The complete reality behind the Earth collapse story from the level of see of the venture founder was shared by Mr. Do Kwon in the most recent interview with Coinage Media.

Like it Coinlive reported that, soon after three months of “silence” in front of public viewpoint on Terra’s disappearance, CEO Do Kwon broke the silence for the very first time by an unique interview with Coinage Media. The video presented on August 15 exposed lots of information that the local community is wanting forward to.

At dawn on August sixteen, the total interview aired. As a end result, Do Kwon advised the complete reality about his psychological improvement and what he faced in the encounter of a single of the most significant crises in cryptocurrency background.

Unique: @stablekwon He breaks his silence.

Coinage Episode – Inside the Biggest Crypto Crash with Terra Founder Do Kwon

Watch the complete video on our Youtube Channel ⬇️https://t.co/FqCnoZzApj pic.twitter.com/Vjd1KyADi6

– Coinage (@coinage_media) August 15, 2022

Journey to create believe in on UST

In buy for Terra to stand up and be effective, UST should often stay at one USD. For lengthy-phrase survival, Terra convinces the local community by all usually means that UST is the finest stablecoin on offer you on the industry. Hence, Do Kwon has come up with answers that make UST beautiful not only to people in the cryptocurrency market, but also to each day customers.

Thus, Do Kwon and co-founder Daniel Shin founded Chai, a big digital payments startup in South Korea. Bottle permits individuals to use UST to make purchases with no even realizing they are purchasing and marketing cryptocurrency. And when Chai succeeds in Korea, Terra has an undeniable aggressive benefit.

“The idea of cryptocurrency being used in the real world for everyday purchases is a breaking point for Terra, which is what first attracted me to the project and differentiated Terra from countless other competitors.”

In 2019, when the industry entered “winter”, Do Kwon had a difficult time luring traders to join the venture. During this time, he purchased Shin’s ownership stake in Terra, leaving Shin totally free to create his personal Chai.

“In mid-2019 we tried to raise more money for Terra, but the market was really bad.”

Indeed, in June 2022, the newspaper Wall Street newspaper reported that Chai has discontinued UST manufacturing by the finish of 2021. However, Do Kwon nonetheless advertises Chai as a hefty UST consumer, applying Chai as a very good illustration for traders to be optimistic about the long term. Earth in an interview with cryptocurrency investor Anthony Pompliano. To make clear this incident, Do Kwon shared that he did not seriously know that Chai had stopped paying out UST.

Do Kwon made use of swagger and a cult following on Twitter to create a crypto empire that collapsed in a $ forty billion slump. Now the South Korean businessman is trying a comeback. https://t.co/TZu4Tq9pby

– The Wall Street Journal (@WSJ) June 22, 2022

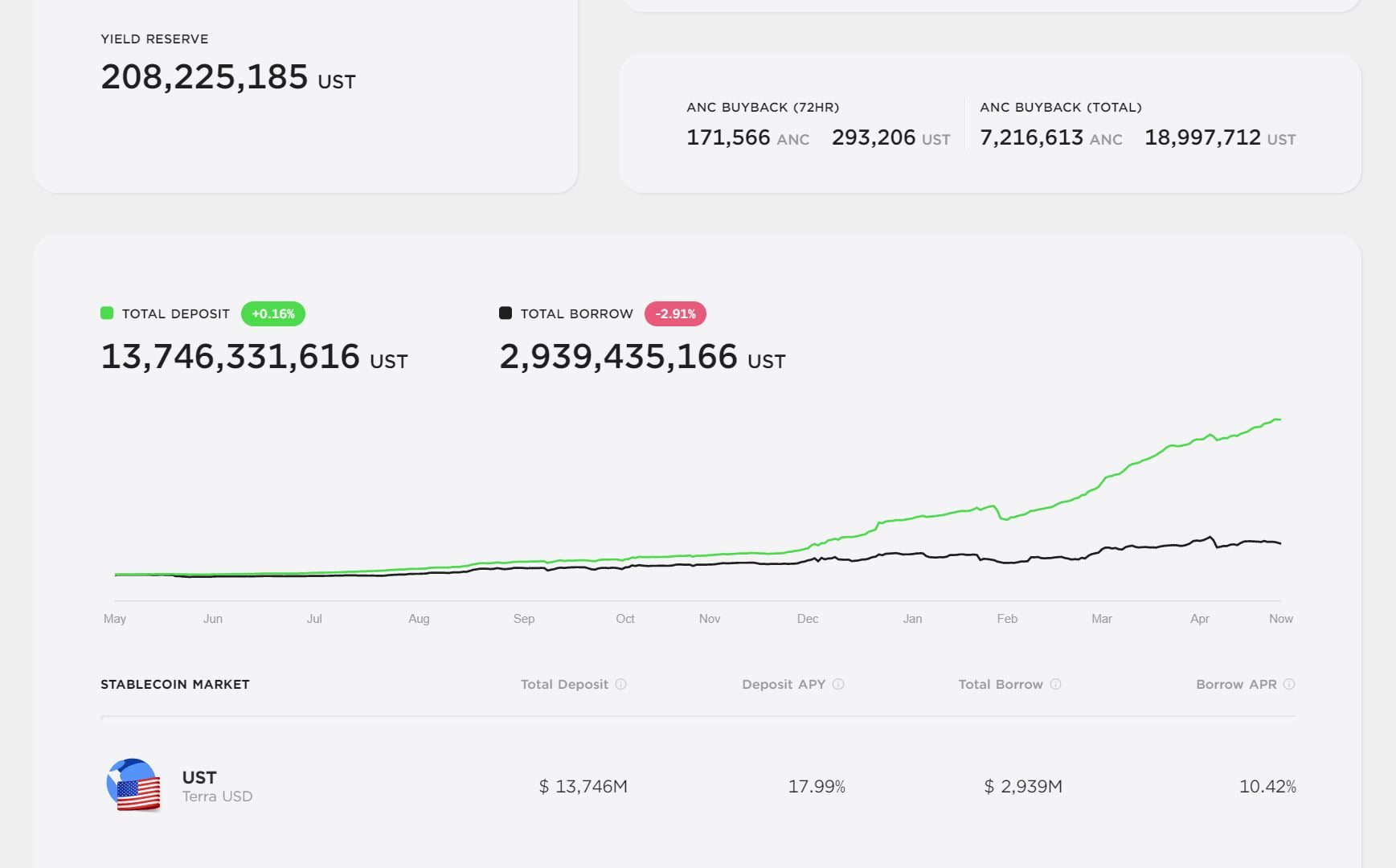

Returning to the principal subject, to carry on “survival”, Do Kwon had to come up with new strategies to advertise Terra, which was nonetheless really youthful at the time. His significant breakthrough came in March 2021, with the launch of Anchor Protocol, Terra’s blockchain-based mostly lending protocol, with a “smug” and “simple” company model of sending stablecoins. UST in Anchor and the platform instantly delivers customers a fixed yearly curiosity price of twenty%.

As DeFi customers flocked to Anchor a lot more and a lot more, LUNA swiftly grew to become a hit. At its peak, Anchor was caught in in excess of $ 13 billion, which represents in excess of 70% of the UST in circulation.

In the approach, Anchor created Terra’s launch pad “too big” to fail. However, absolutely nothing is not possible, with an imbalance in the mint-burning mechanism in between LUNA / UST and the Anchor payments, Earth has fully collapsed in just two weeks.

Since then, it has led to the flood of information and facts that Do Kwon’s conservatism for very substantial curiosity prices (twenty%), in spite of warnings from developers is the result in of the failure. However, in the interview, he dismissed this see, saying as an alternative that he was really cautious in producing the ultimate determination.

“The inner consensus on what individuals want to do with curiosity prices is a two thousand % April with Anchor appropriate from the commence. This is nonetheless the time when DeFi yields are staying adopted by lots of tasks that, focusing on deposits of stablecoins, offer you a handful of hundred % April, numerous thousand % April.

A series of days of “tragedy” hit the Earth

On the evening of May seven, 2022, Terraform Labs (TFL) created unannounced dollars transfers in between teams. Thirteen minutes later on, the attackers took benefit of this minute, marketing almost UST $ 200 million at the moment, and this stunned Do Kwon.

“I was in Singapore. I woke up in the morning and uncovered the Curve pool out of stability mainly because somebody created a really substantial transaction. My very first response appears ordinary mainly because it has presently occurred. I talked to some individuals on Twitter, acquired some messages on Telegram and you know, I did not do also lots of actions at the time considering anything would be fine.

However, issues started off to get worse. More and a lot more anti-UST kernels seem on Curve. I have posted on Twitter so lots of occasions to reassure the local community. “

Subsequently, Do Kwon exposed the truth that the predicament behind the story was pretty complex mainly because his executive workforce had no shifts at the time of the assault, they had been all going to Singapore to attend the quarterly conference at Terraform Labs headquarters. The ultimate date of the transfer and the corporate workforce routine are all within information and facts. Do Kwon believes there was a leak in his workplace.

“Only TFL personnel know this information and facts. So, if you are asking me if there is a * spy * in the TFL, the reply is possibly YES. “

With the reduction of self-assurance in UST, LUNA’s value also started to plummet, the two of which continually “dumped” every single other forcefully soon after Do Kwon burned $ three billion really worth of Bitcoin in the Luna Foundation to “save” the predicament. Guard, such as supplemental fundraising. However, as LFG’s reserves continued to decline and 1000’s of traders misplaced self-assurance each and every minute, all Do Kwon could do was observe UST’s economic climate wiped out from the industry.

“We are established to invest a lot more capital to have the sources to battle. So we created the determination in just a single evening. We known as our current LFG traders, calling lots of of the mates we have in the market by lots of partnerships and substantial money.

I just can not uncover the phrases to describe how it feels. Earth is primarily my daily life. I bet anything on my actions and believe in in Earth and I failed “.

Legal siege of Do Kwon

Not only did the court dismiss the US Securities and Exchange Commission (SEC) appeal in the investigation into the Mirror Protocol – a Terraform Labs venture, but the Korean authorities’ “attack” was at this level the troubling difficulty with Do Kwon. .

He is about to be summoned to testify ahead of the National Assembly of Korea at the proposal of Congressman Yun Chang-Hyun. Not only that, CEO Terra also requirements to put together to encounter a wave of fierce lawsuits from Korean traders.

In addition, the Financial Services Commission and the Financial Supervisory Authority, two big economic regulators in Korea, had to recreate the “Death” economic process force to investigate Terra. The Korean police also want to freeze the assets of the Luna Foundation Guard. The Korean tax company last but not least came to a determination to fine Terraform Labs and Do Kwon for $ 78 million for tax evasion ahead of the Seoul Metropolitan Police Department redirected Terraform Labs’ investigation into “embezzlement” allegations.

Despite staying in a complicated predicament, Terra’s legal workforce left Do Kwon, swiftly resigning at the identical time. However, Do Kwon himself determined to get complete duty for the incident, as nicely as sharing the investigative cooperation approach with the authorities.

“I and I alone are accountable for Terra. The explanation is that the individual who brought about these holes in the very first location is none other than me. “

In terms of due approach, it is not about what you are prepared to go by, it is about how you will cope with it. What we will do is carry to light the information we know. We will be fully straightforward and encounter all doable consequences. “

The predicament has come to be so tense that inside of two days of Coinage Media’s interview with Do Kwon in Singapore, South Korean authorities raided the dwelling of co-founder Daniel Shin, as nicely as Korean cryptocurrency exchanges. FSO listed in its books. Asked irrespective of whether to return to Korea mainly because Korea has banned Terra developers from leaving the nation, Do Kwon stated:

“It was difficult to make that decision, because we never contacted the investigators. They have absolutely no contact with us ”.

Stop or move on?

Immediately soon after the crash, Do Kwon launched Terra two., his brief try to get started rebuilding his crypto “empire”, with no algorithmic stablecoins integrated, in spite of lots of appearances. He is stated to be “quietly” making a new model of UST on Terra two..

New coin launched on …