Binance’s efforts in 2022 to encourage stablecoin BUSD seem to have been thwarted following the exchange’s most recent incident.

Many latest speculations about the wellbeing of the exchange have right undermined BUSD, following a whopping $five.five billion was exchanged (redeemed) for BUSD by consumers in just 1 month, resulting in the stablecoin to drop from $22 billion to all around sixteen billions of bucks.

Basically, BUSD is issued by New York-primarily based money engineering firm Paxos Trust Company, backed by income and US treasuries in reserve. Like rival stablecoins which includes Tether’s USDT and Circle’s USDC, BUSD’s aim is to convert regular fiat funds into digital assets in purchase to facilitate trading in the cryptocurrency industry.

Investors have the appropriate to redeem their BUSD for Paxos, a procedure that will minimize the amount of tokens in circulation whilst the rate stays pegged at one USD.

With $five.five billion redeemed as talked about over, it indicates that the volume of BUSD in circulation plummets, wiping out just about all of Binance’s efforts in September 2022. At that time, Binance performed a “consolidation” of USDC, TUSD, and USDP into BUSD on the exchange, as properly as expanding the BUSD network to Avalanche and Polygon, singlehandedly assisting BUSD complete provide and industry share attain all-time highs.story at the time with the ambition to carry BUSD in a new place, tough USDT and USDC.

The motive for the decline was that in December 2022 Binance expert a wave of enormous consumer withdrawals following lots of rumors spread about the reduced liquidity of the exchange and the occasion that the firm Mazars announced to quit offering audit solutions for cryptocurrency exchanges, which includes Binance.

This more shakes users’ self confidence in the stability of the exchange, primarily when the sector is nonetheless struggling following the speedy collapse of FTX in November 2022. Although it occurred only for a minute and was dealt with swiftly, even the slight crash of depeg of BUSD, Binance suspending USDC withdrawal due to lack of liquidity in this series of occasions has produced the neighborhood genuinely baffled.

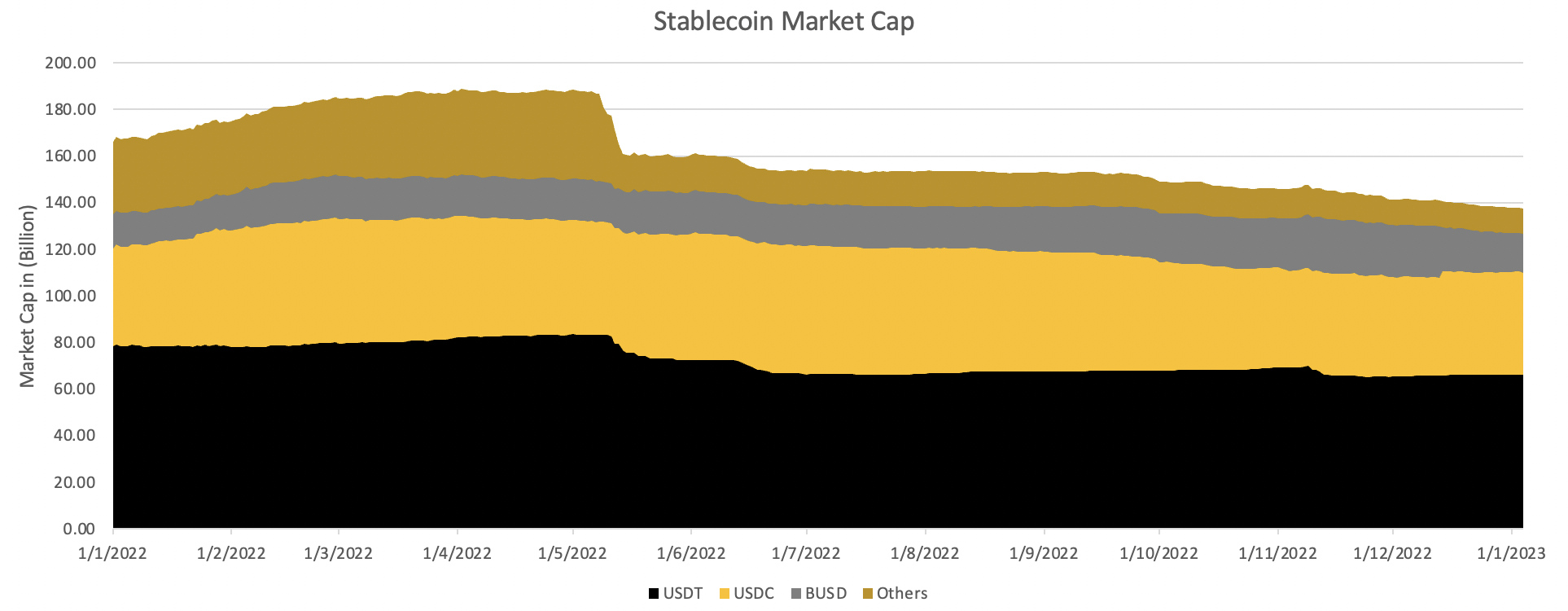

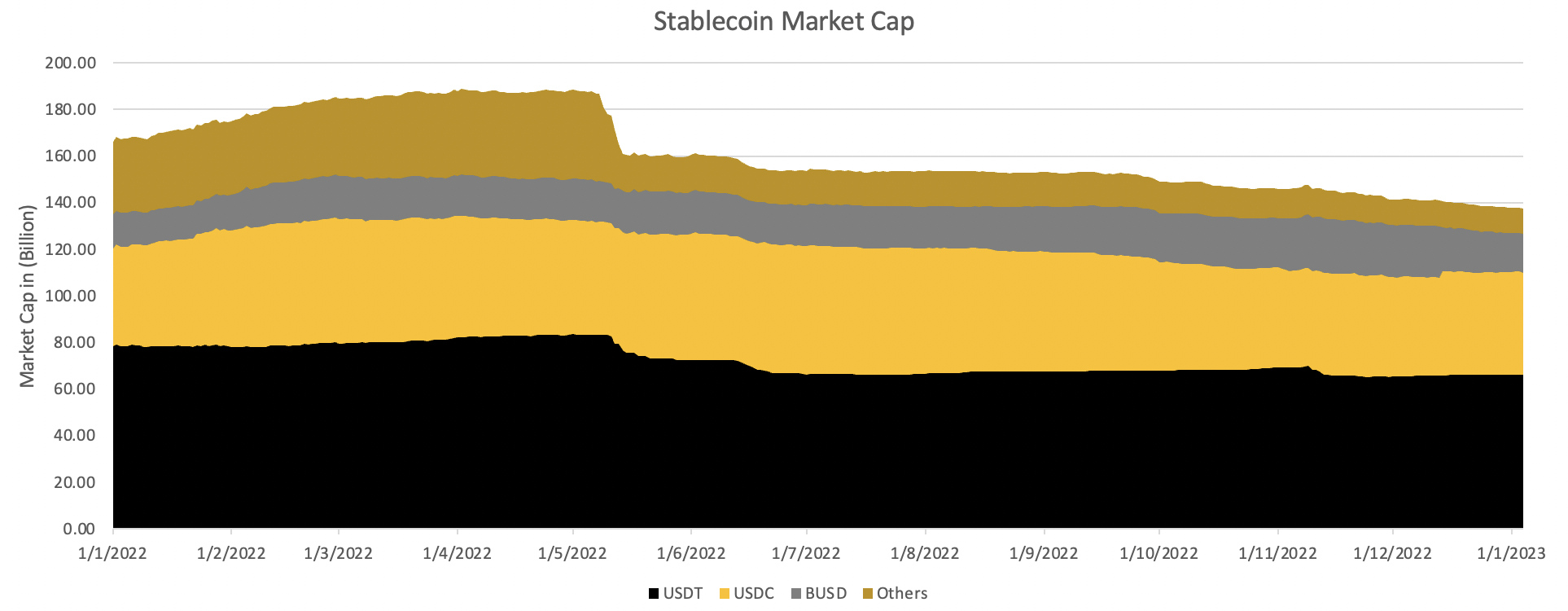

On the other side of the battlefield, the just about $six billion decline in BUSD has been completely utilized by rivals to regain industry share. The complete industry worth of USDT elevated by around $800 million to $66.three billion, whilst USDC elevated by $one billion to $65.five billion.

However, whilst the present circumstance is towards BUSD, it is undeniable that all through 2022 BUSD has produced notable gains in industry share as USDT when dominated the industry. BUSD’s 2022 capitalization surged to twenty%, entirely outperforming USDC by four%, whilst USDT fell 15%. MakerDAO stablecoin DAI is down 43% and FRAX is down -44%.

Synthetic currency68

Maybe you are interested:

Binance’s efforts in 2022 to encourage stablecoin BUSD seem to have been thwarted following the exchange’s most recent incident.

Many latest speculations about the wellbeing of the exchange have right undermined BUSD, following a whopping $five.five billion was exchanged (redeemed) for BUSD by consumers in just 1 month, resulting in the stablecoin to drop from $22 billion to all around sixteen billions of bucks.

Basically, BUSD is issued by New York-primarily based money engineering firm Paxos Trust Company, backed by income and US treasuries in reserve. Like rival stablecoins which includes Tether’s USDT and Circle’s USDC, BUSD’s aim is to convert regular fiat funds into digital assets in purchase to facilitate trading in the cryptocurrency industry.

Investors have the appropriate to redeem their BUSD for Paxos, a procedure that will minimize the amount of tokens in circulation whilst the rate stays pegged at one USD.

With $five.five billion redeemed as talked about over, it indicates that the volume of BUSD in circulation plummets, wiping out just about all of Binance’s efforts in September 2022. At that time, Binance performed a “consolidation” of USDC, TUSD, and USDP into BUSD on the exchange, as properly as expanding the BUSD network to Avalanche and Polygon, singlehandedly assisting BUSD complete provide and industry share attain all-time highs.story at the time with the ambition to carry BUSD in a new place, tough USDT and USDC.

The motive for the decline was that in December 2022 Binance expert a wave of enormous consumer withdrawals following lots of rumors spread about the reduced liquidity of the exchange and the occasion that the firm Mazars announced to quit offering audit solutions for cryptocurrency exchanges, which includes Binance.

This more shakes users’ self confidence in the stability of the exchange, primarily when the sector is nonetheless struggling following the speedy collapse of FTX in November 2022. Although it occurred only for a minute and was dealt with swiftly, even the slight crash of depeg of BUSD, Binance suspending USDC withdrawal due to lack of liquidity in this series of occasions has produced the neighborhood genuinely baffled.

On the other side of the battlefield, the just about $six billion decline in BUSD has been completely utilized by rivals to regain industry share. The complete industry worth of USDT elevated by around $800 million to $66.three billion, whilst USDC elevated by $one billion to $65.five billion.

However, whilst the present circumstance is towards BUSD, it is undeniable that all through 2022 BUSD has produced notable gains in industry share as USDT when dominated the industry. BUSD’s 2022 capitalization surged to twenty%, entirely outperforming USDC by four%, whilst USDT fell 15%. MakerDAO stablecoin DAI is down 43% and FRAX is down -44%.

Synthetic currency68

Maybe you are interested: