One of the prime Bitcoin miners in North America, Bitfarms, took benefit of the bear industry possibility and additional one,000 BTC to its stability sheet.

On January ten, Bitfarms announced that they have just purchased an more one,000 Bitcoins, bringing their complete holdings in BTC to thirty%, additional than four,300 BTC at press time. While Bitfarms does not disclose the typical value for the newest obtain, based mostly on the complete shell out of $ 43.two million, it can be assumed that the organization hit a minimal of $ 43,2000 per BTC.

👌🏻 Increase ours #Bitcoin equity investments thirty%

🔗 More information and facts: https://t.co/xCcIUHkWsU

🚀 $ BITF #BTC #BitcoinMining #Blockchain #NasdaqListed pic.twitter.com/zNz54ps5HK

– Bitfarms (@Bitfarms_io) January 10, 2022

CEO Emiliano Grodzki explained that with Bitcoin’s current decline mixed with mining hardware charges remaining higher, Bitfarms demands to seize the possibility to move additional dollars into BTC.

“Our directional strategy at Bitfarms is to accumulate the majority of Bitcoins at the lowest cost and in the shortest time for the benefit of our shareholders. To this end, we continuously optimize our capital allocation ”.

– See additional: Earnings from shares of Bitcoin Miner this yr absolutely beat BTC

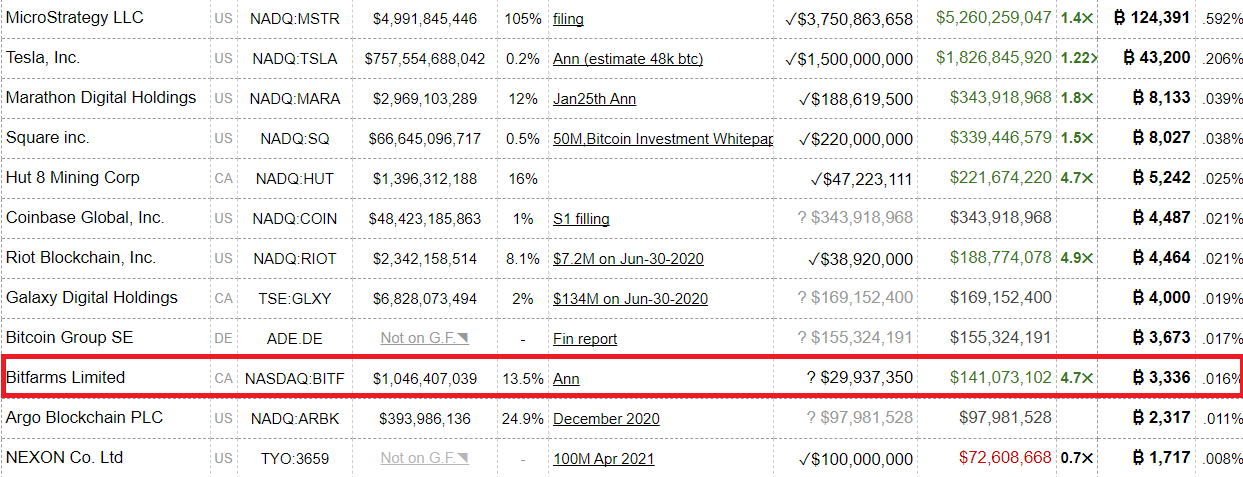

As for prior direct investments in Bitcoin, Bitfarms has often been at the prime of the most rewarding businesses. While the billion dollar investments in Bitcoin (BTC) of giants like MicroStrategy and Tesla had been all x2 at a time when Bitcoin was in solid development momentum in the direction of ATH $ 69,000, Bitfarms’ revenue jumped 760%.

Despite Bitcoin’s latest significant drop, Bitfarms’ investment index stays very amazing, with a four.7x return (not counting the one,000 BTC just purchased).

In addition, Bitfarms also exposed that it had mined three,452 Bitcoins more than the program of 2021. Mostly in August, 391 Bitcoins had been mined by the organization that owns 99% of clean power. The over benefits come mostly from the suppression of China. After the ban, Bitfarms straight away noticed a 50% development in Bitcoin mining productivity.

Founded in 2017, Bitfarms is a publicly traded organization in the United States and Canada. Shares of Bitfarms started trading on the TSX Risk Exchange (TSX-V) in July 2019 and on the Nasdaq in June 2021. The organization has 5 industrial-scale Bitcoin mining services found in Québec and a single facility in Washington state. .

Coin Summary 68

Maybe you are interested: