According to statements by Caroline Ellison, fraud and misconduct at Alameda Research and FTX are escalating.

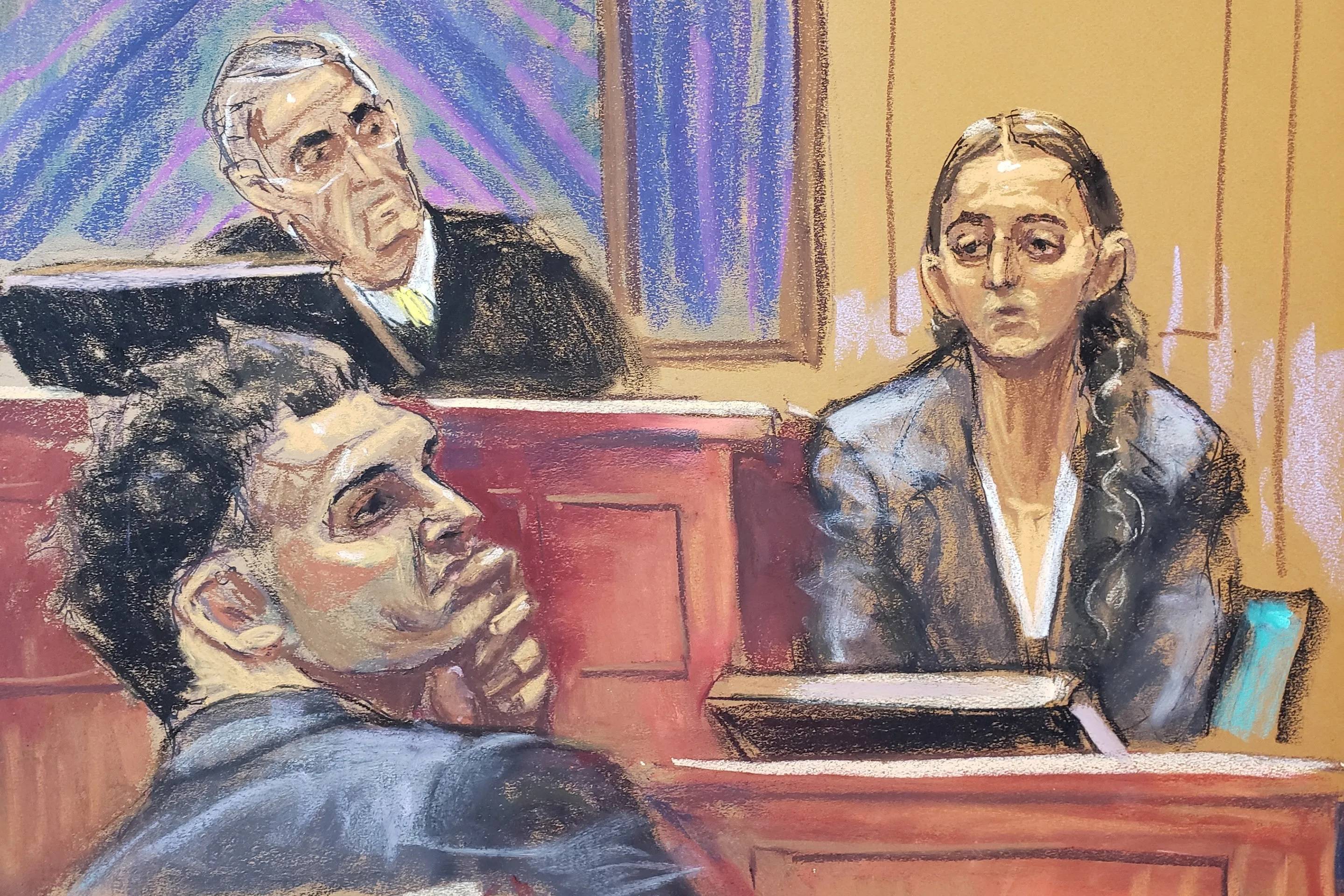

After the fifth day of trial, witness Caroline Ellison – former CEO of the investment fund Alameda Research – continued to be named by the court for cross-examination.

seven asset declarations for dealing with creditors

In mid-2022, the cryptocurrency sector faced a liquidity crisis following the collapse of the LUNA-UST model. Faced with the truth that quite a few events are hungry for dollars, they lend unity Genesis determination asked Alameda Research to repay $400 million in the prior loan amongst the two events.

Caroline Ellison explained that she was instructed by Sam Bankman-Fried to pay out Genesis, for the reason that otherwise this loan company could go bankrupt.

The difficulty right here is that Alameda Research does not have this kind of a big sum of funds, for the reason that the fund also suffered losses due to LUNA-UST, forcing it to withdraw dollars from consumer assets on FTX. According to Sam Bankman-Fried, this is the only way for Alameda to show its money standing in the eyes of creditors without the need of disclosing the holes in its money to the outdoors globe.

Genesis then asked Alameda Research to present money reviews to assess the well being of the fund, to safe the remaining loans.

Caroline Ellison explained the fund’s circumstance at the time was not liquid adequate. Alameda had to borrow virtually $ten billion from FTX, and then lend $five billion to FTX managers. Fearful that Genesis would uncover out, withdraw the loan dollars, and publish the facts outdoors, Sam Bankman-Fried made a decision to falsification of money statements.

Sam Bankman-Fried asked Caroline Ellison to uncover a way to hide Alameda Research’s inner transactions on its stability sheet. Alameda’s CEO then presented Sam with seven asset declarations on June 19, 2022, with various amounts of facts withholding.

In the finish, Sam Bankman-Fried chose the seventh statement, viz The story of Alameda’s dollars lending from FTX was entirely hidden, then send it to Genesis. But Genesis was also in problems at that time and continued to inquire Alameda for reimbursement of a further 500 million bucks. Sam instructed Caroline to meet the creditor’s demands after yet again for the reason that she did not want them to fail.

Under questioning by the prosecutor, Caroline Ellison admitted that she knew her actions had been fraudulent and deceptive and felt exceptionally pressured for the reason that she knew there would not be adequate assets left for FTX consumers to withdraw dollars.

Alameda Research then sent the falsified stability sheet to other lenders this kind of as BlockFi, and so on.

Ellison explained:

“When I first started working in Alameda, if someone had told me that in a few years I would have to falsify reports to send to creditors or embezzle money from clients, I wouldn’t have believed it.”

They bribed Chinese officials to “freeze” $one billion in assets

In November 2021, Alameda Research was concerned in a dollars laundering investigation by Chinese authorities, resulting in $one billion in cryptocurrencies of the fund was frozen on two exchanges, OKX and Huobi (now HTX).

The fund made a decision to recover that dollars bribed some Chinese officials with $150 million. Caroline Ellison explained persons doing work on the situation integrated David Ma, director of the institutional customers group, and Constance Wang, who would later on turn out to be COO of FTX, for the reason that they had been each Chinese.

Before that, Alameda had attempted other methods to recover the dollars, this kind of as employing a Chinese attorney to negotiate with the government, or striving to transfer dollars to other accounts in the fund registered in the names of its red-light sector personnel” Thailand.

As reported by Coinlive, the US Department of Justice charged Sam Bankman-Fried with bribery associated to the over incident in March 2023, but the announced bribe sum was only $forty million. Lawyers for the former FTX CEO efficiently appealed saying Sam Bankman-Fried’s unique extradition deal integrated only eight counts of fraud and racketeering, so the present trial will only appear at 7 counts soon after getting rid of the crime of fraud on money donations laws.

However, the presiding judge nevertheless permitted Caroline Ellison to existing extra for the reason that he imagined it would support clear up the crime at FTX – Alameda.

“Things That Worry Sam”

Caroline Ellison stored a normal journal, like an entry about factors that anxious Sam Bankman-Fried through the summer time and fall of 2022, when Alameda Research started to be “hit” by the liquidity crisis spreading across the cryptocurrency market place .

Sam Bankman-Fried started out blaming Caroline Ellison for failing to initiate hedge investments for Alameda, pushing the fund into its present debt circumstance and owning to withdraw $ten billion in assets from FTX consumers to cover losses. However, Ellison believes Sam’s investment choices are the root lead to.

By September 2022, due to the continued withdrawal of dollars from FTX consumers to repay debt, the sum of dollars owed by Alameda to the exchange enhanced from $ten billion to $13 billion.

In the “Things That Worry Sam” listing, Caroline Ellison explained that the then CEO of FTX was… striving to increase capital from Middle Eastern traderslike Saudi Crown Prince Mohammad bin Salman.

Additionally, Ellison also uncovered that Sam Bankman-Fried took the lead Contact officials get legal action towards Binanceto “play tricks on opponents”.

To keep the impression that factors had been nevertheless calm, the FTX boss had a strategy has acquired the Snapchat messaging appas effectively as investing in Japanese government bonds.

The days primary up to the collapse of FTX – Alameda

In early November 2022, Alameda Research’s stability sheet was leaked, displaying that the bulk of the fund’s assets had been in the type of FTTs and that the “Sam coins” had been exceptionally illiquid. Cryptocurrency traders thus reacted exceptionally negatively to the over information, resulting in the cost of FTT to drop sharply.

Subsequently, soon after Binance CEO Changpeng Zhao announced that he would liquidate all of the platform’s FTT holdings, FTT went into no cost fall and a wave of withdrawals from FTX started, primary to the collapse of each FTX and Alameda Research just six days later on.

When within facts about Alameda leaked, Caroline Ellison was on trip in Japan, but promptly returned to the workplace in Hong Kong.

The management group near to Sam Bankman-Fried started to assess the circumstance, stating that the sum of dollars coming out of the exchange amounted to 120 million per hour. Some started to query no matter whether FTX had adequate money to satisfy users’ withdrawal requests.

Sam Bankman-Fried asked Caroline Ellison, on behalf of Alameda Research, to publish on Twitter to reassure the investment local community, stating that the fund nevertheless has extra than $ten billion in unaccounted assets and that channels nevertheless exist defensive investments. However, Ellison has now informed the court that these claims had been not genuine.

– the stability sheet breaks down some of our greatest lengthy positions definitely we have hedges that are not listed

– offered the squeeze in the crypto credit score area this yr, we have now paid back the bulk of our loans—Caroline (@carolinecapital) November 6, 2022

He additional that Sam Bankman-Fried was the one particular who initially drafted the publish, but edited it and posted it on his private account.

After Binance’s CEO tweeted to promote FTT, Caroline Ellison went on to create that Alameda Research was prepared to obtain back all of FTT at $22, claiming that Binance was merely “threatening.”

@cz_binance If you happen to be searching to decrease the market’s affect on your FTT income, Alameda will be pleased to obtain it all from you these days for $22!

—Caroline (@carolinecapital) November 6, 2022

Caroline Ellison then shared in a text message with Sam Bankman-Fried that regardless of what was going on, this was the time when her mood was the finest it had been final yr. When Sam asked her why, Caroline replied:

In today’s SBF trial, it was though studying these messages to the jury that Caroline Ellison’s voice broke https://t.co/FR7zCylNyL pic.twitter.com/lfNonduCv5

— Inner City Press (@innercitypress) October 12, 2023

“I think I’ve been hoping for this day to come for a while, and now that it’s actually happened, I feel so relieved that I don’t have to worry anymore, one way or another.”

While sharing the over conversation, Caroline Ellison started to cry in court, saying, “I feel relieved because I don’t have to lie anymore.” She named it “the worst week of her life.”

Sam Bankman-Fried is urgently searching for new traders to get extra dollars to support FTX. The former CEO of the exchange is explained to have searched for all organizations that had offered liquidity at that time, this kind of as Sequoia, Genesis, Apollo, and so on. At the identical time, Alameda Research’s creditors had been nevertheless aggressively demanding the fund repay its debt.

Coinlive compiled

Join the discussion on the hottest problems in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!