Bitcoin returned to its highest worth due to the fact August 2022 just after the Fed announced a .25% price hike.

The Fed slows price hikes

As updated by CoinliveAt dawn on February two, the US Federal Reserve (Fed) announced the newest curiosity price adjustment, therefore raising the typical curiosity price by .25%.

The US federal money price is at present four.75%, the highest due to the fact the 2008 economic crisis.

It can be observed that the Fed has stored its dedication to lower the price of curiosity price hikes in the newest update. In 2022, this company has seven instances to increase curiosity costs, bringing an significant parameter for the US economic climate from .25% to four.five%.

The motive for this comes from a optimistic signal coming from the inflation problem in the US, which just recorded the 6th consecutive month of decline in the December 2022 report.

Even so, Fed Chairman Jerome Powell stated the US central financial institution would sustain its curiosity price hike method right up until it is particular inflation is below management, with a 2023 target price. -five.one%. Many analysts feel the Fed will possible hike costs two or 3 additional instances this yr, then start off cutting costs once again.

Fed officials will hold eight curiosity price meetings in 2023.

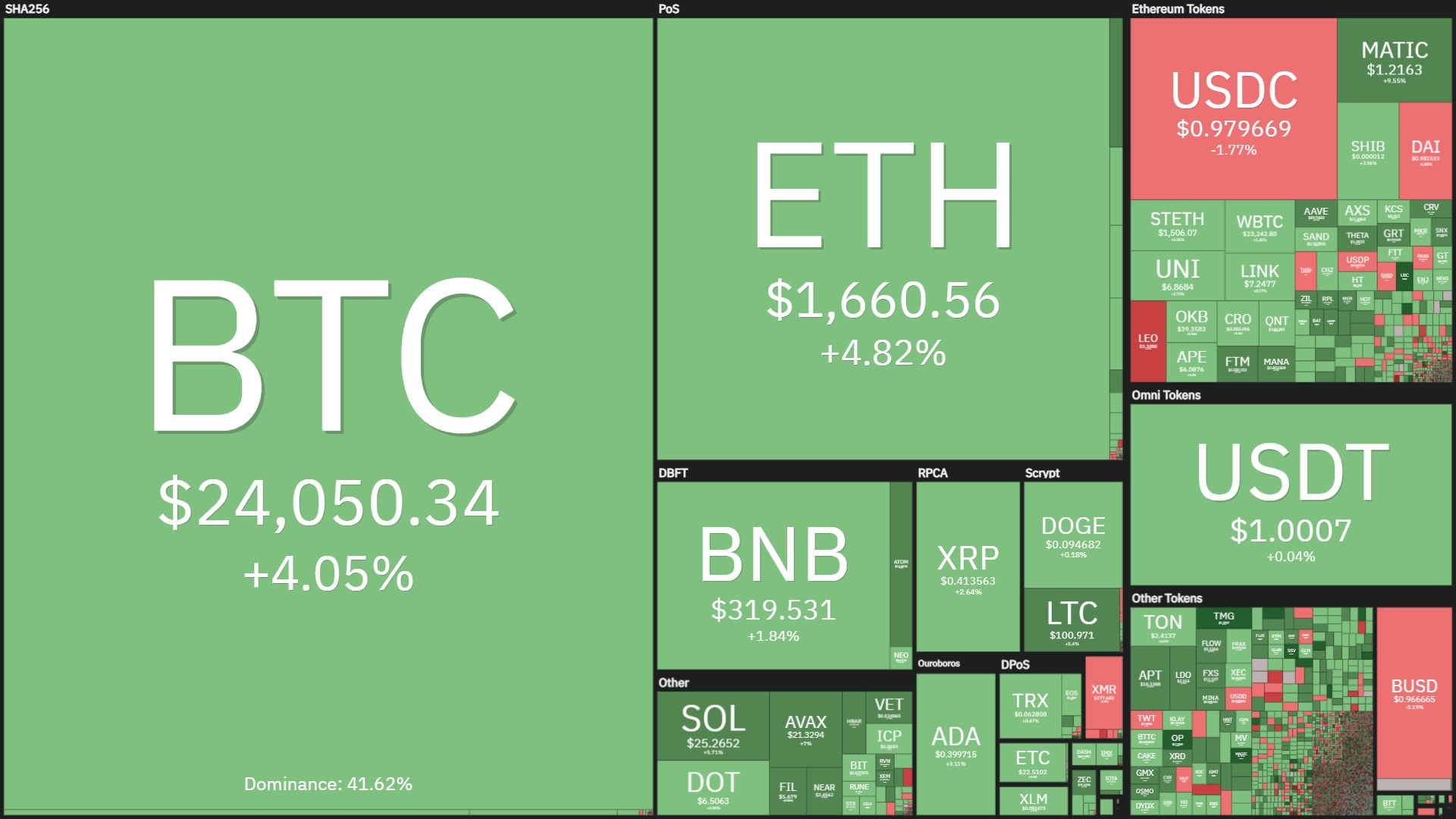

Cryptocurrency Market Continues “Strong Green”

The selling price of bitcoin at the time of the announcement of the US curiosity price hikes did not have substantially volatility, as the marketplace had anticipated the Fed to slow the price hike.

However, in the following hrs, BTC regained momentum and jumped close to 07:thirty, only to temporarily make a new higher at $24,255, the highest selling price so far in 2023. This is also the very first time due to the fact August 2022 that Bitcoin it was in a position to break out of the $24,000 selling price zone.

Ethereum (ETH) speedily caught on to the BTC rally and traded in the direction of $one,696, totally recovering what was misplaced all through the FTX crash final November.

Even the finest altcoins in the marketplace are surging with four-twelve% volatility at the second.

In the previous twelve hrs, the sum of derivatives orders cleared was just $114 million, far fewer than in former sudden highs and lows, with brief purchase volume at 78%.

The cryptocurrency marketplace has just closed January 2023 with a decisive turning stage, with Bitcoin recording a development of 39.eight%, the finest in the final ten many years.

Many important altcoins in latest instances even have x2, x3 and set new ATHs like Aptos (APT) or Optimism (OP).

With February ordinarily getting a “smooth” time period in Bitcoin’s background, plus minor volatility chance from macro information or inside the cryptocurrency marketplace, a lot of crypto traders assume BTC to lengthen their rally additional. .

Synthetic currency68

Maybe you are interested: