- Bitcoin remains unaffected by Trump’s 25% tariff threat.

- No significant market liquidation reported.

- Bulls keep BTC near $94,000 amid ongoing stability.

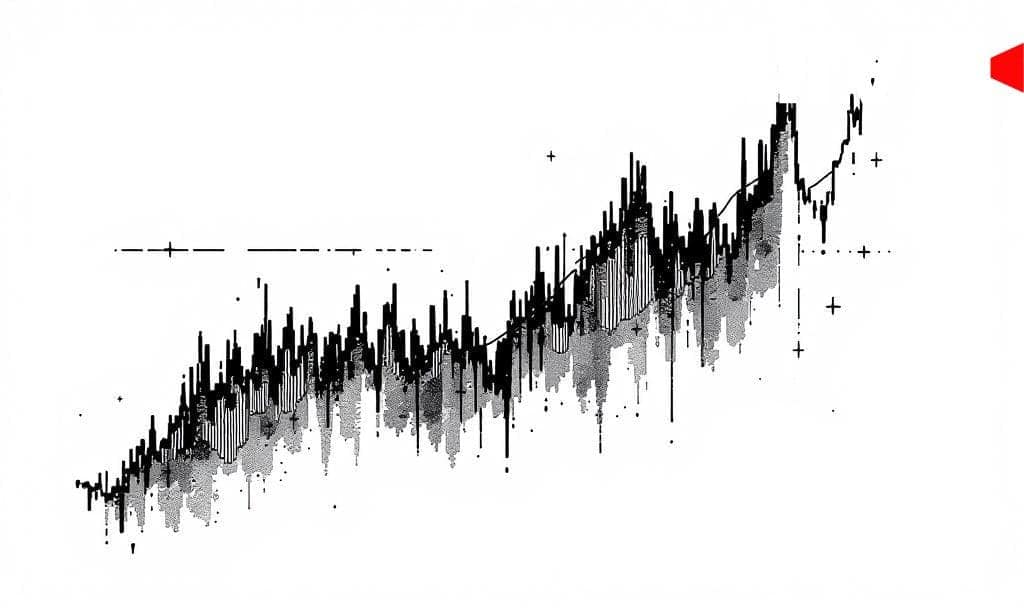

President Donald Trump announced a 25% tariff on nations trading with Iran, impacting primarily Bitcoin, which traded near $94,000 despite a prior dip.

While previous tariff threats led to significant Bitcoin liquidations, the current market showed stability and avoided a similar cascade.

Following President Donald Trump’s announcement of a new 25% tariff on countries dealing with Iran, Bitcoin held steady. BTC’s stability was remarkable, especially given historical volatility during similar announcements.

The announcement was broadcast via Truth Social on January 12. Despite lacking a formal statement from the White House, it posed a potential stress point for global markets.

Investors and analysts noted Bitcoin’s resilience as it continued to trade near the $94,000 mark. The brief dip below $91,000 did not trigger a large-scale liquidation.

Market data revealed that Bitcoin’s current condition contrasted sharply with October 2025, when previous tariff threats led to extensive market turbulence and forced liquidations.

Recent market adaptations, such as lower leverage and pricier hedges, have fortified Bitcoin against such tariff threats. Investors have adopted a more cautious approach explained through stabilized open interest levels.

Historical data indicates that nearly $19 billion was previously liquidated following tariff threats, whereas the current infrastructure appears to mitigate such risks. Increased institutional participation and strategic hedging have provided additional market stability.

Bitcoin’s robust response in the face of geopolitical pressures highlights its evolving role as a stable asset, particularly amidst uncertainties like tariffs.