In response to a significant volume of liquidity fleeing the platform, Binance unexpectedly blocked USDC withdrawals. Meanwhile, BUSD has nonetheless to recover the peg.

Binance all of a sudden halts USDC withdrawal

Not only withdrawing funds, the neighborhood has also fled BUSD en masse above the previous day. Exchanging (swapping) a significant volume of BUSD for other stablecoins triggered the Binance stablecoin to fall into a depeg, falling somewhat from its inherent one:one price tag anchor. In response to the over predicament, Binance all of a sudden made the decision to block USDC withdrawals.

On USDC, we have viewed an raise in withdrawals. However, the channel to trade from PAX/BUSD to USDC necessitates going by means of a financial institution in New York in USD. Banks will not be open for a couple of much more hrs. We assume the predicament to recover when the banking institutions open. one/two

—CZ Binance (@cz_binance) December 13, 2022

However, in accordance to CZ, the PAX/BUSD to USDC exchange channel presently requirements to go by means of a financial institution in New York (USA), but this financial institution is not nonetheless operational, so it can’t be executed. The one:one stablecoin to USDC conversion will resume in the up coming couple of hrs immediately after financial institution opening. BUSD or USDT withdrawal transactions proceed to proceed as standard.

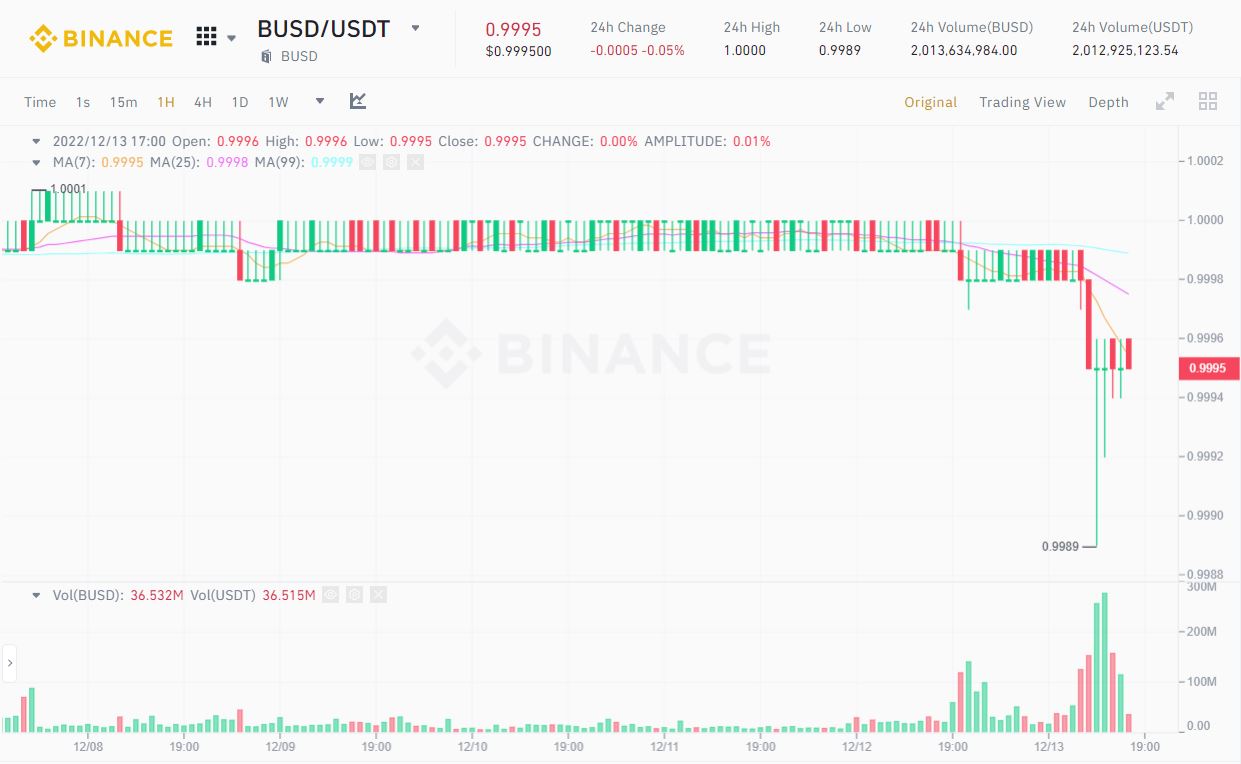

As of now, BUSD is trading all-around $.9995 and has nonetheless to entirely recover the peg. The 24-hour trading volume of the BUSD/USDT pair on Binance is USD two billion, 2nd only to BTC/USDT and five occasions greater than the ETH/USDT pair.

The baffled actions of the founder of Tron

Insecurity proceed covering the market place on the 2nd day of a new week. Part of that stems from Justin Sun’s move when he all of a sudden withdrew $50 million from Binance. But the founder of Tron has reloaded one hundred million USDC on the exchange.

To observe LookonchainJustin Sun withdrew 34 million BUSD and 15.four million USDT from Binance about eleven hrs in the past and transferred them to Paxos Treasury and Circle.

Giustino Sole(0x9f84) 33.911.530 $ billion dollars and 15,432.715 $USDT from #Binance 9 hrs in the past.

Then he transferred 33,911,530 $ billion dollars to the Paxos Treasury.

And traded 15,432,715 $USDT for 15,435,455 $USDC and transferred to #Circle. pic.twitter.com/SCSPcjYVTC

— Lookonchain (@lookonchain) December 13, 2022

At all-around 15:00 on December 13 (Vietnam time), advisor Huobi posted a message proceed to recharge $one hundred million in Binance from Circle.

I just produced $one hundred million @binance. 1亿美元。 https://t.co/tTCyiEBsXW

— HE Justin Sun🌞🇬🇩🇩🇲🔥 (@justinsuntron) December 13, 2022

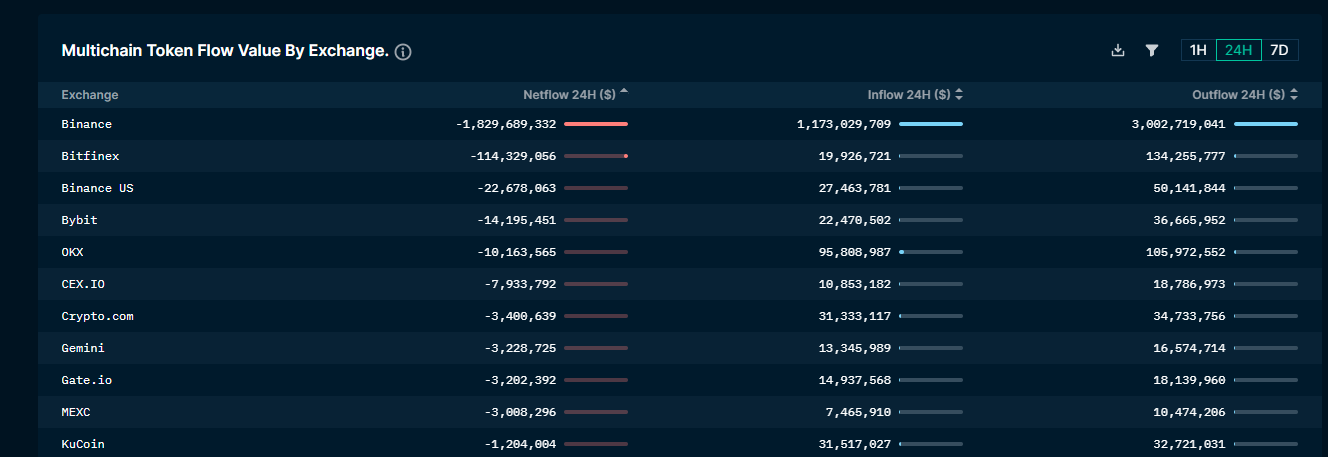

On-chain analysis, billions of bucks have fled from exchanges of all chains in the final 24 hrs. As reported by Coinlive earlier in the dayBinance alone has viewed outflows of up to USD one.eight billion from the exchange.

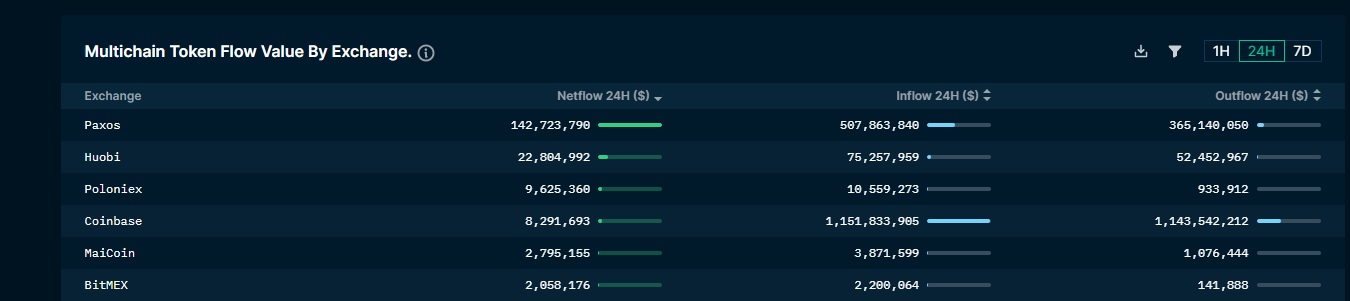

Data from nansen exhibits that Paxos and Huobi are the bigwigs with capital inflows, with about $162 million. Coinbase has also viewed powerful capital inflows, with all-around $124 million injected into the exchange in the previous 24 hrs.

Until now, the good reasons for these movements have not been plainly recognized. However, a spate of withdrawals in current days arose from the controversy that Binance violated the embargo law and aided in funds laundering considering that 2018, raised by Reuters.

The price tag of BNB was also heavily impacted, falling deeply to $255.six at the time of the information.

To observe DeFillama, BNB Chain’s complete assets pegged to DeFi protocols (TVL) decreased by four.five% above the previous day.

Synthetic currency68

Maybe you are interested: