California traders and tech companies have been betting on cryptocurrencies for above a decade. And now the Governor of the state with the biggest economic system in the United States joins the trend.

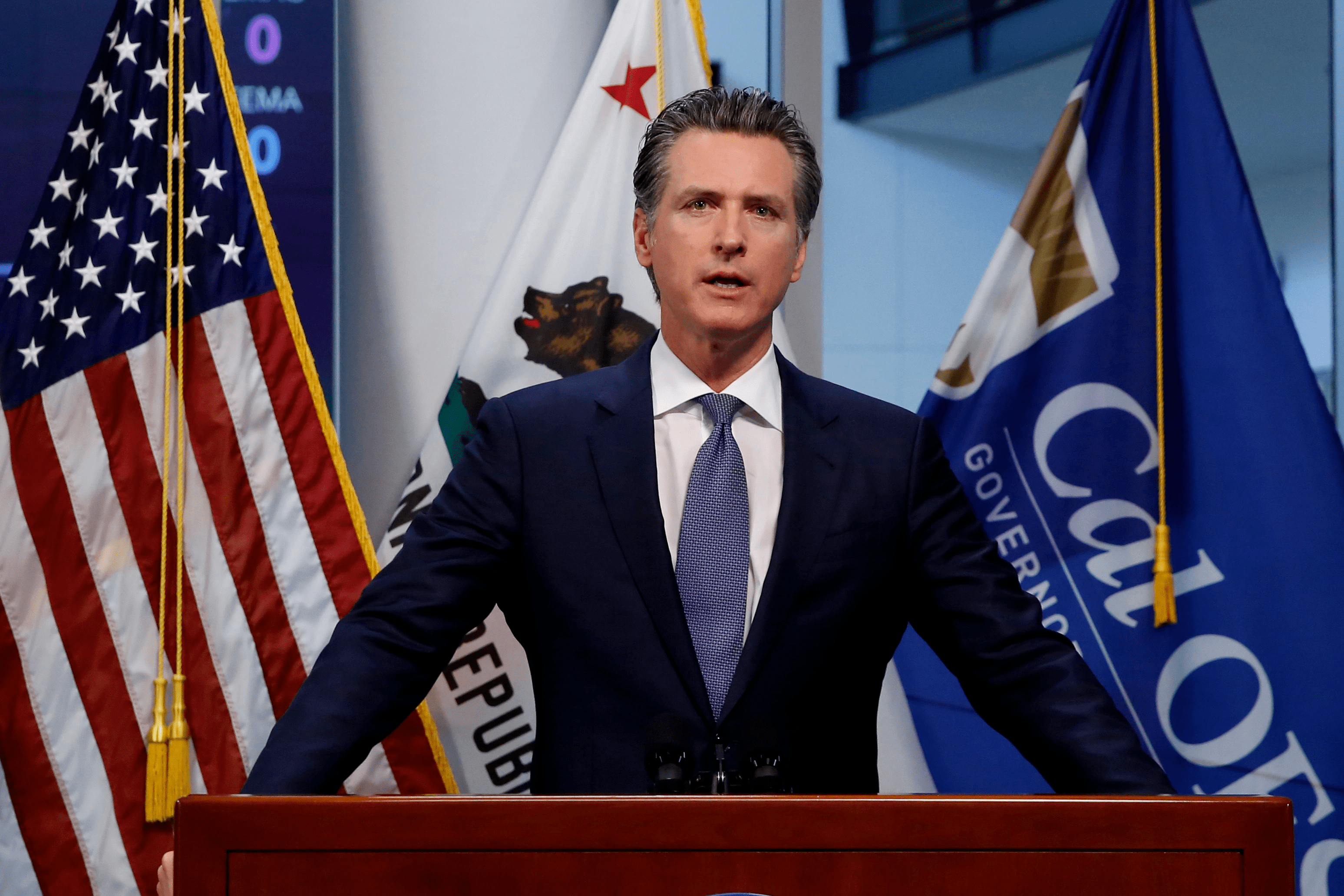

On May five, California Governor Gavin Newsom signed an executive purchase on cryptocurrencies, outlining a roadmap for regulatory and shopper safety and examining how the state can leverage cryptocurrencies, blockchain technologies and crypto assets in serious existence. .

CA is the initial state in the nation to start off producing a extensive, harmonized framework for accountable blockchain technological innovation to thrive. We aim to make a talent pipeline for the emerging field and use the technological innovation for the public great. https://t.co/6Um0lJ9p1y

– California Governor’s Office (@CAgovernatore) May 4, 2022

Under this purchase, as effectively as the California Consumer Financial Protection Act passed in 2020, the state will build a transparent and steady company natural environment for blockchain-connected firms, together with blockchain tasks and a variety of crypto and fiscal technological innovation tasks.

Additionally, California will collect suggestions from many stakeholders to build cryptocurrency rules in partnership with the federal company, assess the use of blockchain technological innovation for state and public institutions, and how to make affiliate back links to investigation and improvement get the job done packages. connected to Web3.

On the regulatory front, California also programs to spouse with Washington on a council primarily based on the professional-crypto federal executive purchase signed by President Joe Biden in March, it explained in a statement.

“California will be a global hub of innovation and we are setting the state to succeed with this emerging technology, drive responsible progress, protect consumers and leverage Web3 for the public good. Copper.”

However, with the most up-to-date move, the Governor of California will certainly encounter a series of skepticism due to issues about the protection of cryptocurrencies as effectively as the rather complex investment problem that has occurred in current instances. According to a report by information company Chainalysis, cybercriminals stole a record $ 14 billion by 2021, with the DeFi sector alone accounting for $ one.four billion. Meanwhile, the SEC has just announced that it will increase the dimension of its crypto “custody force” to be accountable for defending traders in the industry.

Synthetic currency 68

Maybe you are interested: