The world’s # one cryptocurrency Bitcoin (BTC) has had sudden ups and downs, with inflation continuing to be the result in in the United States.

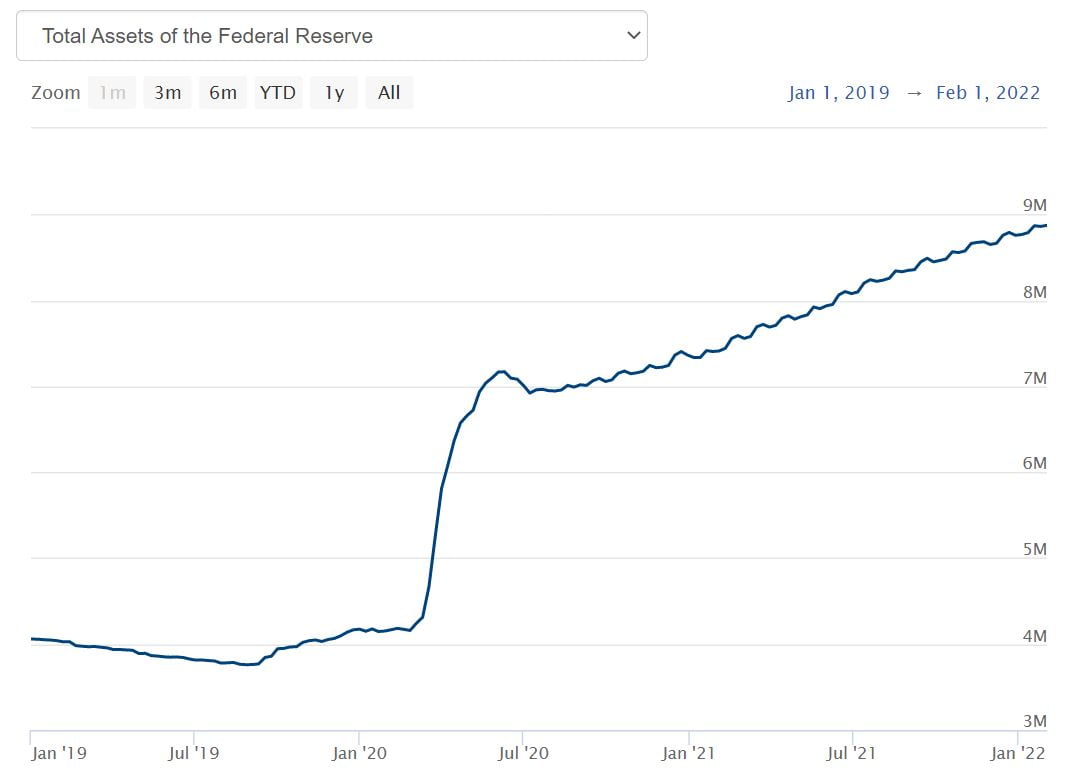

On the evening of February eleven, the US financial statistics companies launched the hottest inflation information. This information is followed not only by the cryptocurrency market place, but also by the common monetary and securities industries simply because the United States has skilled a steady improve in the fee of inflation following a time period of two many years due to the fact the fourth quarter of 2021. printing funds to conserve the economic system ahead of the COVID-19 pandemic. According to statistics, additional than 50% of the existing USD give has been printed by the US government in the previous two many years.

History of Bitcoin and US inflation

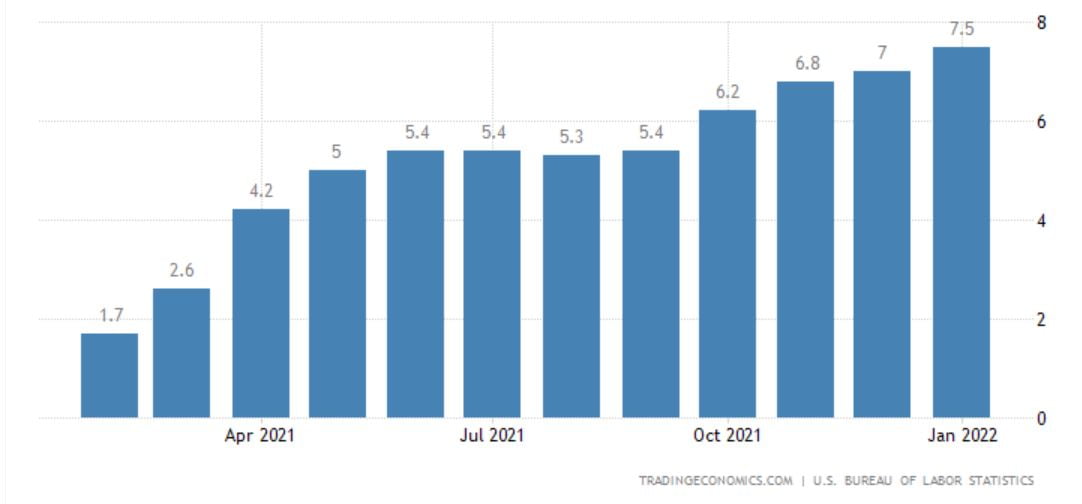

Inflation in the United States commenced increasing from October 2021, reaching six.two%. In the following months, that fee remained on an upward trend and peaked at seven.five% in January 2022, the highest degree in 4 decades.

The first information of increasing inflation has been incredibly very well obtained by the cryptocurrency market place, with The great Bitcoin rallies each time inflation figures for October, November and December are launched.

Rising inflation signifies the dollar is depreciating, creating the worth of BTC and altcoins to rise as they are viewed as an successful investment alternative to safeguard assets. The greatest cryptocurrency in the planet even hit an all-time higher of $ 69,000 in mid-November 2021 following information that inflation in the US has risen.

However, by January 2022, the standard sentiment in the monetary and cryptocurrency markets had steadily turned into concern about US inflation displaying indicators of having out of management. The explanation is that the US Federal Reserve (Fed) will definitely have to stage in to management inflation, by decreasing USD provide and raising curiosity charges on credit score. The “ghost” of increasing curiosity charges is the most important aspect that keeps the two stocks and cryptocurrencies in a “red” January. BTC corrected from $ 47,900 to $ 32,900 all through that time period.

However, at the meeting in late January, Fed officials determined not to increase curiosity charges for the time remaining simply because they did not want to produce an sudden effect on the market place. Instead, the timing for the curiosity fee hike will be moved to the up coming meeting in March 2022.

As a consequence, Bitcoin regained momentum in the recovery, moving from the very low of $ 32,900 to the area of $ 45,000.

BTC’s response to January 2022 inflation information

At all around eight:thirty pm on February eleven, the United States continued to publish January inflation information, as a consequence, inflation nonetheless rose .five% to seven.five%, the lowest degree. higher of the final forty many years.

BREAKING: US buyer charges rose seven.five% in January, the quickest yearly speed due to the fact 1982, growing stress on the Federal Reserve to aggressively tighten policy https://t.co/HZU1tehEVA pic.twitter.com/1zEBuPOAYf

– Bloomberg (@business enterprise) February 10, 2022

Even so, as opposed to in past instances, Bitcoin’s first response was detrimental. The greatest cryptocurrency on the market place offered sharply from $ 44,900 to $ 43,a hundred to the shock of lots of traders.

Some argue that the cryptocurrency market place is no longer optimistic about inflation information, simply because increasing inflation signifies the Fed’s approaching measures will be additional aggressive.

However, just above an hour later on, BTC started “building a column” to recover, returning to the area of $ 45,000 and even climbing to $ 45,821 all around 00:15 on February eleven, a higher worth threshold due to the fact January one, 2022.

Bitcoin has due to the fact returned to a downward trajectory, most not long ago hitting a very low of $ 42,600 all around seven:45 am, ahead of recovering to $ 43,600 at press time.

According to Coinglass information, the amount of derivative orders cleared in the final twelve hrs of a roller coaster trip of the cryptocurrency market place was $ 230 million, with $ 83 million coming from Bitcoin. In which, virtually 70% are lengthy orders. It can be viewed that the liquidation worth of the latest shifts is not higher, in contrast to the powerful market place dumps in the previous.

Synthetic currency 68

Maybe you are interested: