The cryptocurrency market place collapsed soon after the Fed announced September inflation. The cost of BTC has plunged to $ 18,200, ETH has reached $ one,190 and is exhibiting no indicator of stopping.

At seven:thirty p.m. on the evening of October 13, the United States publishes the September Consumer Price Index (CPI), a signal that represents the inflation fee of the US economic climate, which is previously at the highest degree in the final four decades. current months.

According to the newest information launched, the US CPI for September was eight.two% – larger than the eight.one% anticipated.

Last week, the non-farm index or non-farm payroll was launched, in accordance to which unemployment rate in September it was three.five%, decrease than the forecast of three.seven%. This at first showed that the US economic climate had far more or much less indications of recovery, top to a more powerful dollar. As a outcome, the two the stock market place and the gold and cryptocurrency markets have declined.

The cryptocurrency market place is plunging due to the aforementioned information.

The cost of BTC is trading at $ 18,400, obtaining reached $ 18,200 at a single stage, down sharply from $ 19,000 a couple of hrs in the past.

The cost of ETH is trading at USD one,210, there was a time to attain the larger USD one,190. While just a couple of hrs earlier, ETH was holding about $ one,280.

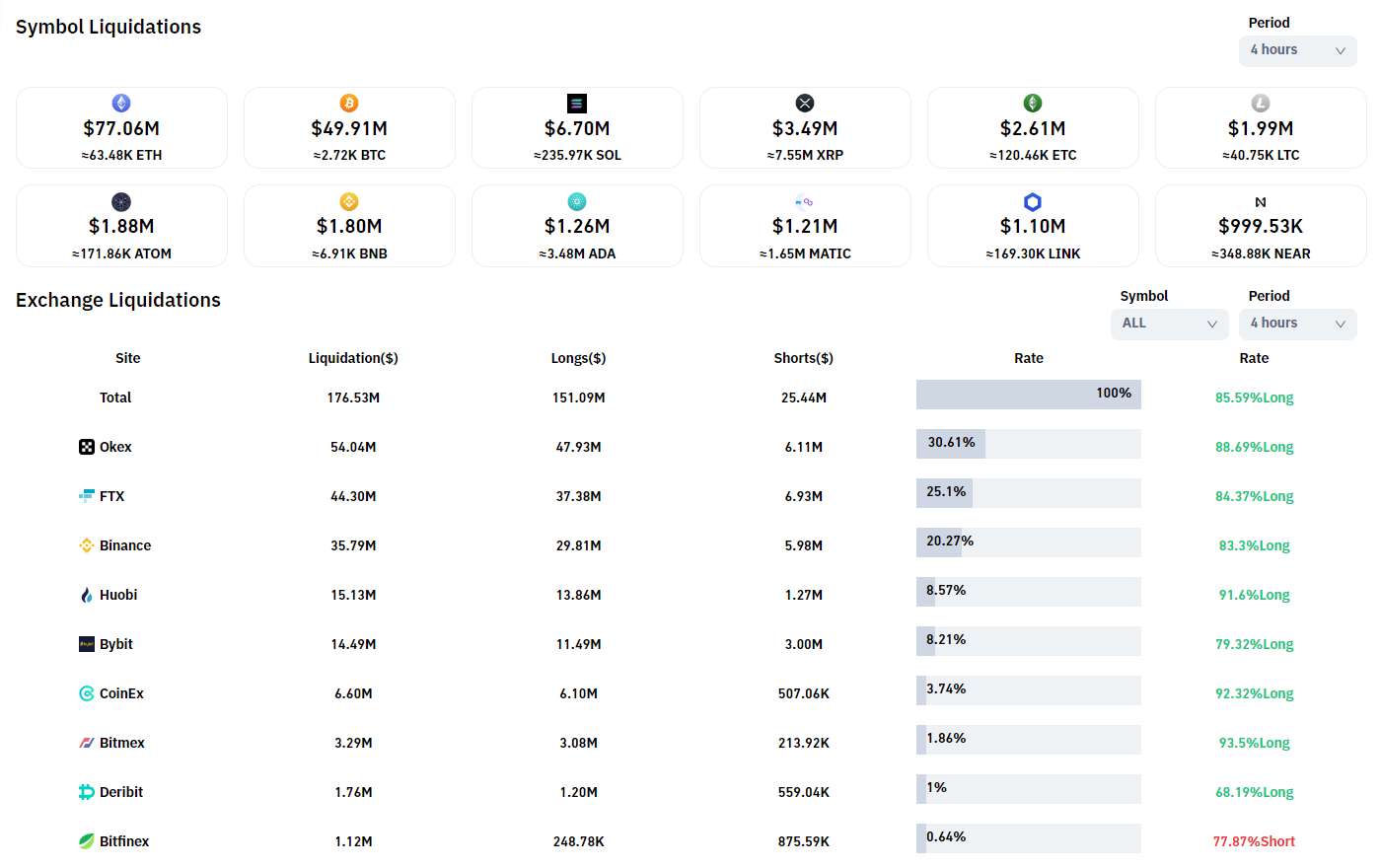

Total derivatives orders cleared in the final four hrs had been $ 176 million with 86% of lengthy orders “killed”. The most liquid lengthy positions in ETH, up to $ 77 million.

With the existing predicament, most assume the Fed to carry on to increase curiosity prices by .75% or far more in the upcoming dawn curiosity fee adjustment on October 22nd. Last month, the Fed also maintained this variety, top to a sharp drop in BTC and ETH costs.

The existing predicament is possible to carry on until eventually the finish of 2022.

Synthetic currency 68

Maybe you are interested: