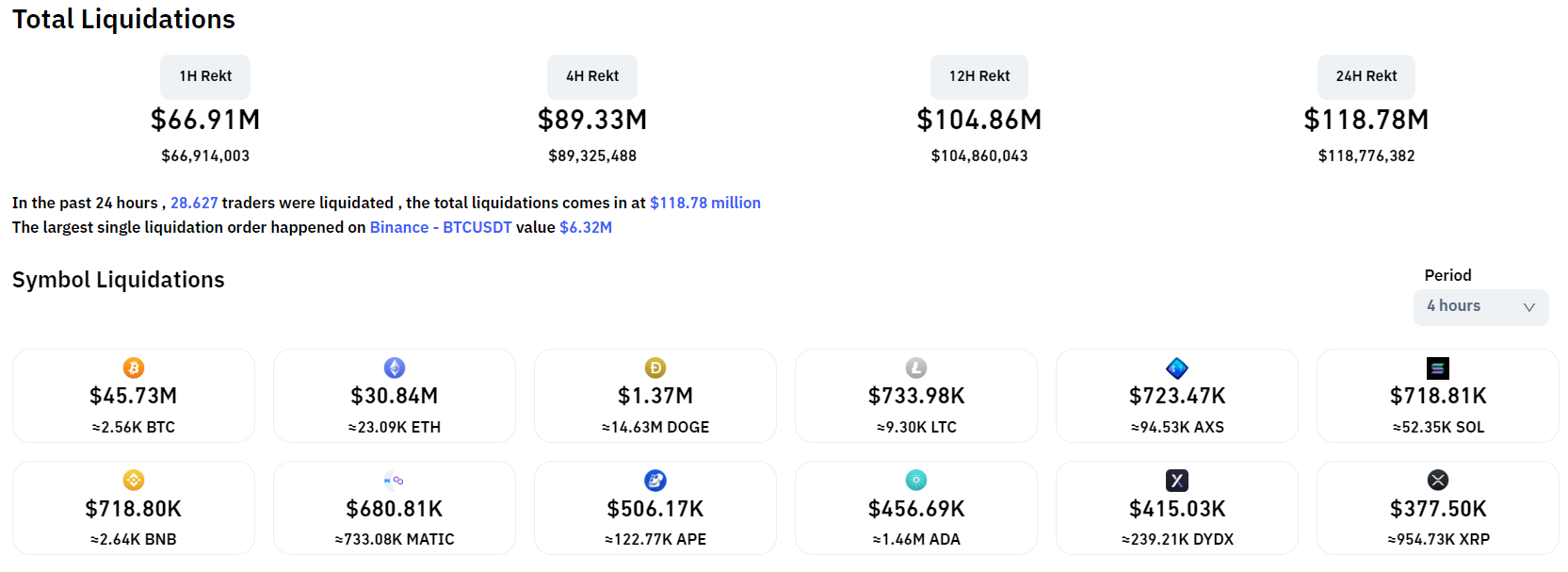

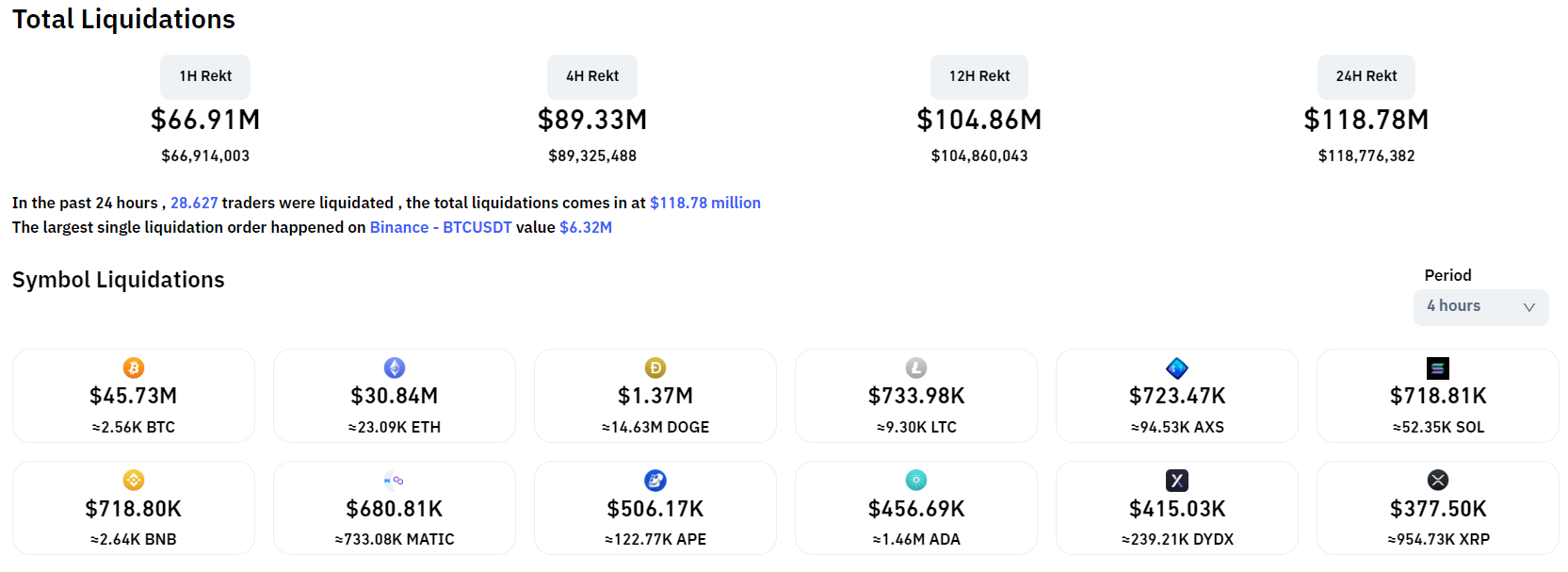

The newest four-hour liquidation price hit almost $90 million, with BTC and ETH building up the vast majority. In which, above 94% of the burned orders had been quick orders.

Subsequently, at dawn on December 15 (Vietnam time), the US Federal Reserve (Fed) will announce the last 2022 curiosity price adjustment. release for the index to attain its highest degree considering that the 2008 economic crisis but almost nothing can be specific.

Synthetic currency68

Maybe you are interested:

On the evening of December 13, the United States launched CPI information for November, a measure of inflation in the world’s greatest economic climate, and brought about a optimistic recovery in the cryptocurrency industry.

As has been repeatedly reported by Coinlive, 1 of the information that has had a standard influence on the cryptocurrency industry during 2022 is the month to month releases of the customer selling price index (CPI) in the United States. The CPI is thought of a measure of US inflation, which has reached its highest degree in three-four decades considering that the middle of this 12 months.

As a outcome, the US CPI in November 2022 was only seven.one% larger than the similar time period final 12 months, down from seven.seven% in October and beneath economic observers’ expectations of seven.three% .

This is the fifth consecutive month that the US 12 months-on-12 months inflation price has declined.

At the similar time, the Core CPI distinction (minus volatile goods this kind of as foods and power) involving November 2021 and November 2022 also fell to six% from six.three% the preceding month.ten, yet another signal that inflation it acquired cold.

The selling price of Bitcoin (BTC) reacted positively to the aforementioned info, growing by five.five% from 24 hrs in the past to $18,000 – the highest worth threshold considering that November 9, when the exchange FTX started to reveal challenges of liquid assets.

Ethereum (ETH) jumped seven.two% to $one,349 on the side of BTC.

The main altcoins in the industry all rallied four-six%.

The newest four-hour liquidation price hit almost $90 million, with BTC and ETH building up the vast majority. In which, above 94% of the burned orders had been quick orders.

Subsequently, at dawn on December 15 (Vietnam time), the US Federal Reserve (Fed) will announce the last 2022 curiosity price adjustment. release for the index to attain its highest degree considering that the 2008 economic crisis but almost nothing can be specific.

Synthetic currency68

Maybe you are interested: