The social network Twitter (X) exploded on the evening of October sixteen when rumors appeared that the SEC would approve BlackRock’s iShares Bitcoin ETF proposal.

Bitcoin ‘Virtual Pump’ to $thirty,000 Due to Fake News SEC Approves BlackRock’s Bitcoin Spot ETF Proposal

Bitcoin ‘Virtual Pump’ to $thirty,000 Due to Fake News SEC Approves BlackRock’s Bitcoin Spot ETF Proposal

The over information and facts was shared by information web-site Cointelegraph on its official X account.

Original tweet from Cointelegraph (this submit has because been deleted)

Original tweet from Cointelegraph (this submit has because been deleted)

However, the neighborhood is nevertheless “hunting” for the supply of the over information and facts, for the reason that thorough paperwork have not nevertheless been published.

ETF analyst James Seyffart of Bloomberg believes that the over information and facts is unfounded. However, this account nevertheless believes that the all round progress by the Bitcoin ETF proposal is nevertheless good.

I think this is fake information.

While this would be good for the factors we are saying. I can not obtain anything at all to verify this at the second. #Bitcoin https://t.co/gVGGUsBfga

—James Seyffart (@JSeyff) October 16, 2023

Then journalist Eleanor Terrett refused FOX Business stated that she contacted BlackRock for confirmation, and was informed by the asset management business that the over information was false.

🚨BlackRock just confirmed to me that this is false. Their request is nevertheless below critique. https://t.co/XifIWZ0Ule

— Eleanor Terrett (@EleanorTerrett) October 16, 2023

BlackRock confirmed that its proposed Bitcoin spot ETF is nevertheless below critique and awaiting SEC approval.

🚨NEW: Official statement a @FoxBusiness from @Black Rock:

“The iShares Spot Bitcoin ETF is still under scrutiny by the SEC.”

— Eleanor Terrett (@EleanorTerrett) October 16, 2023

At the time of creating, quickly just after the over information and facts was launched, Bitcoin had a sharp rise to $thirty,000 only to abruptly plummet to $28,000 when the information was rejected by BlackRock.

15 million chart of the BTC/USDT pair on Binance as of eight.55pm on October sixteen, 2023

15 million chart of the BTC/USDT pair on Binance as of eight.55pm on October sixteen, 2023

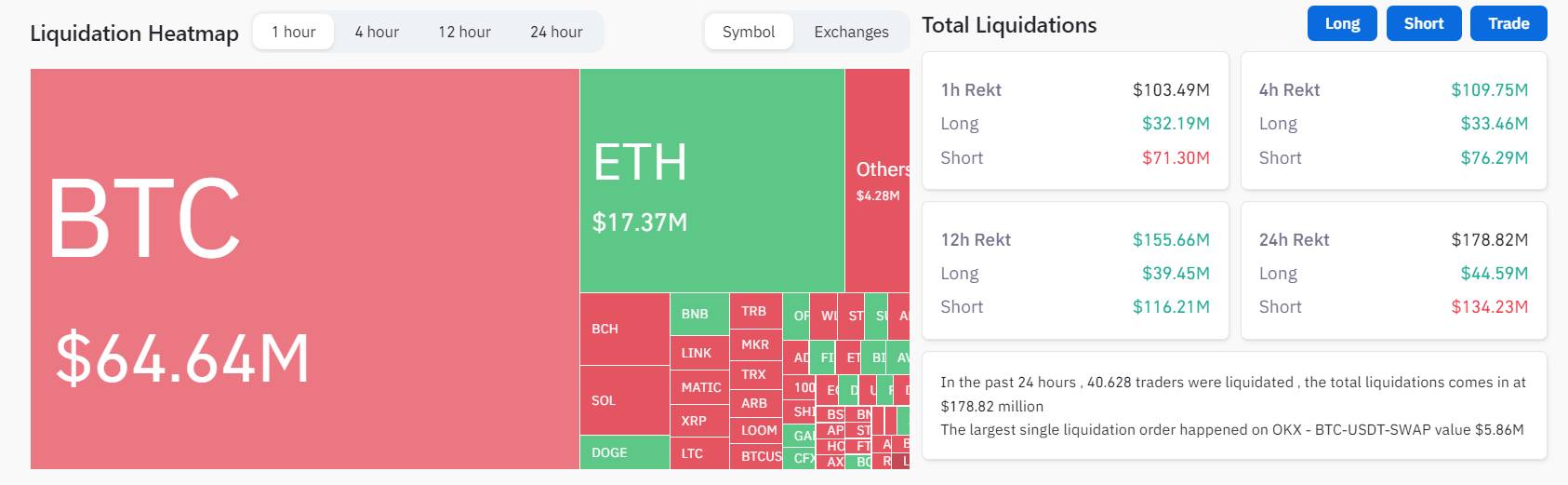

According to Coinglass statistics, a lot more than $one hundred million in crypto derivatives orders have been burned in the final hour, generally coming from Bitcoin. Of these, the percentage of quick-phrase orders represents pretty much 69%.

Cryptocurrency market place settlement information as of 9pm on October sixteen, 2023. Photo: Coinglass

Cryptocurrency market place settlement information as of 9pm on October sixteen, 2023. Photo: Coinglass

As Coinlive reported, at the finish of September the US Securities and Exchange Commission (SEC) postponed its critique of all Bitcoin spot ETF proposals from Wall Street giants. The SEC has not nevertheless licensed any spot Bitcoin ETFs due to considerations about fraud and value manipulation in the cryptocurrency market place.

Cryptocurrency ETF proposals are below scrutiny by the SEC. Photo: Bloomberg

Cryptocurrency ETF proposals are below scrutiny by the SEC. Photo: Bloomberg

This incident is reminiscent of the time when Litecoin (LTC) was also “pumped and dumped” in 2021 due to fake information in collaboration with Walmart.

Coinlive compiled

Join the discussion on the hottest challenges in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!