If there is a single blockchain undertaking that has been hit hardest by the FTX crash, it is Solana. Both cryptocurrencies know that Sam and Alameda Research have personally been Solana’s “backers” given that its inception. Most of the top rated coins in the procedure are also “favourably” listed on the FTX exchange.

Of program, when this stalwart collapses, the effect on the Solana ecosystem is indisputable. So does Solana nevertheless have the capacity to “come back” or not? Does the undertaking nevertheless have likely? Let’s come across out with Coinlive!

The hyperlink amongst Solana and FTX/Alameda

The romantic relationship amongst Solana and FTX/Alameda has lots of “rooted strings” which we can classify into four clues as follows:

- SOL tokens

- Solana’s DeFi Ecosystem

- Alameda’s investments in the Solana tasks

- The assets of the Solana Foundation are held on FTX.

How is the Solana ecosystem impacted?

About the SOL Token

The Alameda Research Foundation initially held 58 million SOL tokens, accounting for eleven% of the project’s complete provide.

It is not clear how lots of tokens the Alameda fund nevertheless owns and how lots of it has downloaded. Due to this “ambiguous” nature, when information of FTX’s collapse broke, the local community immediately “invited” every other to promote SOL, primary to the collapse of most of the SOL tokens.

I’ll purchase all the things you have ideal now for $three.

Sell me anything at all you want.

Then go fuck your self. pic.twitter.com/f1eJjqNKIk

—CoinMamba (@coinmamba) November 11, 2022

About DeFi on Solana

As Coinlive reviews, virtually $700 million has been wiped out of the Solana ecosystem.

The most common DeFi undertaking of the procedure is DEX Serum, produced with a single hand SBF set up Candlestick. Fortunately, in subsequent developments, Serum obtained help from the Solana local community, so SBF’s influence steadily declined.

Currently, Serum strategies to fork the undertaking to recover the FTX-managed personal important, therefore providing a hundred% rights to the developers and the local community. Thanks to this information, the rate of SRM greater by extra than a hundred%.

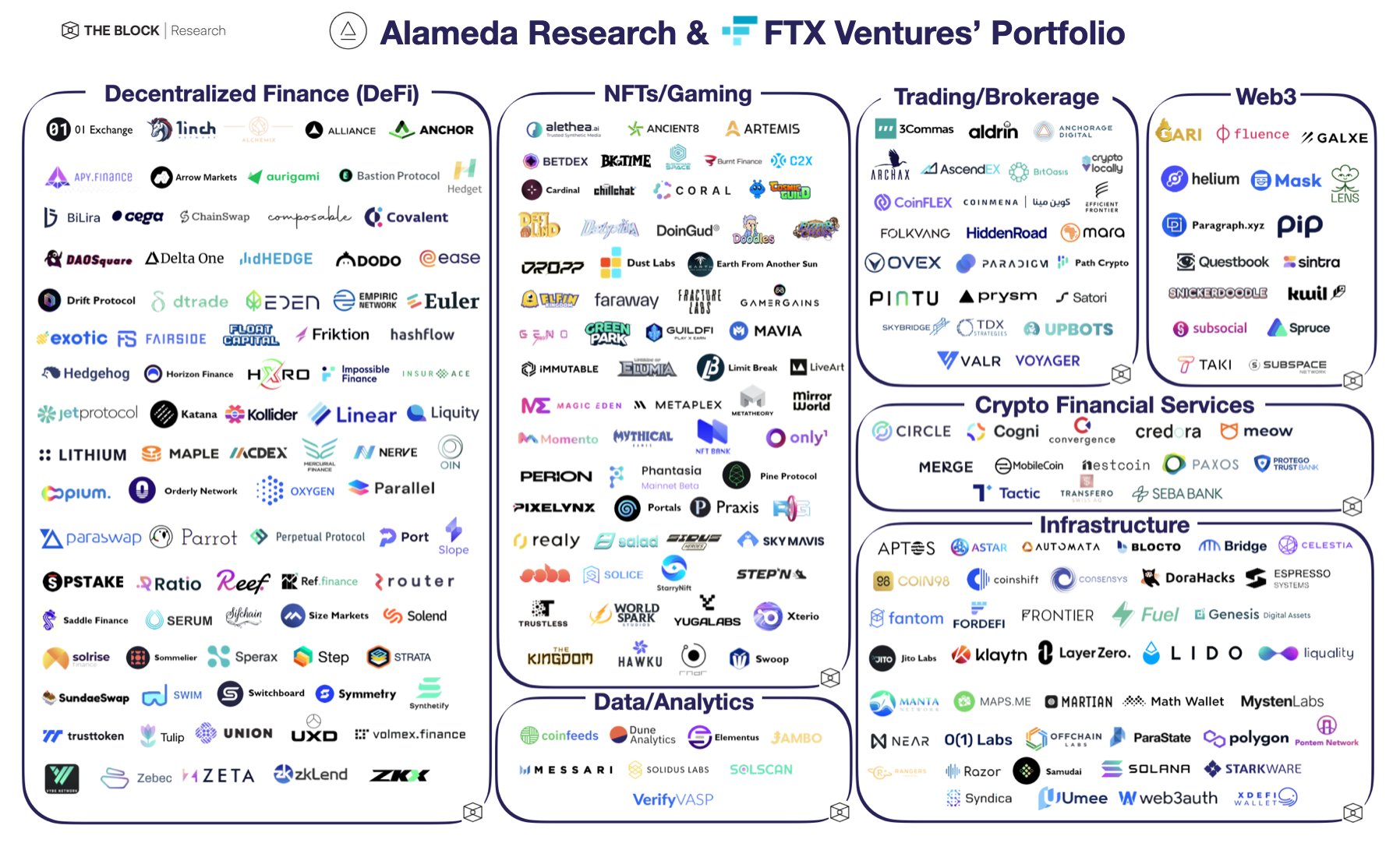

FTX/Alameda investment data

It can be mentioned that SBF and Alameda designed the Solana procedure as the identify of a VC fund that is indispensable in most of these tasks. This was as soon as a “pride” of the local community of SOL lovers, but has now turn into a “ghost” that helps make anyone anxious.

Typical tasks that SBF hit “octopus faucet” this kind of as Coin98, Maps.me, Oxygen, PsyOptions, and so forth. Where, Oxygen and Maps.me are struggling simply because FTX holds most of the tokens and claims to seek out legal help. .

It is incorrect to take into account OXY and MAPS as a “typical example” of the aftermath left by FTX, simply because these two tasks have been dormant for lots of months.

FTX’s collapse has only “added more fuel to the fire,” accelerating the progress of “getting to the end” of aborted tasks.

For tasks that are truly searching to BUIDL through downtrend season, the local community really should be cautious to take into account. VC investment in the undertaking has two varieties as follows:

- Project token, with and without having vesting

- Project actions. It really should be mentioned that most cryptocurrency businesses now have no IPOs, so there are no publicly traded shares.

When FTX goes bankrupt underneath Chapter eleven, the court will assign a representative to liquidate the assets of the exchange. Both the token and the quantity of undertaking shares invested by FTX will be listed as assets to be liquidated. Usually, the sale of liquidated assets is carried out by way of OTC per token and offered affordable to the holding business.

Therefore, even in the “most pessimistic” point of view, tasks invested in FTX will encounter a token promote – but will have the capacity to know in advance to “cover” themselves – rather than lead to a collapse of the whole undertaking.

Solana Foundation sources on FTX

FTX was as soon as a really well-known exchange, so it is understandable that lots of tasks reserve their money on the exchange. The truth that “jailed” assets are not able to be withdrawn from FTX is an inevitable consequence.

The Solana Foundation announced that it has $one million that are not able to be withdrawn to FTX, which is much less than one% of the fund. He really should take into account that the quantity of duties at isn’t going to have an impact on their operations as well a great deal.

The inherent energy of the Solana procedure is nevertheless there

This is adequate to see that Solana was badly impacted by the FTX incident. But that isn’t going to indicate there is no probability of recovery, even if it will be for a lengthy time.

Solana is not an “anonymous secondary” undertaking, but a Layer-one that has a specific area in the marketplace. A huge local community of developers, marketers and builders, creating in the spirit of decentralization, not only dependent on the “management” of FTX.

Co-founder Solana Labs confirmed on Twitter that it has adequate sources to operate constantly for thirty months. Of program, this data is not a hundred% genuine, but we can nevertheless rest assured.

The runway is in $, ~thirty months at latest consumption. We realized our lessons in 2018

— toly (@aeyakovenko) November 9, 2022

In addition to DeFi, NFTs on Solana are also incredibly lively. Magic Eden is nevertheless the primary NFT marketplace platform, searching to appeal to consumers and income movement to this procedure.

Naturally, Solana’s long term is incredibly hard. Downtrend, domino chain broken by FTX or reduction of local community believe in, and so forth. All of these will be problems that the Solana tasks will have to handle.

Jane

Maybe you are interested: