There are numerous resources to aid us analyze and recognize the marketplace correctly, from basic things to technical evaluation. Among them, Bitcoin Dominance is normally a trump card that aids raise the probability of proper guessing by traders irrespective of college, brief-wave traders or lengthy-phrase hodlers. This short article will clarify the strengths and weaknesses, as very well as analyze extra varied perspectives on BTC dominance. Hopefully by way of that you can figure out a sensible and ideal tactic for your self.

Basic

For individuals who have just stepped into crypto, or have just realized this business for a though, you need to refer to the short article What is BTC Dominance?. Some essential vital factors we need to master:

- BTC Dominance is the indicator that speaks correlation power of Bitcoin relative to the whole crypto marketplace. A greater quantity signifies that BTC is dominating the marketplace, though a reduce quantity signifies a weakening of the BTC coin.

- Monitoring BTC Dominance can also demonstrate us Movement income movement What’s going on in crypto? The Spillover impact, in crypto, is very similar to that in other money markets. Nom na is dollars flowing to the valley.

- Grasp the over two things, we will be capable to go up trading program for themselves, when contemplating “BTC Price”, “Total Market Cap” along with BTC Dominance. Note that working with BTC Dominance in mixture with other indicators will have a considerably much better impact than working with it alone. Two situation analyzes later on in the short article will clarify this stage.

Those will be the three primary difficulties we will examine in extra depth under.

Correlation power

Why is BTC Dominance an indicator of Bitcoin’s relative power? Let’s get a search at the Dominance formula for any coin X:

Dominance X = Coin marketplace capitalization X / Total crypto marketplace cap x one hundred%

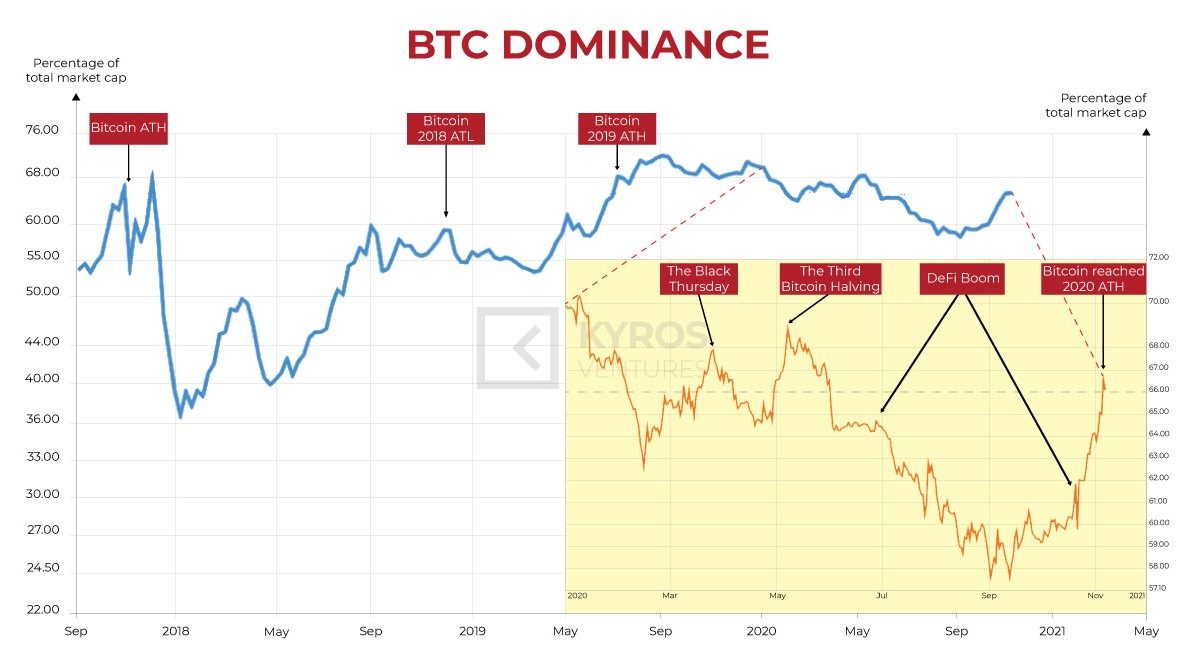

The over formula, when utilized to Bitcoin, will demonstrate the correlation of BTC capitalization to the complete marketplace capitalization at a offered time. When all these instances are mixed into a trend, we have the BTC Dominance chart. Let’s get a search at the relative power of BTC through the bull cycle from late 2017 to the existing.

BTC price tag top rated/bottom is not always BTC Dominance top rated/bottom. Notice the following milestones and their positions on the chart:

- Bitcoin ATH 2017

- 2018 ATL Bottom

- Peak ATH 2019

We can observe Bitcoin price tag peaks and troughs usually in advance of The top rated of BTC Dominance appeared. In other phrases:

The BTC Dominance peak will verify the BTC price tag top rated/bottom.

We can apply BTC Dominance to do confirmation signal trusted immediately after the Bitcoin price tag has just produced a new higher or lower. For illustration, the truth that BTC Dominance also peaked correct immediately after the Bitcoin price tag peaked would reinforce the belief that Bitcoin’s prior peak was by now ATH. The situation with the Bitcoin bottom has the exact same logic, but the confirmation peak of BTC Dominance will have a close to-simultaneous time when the BTC price tag bottoms.

BTC Dominance is presently all around the 65% mark, which is 70% reduce than the 2019 BTC Dominance ATH of 70%. While the Bitcoin price tag is nevertheless sideways, it has not been capable to break $twenty,000. So in the close to potential we will have the chance to observe irrespective of whether Bitcoin can peak and have confirmation from BTC Dominance or not.

In exchange for the actual confirmation of the top rated and bottom of the Bitcoin price tag, this process has a lag and this delay is at times hard to measure. For that purpose, this tactic is usually extra ideal for lengthy-phrase traders than brief-phrase traders.

Cash movement shifting

The picture over illustrates how the fiat-to-crypto dollars movement will go. It is clear that Bitcoin is taking part in an particularly vital position in this circulation. Cash movement in crypto is very similar to spillover impact in other money markets all around the globe this kind of as stocks. When the stock marketplace is flourishing, dollars will movement from blue-chip stocks to penny stocks, and dollars will also withdraw in the opposite path when the marketplace is negative.

In crypto, our income movement will be Fiat/USD > Bitcoin > Altcoin top rated > Altcoin Mid-cap > Altcoin Low-cap. We’ve viewed a rotation like this as crypto has been displaying indicators of fantastic given that late July. Bitcoin took the lead, not lengthy immediately after that the top rated altcoins rose and last but not least the complete marketplace went green.

When the marketplace is favorable, income movement will prioritize pouring from harmless assets to riskier assets.

Without the inflow of dollars into altcoins, both straight or indirectly by way of BTC, the spillover impact is unlikely to be absolutely finished. Remember the 2017 peak of the crypto marketplace thanks to no tiny portion of the ICO. The ICO trend then was catalysts marketing spillover results from BTC to altcoins, led by ETH since most ICO tasks originate from the Ethereum blockchain. Fomo traders get tokens of ICO tasks with BTC, ETH and other altcoins When marketing tokens, the revenue in the two amount and price tag of BTC, ETH. The wave of new dollars flowing into the marketplace constantly and quickly is when we witness the peak of the Spillover impact.

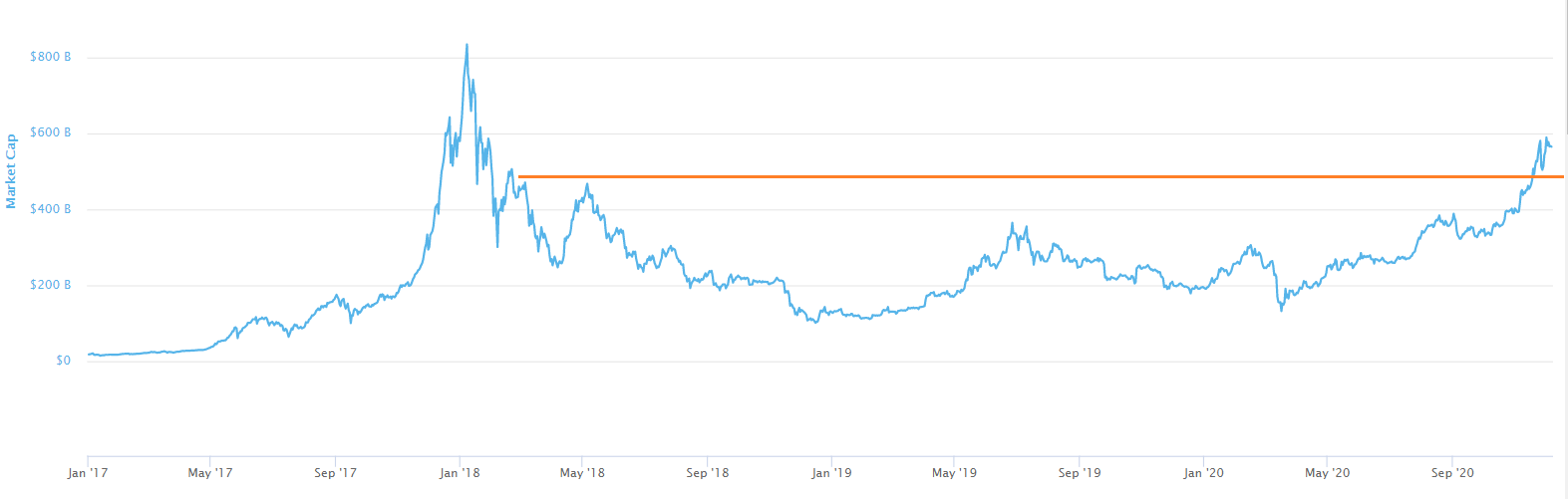

Currently, the 2020 crypto cap has surpassed the May 2018 peak (Figure two). But observe Figure three under, when the non-Bitcoin marketplace cap top rated has not nonetheless crossed the May 2018 peak. This proves a single matter:

The recent bullish momentum is relying also considerably on Bitcoin.

In purchase for us to see the complete marketplace to the moon once more like in 2017, it will absolutely will need a catalyst to drive the spillover impact. Knowing that this 2020 bullrun is unique from the 2017 bullrun, what could be the catalyst for the up coming bull run? DeFi, Ethereum two. or CBDC? All of this will be mentioned in the following difficulties of Coinlive. Hope you study it and search forward to it!

Well, immediately after recognizing the fundamentals, can you confidently enter the marketplace? Is the real application of BTC Dominance to the transaction as planned? Let’s discover out the final but most vital portion: Real fight.

Trading tactics

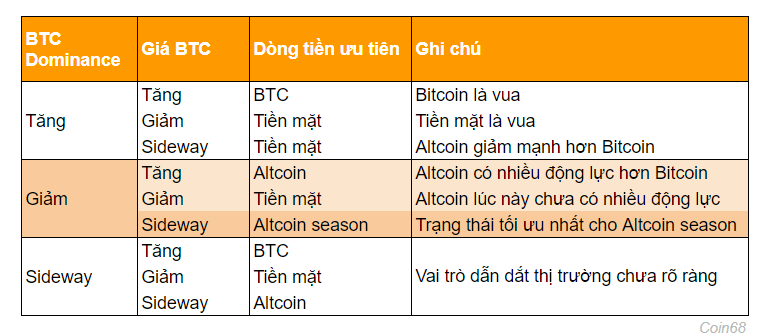

To summarize the tactics we can discover on the Internet, Coinlive has compiled a cheatsheet – Trading Strategies with BTC Dominance, on correlation with “BTC Price”. In addition, we have clarified the “Preferred Cash Flow” to make it a lot easier for our readers to practice, along with the “Note” that additional clarifies why the income movement is so prioritized.

Exclusive cheatsheets like these are only out there at Coinlive, so comply with our content articles usually, conserve or bookmark your preferred articles and share it with everybody!

Situational evaluation

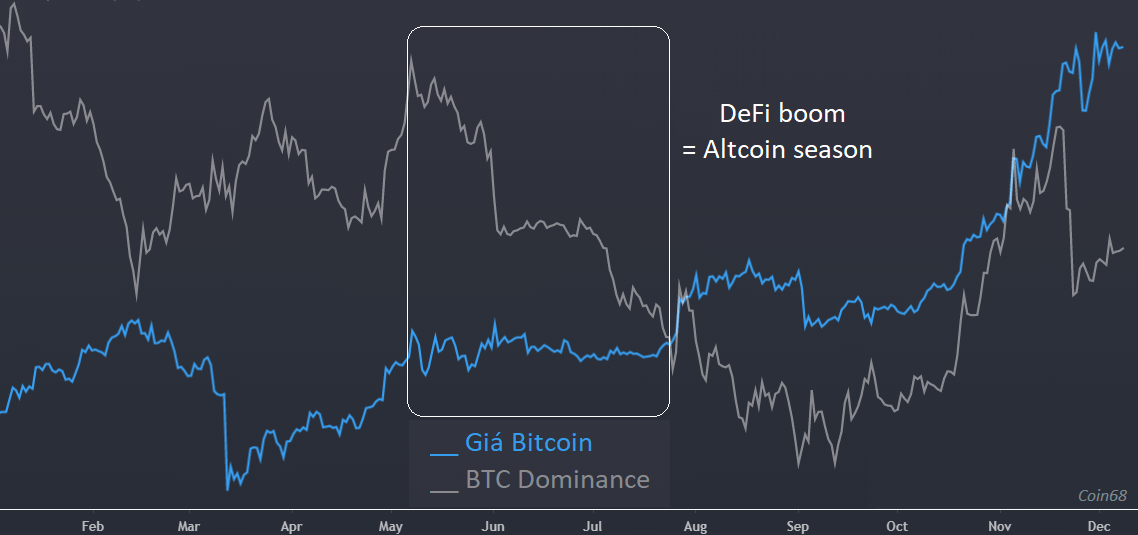

Figure five exhibits an illustration of the Altcoin season with two criteria:

- Bitcoin Sideway Price

- BTC Dominance is down.

After the Black Thursday March 2020 crash followed by a marketplace rally, Bitcoin showed indicators of slowing down and sideway in the $9,000 – $eleven,000 price tag selection, from May to the finish of July. This is also the time when the DeFi trend exploded and grew most strongly, bringing the capitalization worth of connected Altcoins to excellent development. As a consequence, BTC Dominance dropped constantly from 69% to 61%, in advance of bottoming out this yr in the 57% area in September.

Through the over condition evaluation, we can see that this yr there is an altcoin season thanks to the strengthening of the DeFi trend in basic, or Yield farming in distinct. We’ve had pretty much three complete months to catch the indicators of Altcoin season and get on board. For individuals who however miss this train, do not fear, the marketplace is normally prepared when you are prepared. Therefore, preserve bettering your understanding and true fight encounter. Coinlive normally accompanies and is delighted to serve our dear readers with in-depth information and content articles.

Coinlive workforce

Maybe you are interested: