With Bitcoin’s development price extraordinary this week, the altcoin race is beginning to enter a much more extreme phase than ever. The most important emphasis is the robust rise of Binance Coin (BNB) and Cardano (ADA).

BNB has returned to the third biggest coin on the market place

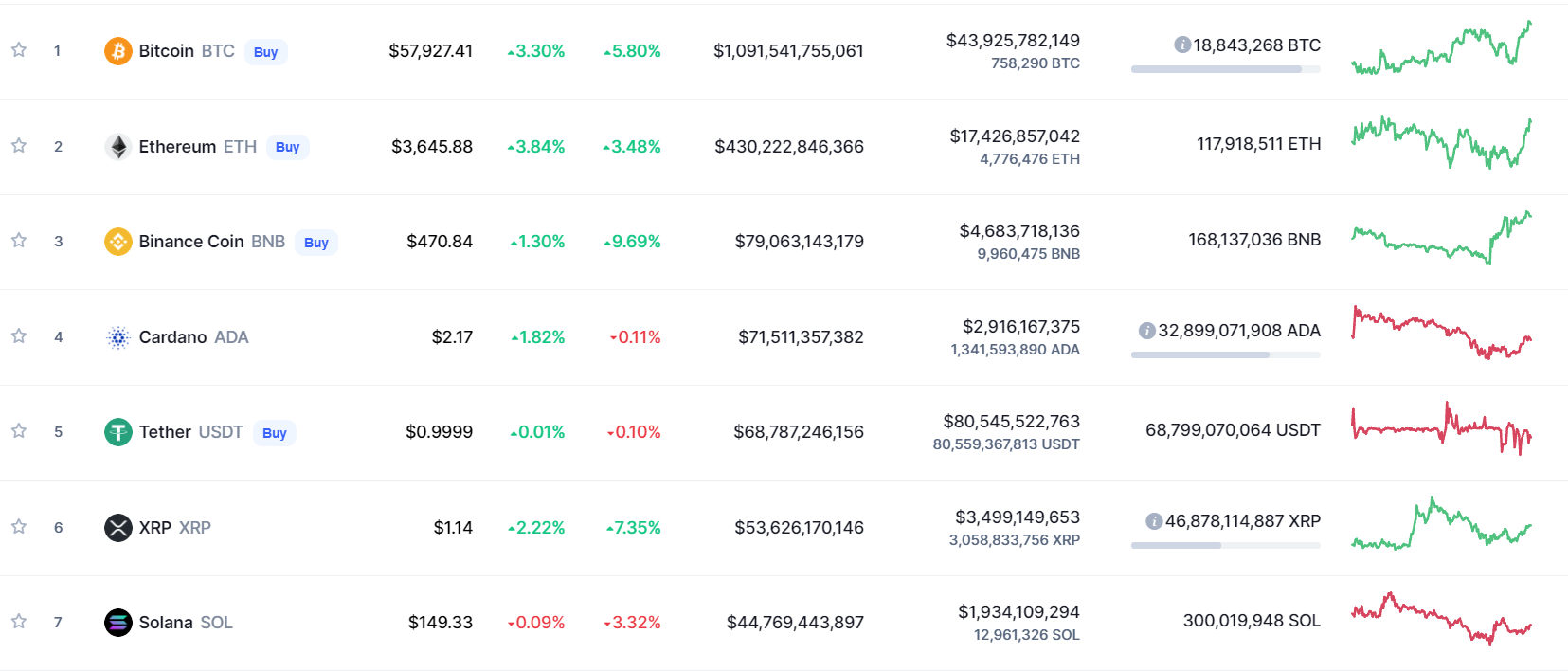

Cardano (ADA) has observed a “huge” rise in the previous twelve months as the ADA has enhanced one,840.five% to date, assisting to maximize the quantity of individuals who turn into ADA millionaires by 173%. However, above the previous month, the ADA has fallen by 18% and by four.eight% above the previous 7 days. Pushing ADA’s market place capitalization up to $ 71.five billion, that means ADA has to give way to Binance Coin (BNB).

BNB’s exceptional efficiency in latest days was not totally due to luck. After a lengthy time period of cost stagnation considering that the boom in the initially quarter of 2021, BNB seems to have acquired some momentum, waiting for the possibility to return to the market place in light of the latest “pressure” from other impressive ecosystems this kind of as Solana (SOL), Avalanche (AVAX) pleasant Fantom (FTM). BNB is now trading at $ 472, up seven.13% above the previous 24 hrs.

Like Coinlive anticipated in September, CZ is pretty probably to have ideas to strengthen her “baby” Binace Smart Chain (BSC) and BNB. The whole picture surrounding this occasion is summarized in the video under, please read through for reference.

– See much more: The fortunes of BNB? CZ’s chess game and the Binance ecosystem

Binance Smart Chain (BSC) starts boom

And, of program, the “whopping” $ one billion funds movement in the improvement of the Binance Smart Chain ecosystem is a single of CZ’s beginning moves. Not only that, Binance has turn into a jersey sponsor for the Lazio Club, established to deliver the wave of Fan Tokens back to the market place.

Safepal (SFP) is the most critical encounter of the Binace Smart Chain (BSC) ecosystem produced doable by the over move. In one day, SFP rose 185.24%, hitting its highest cost on October 14 at $ three.sixteen, only about $ one.two from its previous higher of $ four.39.

Oven Token (BAKE) was no exception to the BSC surge, with efficiency up 25.79% above the previous 24 hrs from a reduced of USD one.eight to USD two.four.

Additionally, Binance’s compliance and latest string of legal “winnings” have designed terrific prestige and believe in in the neighborhood. It can be described that Binance “protests” China right after what this nation has brought about by stopping all trading routines with CNY, making it possible for only Chinese customers to withdraw income. Even, CZ was pretty “cautious” prior to signing up to register three other Binance organizations in accordance with the law in Ireland.

The ADA “takes your breath away” in contrast to BNB

In standard, all of the over aspects are helpful for the lengthy-phrase improvement of BNB. However, that does not indicate ADA has been “left behind” and accepted as the guy behind BNB. The September story about ADA’s dynamic and optimistic routines is the clearest evidence of this.

Arguably, the unfavorable effect on ADA comes mostly from the publish-deployment of intelligent contracts, when transactions and applications are nevertheless a huge query mark.

With an ecosystem and capital movement that is deemed to be the biggest in the market place and founder Charles Hoskinson’s statement that the platform will explode a yr in the past, Cardano (ADA) recorded only one (a single) intelligent transaction inside of 24 hrs, creating the neighborhood “sit still” is understandable.

The worldwide ADA trading volume is somewhere around $ one.9 billion, and the Binance exchange now has the highest ADA trading volume. Tether (USDT) is the trading pair that accounts for 58.58% of all ADA transactions. ADA is trading at $ two.17 at press time.

However, it is nevertheless extremely hard to judge BNB or ADA, from which side it is entirely superior. Because the cryptocurrency market place is normally on the move and improvements pretty swiftly. Fierce competitors and frequent development in between main platforms have normally been an critical development engine for the whole business. Therefore, from an investor point of view, we really should have a neutral outlook to far better grasp the pulse of the market place.

Synthetic currency 68

Maybe you are interested: