The return of Bitcoin Ordinals and BRC-twenty has brought on grid gasoline costs to skyrocket, immediately bringing revenue to mining businesses.

Bitcoin transaction costs have elevated almost one,000% due to the fact August thanks to the return of Ordinals

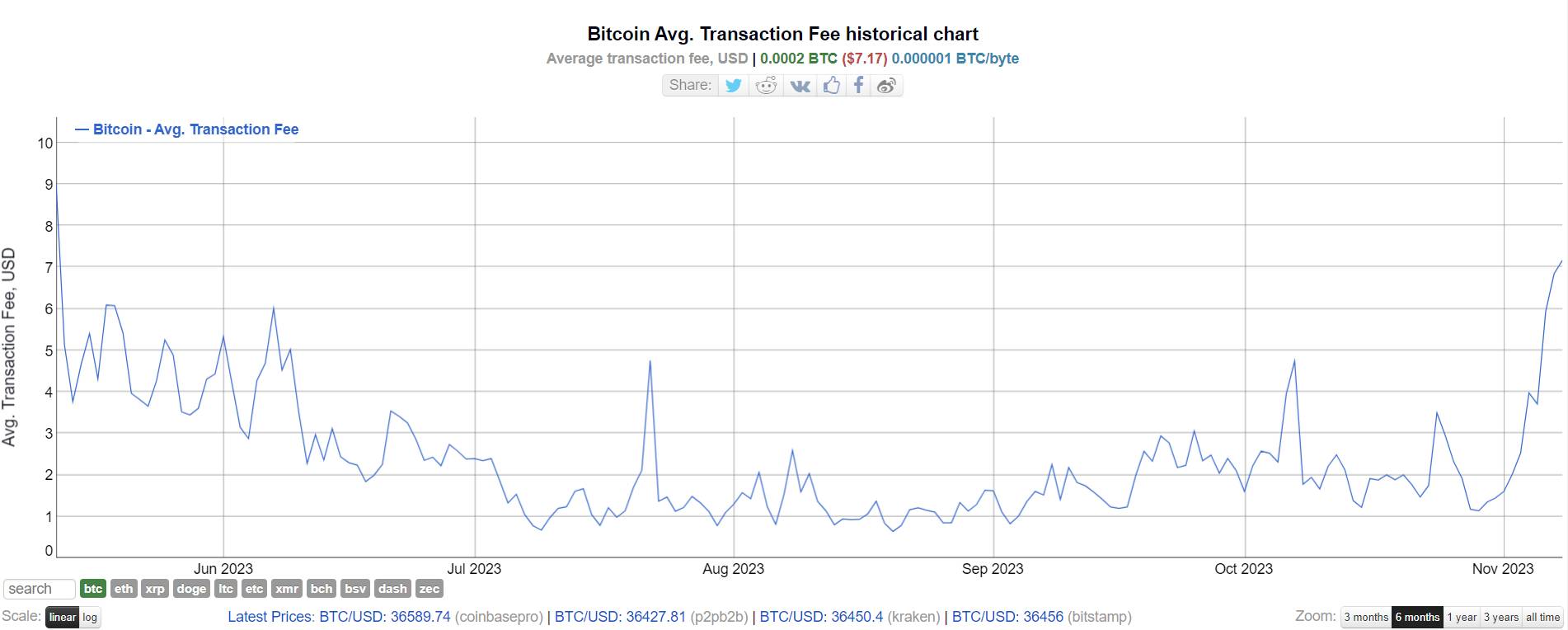

Bitcoin transaction costs have elevated almost one,000% due to the fact August thanks to the return of Ordinals

Bitcoin transaction costs elevated to the highest degree due to the fact the meme coin craze in May 2023, thanks to the transformation of Bitcoin Ordinals and BRC-twenty waves.

In August, when the sideways market place was gloomy and the key phrase “BRC-20” was progressively “dead”, the BTC transaction charge at that time was only USD .64. But nowadays this figure has elevated by all around 970%, settling at USD six.84.

Average Bitcoin transaction costs above the final six months. Source: BitInfoCharts (November 9, 2023)

Normally, escalating costs on the blockchain implies that customers have a higher demand to transact and use that blockchain. Typically for Ethereum, gasoline costs enhance and network congestion happens when specified tasks are underway scorching hitsattracting customers to experiment, purchase and promote NFTs and “plow airdrops”.

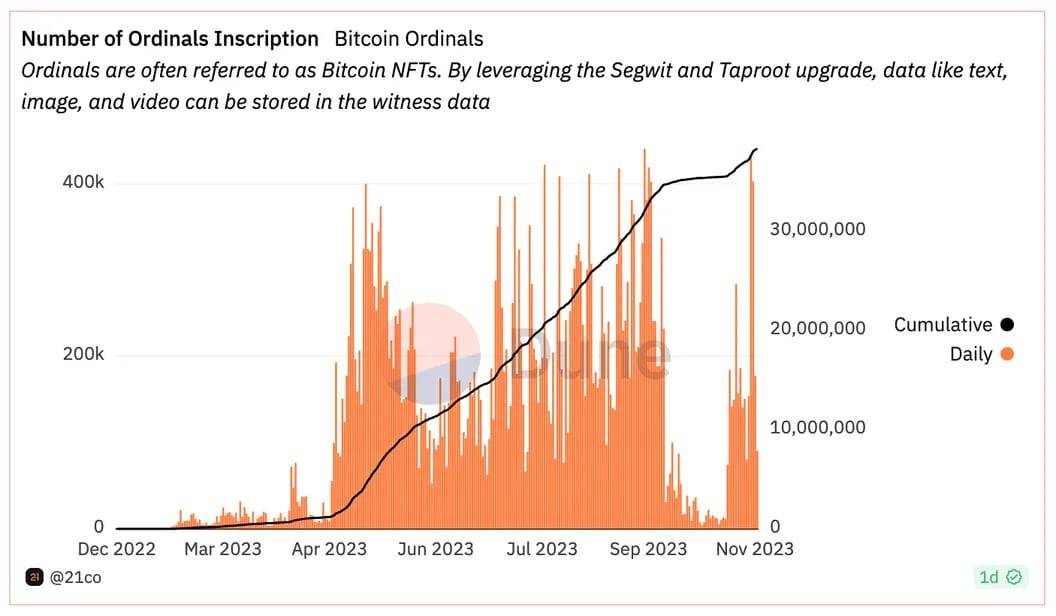

The story is very similar with the Bitcoin blockchain. According to the digital asset management firm 21Sharesthe quantity of subscriptions uploaded to the chain in the final two weeks is just about one.9 million, displaying an enhance in demand.

Number of registration orders on the Bitcoin network. Source: 21.co compiled on Dune Analytics

Number of registration orders on the Bitcoin network. Source: 21.co compiled on Dune Analytics

Data CryptoSlam It also displays that Bitcoin is foremost in NFT income volume (minus wash trading transactions) above the previous 24 hrs, surpassing Ethereum, which is the NFT ecosystem that often dominates the market place.

The cause Ordinals has had a magnificent “comeback” is partly mainly because Binance just did ORDI listing announcementit is the 1st BRC-twenty token to seem on this exchange.

Thanks to the Binance identify and as evidenced by the steady enhance in the rate of ORDI due to the fact its listing, customers have begun to get an curiosity in Bitcoin NFTs once again, escalating on-chain minting action, leading to gasoline costs to skyrocket.

The 21Shares analyst explains:

“Although the current role of Ordinals is limited to the memecoin segment, their explosion confirms demand for the Bitcoin block space.”

Additionally, the enhance in gasoline costs immediately added benefits BTC miners as transaction costs now account for around eight.five% of their income. This quantity will enhance when the Bitcoin Halving 2024 happens.

Also on the morning of November 9, Vietnam time, the rate of BTC officially surpassed the USD 36,000 mark and is “testing a new peak” of 2023.

Coinlive compiled

Join the discussion on the hottest problems in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!