BTT, the native token that operates the decentralized peer-to-peer (P2P) file sharing platform BitTorrent, has become the focus of the market over the past 24 hours, increasing by 4%.

However, while this increase may reflect renewed interest in the token and a possible change in market sentiment, data from BTT’s price chart hints at a short-term correction.

BitTorrent Lacks Gaining Momentum to Continue Its Upward Momentum

The price of BTT has increased by 4% over the past 24 hours. As of press time, the altcoin is trading at $0.00000111, with trading volume moving higher.

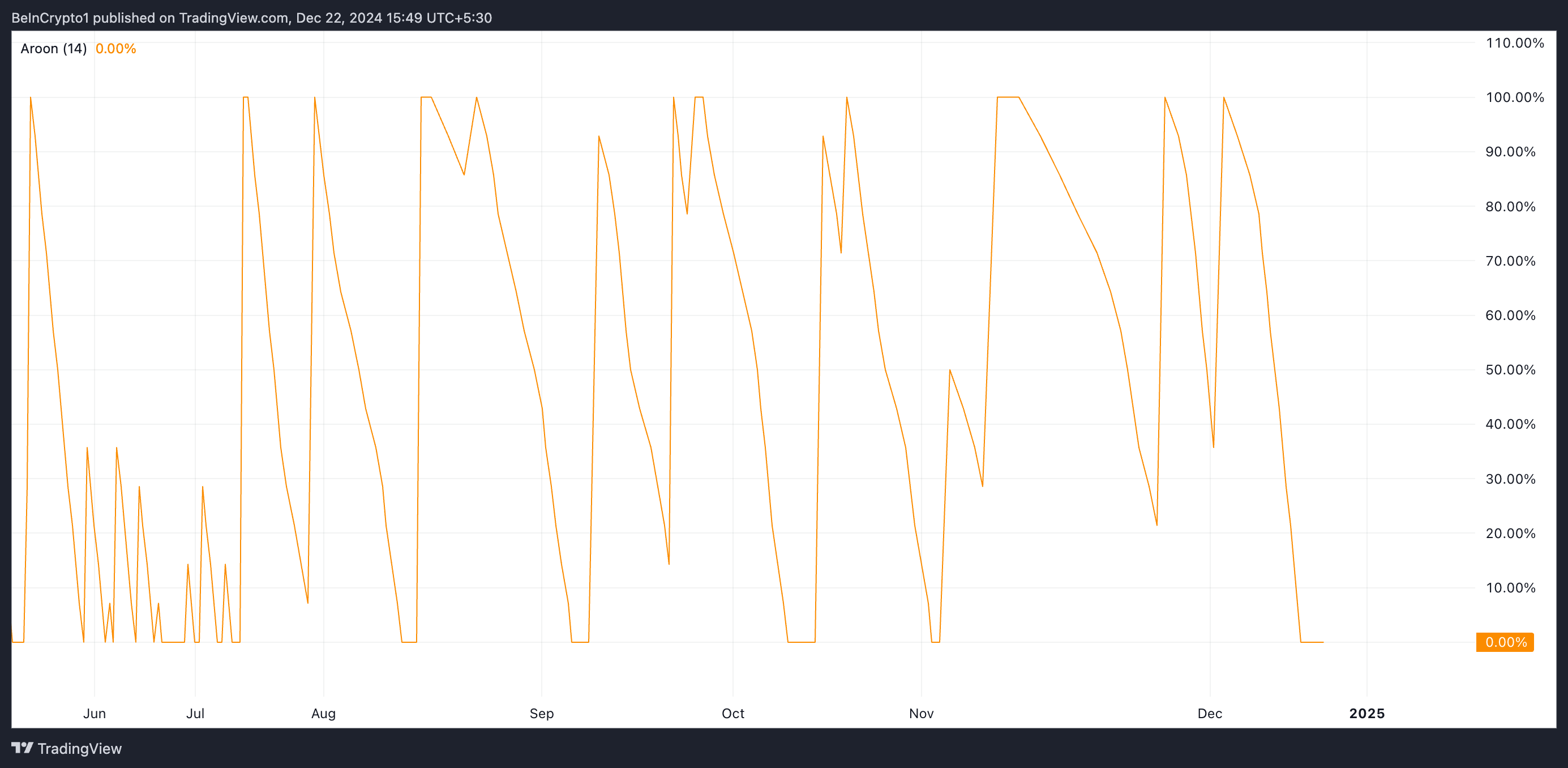

However, despite the price increase, BTT’s Aroon Up Line index is currently at 0%, indicating that the uptrend does not have strong momentum. The Aroon Index measures the strength and direction of a trend by evaluating the time since the highest high and lowest low over a specific period of time.

When the price of an asset increases while the Aroon Up Line index is at 0%, this indicates that although the price is increasing, there has not been a strong upward momentum recently. The Aroon Up indicator measures how recently a new trend peaked within a given timeframe. A value of 0% indicates that the asset price did not reach a new high within the specified time period.

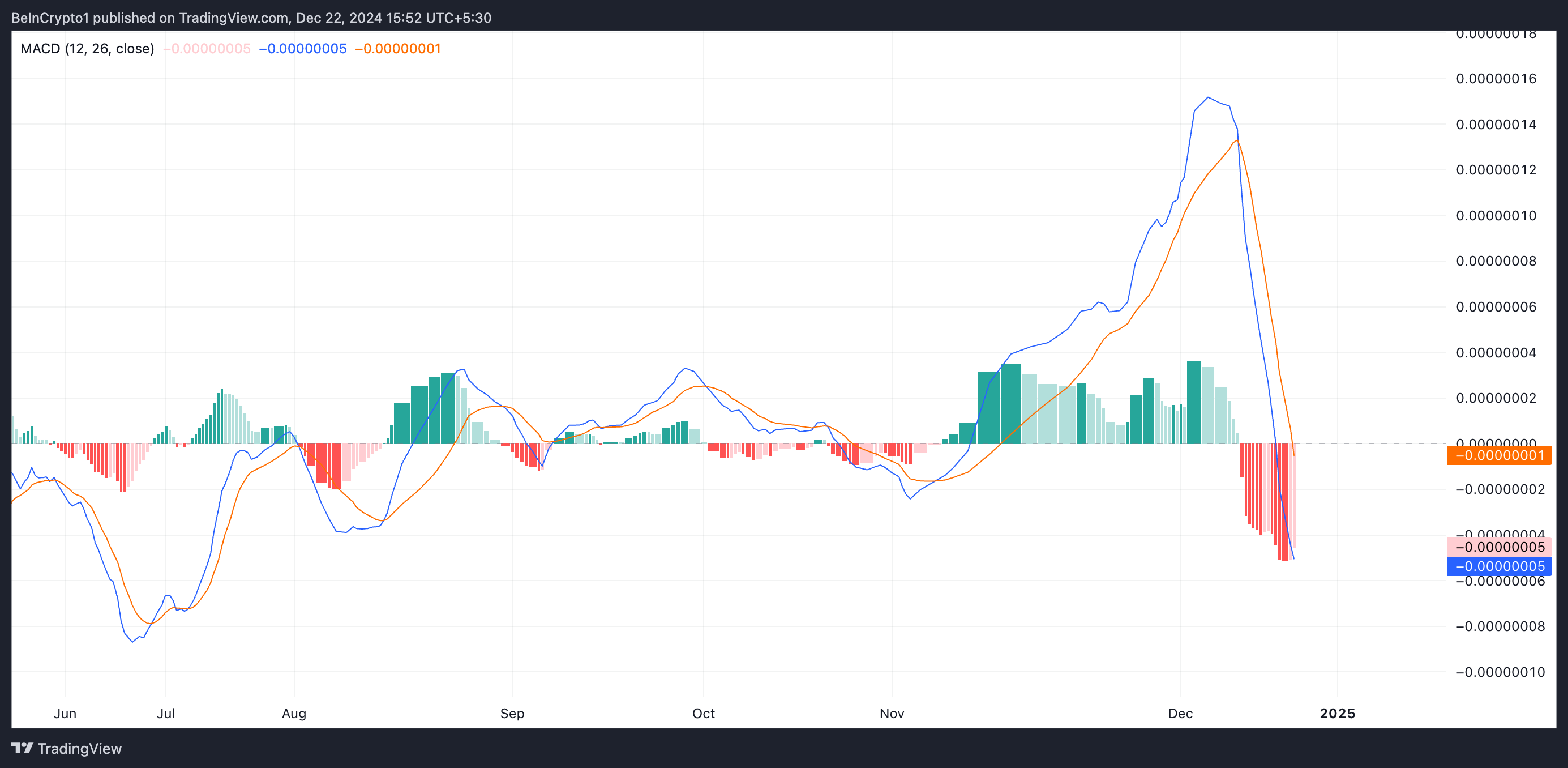

BTT’s Moving Average Convergence (MACD) indicator reinforces this negative view. At the time of writing, the Token’s MACD line (blue) is significantly below the signal line (orange).

An asset’s MACD indicator identifies the trend and momentum in its price movements. It helps traders identify potential buy or sell signals through the crossover between the MACD line and the signal line. As in the case of BTT, when the MACD line is below the signal line, this indicates a bearish trend, suggesting that the price of the asset may decrease. Traders often consider this crossover a potential sell signal.

BTT Price Forecast: Token Eyes Critical Support, But Buyers May Increase Profits

According to the daily chart, BTT is currently trading above the critical support level at 0.00000093 USD. If the sell-off worsens, the token’s price could test this level. If sellers prevail, BTT could extend its decline and plunge to $0.00000067, a low it reached in August.

Conversely, if buying pressure strengthens, BTT could continue its upward momentum and surpass the resistance at 0.00000114 USD. A successful breakout of this level could help the Token regain $0.00000128.