The battle of stablecoins is acquiring fiercer as Binance USD (BUSD) falls out of the leading ten by capitalization. Meanwhile, Tether (USDT) has a lot more than 50% market place share, but can it final prolonged when other rivals are not inferior?

As Coinlive reportedly, BUSD is steadily “disappearing” from the stablecoin map in the market place immediately after Paxos obtained a “death sentence” from the US government. Although Paxos is committed to keeping margin and converting BUSD to fiat, the market place share of this stablecoin can be viewed to be in severe decline.

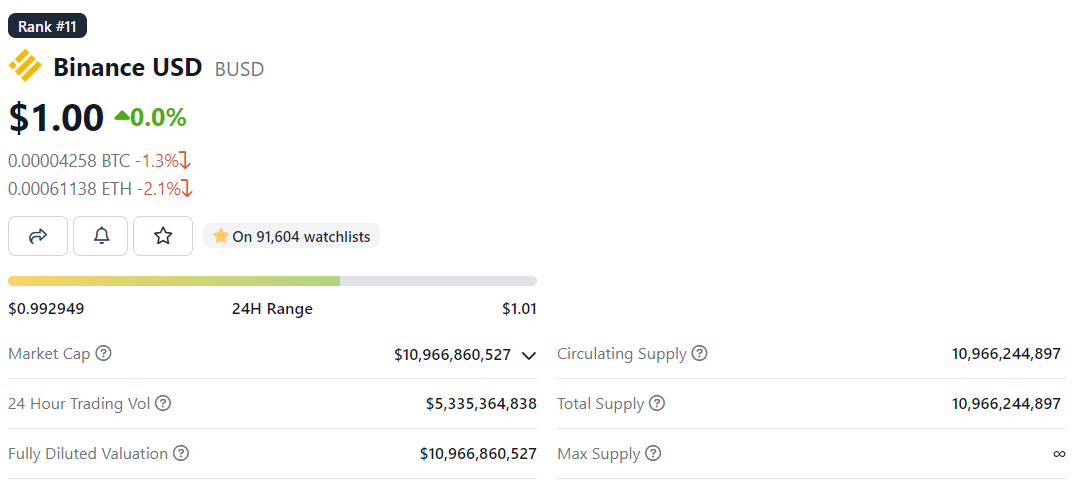

Due to the inability to mint new coins plus Paxos continuously burning coins, the existing provide of BUSD is only about ten.98 billion tokens, down just about 31% in the final thirty days.

🔥 🔥 🔥 🔥 🔥 🔥 140,000,000 #BUSD (US$140,000,000) burned at Paxos Treasuryhttps://t.co/0cvJVREUvX

— Whale Alert (@whale_alert) February 27, 2023

This straight displays the market place cap ranking of the stablecoin. Capital in advance of the scandal broke, BUSD was in 6th location by market place capitalization, but now it has slipped out of the leading ten, stopping at 11th location by market place capitalization. CoinGecko.

Some individuals go down, some go up. Tether (USDT) is the coin that receives the most advantage when it continues to hold its exclusive place. Second DefiLlamathe complete provide of USDT was maximize of about five%. above the previous thirty days, bringing the stablecoin’s market place capitalization to $70.9 billion.

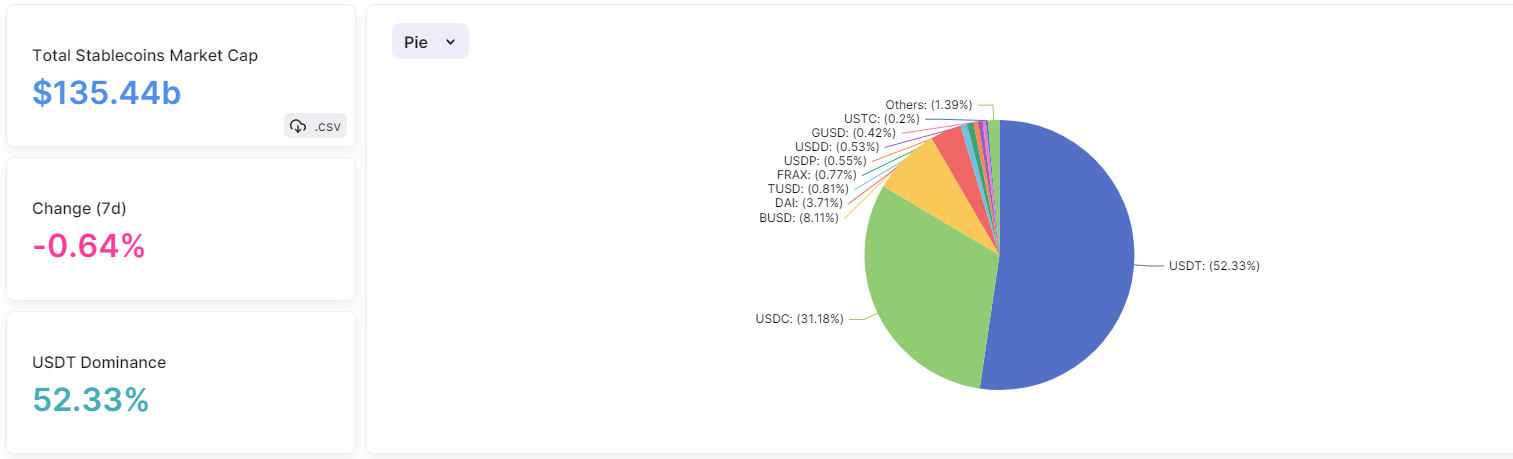

With the complete cap of the stablecoin array falling to about $135.four billion, Tether straight holds the place 52.three% market place share.

In 2nd location is the USD coin (USDC) issued by Circle. Despite embroiled in rumors of Paxos-BUSD “pointing” to New York officials, Circle has stalled as of late. USDC’s market place capitalization is at present roughly $42.two billion, equivalent to 31.two% market place share pie.

Another stablecoin that is acquiring a great deal of awareness is TrueUSD (TUSD). The local community thinks that Binance is shifting its concentrate to TUSD immediately after no longer becoming capable to “do business” with BUSD, as Binance printed a massive quantity of TUSD stablecoins on February 17th.

Over a thirty-day time period, the provide of TUSD sixteen% maximize., bringing the market place cap to the $one.one billion milestone. Currently, TrueUSD has a market place share of .eight%, ranking 5th immediately after USDT, USDC, BUSD and DAI.

The battle of stablecoins is anticipated to develop into a lot more and a lot more fierce in the close to potential with the participation of new faces this kind of as crvUSD from Curve, GHO from Aave or fUSD from Fantom.

Synthetic currency68

Maybe you are interested: