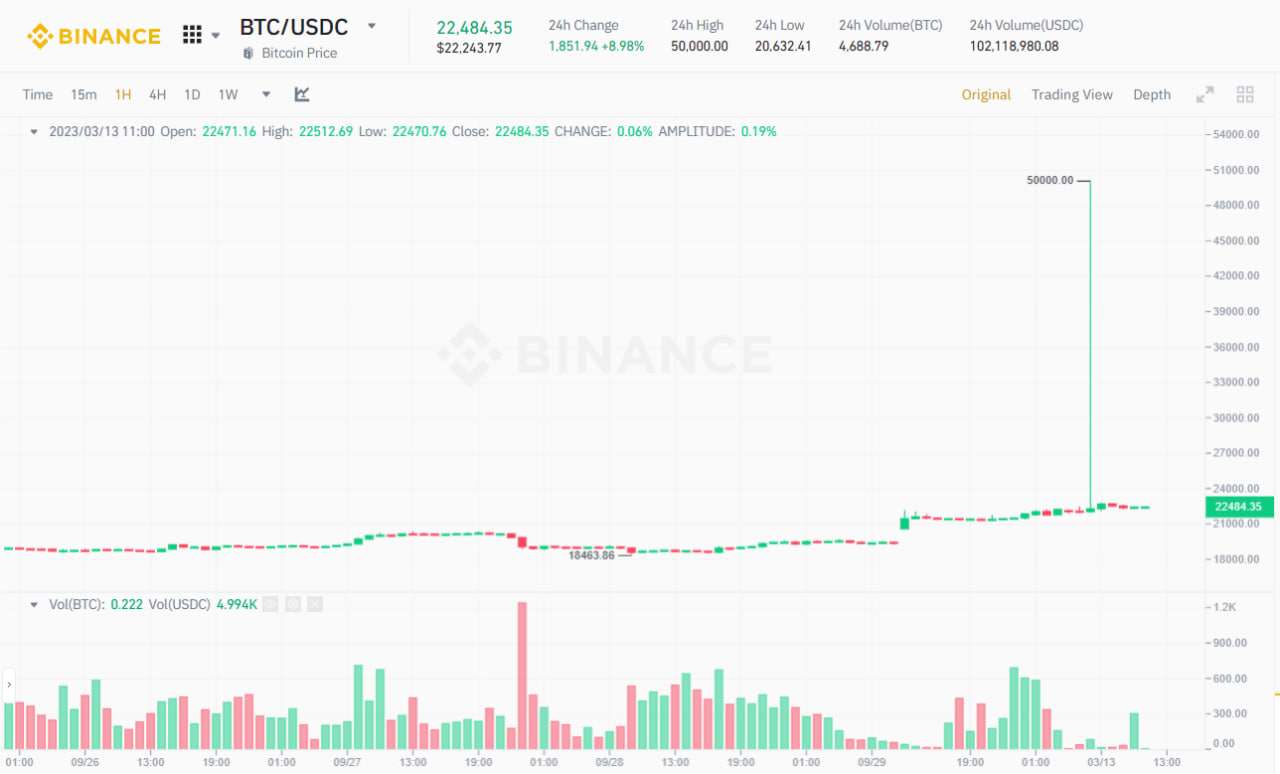

Bitcoin abruptly returned to its November 2021 value on the morning of March 13, what occurred?

Is the BTC/USDC Trading Pair “Overpriced” on Binance?

On the morning of March 13, the value of the BTC/USDC trading pair abruptly reached the $50,000 mark, the November 2021 value assortment, just before the total cryptocurrency marketplace plunged into the existing bear season.

The value of the Binance BTC/USDC trading pair abruptly reached USD 50,000 and then returned to standard, which may possibly be brought about by inadequate depth. https://t.co/1mIwnkORKt pic.twitter.com/pTnosXybXx

— Wu Blockchain (@WuBlockchain) March 13, 2023

The explanation provided for the over flash action is that USDC, Circle’s stablecoin, is in danger of operating out of liquidity.

On March eleven, the worth of USDC fell from the $one mark and was heavily depeg following Circle’s management unit admits it could “lose everything” due to its hefty publicity to Silicon Valley Bank. The volume of income the firm is “contained” right here is up to $three.three billion, or eight.25% of the $forty billion complete assets utilized as reserves for USDC.

This info designed a wave of panic in the neighborhood and end users massively experimented with to flee to other stablecoins. At the exact same time, USDC-wealthy pools on DeFi platforms like Curve have also dried up.

In the midst of burning oil, Binance has closed the conversion of USDC to BUSD to consist of the switching stress on the floor. Coinbase quickly followed suitend providing USDC to USD swaps, until finally now US banking institutions are open to do the job once more, since it can be the weekend.

Binance has temporarily suspended the automated conversion of USDC to BUSD due to existing market place disorders, in particular linked to substantial inflows and the increasing burden to assistance the conversion.

This is a standard procedural threat management stage to consider even though we check the predicament.

— Binance (@binance) March 11, 2023

USDC value misplaced its peg heavily, dropping to $.882 and tremendously influencing other steady coins. This is the deepest depeg of this stablecoin considering the fact that July 2020, poor than when LUNA-UST or FTX had a crisis.

But in accordance to the most up-to-date announcement, Circle has provided a alternative, pledging to cover the shortfall on collateral assets and resuming USD conversion on Monday morning (US time), once more at the charge of one USDC to one USD.

Furthermore, Binance also “uses this opportunity”, open trading USDC/USDT futures with up to 30x leverage. Before that, OKX, Huobi, Bitmex and Bybit did comparable issues, with up to 50x leverage.

A day earlier, the exchange also additional spot trading pairs BNB/USDC, BTC/USDC, and ETH/USDC, in an work to appeal to additional liquidity to the exchange and “rescue” Circle’s stablecoin.

#Binance will include the following trading pairs:

🔸BNB/USDC

🔸BTC/USDC

ETH/USDChttps://t.co/tSYDb0BTu6— Binance (@binance) March 12, 2023

Update on Silicon Valley Bank developments

As reported by the mediaUS officials are racing to ease the well being of the nationwide economic process, following the collapse of Silicon Valley Bank (SVB) final weekend. After many days of falling into a significant capital crisis, SVB was shut down by California authorities on March ten and turned in excess of to the FDIC to liquidate assets. This is the 2nd greatest collapse in the historical past of the US banking sector, following Washington Mutual throughout the 2008 economic crisis.

In the most up-to-date press release from US Treasury Secretary Janet Yellen, US Federal Reserve Chairman Jerome Powell and Federal Deposit Insurance Corporation (FDIC) Chairman Martin J. Gruenberg, all deposits with SVB will be secured, such as these over to USD 250,000.

The Fed announced a “bank lending program,” for troubled depository institutions with additional relaxed terms than normal, to meet the requirements of all depositors. Umbrella he flatly rejected the chance of the government bailing out SVBthe US Treasury Secretary nonetheless has “set aside $25 billion from the Exchange Rate Stabilization Fund” for the Fed’s plan, but this revenue is not anticipated to be utilized.

Before the over info, the worldwide economic market place and The cryptocurrency marketplace is progressively flourishing, Bitcoin rallied to $22,600 this morning. Circle’s expired stablecoin has also recovered, but has not however returned to the $one restrict.

But the work right here is just to guard end users, not to conserve SVB and set a poor precedent for banking institutions dealing with comparable challenges, a government official confirmed with Bloomberg.

Synthetic currency68

Maybe you are interested: