Celsius Network’s lending platform is stated to be getting ready for “bankruptcy” soon after blocking consumer withdrawals.

On the morning of June 15, newspaper Wall Street newspaper reported that Celsius Network, the lending platform at the center of the present promote-off in the cryptocurrency market place, has employed law company Akin Gump Strauss Hauer & Feld LLP to put together for the “debt restructuring” course of action.

The WSJ supply exposed that Celsius “is considering investor financing options, but has not overlooked other possibilities such as corporate restructuring.”

Crypto Lender Celsius Hires Restructuring Lawyers After Account Lockout – WSJhttps://t.co/t3UXRJEWCF

– IGSquawk (@IGSquawk) June 15, 2022

In November 2021 alone, Celsius announced a productive $ 750 million fundraiser for a valuation of up to $ three.25 billion, with the participation of quite a few significant investment institutions, together with Canada’s 2nd biggest pension fund. However, due to many occasions, from donating funds to a hacked task to investing in LUNA-UST, then stETH, Celsius’ liquidity has eroded above the previous six months at an alarming charge.

Also a couple of hrs in the past, the project’s Twitter webpage also published the hottest update, stating the following:

.@CelsiusNetwork is operating 24/seven for our neighborhood. It’s all near at hand, so there will be no Twitter Spaces this week.

– Celsius (@CelsiusNetwork) June 14, 2022

“Celsius Network is operating tricky for the neighborhood. Since all personnel are on duty, there will be no meetings on Twitter Spaces this week. “

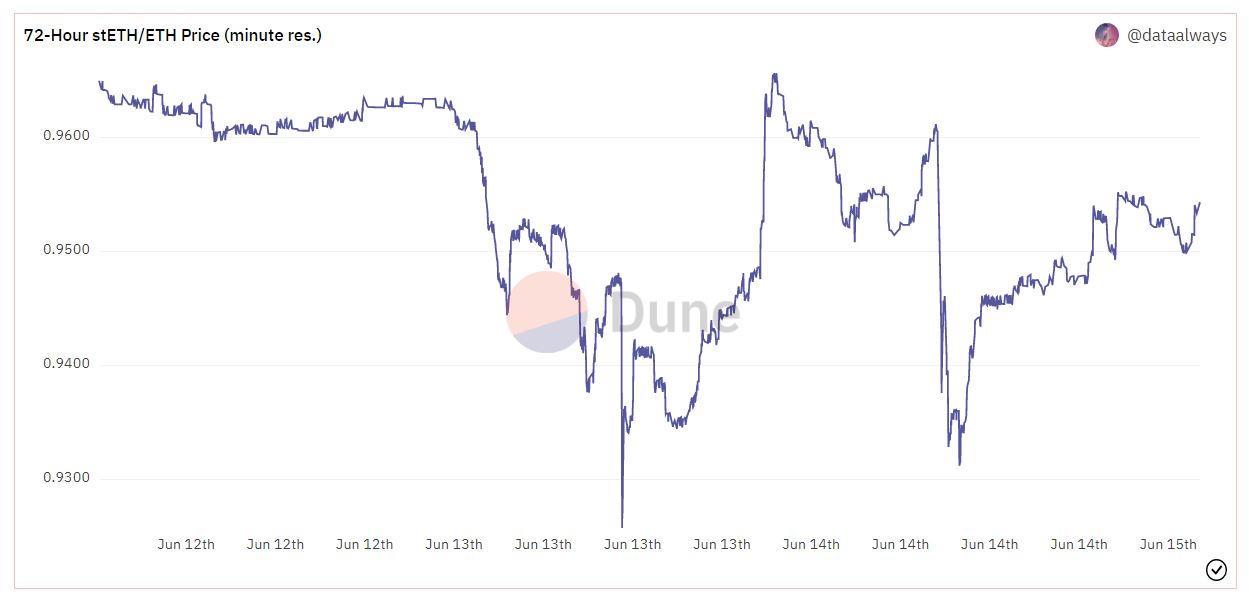

As reported by Coinlive, the Celsius challenge commenced when the stETH token (which represents ETH staking on Lido to join Ethereum two.) slipped in value in contrast to ETH on Curve. Since most of Celsius’ assets are in the type of stETH, quite a few worry that the task will no longer have sufficient liquidity to spend consumers and perform substantial withdrawals.

On the morning of June 13, Celsius announced that it was blocking deposits, withdrawals and transactions on its platform, resulting in a new panic in the cryptocurrency market place and plunging the rates of BTC, ETH and quite a few significant altcoins to their lowest amounts considering the fact that then. December 2020 January 2021.

Some Twitter consumers have “dug up” the Celsius statement by announcing that in the occasion of default, bankruptcy or money insolvency, the user’s cryptocurrencies in the Earnings services or The collateral in the Borrow (borrow funds) services may well not be recoverable , you will have no ideal to Celsius other than to turn out to be a creditor of the platform beneath applicable law.

Office pic.twitter.com/vrQ8SQHwle

– icebergy ❄️ (@icebergy_) June 13, 2022

Meanwhile, Celsius is nonetheless actively mortgaging remaining assets to hold a DAI loan buy on Maker to meet liquidity. As of the morning of June 15, Celsius is investing up to 39,862 WBTC (really worth above half a billion bucks) to borrow 231 million DAI, the biggest DAI loan buy on Maker at the minute. This loan buy will be liquidated if the BTC value drops to $ 14,000.

Loan orders of $ 303 million on Aave and $ 217 million on Celsius’s Compound are also regarded additional secure considering the fact that June 13.

Upgrading of positioning on chain by one/ten Celsius🧵

TL DR: Significantly more healthy.

Celsius continues to locate additional shekels, incorporating to their warranties across the board for three principal spots:

one) Maker wBTC Vault now has a $ 14k liquidation value, soon after having to pay additional of your DAI debt pic.twitter.com/UWBB1BUgAC

– DeFiyst (@DeFiyst) June 14, 2022

The value of the CEL token in the previous 24 hrs out of the blue had a 300% enhance on the evening of June 14, most probable a “kill short” phase, just before returning to its outdated degree at the time of creating.

The stETH / ETH exchange charge is temporarily recovering to the .95 degree soon after falling twice to .92 on June 13 and to .93 on June 14. Many significant investment money this kind of as Alameda Research and Three Arrows Capital are stated to have dumped a significant volume of stETH in the previous couple of days, and Three Arrows Capital is stated to be struggling due to the latest market place downturn.

Synthetic currency 68

Maybe you are interested: