Cryptocurrency loan company Celsius is on the verge of working out of income rapidly.

According to law company Kirkland & Ellis paperwork filed August sixteen, Celsius will possible run out of income by October 2022. At the exact same time, the business also owes $ two.eight billion far more than it at present holds.

Celsius filed for Chapter eleven bankruptcy in July 2022 soon after a liquidity crisis in the cryptocurrency industry forced the business to end withdrawals. Since then, Celsius has worked its way by a restructuring system and examining how creditors spend.

Early in the trial, it emerged that Celsius was dealing with a $ one.two billion reduction on its stability sheet, with reported assets of $ four.three billion and liabilities of $ five.five billion at the time.

– See far more: A appear at the background of Celsius Network

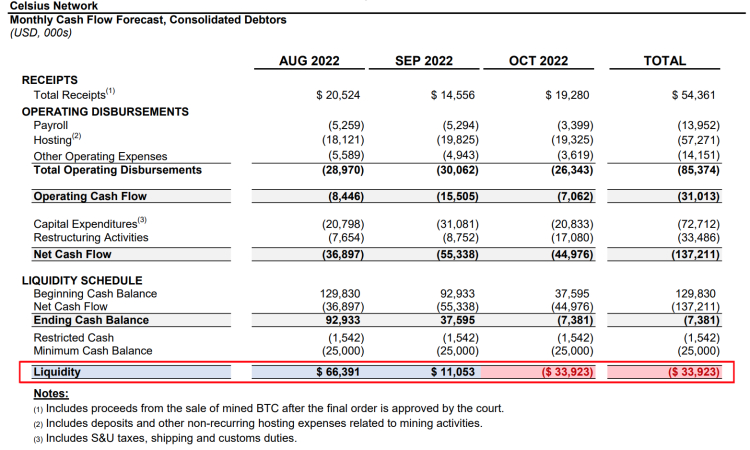

However, it now seems that the company’s monetary problem has worsened. Celsius has only about $ 130 million in money left. With all present working, capital and restructuring prices, Kirkland & Ellis expects the business to be near to a detrimental $ forty million by October 2022.

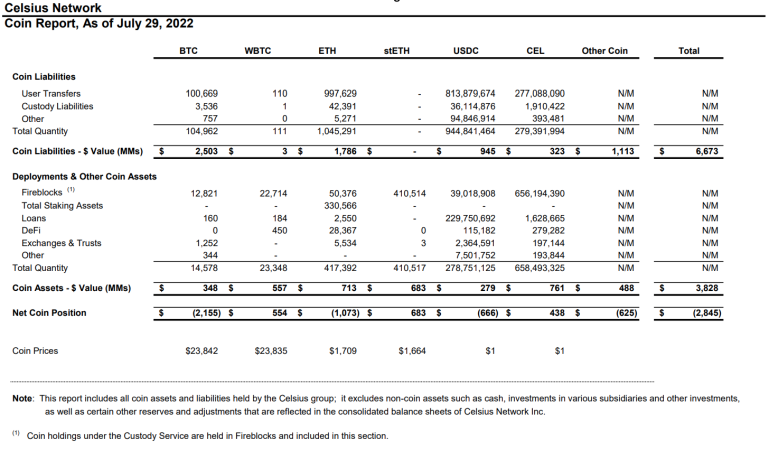

The greatest flaw, nevertheless, lies in the company’s cryptocurrencies. Celsius recorded a considerable gap concerning its holdings and its liabilities, amounting to a reduction of $ two.eight billion in crypto liabilities. The business owes $ two.five billion in Bitcoin (104,962 BTC) even though holding $ 348 million in Bitcoin (14,578 BTC) and $ 557 million in WBTC (23,348 WBTC).

Additionally, Celsius holds $ one billion significantly less in ETH than it owes its end users, even however 410,000 stETH is even now owned by the business. The USDC stablecoin reduction was also $ 700 million.

According to the repository, Celsius has 658 million CEL tokens in its reserve, which is the platform’s native token. Celsius owes prospects CEL 279 million, leaving the business with a stability of 379 million.

Contrary to present industry charges, CEL’s place would be well worth practically $ one billion, far more than double what is documented, as CEL rose far more than 500% from a reduced of all over $ .four just as the business went bankrupt and it even surpassed $ four.50 when it was reported that Ripple was thinking of obtaining Celsius assets to broaden the company’s place. At press time, CEL is trading at $ two.83.

However, increasing charges did not aid Celsius remedy the spending budget trouble. Most of the CEL supplying is locked on the platform and liquidity on exchanges is really reduced. If the business tries to promote CEL to compensate for some of the reduction on its stability sheet, CEL’s rate can rapidly “drop” sharply and offering CEL will be really hard.

Consequently, Thomas Braziel, founder of 507 Capital, an investment company that financed the bankruptcy and restructuring, stated:

“The portion of the assets held by CEL might be worthless. The debts are even now there for the reason that CEL holders will possible consider to declare as minor injury as feasible and declare $ one / CEL. “

However, the information was all archived prior to the company’s 2nd day of hearing, scheduled for the afternoon of August sixteen. There will also be a meeting of creditors on August 19, prior to which they had been established to end the business from offering Bitcoin. In a connected improvement, Celsius has just been investigated by Canadian authorities for getting concerned in the large investment reduction of the country’s 2nd biggest pension fund.

Synthetic currency 68

Maybe you are interested: