Troubled lending platform Celsius diminished a big quantity of debt on the DeFi Maker protocol.

As reported by Coinlive, Celsius is the to start with lending platform to enter the “liquidity crisis” which is negatively affecting the complete cryptocurrency market place.

The explanation why Celsius has difficulties comes from the reality that they convert most of the users’ deposits into stETH, the token that blocks ETH on Lido Finance, which has lower liquidity. When the cryptocurrency market place underwent a violent correction in early June, along with the steep drop in the value of stETH, Celsius was massively withdrawn by customers and had to halt all trading / deposit / withdrawal action from June 13th. till now.

Over the upcoming time period, Celsius offered small information and facts on the existing scenario, only stating that it even now requirements far more time to stabilize liquidity and asking customers to be patient. Rumors surrounding the incident this kind of as the company’s CEO was about to flee the US, Celsius was refused the bailout from FTX mainly because he was accused of “losing $ 2 billion” or the company’s shareholders have been lobbying for this to get worse the issues.

Despite the problems, several cryptocurrency customers discover that Celsius even now holds a big quantity of stablecoin loan orders on key DeFi platforms. In unique, starting up from June 17, the corporation has borrowed:

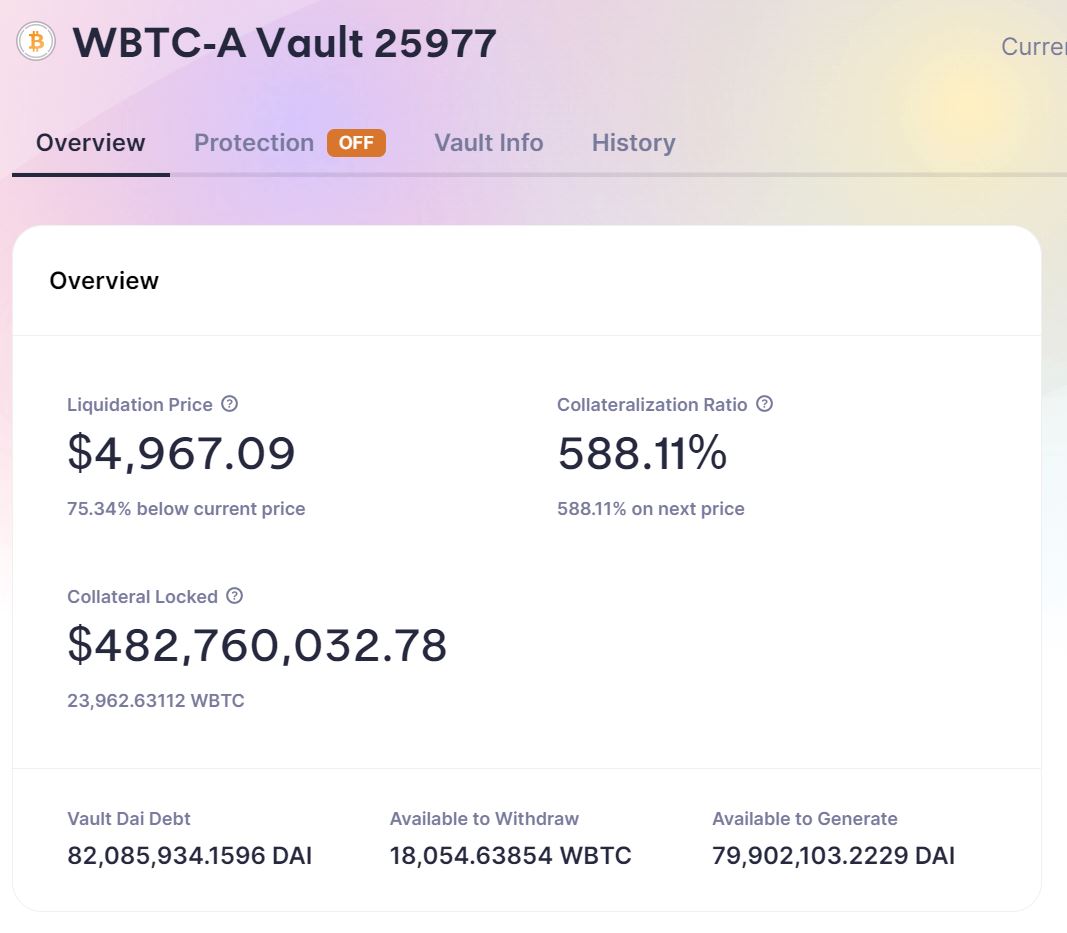

– 224.seven million DAI on Maker, collateralized with 23,962 WBTC ($ 489 million)

– $ 303 million of USDC and DAI stablecoins on Aave, collateralized with $ 596 million of stETH, WBTC, WETH and Website link

– $ 208 million and DAI on Compound, collateralized with $ 394 million in WBTC and ETH.

However, in the upcoming handful of days, Loan order on Maker it was in essence repaid, with $ 120 million in debt paid on the evening of July 4th alone. The loan purchase is even now secured with 23,962 WBTC as just before (well worth $ 482 million), when the borrowed small business is diminished to only DAI 82 million.

With the over move, the new Celsius settlement value fell, bringing the WBTC Collateral Settlement Price from $ 13,600 to just $ four,967. This is also shut to MicroStrategy’s $ three,562 settlement value zone, an investment company that is also shedding heavily from their big holdings in BTC.

Loan positions on Ave And Composed they have been also diminished to just $ 178 million and $ a hundred million, respectively. The over ensure has not diminished but has nevertheless enhanced.

It is even now unclear with the existing scenario, wherever Celsius received the dollars to shell out the debt, as nicely as if there is dollars, mainly because they even now never open deposits / withdrawals for customers.

Meanwhile, allegations proceed to emerge that Celsius is attempting to income out far more tokens. Notably, the founder of the Synthetix undertaking, Kain.eth, posted on Twitter accusing a “difficult lending platform” of massively releasing SNX to the market place.

Pure PVP market place. https://t.co/xcK0LYlp9b pic.twitter.com/gBWRyJqCDd

– DeFiyst (@DeFiyst) July 4, 2022

Some theories propose that Celsius is employing the rest of the dollars to attempt and make it by means of. They will borrow stablecoins on key DeFi platforms employing collateral primarily WBTC and stETH, use these stablecoins to purchase tokens, brief positions and situation tokens. If this is certainly the way Celsius has completed in the previous handful of days to get his dollars back, it would be witnessed as “blatant” market place manipulation.

Synthetic currency 68

Maybe you are interested: