- Bitcoin price ranged $80K-$90K in 2025.

- Institutional activity increased volatility.

- Short-Term Holder SOPR at 0.94 indicated losses.

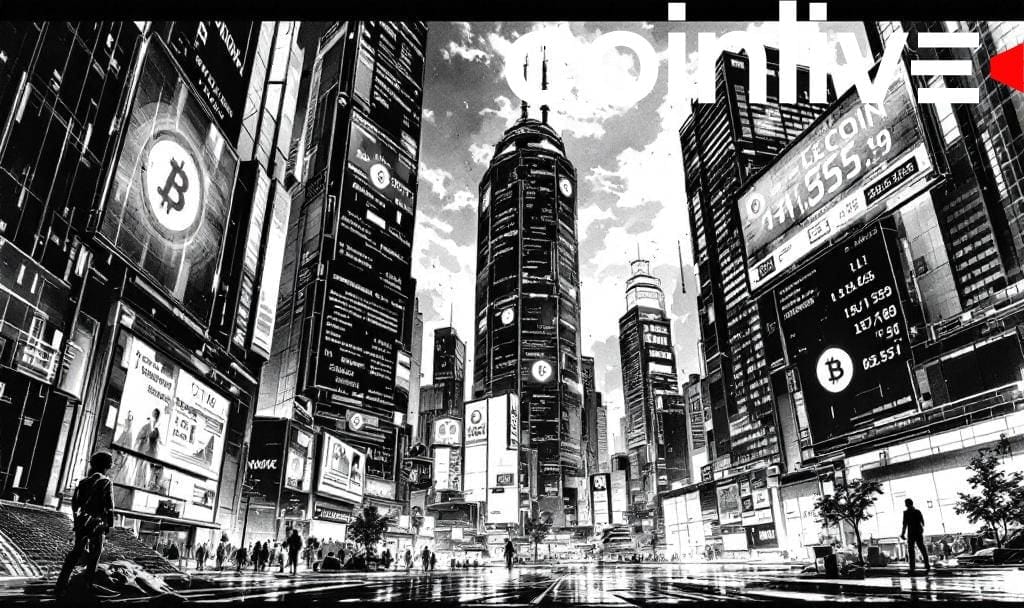

Bitcoin’s price in late 2025 hovered around $89K-$90K amid increased institutional activity, with on-chain metrics accurately foretelling market swings.

These signals underscore significant market shifts, contributing to investor sentiment and price volatility, impacting broader cryptocurrency strategies.

Expert Analysis of Bitcoin Markets

Experts assert that Bitcoin’s price charts presented deceptive signals last year, while eight on-chain indicators accurately predicted every price fluctuation in 2025. Key metrics included SOPR, exchange flows, and Coinbase premium levels.

These indicators showcased predictive power by suggesting market conditions and guiding investor expectations. Despite lacking insight from prominent analysts, the metrics displayed rising volatility and significant institutional influence on Bitcoin.

Market Movements and Investor Behavior

Bitcoin’s price hovered between $80K-$90K, causing a notable impact on trading behavior and market stability. Short-term capitulations were evident as SOPR values suggested a phase of loss realization.

With institutional investors playing a pivotal role, trading patterns showed increased volatility and heightened uncertainty. It appears that there are no specific quotes from individuals related to the on-chain signals predicting Bitcoin’s movements in 2025 from the provided sources. These changes persisted despite stable fundamentals and potential barriers identified by on-chain data.

Historical Trends and Future Projections

Examining historical trends, prices failed to achieve the cost-basis threshold, causing strategic adjustments among holders. This period was characterized by fluctuating market sentiment and speculative pressures.

In 2026, optimistic projections coupled with cautious optimism depicted improved expectations. Data presents a complex scenario, but broader adoption trends and on-chain liquidity highlight potential robust financial outcomes.