After a difficult week of moves, Bitcoin (BTC) is forming optimistic signals, hoping to pave the way for a optimistic rally to come.

According to Santiment, in contrast to the latest bearish trading sessions of Bitcoin, the transaction volume on April 19 has elevated drastically, in particular in contrast to the weekend time period, which generally requires very minimal volumes. .

📈 On a good day to rebound for #crypto, trading volume elevated drastically right after a especially dormant weekend as costs speedily reverted to pre-Thursday declining costs. Congratulations to people who have had the courage to do so #buythedip final weekend. https://t.co/vFTbPHTFPY pic.twitter.com/rMBw7kesFz

– Santiment (@santimentfeed) April 18, 2022

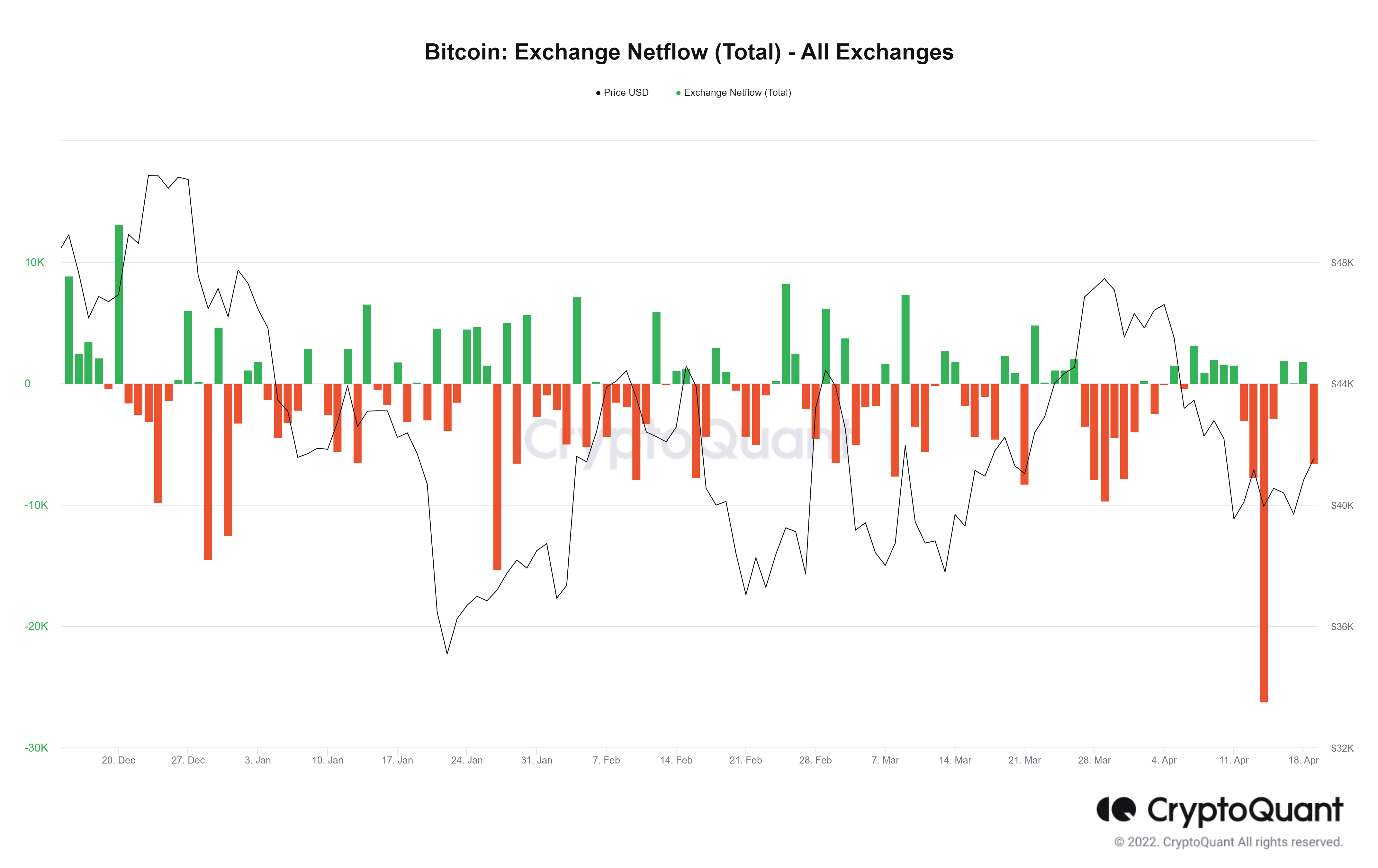

According to a different CryptoQuant information presented by analyst Minkyu Woo, when the BTC sale took spot, there was sizeable volume from the most well-known exchanges in the industry. . She implied that the whales may well have purchased a huge volume of BTC simply because the index was calculated by on the lookout at the inflows of BTC in and out of the world’s major ten exchanges.

Buy the concern of whales.

“A price range of BTC between 37K ~ 40K is where this accumulation phase has been going on from March 2022 until today.”

from @minkyutekkenRead more👇https://t.co/s8sOKjgSjS pic.twitter.com/91sxtAYv8n

– CryptoQuant.com (@cryptoquant_com) April 18, 2022

Minkyu Woo views BTC’s $ 37,000 to $ forty,000 rate selection as an crucial accumulation time period that has taken spot because March 2022 and encourages traders to hold or get extra if achievable. In the previous, in situations that measured a spike in BTC’s withdrawal volume, the bullish response quickly reversed the quick-phrase bearish sentiment in the industry.

#BTC Daily chart,

A clear motion of clever funds has been detected because the fourth quarter of 2020. (Inflow of MA stablecoins)

Seeing the chart beneath, BTC is plainly in the reduced zone and it really is genuinely difficult not to get BTC now. #BTC #Bitcoin pic.twitter.com/ofbtH8UqLQ

– Minkyu Woo (min) (@minkyutekken) April 18, 2022

A related image is unfolding now as BTC recouped all of its losses very speedily final week and even challenged the $ 42,000 threshold at press time.

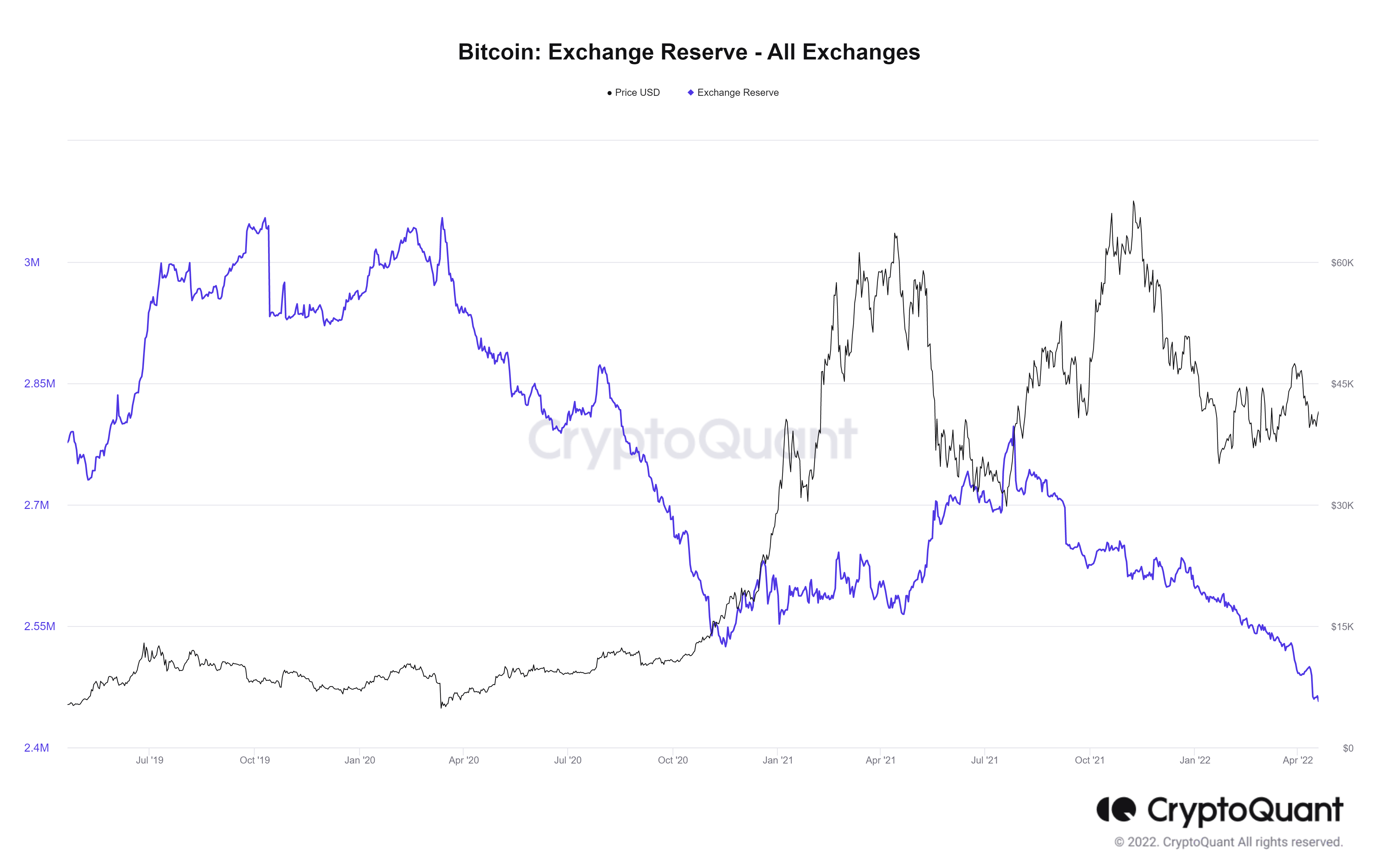

On the other hand, as Bitcoin continued to fall beneath the $ 39,000 mark due to mind-boggling backlog stress from miners on April 18, the BTC provide index in reserve on exchanges also transformed, hitting a new degree. minimal. It really should be mentioned that with only two million BTC left mined because the 19 millionth coin was mined on April one, scarcity is confident to be a sizeable driver for the subsequent BTC rally, in particular towards an ever-expanding wave of adoptions and investments in all nations, corporations and folks.

In terms of information on Bitcoin’s net deposits and withdrawals created on exchanges, we can very easily see that because the starting of 2022, anytime BTC drops to USD 39,000, a really solid accumulation motion promptly happens (indicated by prolonged red lines. ). The highest was on April 15th, whales took the chance to include up to $ one.two billion in BTC. This demonstrates the higher chance that the USD 38,000-39,000 rate selection is presently a new minimal for Bitcoin.

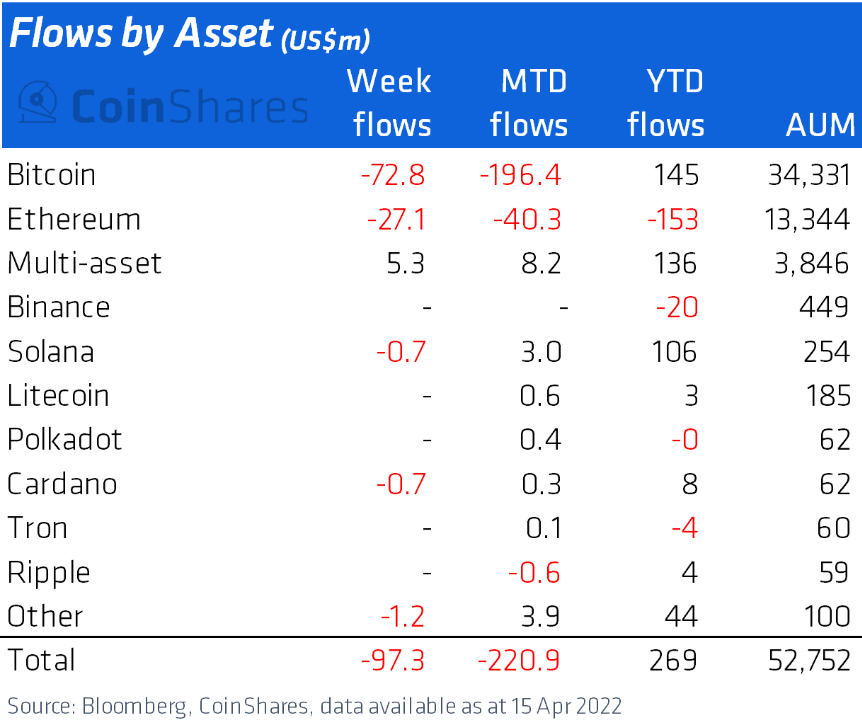

However, in terms of institutional investment, crypto money have had a 2nd consecutive week of Bitcoin “unloading”. According to information on weekly investment flows presented by CoinShares, $ 97 million has escaped the pockets of the large names, but this is by some means significantly less critical than the worst retracement because early 2022 to $ 134 million in the prior week.

Summary of Coinlive

Maybe you are interested: