Cardano price has dropped 13% in the past week, reducing the number of ADA coins being held with profit. On-chain data shows that the total Cardano supply in profit has decreased by 3.55 billion ADA within seven days.

With bearish momentum strengthening, ADA is likely to continue to decline, increasing the risk of a further reduction in the number of coins held with profit.

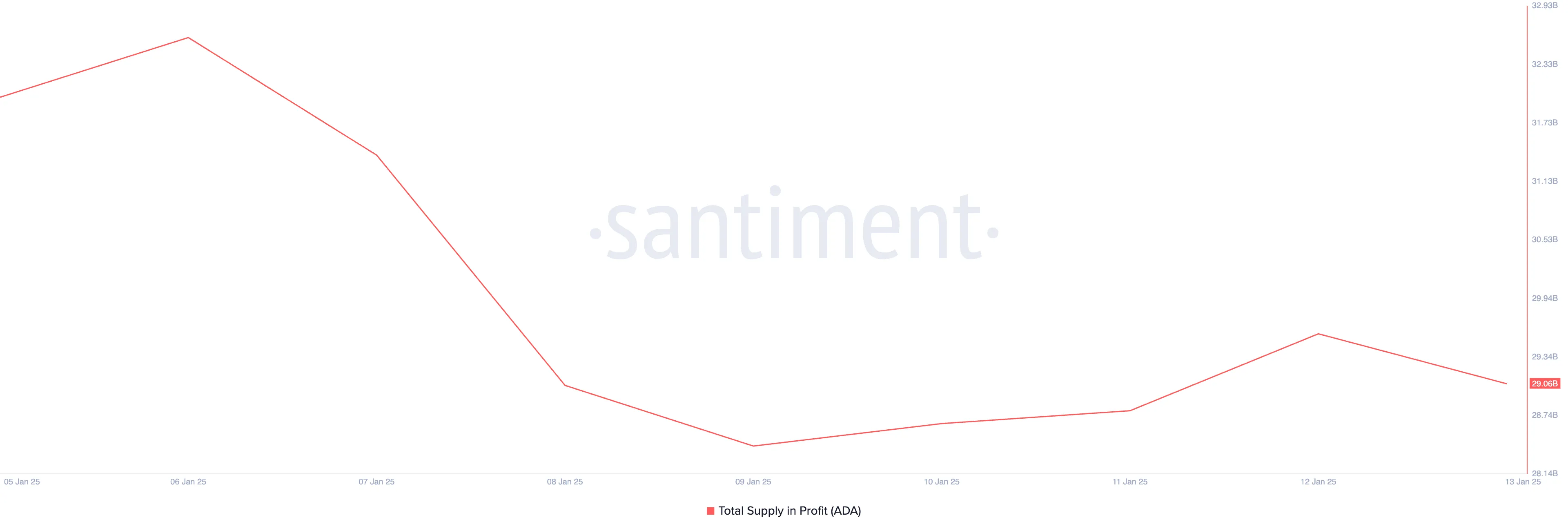

Cardano Supply in Falling Profits

According to Santiment, the total Cardano supply in profit has decreased by 3.55 billion ADA over the past week. At the time of writing, there are 29.06 billion VND out of a total of 42.56 billion VND being held at profit. This indicates that a significant portion of investors currently holding ADA are at a loss, reflecting increased selling pressure and weakening market sentiment.

This increase in selling pressure is due to the continuous decline in ADA value during the assessment period. At the time of writing, the altcoin trades at $0.93, having lost 13% of its value in the past seven days.

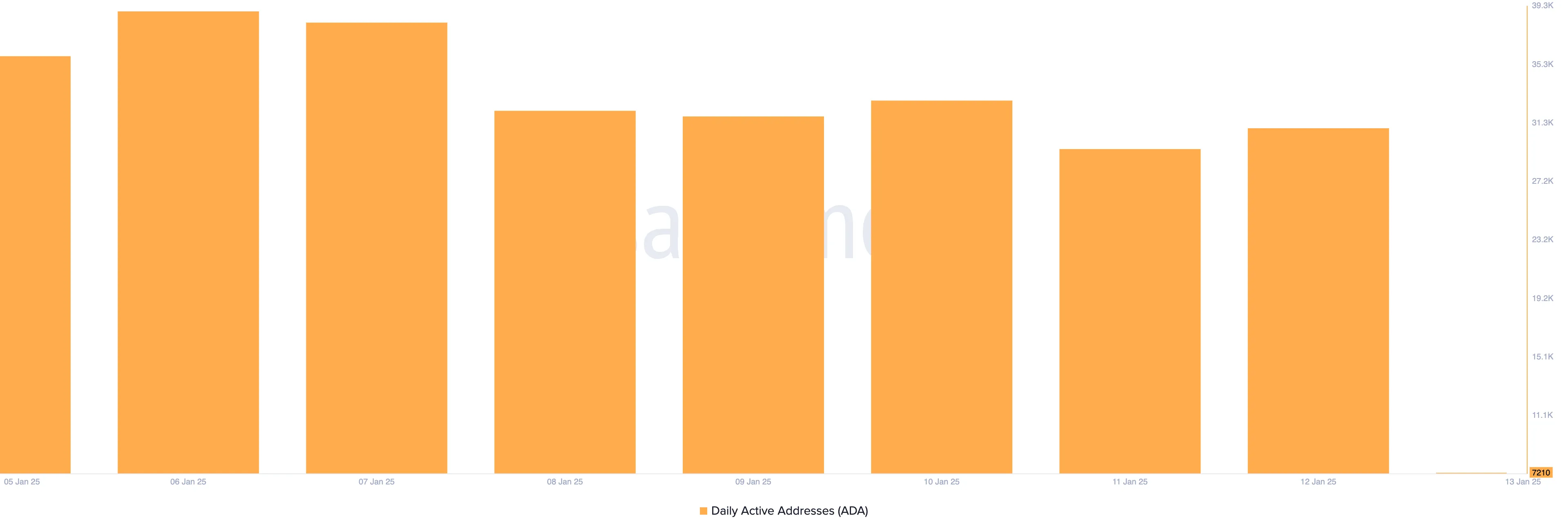

Besides the broader market decline during that time period, the ADA price drop was partly driven by a decrease in activity on the Cardano network. Santiment data reveals an 81% decrease in the number of unique addresses making at least one transaction with ADA per day over the past seven days.

Cardano’s decline in daily addresses indicates a decline in network engagement and usage, which has weakened demand for ADA and put further downward pressure on prices.

ADA Price Prediction: Will it Fall to $0.85 or Rise to $1.12?

ADA’s Relative Strength Index (RSI) on the daily chart confirms increasingly weak demand for the altcoin. This momentum index is below the centerline at 46.83 at the time of writing.

The RSI measures overbought and oversold conditions of an asset. It ranges from 0 to 100, with values above 70 indicating that the asset is overbought and may fall in price. Conversely, values below 30 indicate the asset is oversold and could recover.

With 46.83 and a bearish bias, ADA’s RSI shows selling pressure is dominant, increasing the likelihood of further downside unless buying activity increases.

If buying activity weakens further, the coin’s price could fall to $0.85. Conversely, if market sentiment changes and ADA accumulation increases, the price could rise to $1.12.