In the previous, Canto is an incredibly “hot” Layer-one when the project’s token improved additional than x6x in much less than one month. Canto is also stated by numerous KOLs on Twitter. So what is this undertaking and ought to it be cashed in at this level? Let’s locate out with me in this write-up!

What is Singing?

Canto (CANTO) is a Layer-one undertaking constructed with the intention of setting up DeFi specifically what it needs to be: decentralized, economical and available, launched in August/2022.

Canto is based mostly on the Cosmos Tendermint Consensus Engine, powered by Canto Validator Nodes and the EVM implementation layer through the Cosmos SDK builder.

Canto’s authentic key solutions involve:

- DEX chant: a no cost DEX for liquidity suppliers.

- Singing Loan Market: a pool of common loans from Compound v2.

- Stablecoins NOTE: is a stablecoin issued by Canto Lending Market.

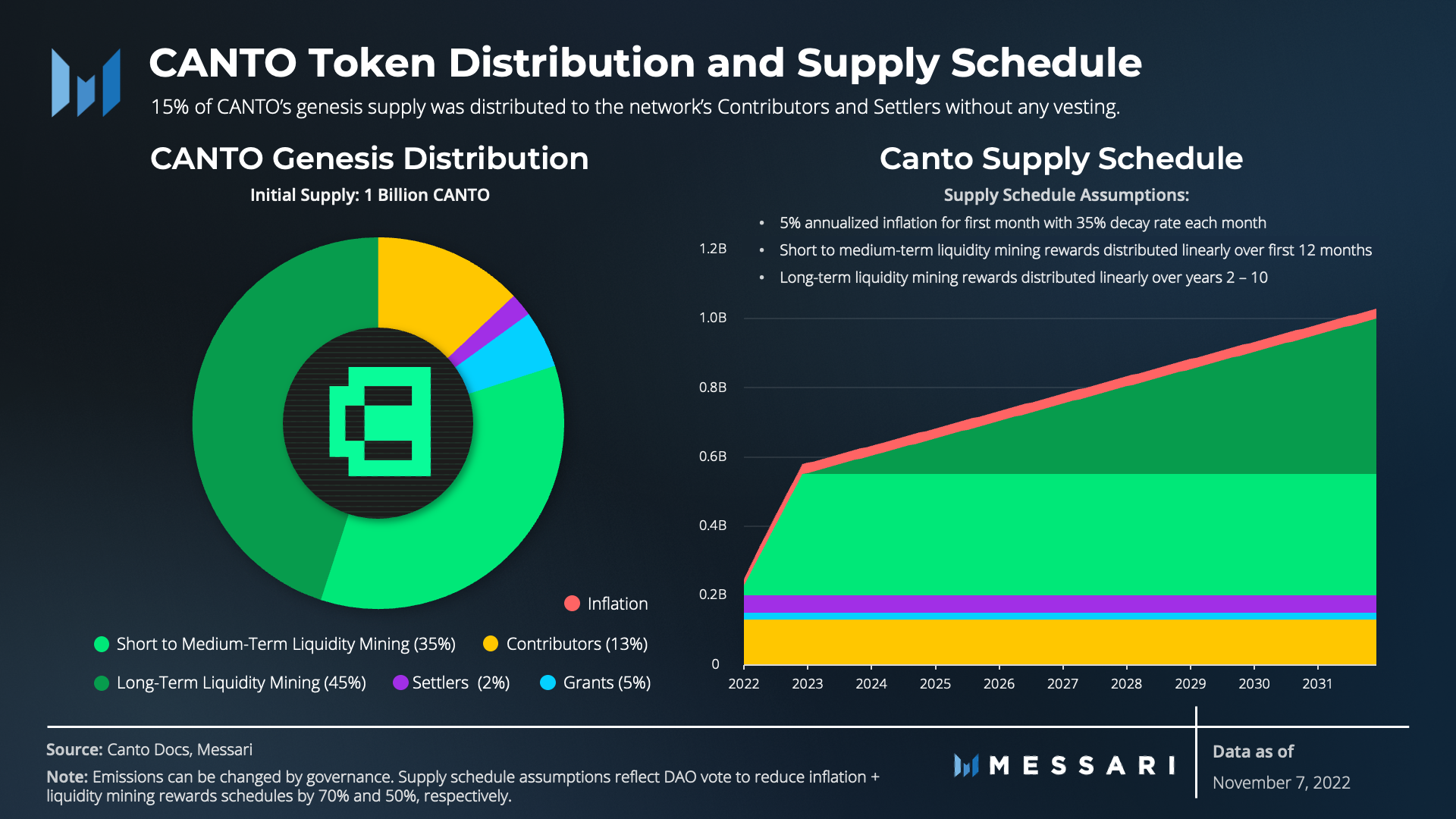

CANTO is the native token of the undertaking. Initially, CANTO’s complete provide will be one,000,000,000 (one billion) tokens. In the long term, CANTO may possibly carry on to inflate and enhance the complete provide dependent on network demand.

You can understand additional about CANTO in this write-up.

In terms of utilization, CANTO is at the moment typically utilized Stake out and as a reward for exercise Cash extractionbut can also be utilized in Government (protocol administration). In it, you ought to discover the token allocation for Liquidity Mining routines:

- 45% of the tokens will be utilized to reward extended-phrase liquidity mining and distributed above the subsequent five-ten many years.

- 35% of the tokens will be utilized to reward brief-phrase liquidity mining, spread above the coming months

Singing Highlights

To realize its intention, Canto relies on three aggressive pros:

- Free for Liquidity Providers (LP): people who deliver liquidity on Canto will be absolutely exempt from the linked charges (liquid deposit/withdrawal).

- Limit long term inflation: DeFi protocols on Canto will be constructed for the local community, will not concern tokens, and will use tokens as a way to “borrow from the future” to appeal to liquidity.

- Minimize “proprietary” end users: Canto will be a liquidity platform only, manipulation will be pushed mostly to third-get together protocols.

Comment:

Usually, DeFi tasks will use their personal tokens to appeal to liquidity and end users by packages like Liquidity Rewards, Retroactive…

Limiting token launches for DeFi protocols can be tricky for the undertaking itself to appeal to liquidity and end users. To fix this challenge, Canto will adhere to the following path:

Attract liquidity by waiving costs for liquidity suppliers even though enabling 3rd get together DeFi remedies to establish on their liquidity degree => engage end users by superior trading expertise => get additional invest => continue to keep attracting liquid assets.

However, this path has the benefit of keeping away from the “future inflation” of numerous older DeFi tasks on the other hand, the real provide/withdrawal of liquidity may possibly not expense also a great deal, so just obtaining expense reduction for LPs may possibly not be an desirable sufficient proposition.

Also, if you know the tokenomics of the undertaking, you will right away see that Canto also employs CANTO tokens to motivate liquidity by liquidity-offering rewards. The only big difference among Canto and conventional ecosystems is at this level, when they generally use Layer-one tokens as a substitute of producing additional tokens than other tasks.

Support and advancement crew

Currently, the details about the project’s advancement crew is nevertheless unknown. Furthermore, the undertaking did not undergo any fundraising.

Real working condition

Canto at the moment develops solutions together with Bridge, Staking, LP Interface, Lending-Borrowing and Governance.

Bridge

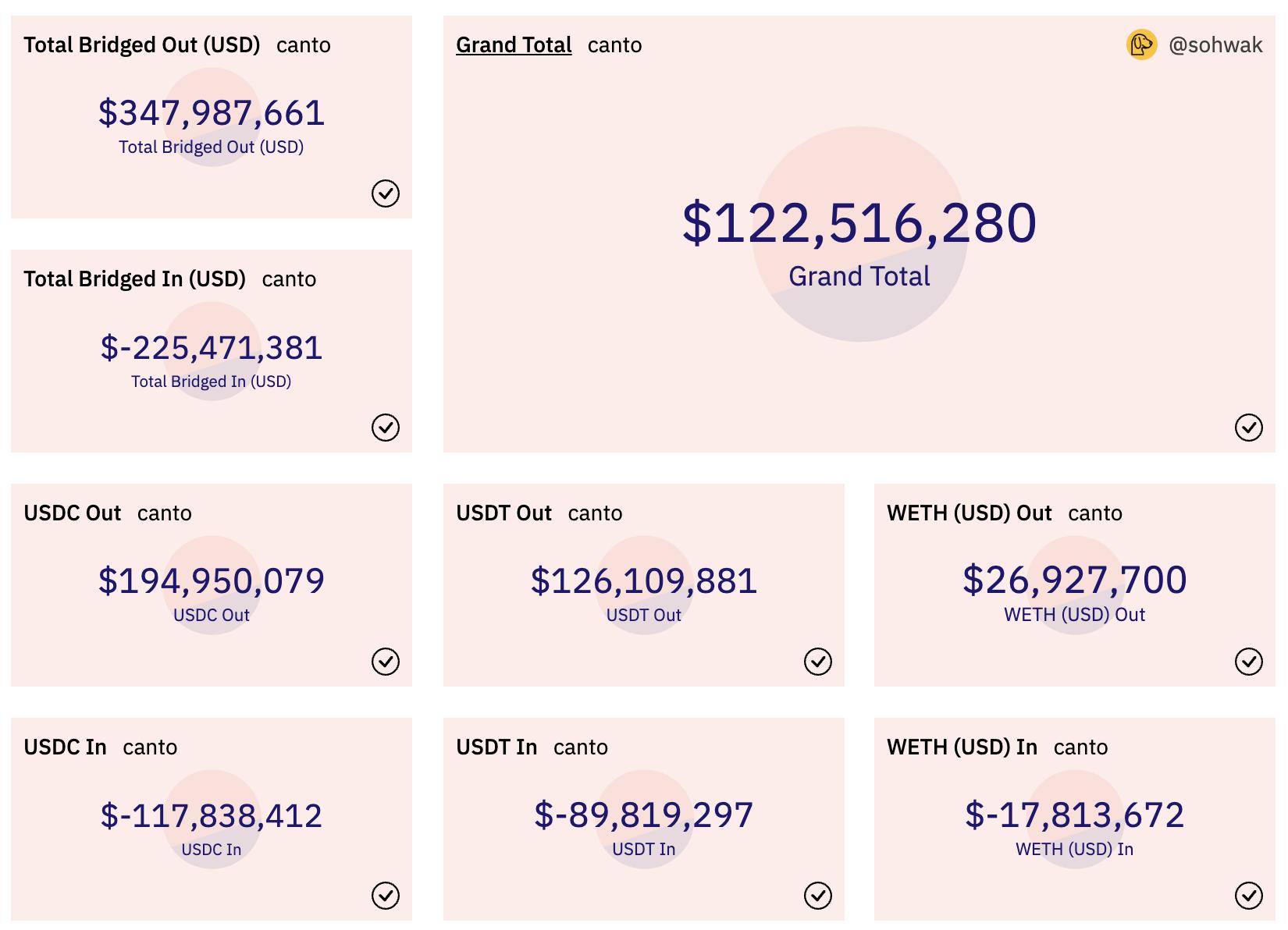

As a bridge to transfer assets among Canto and other ecosystems, it will at first be Ethereum.

Total funds movement among Ethereum and Canto as of noon Jan. thirty is about $347 million, with $225.five million in and $194.95 million out, in accordance to information from Dune Analytics.

As a bridge to a new ecosystem and has just been operational given that August 2022, the complete quantity of $347 million circulating among Ethereum and Canto proves that this bridge is doing work really very well and stably.

The key assets in circulation are mostly stablecoins (USDC, USDT) and WETH.

Stake out

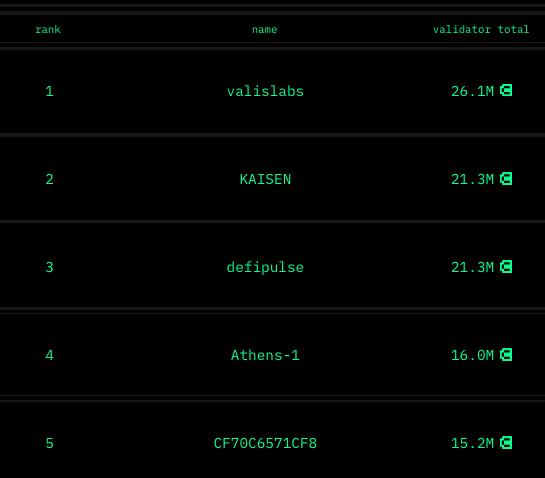

Currently, Canto has 93 lively validators, with a complete stake worth of about $95.97 million, which is about 50% of the excellent capitalization. In certain, care need to be taken that the prime three wallets incorporate additional than thirty% of the complete staking tokens.

Loans and Loans

The working model of this product or service will be equivalent to Compound, which enables end users to use cryptocurrencies as collateral and borrow other cryptocurrencies based mostly on a specific percentage. Currently, Canto Lending only enables two sorts of collateral, USDC and USDT. In the long term, the undertaking will carry on to include additional asset sorts, together with LP tokens to diversify collateral.

According to information on DeFiLlama, the complete assets on Canto Lending are at the moment all around USD 47.9 million, of which the quantity of lent assets is USDT 267,570. The over information demonstrates that the efficiency of capital utilization on Canto is at the moment quite reduced. Most of the revenue is deposited in the ecosystem just for farming to obtain SONG.

Canto DEX and LP interface

This is a product or service for end users to deliver liquidity to the Canto DEX and execute trades. There are at the moment five liquidity pools together with CANTO/ATOM, CANTO/ETH, CANTO/NOTE, NOTE/USDC and NOTE/USDT.

You can see that the NOTE/USDC and NOTE/USDT stablecoin pools have the highest TVL. This is also understandable offered that the liquidity provide in stablecoins is really safe, there will be practically no danger of impermanent reduction. The CANTO/NOTE liquidity pair is also a quite liquid pair as most end users want to get CANTO with stablecoins to participate in the ecosystem.

Government

A product or service that enables token holders to vote to put into action protocol governance proposals. You can stake your SING to participate in the voting.

summary

Basically, the Canto model will function in accordance to the mechanism Free public, which focuses on setting up and strengthening communities. Unlike other Layer-one tasks that only establish infrastructure underlying the protocols, Canto will also establish the most critical setting up blocks of DeFi: DEX, Lending and Stablecoin without having three tasks. separate judgement. This aids Canto focus all the worth on the CANTO coin of undertaking.

However, we need to also realize that Canto is nevertheless quite “young”. The big trading volume is the cause why the marketplace is enthusiastic about this undertaking, but genuinely that volume is mostly from the SONG/NOTE pair. If CANTO falls in price tag, volume will swiftly lower accordingly.

A aspect from that, piece of the puzzleCanto’s ending is also restricted. In common, the funds movement in the ecosystem suitable now is typically speculation on CANTO or farming to obtain rewards (also CANTO). Therefore, CANTO may possibly encounter hefty discharge stress in the close to long term.

Besides, you also want to spend awareness The danger when the undertaking advancement crew is absolutely anonymous. The tokenomics style of the undertaking also demonstrates that there will be big inflation from Liquidity Mining assets in the close to long term (35% of complete provide) and extended phrase (45% of complete provide). So whilst Singing is at the moment a quite scorching key phrase triggering fomo but if you will not have a superior place then be cautious when producing revenue.

Above are my ideas on degree one singing (SINGING) at the minute. See you guys in the subsequent posts!

Poseidon

See other posts by the writer of Poseidon: