The biggest cryptocurrency in the planet, Bitcoin, abruptly rebounded to $ twenty,000 in spite of becoming severely hit by the US CPI information.

As reported by Coinlive, on the evening of October 13, the US launched September Consumer Price Index (CPI) information, resulting in the CPI falling somewhat in contrast to August but not precisely as anticipated by observers. .

As a consequence, not only the US stock market place, but also Bitcoin (BTC) and the cryptocurrency market place took a huge dip. Specifically, BTC when dropped to $ 18,190, the lowest because mid-September.

However, above the up coming twelve hrs, the world’s biggest cryptocurrency had an remarkable recovery, climbing to above $ one,700 to attain a peak of $ 19,551, the highest selling price degree because October seven.

It appears that immediately after the release of the US CPI information, Bitcoin has escaped the grip of this macro indicator, which weighs on the market place from the starting of October until finally now. Furthermore, it also applies to beneficial data about Bitcoin in the previous, for illustration, the hash charge of this network is continually setting new information.

However, the slight reduce in the CPI will have adverse extended-phrase consequences for the market place as it will bring about the US Federal Reserve (Fed) to carry on to put into action its curiosity charge hike policy to have inflation. The Fed will have two a lot more charge changes in November and December, so the rest of October can be explained to be a “breathable” time period for cryptocurrencies.

Thanks to Bitcoin’s recovery momentum, the market’s key cryptocurrencies also rebounded and regained what was misplaced in the landfill on the evening of October 13.

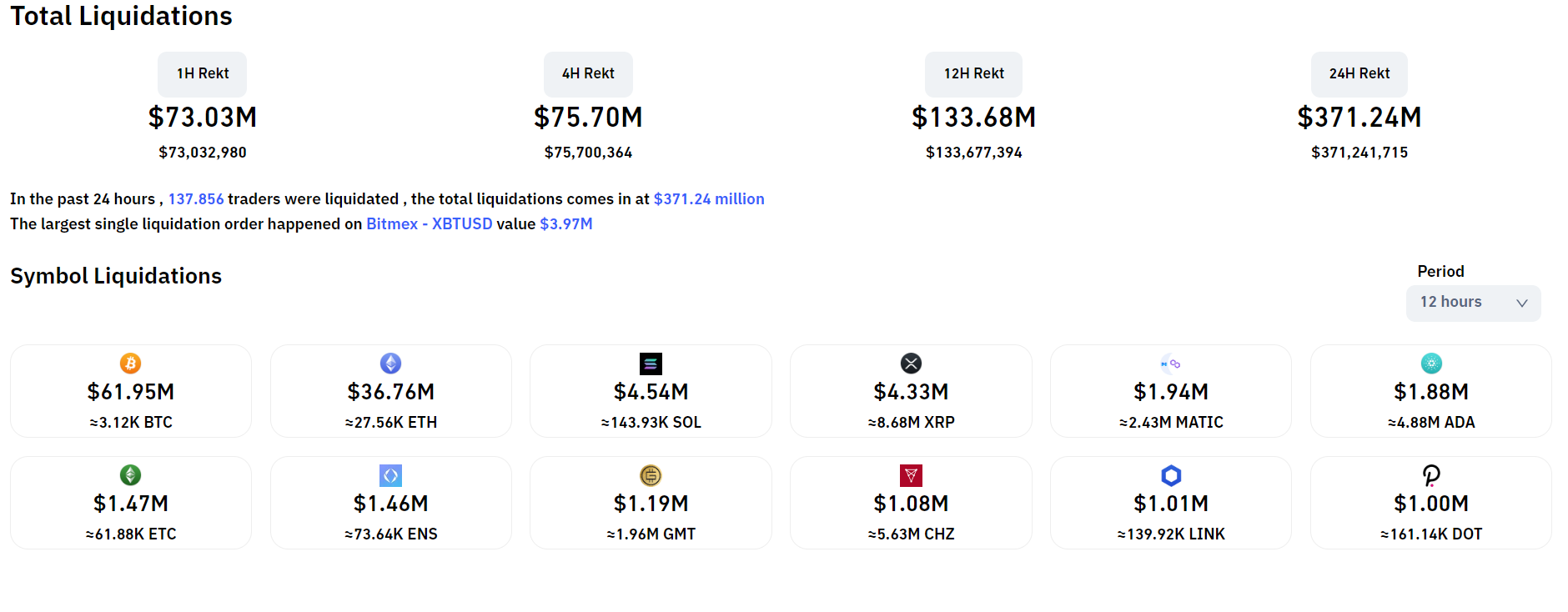

The sudden turnaround of currencies is also plainly reflected in the derivatives trading market place. Over the previous twelve hrs, the volume of cleared long term orders has been above $ 133 million, with an overpowering percentage of brief orders at almost 88%.

Synthetic currency 68

Maybe you are interested: