Mike McGlone’s strategist Bloomberg It is only a matter of time prior to the US approves a Bitcoin ETF.

In an interview on Sept. 21, McGlone mentioned Canada’s approval of the Bitcoin 3iQ and CoinShares ETFs in April of this 12 months is triggering income out of cryptocurrency investments from the United States. This is notably evident in the truth that Cathie Wood’s Ark Invest fund is selling investments in these ETFs. Therefore, the strategist of Bloomberg believes that to retain a aggressive edge, US lawmakers will quickly have to approve this variety of crypto investment.

An ETF is a common variety of investment fund, which lets traders to accessibility the fund’s assets but without having owning to hold the assets right.

When asked when the US will launch a Bitcoin ETF, McGlone mentioned it could be “as early as the end of October”. The analyst also sees a higher probability that the very first ETH Bitcoin fund will be a futures product or service, saying it “will open the door to a massive influx of cash.”

Mr. McGlone also shared his most current report on Bloomberg, predicts that Bitcoin will possible attain $ one hundred,000 in 2021, with the momentum coming from the arrival of a Bitcoin ETF.

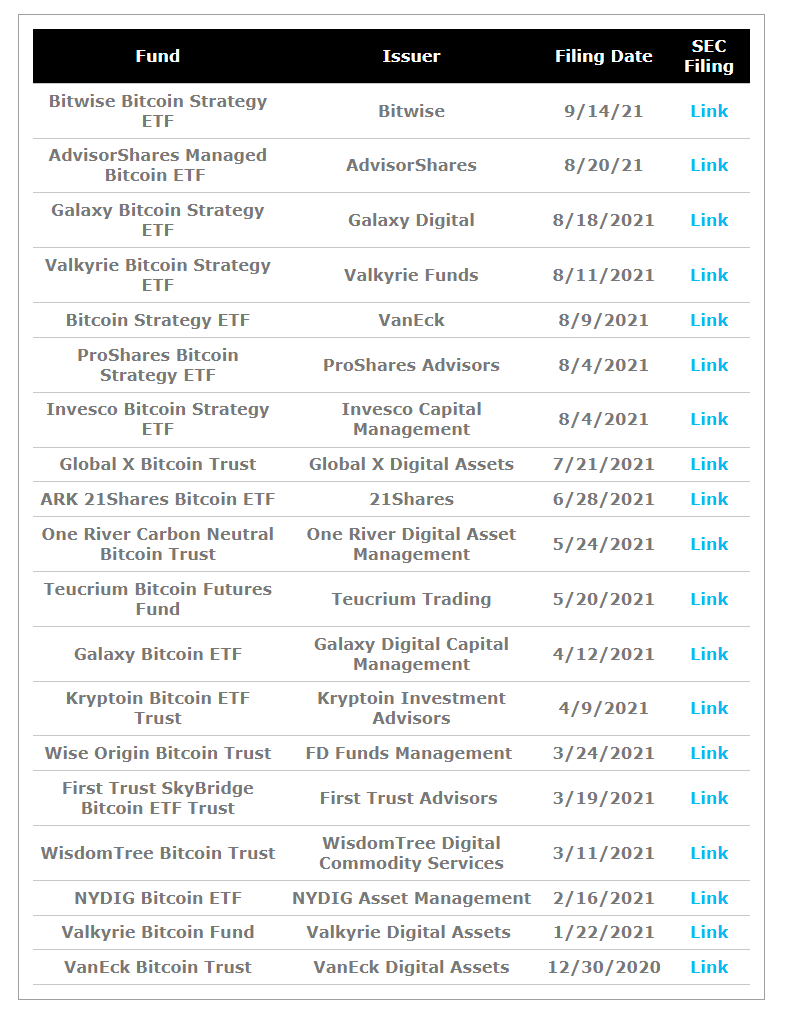

Even so, there are no US authorized Bitcoin ETFs so far. The US Securities and Exchange Commission (SEC) is even now fairly concerned about Bitcoin ETFs, in spite of quite a few units owning utilized to set up this variety of investment from 2018 right up until now.

Synthetic currency 68

Maybe you are interested: