Bitcoin (BTC) price has once again reached an unprecedented peak, surpassing $85,000 for the first time in history. The event has fueled optimism in the market, with some analysts suggesting that perhaps a Bitcoin price correction may not be far off.

Additionally, predictions are growing that BTC could skyrocket to $100,000 by the end of the year. So what’s really going on?

Bitcoin’s impressive performance stirs up greed

Over the past seven days, Bitcoin price has increased by nearly 20%. This increase is related to Donald Trump’s landslide victory in the November 5 US election. A significant increase in institutional demand for BTC may also be responsible for the cryptocurrency’s decline. reached a new record high.

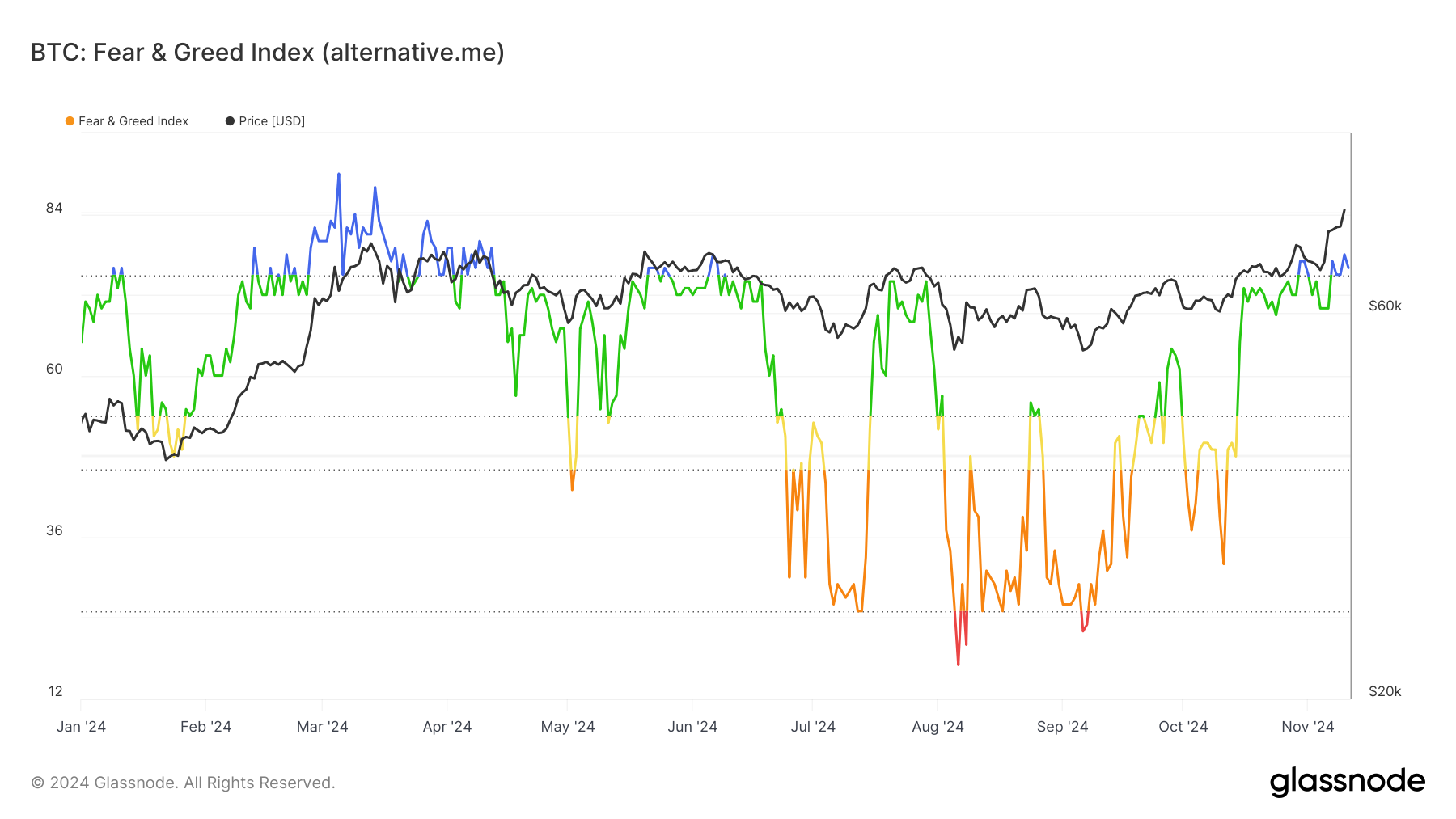

To determine whether Bitcoin can go even higher or if we have reached a local top, it is important to identify whether the market is extremely greedy or fearful. According to Glassnode, Bitcoin’s fear and greed index has reached extreme greed levels. Created by Alternative.me, this gauge evaluates investor sentiment by aggregating data from a variety of sources.

The index ranges from 0 to 100, with close to 0 meaning “extreme fear”, reflecting highly negative sentiment. In many cases, this area shows an almost perfect cumulative score. Conversely, a score near 100 indicates “extreme greed,” indicating maximum fear of losing opportunity (FOMO). If maintained, this position could lead to a period of Bitcoin price correction.

Since the beginning of the year, the last time the index reached this level, BTC price collapsed after a few weeks and entered a long period of correction and accumulation. Therefore, if past results influence the current event, it is possible that BTC is close to a correction.

More interestingly, this phenomenon coincides with a warning from CryptoQuant CEO Ki Young Ju. On Sunday, November 10, Young Ju forecast that the year-end BTC price could be much lower, at $58,974. He also mentioned that the market appears to be overheating which could lead to a Bitcoin price correction in 2025.

“I expected a correction due to the BTC futures market index being too hot, but we are entering the price discovery phase and the market is heating up even more. If a correction and consolidation occurs, the price increase may last; However, a strong recovery late in the year could prepare for a bear market in 2025,” Ki Young Ju emphasize on X.

Investors continue to buy, but experts advise caution

Contrary to CryptoQuant CEO’s view, the Coinbase Premium index has shown a significant increase. This index measures the activity of US investors. The high value could indicate strong buying pressure from US investors on Coinbase.

Conversely, low values may suggest high selling pressure. Therefore, as current results suggest otherwise, Bitcoin price may continue to rise.

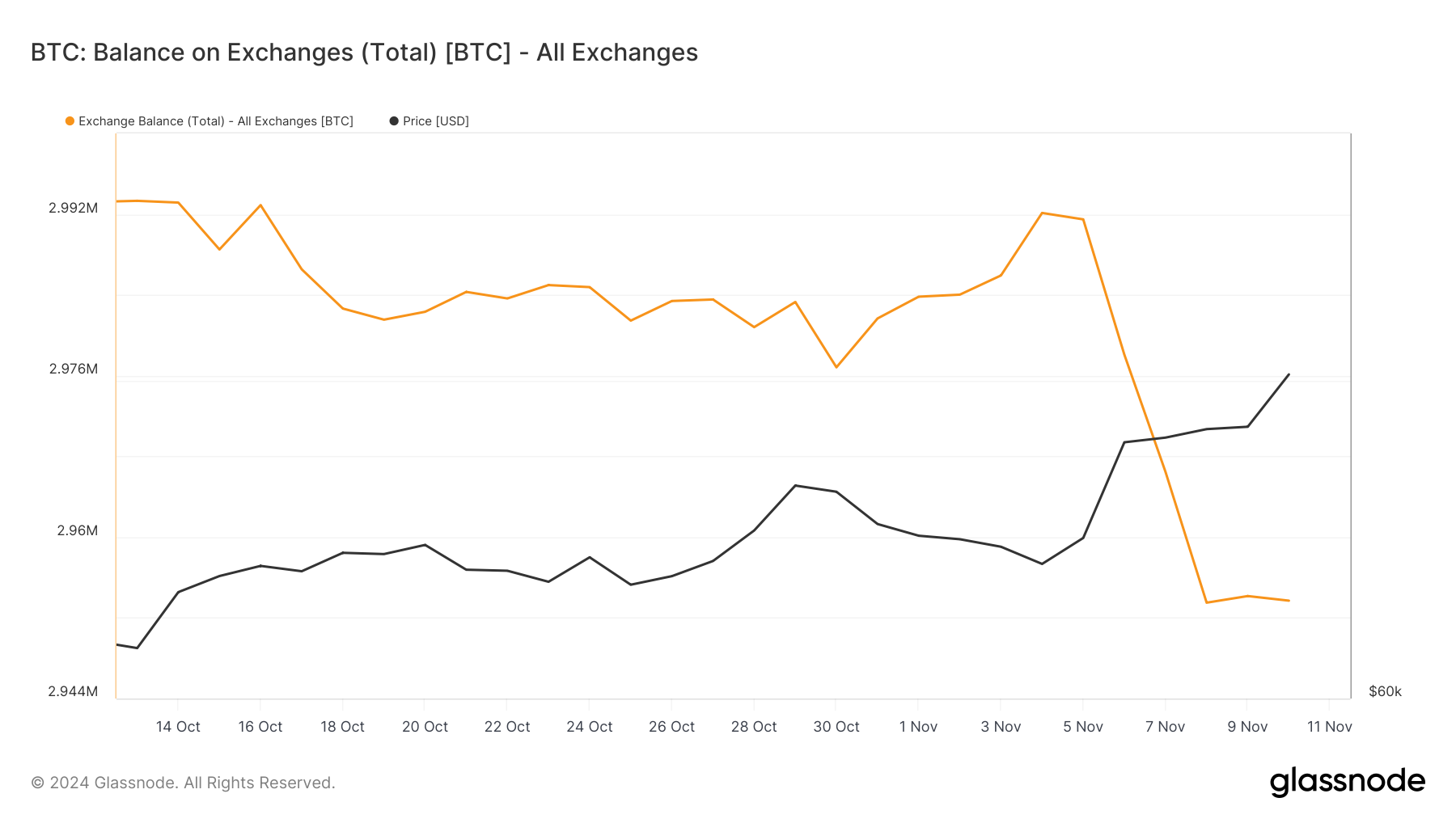

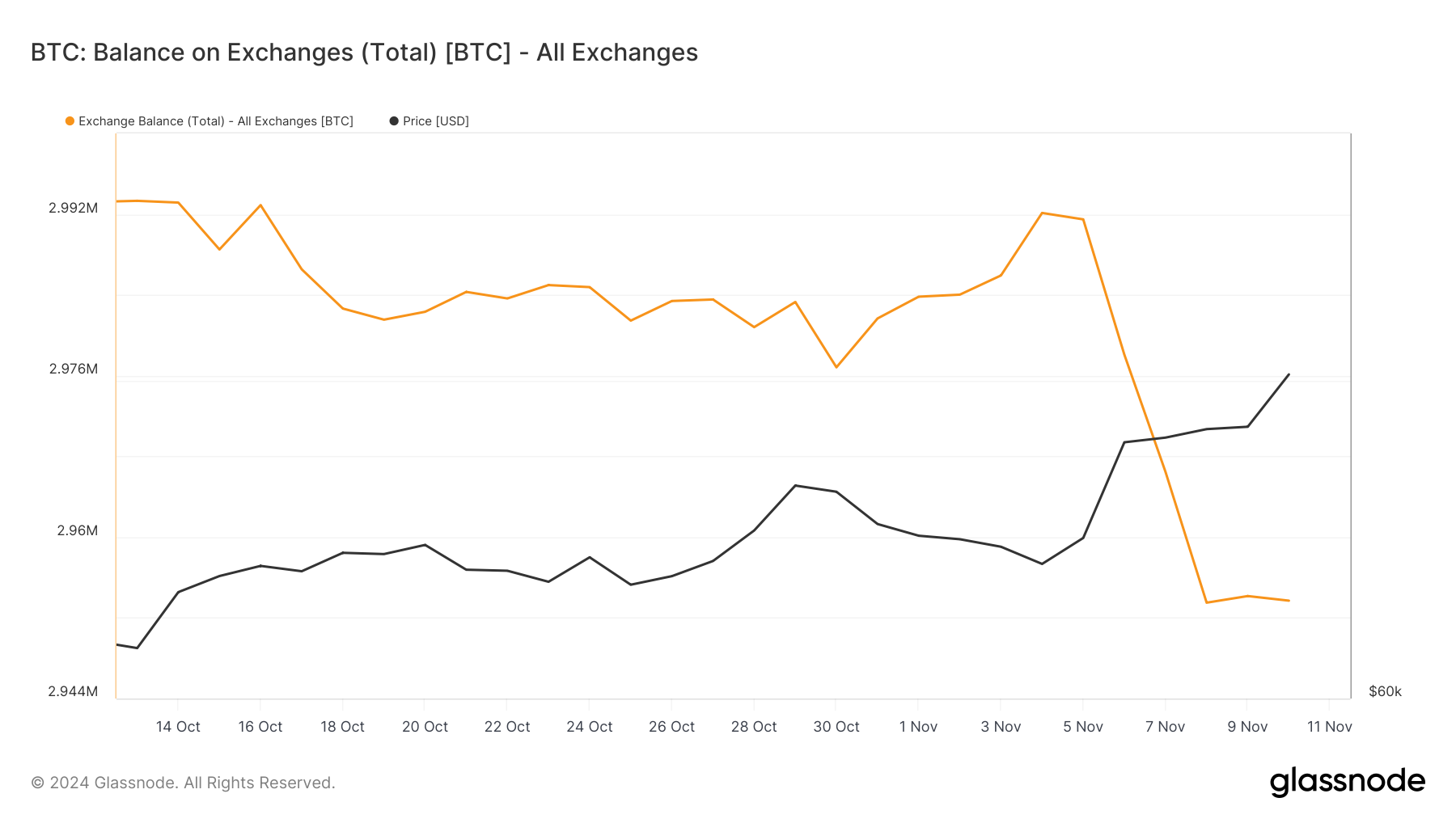

Furthermore, data from Glassnode shows that BTC balances on exchanges have decreased significantly. Exchange balance is the total amount of coins held in exchange addresses.

When rising, it means more holders are willing to sell, which can lead to a decline. Based on the above data, Bitcoin holders have withdrawn nearly 40K BTC from exchanges since November 5.

At current prices, this is worth more than $3 billion. If this continues, then a Bitcoin price correction may not occur in the short term. Instead, the price of this cryptocurrency may continue to increase.

Crypto analyst Michaël van de Poppe, as well as Young Ju, pointed out that a significant increase in futures positions could push Bitcoin prices down initially before the uptrend resumes.

“Large futures positions are open and I think we will see a correction next week before resuming the uptrend. These regulatory opportunities are huge,” van de Poppe speak.

BTC price prediction: RSI enters overbought zone

Currently, Bitcoin is trading at $84,760, and the daily chart shows the cryptocurrency trading above both its 20-day and 50-day exponential moving averages (EMAs). This shows that the Bitcoin trend is growing.

However, the relative strength index (RSI), which gauges momentum, broke above the 70.00 level. Typically, when RSI is below 30.00, it indicates oversold. But since it is now above 70.00, it means BTC is overbought.

So, there is a possibility that a quick correction could occur in Bitcoin price. If that happens, the cryptocurrency could drop to $76,571. On the contrary, if the bulls do not give the bears any chance as of now, this may not happen. Instead, BTC could rise above $86,000 and get closer to $100,000.